Vol. XXII, No. 10, October 2022

- Pumpkin breaks record for largest ever grown in North America

- Drinking is falling out of vogue

- Getting LBE design right the first time

- Healthy kids' meals trending in the restaurant industry

- Are Dave & Buster's comparable store sales really booming?

- How important are restaurant reviews?

- Participation in Halloween-related activities to be at pre-pandemic levels

- Pickleball's popularity and hospitality venues growing

- Interest in non-alcoholic beverages on the decline

- Define your ideal customer - or be magnetic to no one

- Davis Mega Maze Colossal Adventures' corn maze among country's best

- Keeping up with guests' increasingly dynamic preferences

- Robotics creating pizzatainment

- More thoughts on socialized gaming, aka competitive socializing

- Can competitive socialization work with F1 simulators?

Define your ideal customer - or be magnetic to no one

Knowing your target customer is critical to operating and growing any business. Defining your ideal prospect drives all aspects of sales and marketing and provides direction for the design of the entire business and the experience it offers customers.

Unfortunately, for too many companies, a target is viewed as "anyone willing to pay money." In that case, not being deliberate and targeting specific customers means missing out on opportunities.

For many community location-based entertainment venues (LBEs), the focus problem boils down to the owners thinking the road to success is a broad definition of 'family,' having a little bit of something for everyone, something for every age group. Many early family entertainment centers in the 1990s thought they were targeting families but included a billiards area. Then the owners wondered why they weren't attracting as many families as they had hoped. Over the years we've written about the need for a focused assortment, where you tailor every aspect of the business to the targeted guests. This includes the assortment of attractions, food and beverage, programs, and services designed for a narrowly-defined market segment. The bottom line is that to be successful, you need to shoot with a laser at a narrow market niche rather than shoot at the entire population with a shotgun. You can't be all things to everyone, but you can be very special to a particular market niche. Then you will also get secondary markets, although you didn't specifically design for them. This basic proven marketing principle applies to almost all retail, restaurant, and community-based entertainment-type venues that depend on high repeat business and loyal customers. Just think of all the different women's clothing stores and how each brand has a sharp focus.

In the LBE industry, Dave & Buster's is an excellent example. They target adults, especially younger males. They don't have children's games or attractions. Yet they get a significant chunk of business from families with children during the day, especially on weekends. That is a secondary market they get without targeting them. But if they had included children's games or attractions, they would lose most of their business from adults.

The second root cause is a mismatch with the market areas' socio-economic/lifestyles. As much as no one wants to admit it, we humans are class-conscious and like to hang out with people like ourselves regarding our tastes, preferences, values, and lifestyles. Birds of a feather like to flock together. This is especially true for indoor entertainment venues where dissimilar socio-economic/lifestyles don't mix.

Different socio-economic/lifestyle groups have different expectations about quality, which in LBEs deals basically with ambiance or décor, the level of customer service, and the quality and trendiness of food and beverage.

As the number of out-of-home leisure and entertainment offerings continues to expand, with many markets becoming over-saturated, targeting a narrow market segment becomes increasingly essential for success,

Where we find most LBEs miss the boat is in failing to design their facilities to the level of quality to attract the upper socio-economic market, which we will call the upscale market. This market segment accounts for 70% of all community-based entertainment spending and over 60% of all local restaurant and bar spending. What those LBEs do is offer Walmarts to markets where the majority of households are a match for Targets or even Nordstrom.

When it comes to the quality of the physical facility- the ambiance, décor, or what we call quality-of-place, and staff training and menu development, the LBEs failed to make an adequate investment - they underspent. That's right; their centers didn't cost enough. This is the opposite of the widespread belief that you can maximize return on investment by spending the least amount of money. Walmarts cost less to build than Targets and Nordstrom's. P.F Chang's China Bistro costs more to build than your local Chinese restaurant or a Denny's. They all are designed to attract a particular socio-economic.

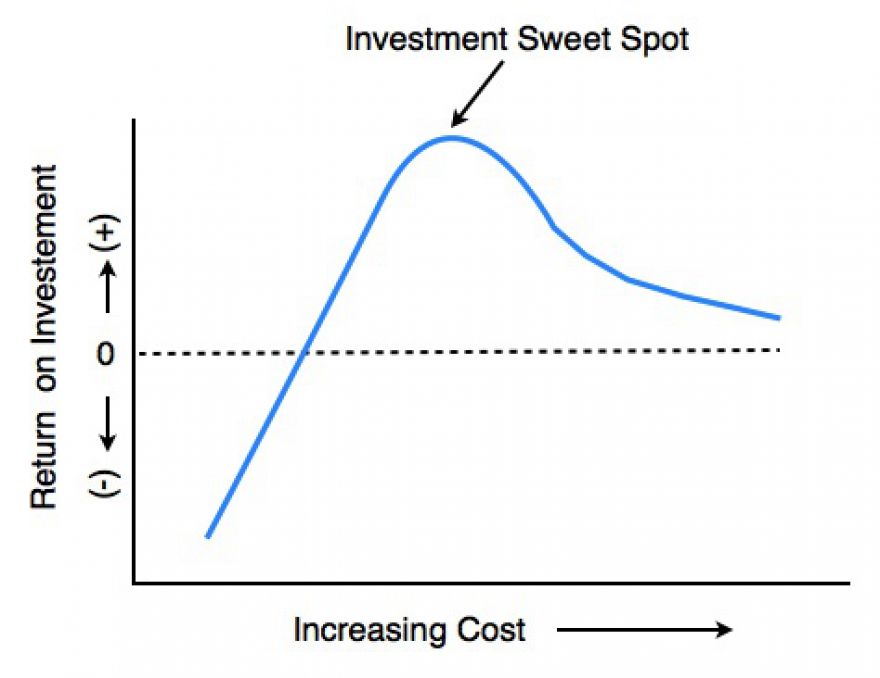

There is an investment sweet spot, the needed investment to attract a particular socio-economic/lifestyle that achieves the maximum return on investment. There is a direct relationship between cost and return before the sweet spot is found-the greater the cost (properly spent), the greater the return. Once the sweet spot is reached, the relationship becomes inverse-increasing cost means decreasing return.

The investment sweet spot varies with the particular socio-economic/lifestyle group the LBE is targeting. The higher you go up the socio-economic ladder, the greater the investment required to attract them. It takes a much higher level of finish, service, and food to please an upscale market. But for that added investment, you achieve the highest repeat business and higher prices, resulting in higher revenues and profits. Invest too little and they might not show up at all.

In many of the poorly performing centers we've examined over three decades, we traced the cause of the under-investment back to the feasibility study, where neither the target market, in terms of age and type of group, nor the socio-economic/lifestyle segment with the best market opportunity was defined and with it, what was required to attract them. Good feasibility studies deal with much more than numbers. They thoroughly analyze a market and competition and then define the best LBE brand identity and characteristics to create the most successful project.

Success deals with much more than the mix of entertainment. It deals with the entire emotional experience the guest has based upon their expectations and their need to feel that the LBE reflects who they are, their values and tastes. Only by defining who the guests are that should be targeted, including their socio-economics/lifestyles, and determining the needed attributes and quality required to attract them can LBEs find the investment sweet spot for maximum success.

Vol. XXII, No. 10, October 2022

- Pumpkin breaks record for largest ever grown in North America

- Drinking is falling out of vogue

- Getting LBE design right the first time

- Healthy kids' meals trending in the restaurant industry

- Are Dave & Buster's comparable store sales really booming?

- How important are restaurant reviews?

- Participation in Halloween-related activities to be at pre-pandemic levels

- Pickleball's popularity and hospitality venues growing

- Interest in non-alcoholic beverages on the decline

- Define your ideal customer - or be magnetic to no one

- Davis Mega Maze Colossal Adventures' corn maze among country's best

- Keeping up with guests' increasingly dynamic preferences

- Robotics creating pizzatainment

- More thoughts on socialized gaming, aka competitive socializing

- Can competitive socialization work with F1 simulators?