Vol. XXII, No. 6, June 2022

- Editor's corner

- Social, social, is it the future of LBEs?

- The latest on food and beverage LTOs

- Death by the experience gap

- The Australians are coming - again!

- The pandemic has caused a redistribution of demand

- Plant-based protein foods grow in availability

- The growing appeal of new school mini-golf

- How fast is location-based entertainment spending recovering?

- Competitive socializing venue on steroids opening

The pandemic has caused a redistribution of demand

Now more than two years into the pandemic, all types of out-of-home leisure venues may expect the demand for their experiences to return to pre-pandemic levels. But that's not the case according to research for the first quarter of 2022 by Impacts Experience reported by Colleen Dilenschneider in her enewsletter. It shows that Americans have shifted the type of cultural venues they prefer to visit compared to 2019; demand has been redistributed from some type venues to others. And the research suggests that the changes may prove long-lasting. The research findings are likely just as applicable for location-based entertainment as for cultural venues.

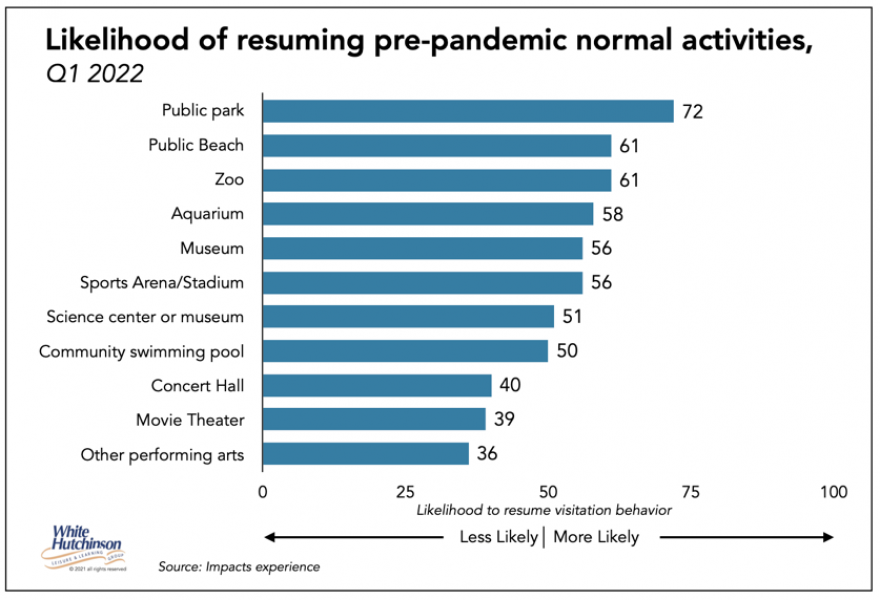

The research asked people, "On a scale of 1 to 100, where a response of 1 means a significant decrease in my likelihood of visiting,' a response of 50 means' the same' or 'no change in my likelihood of visiting,' and a response of 100 means a 'significant increase in my likelihood of visiting: How likely are you to visit a(n) [organization type] after the current coronavirus-related restrictions are removed and you can resume your normal activities?"

The metric measures how likely people are to return to their normal, pre-coronavirus behaviors at particular types of cultural venues. In the following chart, a response of 50 indicates no change whatsoever in intended future attendance compared to pre-pandemic attendance. Any response greater than 50 indicates a proportionately higher level of intended future attendance for a type of venue, and, conversely, any response less than 50 indicates proportionately less intended demand.

This chart shows how likely people are to resume their pre-pandemic attendance behavior as of the first quarter of 2022.

The findings show a redistribution of demand away from stationary, indoor activities such as theaters and concert halls towards outdoor activities or those that allow freedom of movement, such as museums and zoos. The findings also suggest that people not only adjusted their behaviors in response to the pandemic but have settled into these preferences as a "new normal." Now, over two years, people are way beyond the amount of time it takes to form new habits. Returning to their pre-pandemic behaviors may not happen at all.

For location-based entertainment (LBE), the findings strongly suggest that outdoor venues, such as mini-golf, go-karts, venues such as TopGolf, and many forms of agritourism, may see increased demand compared to pre-pandemic. In contrast, some indoor type LBEs, including movie theaters and smaller indoor venues with less freedom of movement, such as escape rooms, karaoke, and indoor music venues, may see reduced demand.

Another factor that will probably result in a redistribution of demand from older type LBEs, regardless of whether they are indoor or outdoor or their size, is the emergence of new types of LBEs, especially the competitive socializing ones (see articles in this issue). The new-type LBEs have caused an experience gap for the older-style LBEs, especially older FECs (see the experience gap article this issue).

Vol. XXII, No. 6, June 2022

- Editor's corner

- Social, social, is it the future of LBEs?

- The latest on food and beverage LTOs

- Death by the experience gap

- The Australians are coming - again!

- The pandemic has caused a redistribution of demand

- Plant-based protein foods grow in availability

- The growing appeal of new school mini-golf

- How fast is location-based entertainment spending recovering?

- Competitive socializing venue on steroids opening