Vol. XIX, No. 1, January 2019

- Editor's corner

- Celebrating our 30th anniversary

- Current projects

- National survey of CLV & FEC participation

- The generations defined for 2019

- 30 trends & market forces impacting the future of location-based entertainment

- Who spends the most time and money at restaurants?

- Does your brand have purpose? It should

- Miniature golf returns to its roots

- 8 ways that Gen Z moms differ from Millennial moms

- The future of out-of-home entertainment - predictions of its future

- Miniature golf design for tomorrow - part 2

The future of out-of-home entertainment - predictions of its future

When our company first started working exactly 30 years ago this January 9th in the location-based entertainment (LBE) industry, also known as the out-of-home (OOH) entertainment industry, our company's name was the White Hutchinson Entertainment Group as we predominately worked in the family entertainment center, children's entertainment center and bowling industries. Over the years, the OOH venue models evolved beyond just pure entertainment. Based on our research on macro-trends impacting the OOH entertainment industry, we saw where the future was headed, and around ten years later changed our name to the White Hutchinson Leisure & Learning Group to better fit the work we were doing with evolved concepts of OOH leisure that included more than just entertainment, such concepts as edutainment, eatertainment and agritainment.

The FEC models that evolved shortly after we entered the industry were designed for different times, expectations, behaviors and values in a world that that didn't have a wide variety to choose from for OOH entertainment. The problem we see in the LBE industry today is that way too many venues are still basically following that mindset. They are stuck in a time warp of thinking when the world, the consumer and their tastes, expectations, values, just about everything about them has dramatically changed and as a result, has changed their leisure behaviors.

So here we are 30 years later in the middle of one of the most disruptive and dynamic periods in all of human history with the pace of change accelerating faster than ever before. As a result, the OOH leisure industry is being disrupted by multiple technological, cultural, demographic, behavioral and other changes (many listed in our trends article in this issue), as well as many of the changes we wrote about four years ago in our white paper, The Perfect Storm: LBE disruption & opportunity. Entertainment, socialization and leisure have changed in ways that the legacy models and concepts for LBEs no longer fit.

The problem is that most of the LBE industry has basically been evolving by iteration, improving on the way they do things today with the same old business models, rather than also evolving by innovation, doing new things and in new ways. Iteration is based on trying to improve yesterday's version of normal, not the new normal of how consumers and their aspirations have changed. When you truly innovate based on where the world and consumers are today and where they are headed in the future, you create disruption, doing new things that make the old things, the old models obsolete, as once consumers experience these new options, it becomes their new expectation.

There are a number of community-based leisure venue (CLV) players that exhibit innovation, and as a result, are disrupting the legacy models. Top Golf and Punch Bowl Social are two examples. Although both have components from models that have been around for decades, they have served them up in a completely new way that matches the tastes and preferences of the modern leisure consumer. The most innovative change is that they don't consider themselves entertainment venues. Their entertainment revenues are the minority of their revenues. Instead they are social destinations that feature great food and drink, along with highly approachable interactive social games. Then you have the emergence of niche players, places like Spin and Flight Club, which have taken nontraditional LBE games, ping pong and darts, and mixed them in with food and drink as appealing social destinations.

What these four examples illustrate are new innovative CLV models that really come out of the restaurant and bar industry far more than the entertainment industry. And they are much more focused on a target niche of customers than the legacy FEC models that try to have the broadest appeal. And they are focused on the social communal experience rather than an entertainment experience. It's a complete paradigm shift of what a CLV experience needs to be.

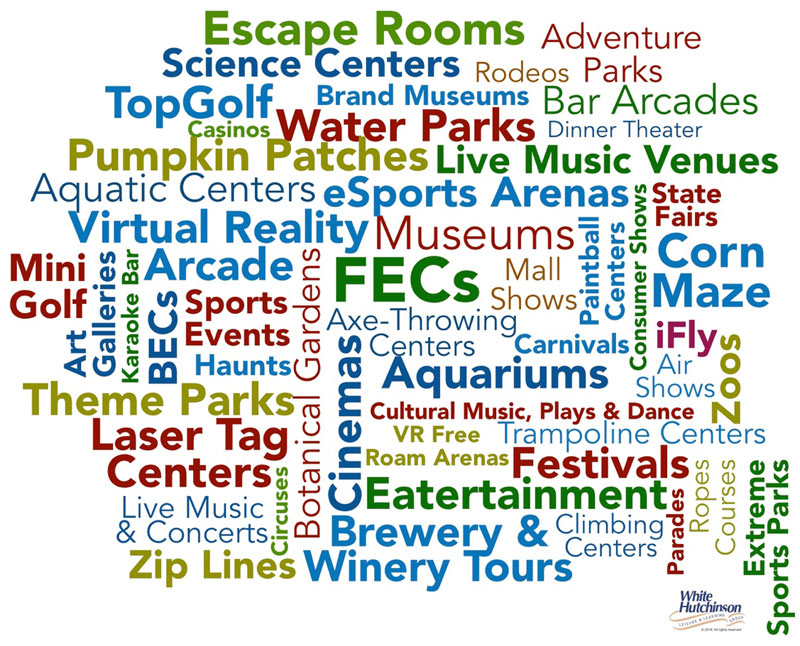

So, as Ziggy shows us, it's time to buckle up for 2019 and beyond. What does the future hold, what does it take to have a CLV model that will be successful into the future? Unlike when our company started in the industry and there were limited options, today the OOH leisure and entertainment landscape is flooded with options and variety and the number is constantly expanding. Today it is a very crowded and competitive OOH leisure venue marketplace.

And in addition to all the OOH leisure choices consumers now have, there has also been a great expansion of all the at-home digital entertainment and social options. In fact, today we even have the ability to have top quality restaurant meals delivered to our homes to enjoy along with our digital entertainment options. So today, not only is a CLV competing with a larger universe of OOH options, but it is competing with the sofa at home.

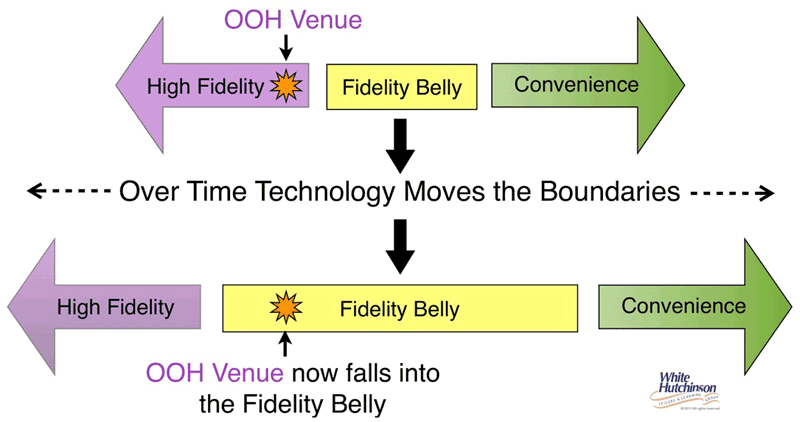

Today's consumers are overwhelmed with choices for their limited leisure time. It's a zero-sum game for not only their leisure time, but also their discretionary leisure spending. Neither expands just because there are more leisure options. All that occurs as the number of OOH as well as at-home options expand is cannibalization. Today it takes an extremely compelling OOH experience, what we call a High Fidelity experience that qualifies as time well spent, to win out over all the competition.

Consumers now make leisure choices in terms of two key dimensions - experience and convenience. It's a trade-off between Fidelity, the quality of the experience, and Convenience - the ease of access in time, effort and money. The more Convenient digital at-home screen-based entertainment and socialization choices become, the higher the Fidelity that an OOH experience has to have to compete and attract people to leave their homes. And paradoxically, people are willing to pay a higher price for that higher Fidelity experience, as it has a higher perceived value. And as digital entertainment and socialization improves in Convenience, which it is doing at an accelerating rate, what used to be a High Fidelity experience is no longer considered High Fidelity and falls into what is called the Fidelity Belly, basically defined as mediocrity, a place that's no longer competitive.

Today, and even more so in the future, the Fidelity of an OOH leisure experience is highly dependent on the quality of the food and drink. One of the most significant contributions the Millennial generation has made to foodservice is to teach us that mediocre, unexciting food is not acceptable at any location, including at CLVs. Consumers' expectations are that food has to be great-high quality, fresh and innovative. And food -where we dine, what we cook, where we grocery shop, what we eat and drink - has become an essential part of popular culture, the kind of thing we discuss over drinks, share on Instagram and debate on Twitter. Food culture has transitioned from Kraft cheese to artisanal craft cheese. Unique, from-scratch, epicurean cuisine paired with hand-crafted and artisan beverages is now the expectation, it's the table stakes. On Instagram and other social media, food experiences are used to gain bragging rights and social capital. Food is as important, now often more so than the traditional entertainment at CLVs. In fact, a large segment of consumers now considers dining out to be entertainment on its own.

Predictions for the future

So here are some of our predictions of what we see for the future success of CLVs in 2019 and beyond:

- Great food and beverage, scratch kitchens producing innovative and craveable foods and bars serving craft beverages have become essential to the CLV visit experience. We are already seeing legacy chains such as Dave & Buster's and Chuck E. Cheese's struggling with this component of the experience they offer guests.

- In the major markets, there will be overexpansion to the point where the supply will exceed the demand, resulting in a shake out of all but the highest Fidelity venues. This is partially being driven by all the malls and shopping centers chasing after entertainment and restaurants to fill empty stores and create traffic to their centers. The other factor is the proliferation of new concepts like escape rooms and axe throwing and the stock market and venture capital-driven expansion of many of the major chains. It's a zero-sum market for consumers' OOH leisure time and spending and an increasing supply of venues will only have to share that limited market. The venues with the highest probability of closing in the shake-out will be the old legacy models and the mediocre independent operations.

- Reservations for just about everything a CLV offers will grow in importance as consumers' time famine grows. Consumers increasingly are looking to save time and get more out of less time.

- We will continue to see the closing of the older bowling alleys that were built during the heyday of league bowlers. The ones that diversify by becoming bowling-entertainment centers will struggle unless they target the adult market rather than the traditional family entertainment center market that many are mistakenly targeting, (except in some unique markets).

- The visual of the entire facility, not just of the food and drink, will become increasingly important as people share more and more of their experience with photos on social media. Is the entire experience Instagrammable?

- Being a purpose-driven brand - being a socially and environmentally responsible brand that is fully transparent will become important to staying competitive as consumers increasing vote with their time and money based on how a company aligns with their values. The majority of consumers want to associate with brands that take a stand on social and political issues they align with as it is a way to tell other people something about their identity when they share it with them as well as possibly gain social capital. CLVs will need to have a compelling story about their values and behaviors supporting them. (see Does your brand have a purpose? in this issue).

- Festivals, special and live events and other limited time experiences will become increasingly essential to drive repeat appeal, as with so many OOH options, same old, same old attraction has lost its appeal.

- Loyalty programs, especially if on an app, will grow in importance.

- We humans are a very social species. Our connection with others and our individual identity matter more than just about anything else. Nothing raises the Fidelity of an experience more than a social dimension. With the high appeal that digital options how offer consumers on social media, Facetime, texting and other options, the Fidelity of OOH socialization has to be very high. The CLVs with the highest fidelity social quotient's will be the winners.

- Offering communal social experiences for both small gatherings and large groups will grow in importance.

- Social games of all types, including in game rooms, where people play face-to-face, will grow in popularity.

- More and more, the Highest Fidelity venues, the ones offering the highest quality experiences, even if more expensive than the competition, will gain an increasing market share. Consumers are willing to spend more to be assured of an experience that will not be a waste of their precious limited leisure time.

Vol. XIX, No. 1, January 2019

- Editor's corner

- Celebrating our 30th anniversary

- Current projects

- National survey of CLV & FEC participation

- The generations defined for 2019

- 30 trends & market forces impacting the future of location-based entertainment

- Who spends the most time and money at restaurants?

- Does your brand have purpose? It should

- Miniature golf returns to its roots

- 8 ways that Gen Z moms differ from Millennial moms

- The future of out-of-home entertainment - predictions of its future

- Miniature golf design for tomorrow - part 2