Vol. XVI, No. 7, August/September 2016

- Editor's Corner

- Laser tag facilities increasing

- Industry education experience coming to Phoenix

- Latest on our South Sound social hub project

- Paintball's 1909 heritage

- Expanding community leisure competition

- The end of staycations

- No waiting required; the next BIG THING has arrived!

- Trampoline park injuries on the increase

- Mega Maze - 170 years, 7 generations & counting

- Beer reigns supreme as Americans' preferred alcoholic beverage

The end of staycations

Past Leisure eNewsletters have featured a number of articles documenting the staycation trend - rather than taking a vacation trip and spending on entertainment there, people have been taking their vacations at home. Spending data for 2015 indicates that finally eight years after the beginning of the Great Recession, the staycation trend has come to an end and people are increasing their participation and spending on entertainment and admission to sporting events on trips away from home and while on vacation.

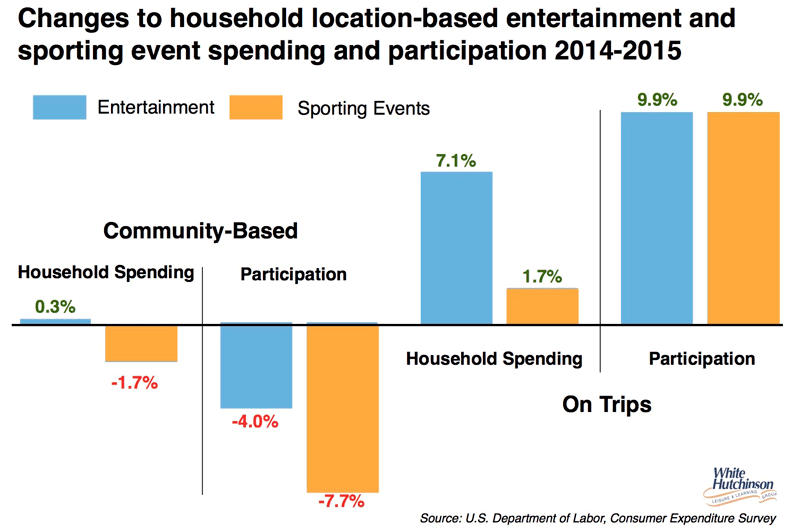

Between 2014 and 2015, average household spending for entertainment of all types on trips (defined as 50 miles from home or on overnights stays) increased by 7% (inflation-adjusted) and spending on admissions to sporting events increased by 2%. Not only is spending up, but participation has increased. The number of households participating at entertainment venues and at sporting events on trips has both increased by 10%.

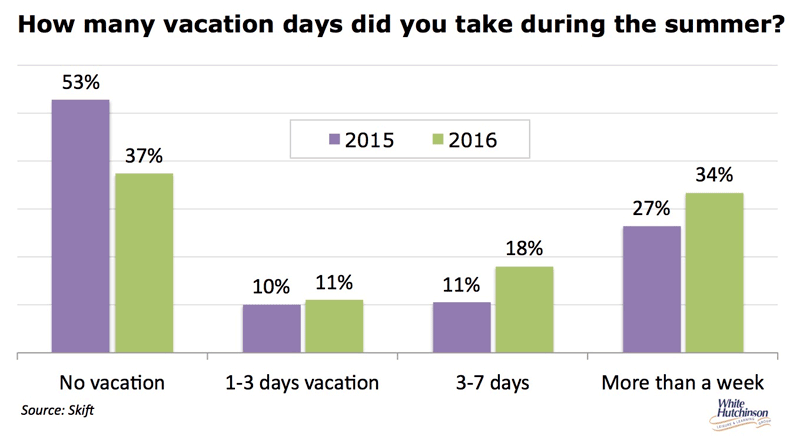

The increased participation is most likely due to the increase in people taking summer vacations. In 2015, more than have of adults didn't take any summer vacation (53%). 2016 say a significant drop to only 37% of all adults. Additional, 2016 saw an increase in the percentage of vacationers taking more days of vacation time.

The increased spending is in line with a 4.5% increase in average household total spending in 2015 compared to 2014. Every age group saw in increase in 2015.

This is all good news for any entertainment and sporting event venues that depend on vacationers and day-trippers for their business.

Now for the bad news. Even with increased household incomes and spending and increasing consumer confidence, average household spending at community-based entertainment venues basically stayed flat from 2014 to 2015. And the percent of households participating at community entertainment venues actually decreased by 4%. That means less households are visiting community entertainment venues, but the ones that are have increased their spending. The overall 3% increase in household spending on location-based entertainment is all taking place on trips and vacations, not in consumers' local communities.

The news is worse for community sporting events. Average household spending decreased by 2% and participation was down by 8%.

We plan to have a more in-depth analysis of these trends in a future issue.

Vol. XVI, No. 7, August/September 2016

- Editor's Corner

- Laser tag facilities increasing

- Industry education experience coming to Phoenix

- Latest on our South Sound social hub project

- Paintball's 1909 heritage

- Expanding community leisure competition

- The end of staycations

- No waiting required; the next BIG THING has arrived!

- Trampoline park injuries on the increase

- Mega Maze - 170 years, 7 generations & counting

- Beer reigns supreme as Americans' preferred alcoholic beverage