Vol. XVI, No. 10, December 2016

- Editor's Corner

- The changing composition of American households

- The trilogy of the healthy Cs

- What's driving the evolution and success of the new school CLV models?

- Hatchet throwing and beer; watch out for your scalp!

- Trading up, splurging on high fidelity premium experiences

- The growing appeal of agritainment

- Showing appreciation for your loyal guests

Trading up, splurging on high fidelity premium experiences

Back before the Great Recession we saw consumers engaging in trading up to what is called affordable luxury. Back then Americans were willing, even eager, to pay a premium price for certain goods and services that possessed higher levels of quality, taste and aspiration than other goods in their category, but that weren't so expensive as to be out of reach. To afford to do this, consumers traded down to low-cost generic products and services that were not important to them. So a consumer might buy less expensive grocery store brands to save money so they could trade up to a premium imported cheese.

The Great Recession brought much of that practice to a screeching halt. With incomes squeezed and the fear of uncertain economic times, people became super cost-conscious and tightened their wallets, only trading down since they either didn't have the money to afford any types of luxury or they just became far more conservative in their spending. Trading up to affordable luxury was something that was deferred to hopefully better times.

It appears those times have returned for a segment of the population, at least for out-of-home leisure experiences, with what is called splurging, trading up to premium leisure experiences.

Research by PGAV Destinations has found that the desire to splurge is greatest with people 18-34 and with parents with children. Their research found that splurgers are looking for quality, for premium experiences. It's not about the cost, but rather about the value in terms of the experience meeting their needs.

From the guests' emotional perspective, PGVA's research found a number of top drivers of premiumization that all included a strong socialization component. At the top of the list is “reconnecting with friends and family in a fun environment.” Closely tied were “time together with loved ones” and “a fun getaway with friends and family.”

Research in the consumer goods industry is also seeing a similar phenomenon that is being labeled as the hybrid consumer. Using money saved by trading down on staples, hybrid consumers are trading up to premium, high-end products that matter most from an emotional and social perspective, such as premium brands in supermarkets. As a result, markets are becoming increasingly polarized into two extremes, value or premium, with less interest in mid-market products.

Splurgers and the hybrid consumers really have same goal: saving in some areas so they can purchase premium experiences and goods in others. It all ties in with the High Fidelity trends we are seeing with entertainment and social experiences. Consumers either choose the high fidelity, premium social and entertainment experience that they will pay a premium price for or the convenient experience that is low cost and low quality, almost entirely in-home or available via screen-based technology. The middle ground, what is called the fidelity belly, has no appeal the same as mid-market products.

The continuing challenge for out-of-home leisure and social destinations is that the better and more convenient at-home and screen-based technology options become at satisfying consumers' entertainment and social needs, the higher the fidelity of the out-of-home experience has to become to attract consumers off their couches, away from their screens and out of their homes. The recent Pokémon GO phenomena has changed the playing field, as now augmented or mixed reality has presented a highly convenient screen-based technology for an out-of-home experience that is both entertaining and social. You no longer have to pay to visit an entertainment venue. And advances in at-home AR and virtual reality are sure to raise the appeal of at-home entertainment and social experiences even higher in the future.

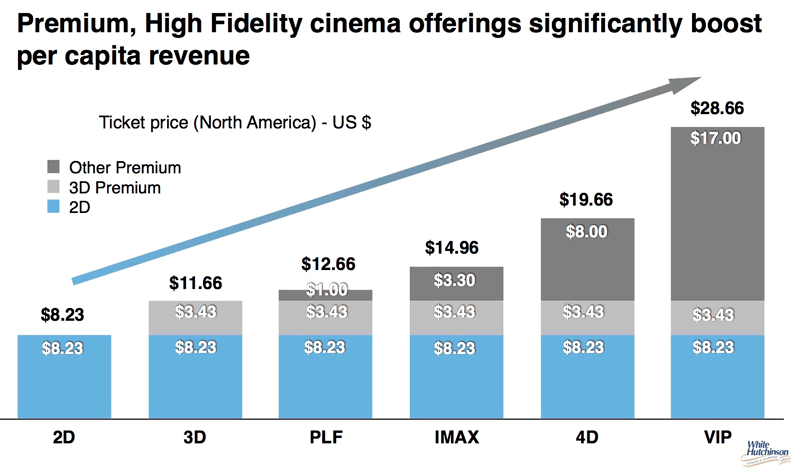

An excellent example of premiumization, the move to high fidelity and more expensive out-of-home leisure experiences is what has been happening with the cinema industry. As at-home streaming movies and shows become more attractive on large, high definition screens, the movie theatre industry has had to move to higher fidelity moviegoing experiences to stay competitive. They have installed digital high quality projectors to improve the screen experience. And despite charging a higher ticket price for the higher quality experiences, the moviegoing audience is more than willing to pay for it.

The same phenomenon holds true for the changes cinemas are making to their theater seating. They are tearing out the traditional cinema seats and replacing them with lush electric leather recliners to better compete with the at-home movie viewing experience. Despite then only getting one-half to one-third of the seating capacity, both attendance and revenues have increased.

In our October issue, we reported how average household spending is increasing for entertainment on trips and vacations, but not for entertainment in the local community. We believe this is an example of the growing splurging phenomenon, as although most attractions at tourist locations can be expensive, they are high fidelity. In the local community most entertainment venues, although less expensive, don't have that quality, the high fidelity, so instead consumers are just sticking to their convenient at-home screen options.

So the bottom line for community-based leisure venues, including all types of family entertainment centers (FECs) is quite simple. In our world of highly convenient and compelling digital screen and at-home options, if you want to attract consumers, you need to offer compelling premium experiences. The venues that people visit on trips and vacations are raising consumers' expectations of what a high fidelity experience is. Lower quality, mediocre community-based experiences no longer have appeal. Instead, consumers opt for their convenient screen-based options. Today, it's either one extreme or the other.

Vol. XVI, No. 10, December 2016

- Editor's Corner

- The changing composition of American households

- The trilogy of the healthy Cs

- What's driving the evolution and success of the new school CLV models?

- Hatchet throwing and beer; watch out for your scalp!

- Trading up, splurging on high fidelity premium experiences

- The growing appeal of agritainment

- Showing appreciation for your loyal guests