Vol. XXII, No. 12, December 2022

- Editor's corner

- The role of alcohol at location-based entertainment

- Dave & Buster's Q3 2022 results

- Death by a thousand cuts

- Should location-based entertainment prioritize sustainability?

- What do people find meaningful and fulfilling?

- Why the birth rate is declining

- Two different eatertainment venues

- Why market and financial feasibility studies need to be different today

- Time saved, or time well spent?

- Older Gen Z trending vegetarian, vegan, and flexitarian

Death by a thousand cuts

Last month's issue featured an extract from a very insightful article by Jim Kessler, owner of Lasertron. Jim predicted that the growth of many smaller out-of-home social bonding and game venues (a.k.a. referred to as socialized gaming or competitive socializing venues) and other smaller location-based entertainment venues (LBEs) would result in many large LBEs, especially large family entertainment venues (FECs), that don't dominate in at least one specific type of entertainment/attraction, struggle to stay profitable.

Jim said, "It won't be one big entertainment center coming into another big entertainment center's backyard (although that will certainly happen); it will be 10 or more smaller venues popping up within all the different communities that make up a city and surround the big box center. As each new venue opens, it will take another slice of revenue away from the big box center until its profitability completely disappears."

Jim also pointed out that with the tens of thousands of bars and restaurants, if just a small percentage enter the out-of-home entertainment market, which some are starting to do, "it's going to get very bloody for everyone."

It's just not smaller LBEs, bars, and restaurants that are applying a thousand cuts to the financial viability of existing LBEs. Anything people can do with their leisure time is as well. The amount of time people spend attending LBEs is not some fixed amount from year to year. Other leisure activities can cut into that time. One leisure activity that is slowly applying cuts to out-of-home entertainment is people's at-home digital entertainment/leisure.

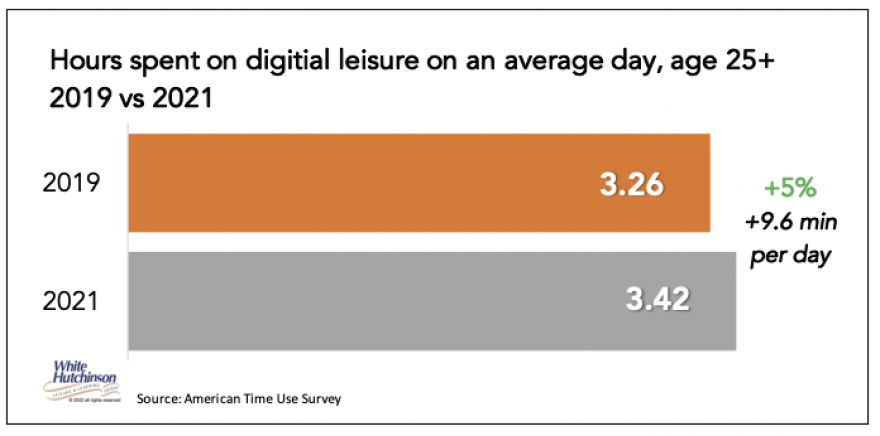

The pandemic accelerated people's use of digital entertainment, and some of the increase may be permanent. Here you can see the change between pre-pandemic 2019 and 2021.

However, since we're still not totally out of the pandemic to a point where things are stabilized at a new normal, we're going to use data through 2019 to illustrate a thousand cuts to LBEs from at-home digital entertainment/leisure activities.

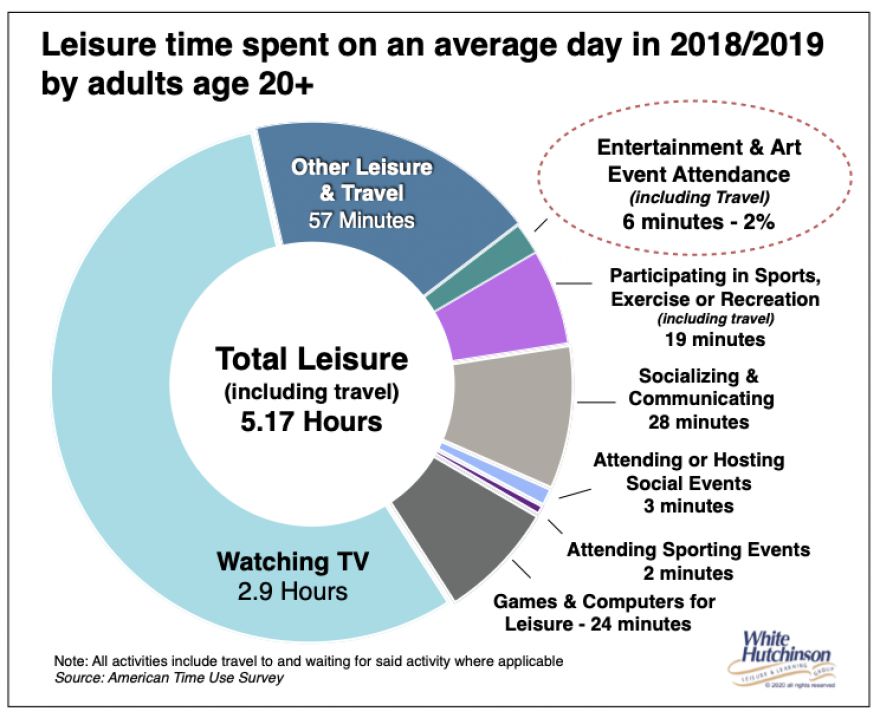

The first thing to recognize is a very small share of people's leisure time is devoted to attending not just all types of location-based entertainment, which also includes movie theaters and theme parks, but also cultural and art venues. For adults aged 20+, only an average of 6 minutes a day, just 2% of all their total leisure time is spent attending entertainment and arts venues. That's only one-quarter of their daily time playing digital video games and using computers for leisure.

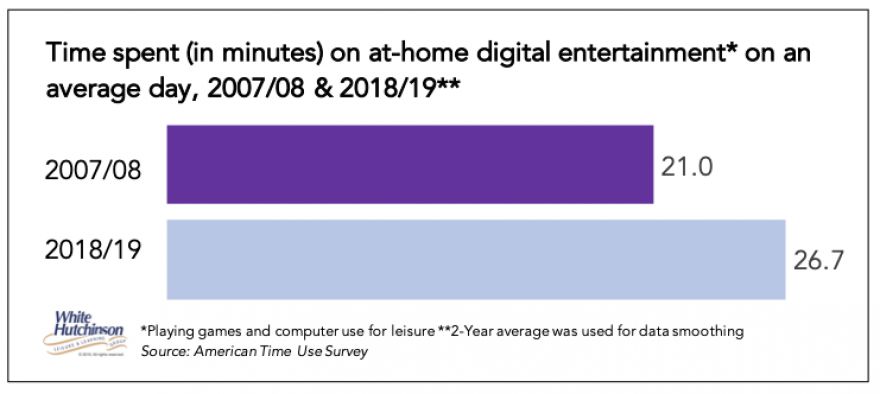

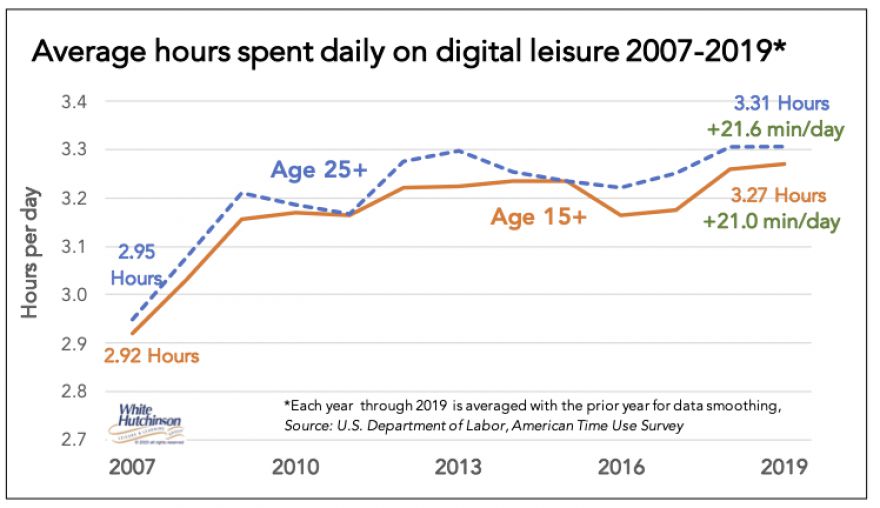

Between 2007 and 2019, the average American age 15+ increased their time for at-home digital entertainment playing games and computer use for leisure by more than one-quarter, from 20 to almost 25 minutes a day.

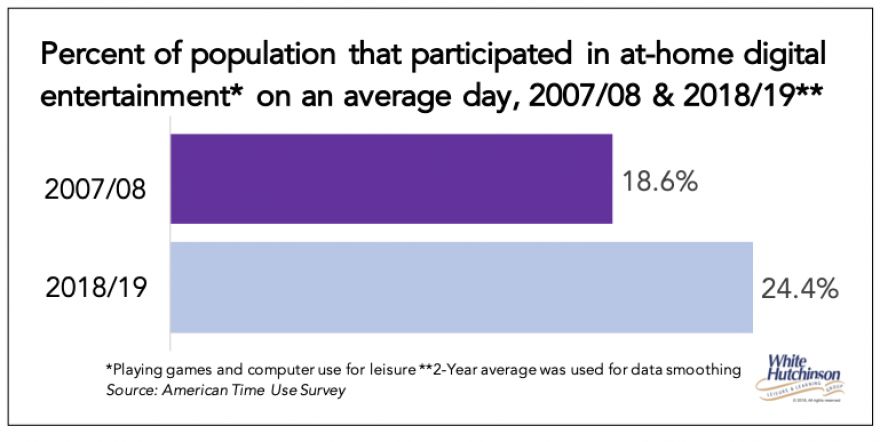

In 2007, less than one in five people participated in at-home digital entertainment playing games and computer use for leisure. That grew to nearly one in four in 2019.

Not only are more people playing games and computer use for leisure, but the time they're spending has increased as well.

Average time use for all at-home digital entertainment/leisure, which includes video games, computer use for leisure, and watching television for age 25+, increased by 21 minutes a day between 2007 and 2019.

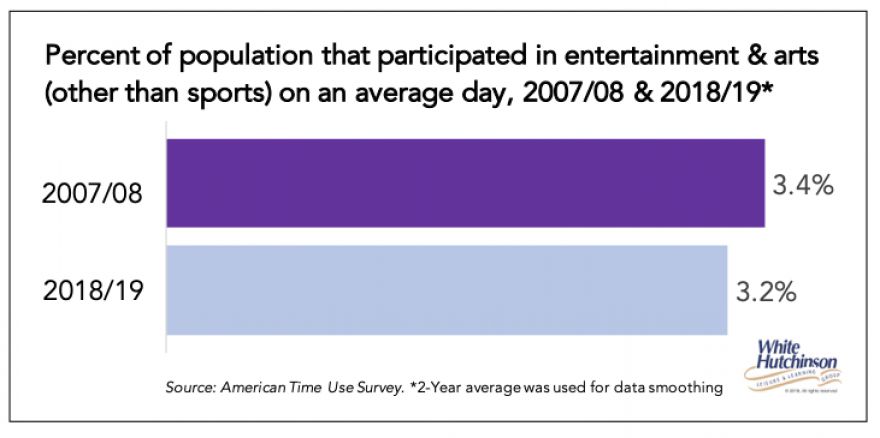

Meanwhile, between 2007 and 2019, the percentage of aged 15+ who participated in out-of-home entertainment and arts on an average day declined by 6% from 3.4% to 3.2%

During the same period, the average time aged 15+ attended OOH entertainment and arts didn't change.

What all this means is not only is the size of the location-based entertainment venue pie being sliced up into more slices by new smaller social bonding venues and restaurants and bars entering the out-of-home entertainment space, but at the same time, the size of that pie is shrinking by people shifting some of their leisure time away from LBEs to digital at-home options.

Vol. XXII, No. 12, December 2022

- Editor's corner

- The role of alcohol at location-based entertainment

- Dave & Buster's Q3 2022 results

- Death by a thousand cuts

- Should location-based entertainment prioritize sustainability?

- What do people find meaningful and fulfilling?

- Why the birth rate is declining

- Two different eatertainment venues

- Why market and financial feasibility studies need to be different today

- Time saved, or time well spent?

- Older Gen Z trending vegetarian, vegan, and flexitarian