Vol. XVIII, No. 2, February-March 2018

- Randy's travelogue - journey to Milan, Italy & FICO Eataly World

- When something goes wrong, apologize, apologize, apologize to the customer: WRONG!

- Doc Brundy's sodacad under construction

- Changes to the leisure time landscape and its impact on out-of-home entertainment and arts

- Restaurant campers

- It's a beautiful Saturday

- iGen and Clean Lifers partying, drinking & hanging out less

- The six laws of customer experience

- Fighting for out-of-home entertainment participation & spending

- Clean restrooms means more revenues and profit

- Short introduction to Urban Neuroscience

- The future ain't what it used to be

Fighting for out-of-home entertainment participation & spending

Digital entertainment spending is continuing to win a greater and greater share of consumers' spending while the share devoted to out-of-home (OOH) entertainment and the arts declines.

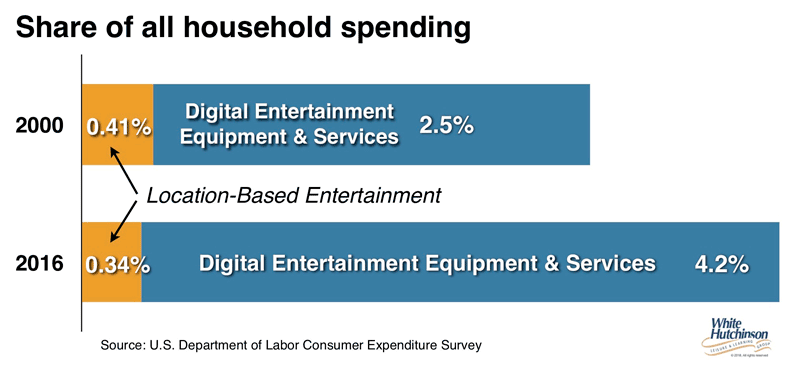

The share of all household spending for digital entertainment increased by nearly two-thirds from just 2.5% in 2000 to 4.2% in 2016. During that same time period, the share of spending for OOH location-based entertainment and arts has declined by one-sixth. Digital entertainment spending in 2016 was twelve times greater than for OOH entertainment and arts.

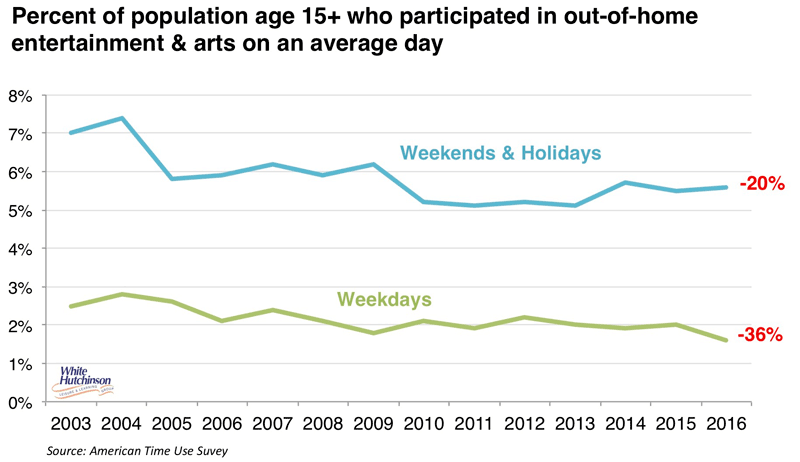

A declining percent of the population is participating in OOH entertainment or art events on the average day.

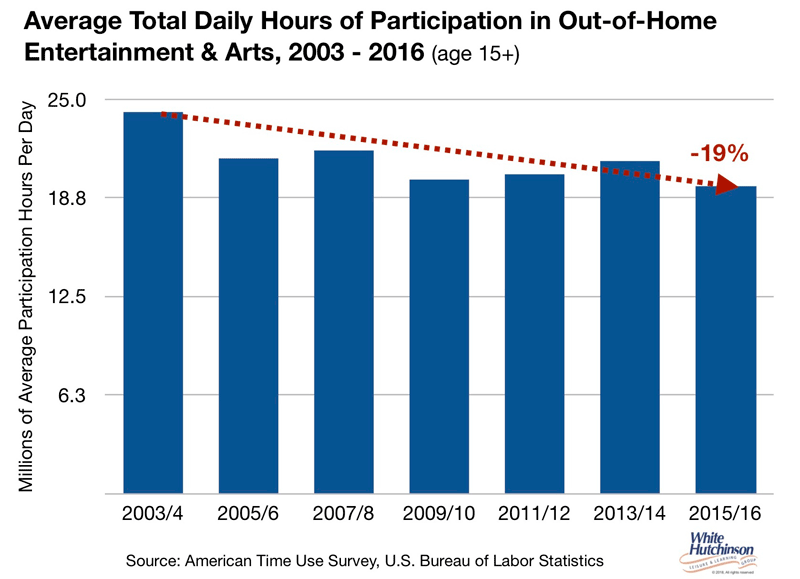

Not only is there a drop in participation, but there also a drop in average time spent by the population age 15+ at OOH entertainment and arts activities. Even with a one-seventh (+14%) increase in the total population age 15+, the larger population spent nearly one-fifth less total time at OOH entertainment and arts events (-19%) in 2016 compared to 2003.

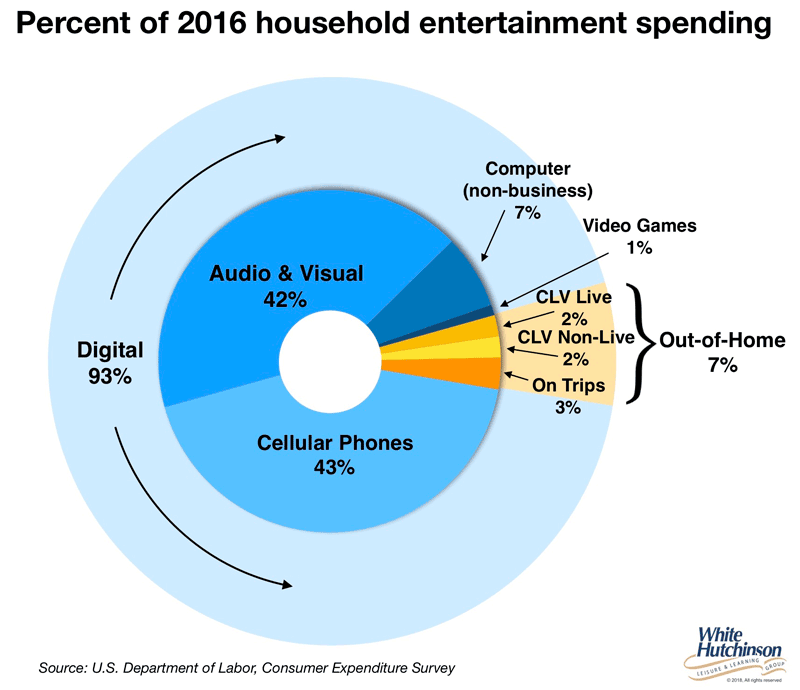

The graph below shows how small a share OOH entertainment and arts spending comprises of all entertainment spending. And community leisure venue (CLV) entertainment and arts spending on non-live entertainment such as typically found in family entertainment centers (FECs) is only one 50th of all entertainment spending.

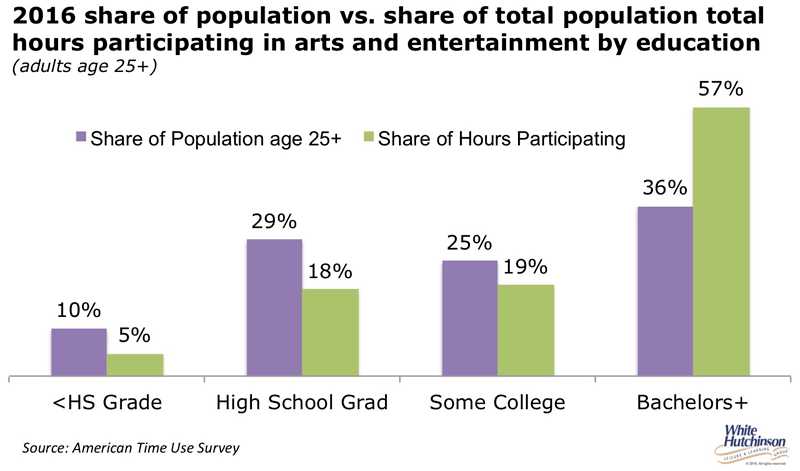

When people are leaving home for entertainment and arts, it's the higher socioeconomic adults who spend the most time at those venues. Although adults age 25+ with a Bachelor's or higher college degree made up only 36% of the age 25+ population in 2016, they accounted for more than half (57%) of all hours spent participating in entertainment and arts.

Implications for OOH entertainment

The market pie for participation at and time and money spent at OOH entertainment and arts has significantly declined as screen-based digital options displace it. This trend is likely to continue into the future as new consumer digital entertainment options go mainstream, such as virtual and augmented reality.

Today there is less demand for OOH entertainment and arts than in the past. This means that many CLVs that might once have been successful will become marginal or fail and that many new projects that are based on projections of past demand into the future will not achieve their projected results.

There is still opportunity for successful CLVs. However, to win, they will need to be high quality, High Fidelity, offering shareworthy and repeatable experiences built on new formulas rather than formulas from the past that target the higher socioeconomic consumers.

Vol. XVIII, No. 2, February-March 2018

- Randy's travelogue - journey to Milan, Italy & FICO Eataly World

- When something goes wrong, apologize, apologize, apologize to the customer: WRONG!

- Doc Brundy's sodacad under construction

- Changes to the leisure time landscape and its impact on out-of-home entertainment and arts

- Restaurant campers

- It's a beautiful Saturday

- iGen and Clean Lifers partying, drinking & hanging out less

- The six laws of customer experience

- Fighting for out-of-home entertainment participation & spending

- Clean restrooms means more revenues and profit

- Short introduction to Urban Neuroscience

- The future ain't what it used to be