Vol. XVII, No. 1, January 2017

- Editor's Corner

- Are you ready for hygge?

- 2017 Foundations Entertainment University dates

- Top 2016 articles

- The untold truth about feasibility studies

- The growing inequality of entertainment & the growth of eleisure

- What's happening to sports participation?

- Becoming the industry contrarian

- Is a new virtual reality disruption coming to out-of-home leisure?

- Predictions for 2017

- The curse of customer fatigue; the downfall of many CLVs & FECs

The untold truth about feasibility studies

The conventional wisdom about market and financial feasibility studies totally misses the mark when it comes to development of highly profitable community leisure venue (CLV) businesses, including family entertainment centers (FECs), bowling- and laser tag-based centers and family fun centers. The conventional wisdom is to take some stock concept mix of attractions, examine the trade area's demographics based on some distance rings, such as 10 and 15-miles, and then project attendance and per capita revenues based on some standard model based strictly on historical data and the site's total population. Sometimes, the studies are not even based on a particular site, but rather just a general market area.

Surprisingly, or not so surprisingly, feasibility studies following this approach typically determine the project is feasible, especially when a supplier performs the study. Unfortunately, this is also the case with too many industry consultants. Rarely is a project not found feasible.

Here are the fallacies in this too often standard approach to CLV and FEC feasibility studies:

Defining trade areas

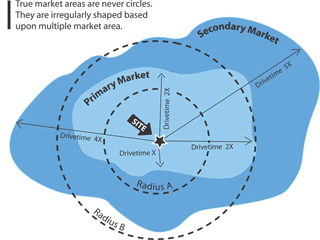

Trade areas are not concentric circles. Rather they are a function of drivetimes, the location of competition, physical and psychological barriers and other factors that influence consumer behavior.

Location makes a big difference

The exact geographic location of the project can have a significant impact on the size of the trade area. Sites less then half-a-mile apart can have completely different trade areas. A market feasibility study for an entire smaller town or portion of a larger city can be helpful to determine if the market might be large enough to search for a site, but its data will never be correct for an actual site. Once a site is selected, then market feasibility needs to be run for that site to determine it's precise trade area(s) and its composition.

Populations vary

Not all trade area populations are the same. Population size alone cannot determine market penetration, attendance or spending. Trade area populations vary greatly in age distributions, incomes, household composition and other socioeconomic and lifestyle factors. These all impact feasibility and have to be analyzed.

Demographics don't tell the whole story

Market studies that rely only on demographics to define a trade area's population only give a broad picture of the population's composition. Demographics only lump people in large categories and averages. It's a little like describing a roller coaster by its average height. You don't get a clear picture of its characteristics. In addition to demographics, what are called psychographics - personality, values, attitudes, interests, behaviors and lifestyles - influence who will participate and how much they will spend on location-based entertainment. This is why also determining the socioeconomic-lifestyles (SELs) of a trade area is so important to understanding and analyzing a trade area's population.

Stock formulas are not a fit

Stock models to determine market penetration, attendance and per capita spending are based on averages and fail to reflect both a different trade area population's composition, the impact of competition and factors such as pricing that vary in different areas.

The mix matters

Stock models for the mix are rarely, if ever, the best choice for a trade area. Rather, based on the trade area's composition, the site's characteristics and the competition, the mix and concept needs to be curated to match the social, dining and entertainment needs and demands of that specific market. In other words, a unique brand identity needs to be developed for the center that is the best match for the market, not just a copy of some other center.

Feasibility has changed

Projects that were considered feasible less then five years ago may no longer be so, both due to the project's mix and socioeconomic positioning as well as the trade area's size and composition. There has been a dramatic shift over the past few years in what works for CLVs, including who they need to target, what they need to offer and the size market required to support them based upon a loss of most of the middle class, a market shift to a higher socioeconomic potential customer base and an over decline in CLV participation and spending. Those stock formulas based on yesteryears' performance no longer fit neither the current times nor the future.

Suppliers look out for their self interests, not yours

Suppliers are in the business of making profits by selling their products. Of course, not only their feasibility studies, but also the mix they recommend for a project will serve their self-interests, not that of the center developer.

Cost matters

Determining the exact cost of the project is critical to both feasibility as well as the project's funding. The biggest variable is construction costs. Typical feasibility studies use some industry mean construction cost to project costs. Rarely, if ever, do such costs match the exact conditions and requirements for a particular location.

Our contrarian approach

The White Hutchinson Leisure & Learning Group is considered a contrarian in the industry when it comes to CLV and FEC feasibility studies, as we don't follow the conventional wisdom. In fact, we often tell clients their projects are not feasibility. We believe it is our duty to help clients make the best business decision, and quite often, that means not proceeding with a particular project at a particular site.

Success in the CLV industry is very challenging today. CLVs have to compete with every other option consumers have for their discretionary income and leisure time. Those options are now almost limitless, both out-of-home as well as on consumers' screens. So, the last thing you want to do is take on any type project that has any handicaps and it not totally optimized for its market, assuming the market size is large enough.

So to be as accurate as possible with our assessment of a site's feasibility, we visit the site and visit and evaluate all competition. We will see things in the field we might not comprehend by just looking at maps and websites like some consultants do. Sometimes, we reject the site and help our client find a more feasible site.

We then determine the trade areas based on multiple factors, just not some arbitrary concentric circles based on our studies of where customers lived for many existing projects. True trade areas look more like this than concentric circles.

We then super analyze the population using detailed demographics and socioeconomic-lifestyle segmentation.

When it comes to the mix, we don't just agree to some stock development formula, which in many cases may be obsolete based on yesteryear's centers or not the best solution for that particular site in that market. Instead, based on our analysis of the market and competition, we develop a bespoke product mix and design to meet the social, dining and entertainment needs and potential of the unique characteristics of that market population, one that will give the center a strong brand identity and that will have long term appeal.

When it comes to projecting the cost of a project, we don't just use some estimate based some average cost per square foot to build/renovate. Instead we develop preliminary plans for the project and then have a local general contractor prepare a realistic construction cost estimate.

Our feasibility studies include a lot of other work and analysis that you won't find in the more boilerplate ones that are unfortunately so common in the CLV industry. That is the reason RePlay magazine said our FEC "feasibility studies are often praised by other industry pros as the crème de la crème of this niche of the industry." We see it as our obligation to assure your clients' success, and that means doing it right.

True due diligence for a feasibility study takes a lot of work. It lays the foundation for everything that follows. It is the step that either builds potential fatal flaws into a project or lays the groundwork for business success.

To learn more about feasibility studies, check out this list of articles.

Vol. XVII, No. 1, January 2017

- Editor's Corner

- Are you ready for hygge?

- 2017 Foundations Entertainment University dates

- Top 2016 articles

- The untold truth about feasibility studies

- The growing inequality of entertainment & the growth of eleisure

- What's happening to sports participation?

- Becoming the industry contrarian

- Is a new virtual reality disruption coming to out-of-home leisure?

- Predictions for 2017

- The curse of customer fatigue; the downfall of many CLVs & FECs