Vol. XV, No. 9, November 2015

The changing demographic landscape

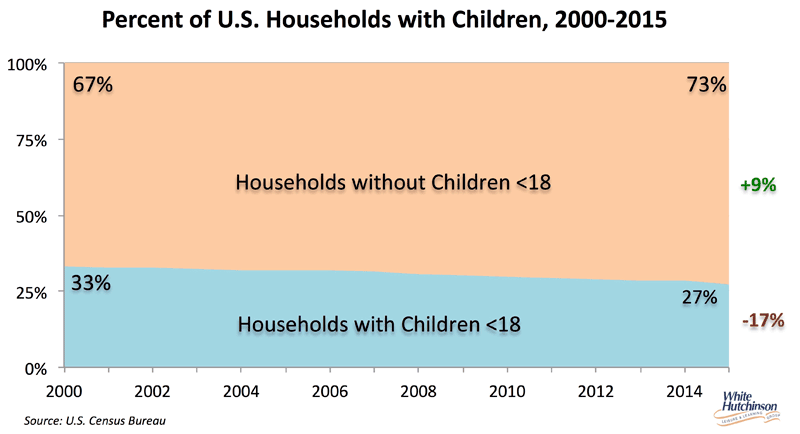

There are a number of demographic shifts occurring in America. One that is very significant to the family entertainment center industry is a decline in the number of households with children. Whereas 1/3 of all households used to have children back in 2000, this year their share has declined by 1/6th to just over 1/4 of all households (27%), while households without children have grown from 2/3rds to 3/4s of all households (73%).

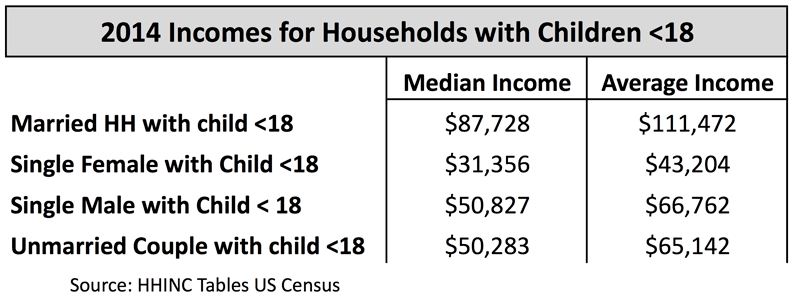

Not only has the percentage of households with children declined, but the absolute number of households with children has also declined over the 15 years despite an almost 1/5th increase in the total number of households (+19%, +19.9 million). Today, there are 615,000 less households with children than in 2000. Even more troubling is that the number of married families with children has declined by 1.6 million while the number of single parent and unmarried couple households has increased by 1.0 million. Married couples with children are a primary target for family and children's entertainment centers as they have much higher incomes than either single parent or unmarried couple households.

Of course this is a macro trend. There are still select areas of the country with an adequate density of higher socioeconomic families with children to support a family or children's entertainment center. However, today, even in those areas, it takes a larger market size than a few years ago due to the growing market share that both digital entertainment and social media is taking of both consumers' leisure time and discretionary incomes (see our white paper Disruption Gives Rise to a New Business Model). Today, the market opportunity has shifted more to adult-oriented centers that also have appeal to all but the youngest children visiting with the parents.

Additional reading - previous articles about changing demographics:

- The rise of young adult singledom

- America's middle class is shrinking

- Uptick in births in 2014

- Trends with age of marriage, 1st births, childlessness & family size

- The changing American family