Vol. XXIV, No. 1, January-February 2024

The shift to a more sober social culture

Food and beverage is growing in importance as an essential part of the mix for location-based entertainment venues, especially as demonstrated by the emergence and growth of the many social gaming (eatertainment) chains. At the same time, a long-term trend is underway that affects the beverage offerings.

'Dry January,' the annual sobriety challenge that emerged about a decade ago, may be a harbinger of a cultural shift that has been gaining momentum in recent years.

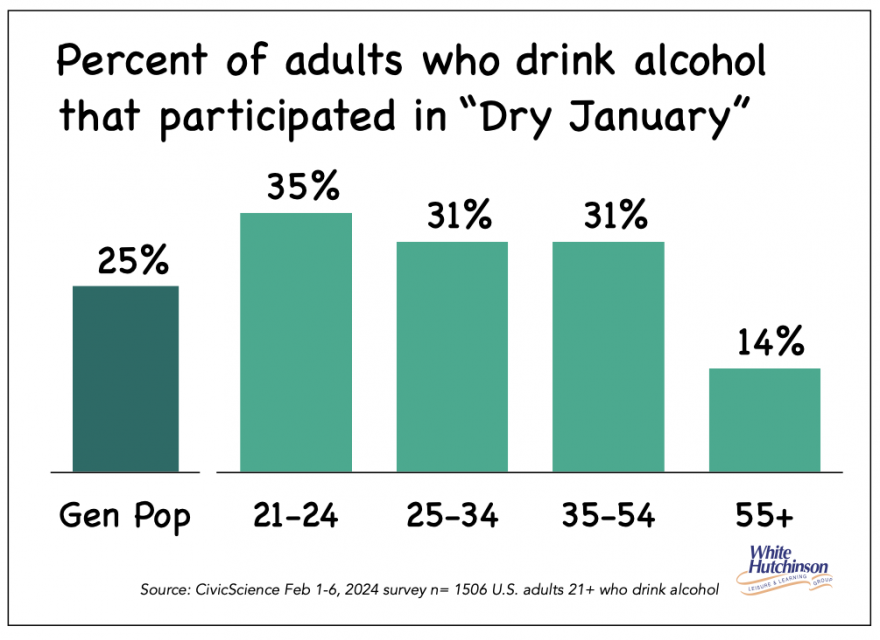

This year, a quarter of Americans 21+ who drink alcohol successfully completed Dry January. That figure surpasses the 16% who avoided alcohol during Dry January 2023. Adults aged 21 to 54 had the highest completion rates at around one-third.

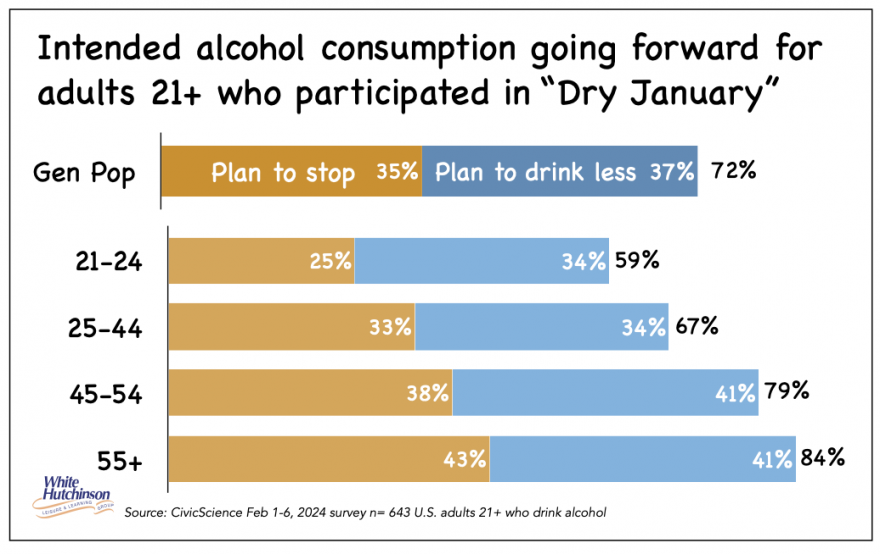

The majority of adults of all ages who participated in Dry January say they plan to stop drinking altogether (35%) or plan to drink less but not wholly eliminate alcohol (37%). Only 28% of those who avoided alcohol in January say they will return to their regular everyday drinking habits.

If Dry January participants' intentions hold true, it will mean a significant increase in teetotalers and a reduction in overall alcoholic drink consumption

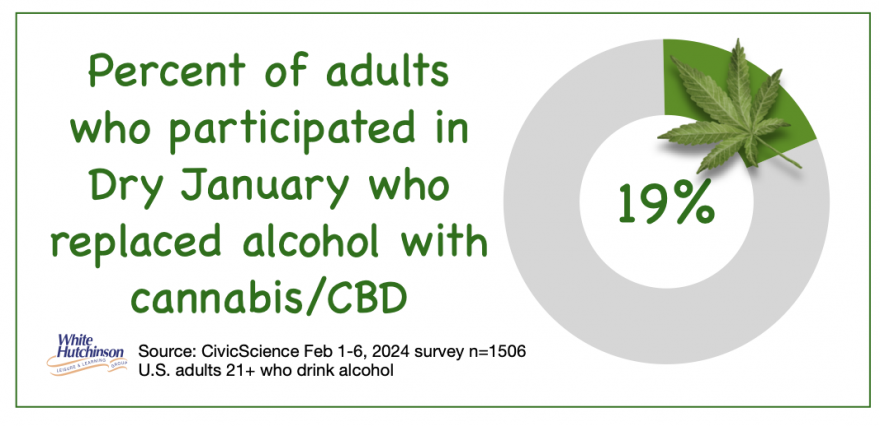

Interestingly, nearly one-fifth of participants (19%) said they used cannabis or CBD products instead of alcohol during Dry January.

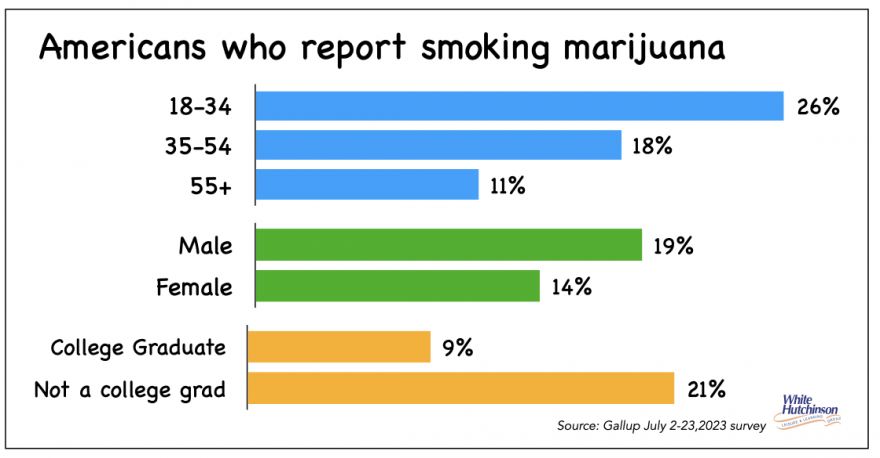

Young adults are the highest users of marijuana.

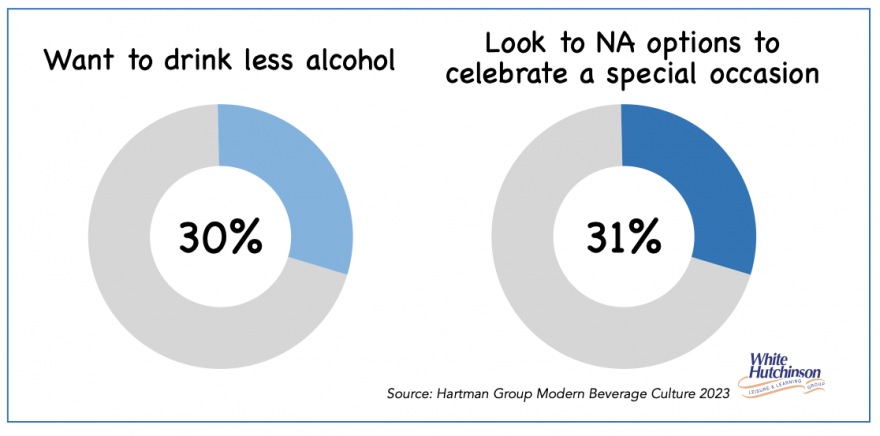

Three in ten adults of drinking age report wanting to drink less alcohol. 31% are using nonalcoholic beverages to celebrate a special occasion.

Called the 'sober curious' movement, a significant percentage of young adults (Gen Z and Millennials) are drinking significantly less alcohol than older generations did at their age. A 2018 Berenberg Research report found that Gen Z is drinking 20% less alcohol per individual than Millennials, who drink 20% less than Gen X did at their age.

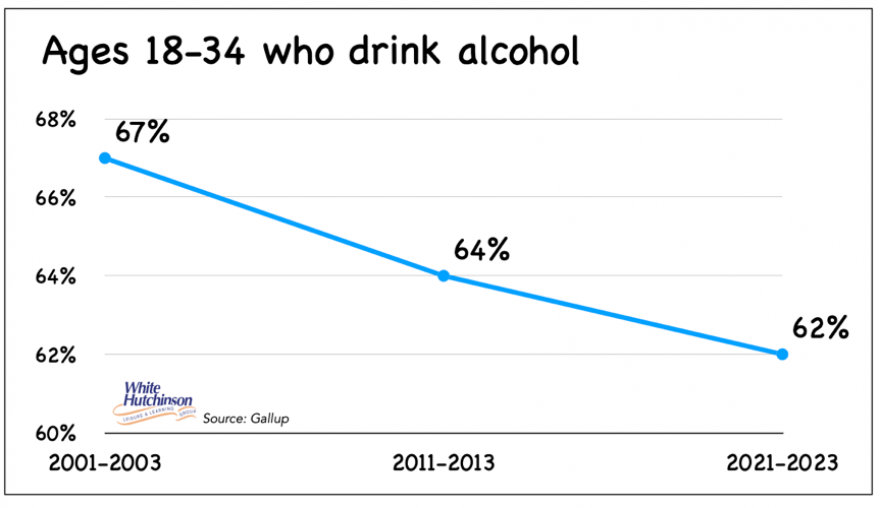

A recent Gallup Poll survey found that 62% of adults under 35 drink alcoholic beverages, down from 72% two decades ago. That number will likely continue declining since Gen Z drinks the least of any demographic. Young adults increasingly see nursing a nonalcoholic beverage as a socially acceptable, perfectly normal alternative to downing shots and chugging beer.

According to a 2023 Harris Poll food and beverage report, 57% of young adults ages 18-34 said they had decreased their alcohol consumption in the past year.

Driven by a more risk-averse and cautious mentality, young adults' reasons for not wanting to consume alcohol tend to be rational, such as a fear of losing control, the expense of drinking, and the potential to feel adverse physical effects, including a bad hangover. In addition, health and wellness continue to be key motivators for limiting or reducing alcohol across adults of all ages. AMPLYFi found that 41% of U.S. drinkers choose no or low-alcohol options due to health and wellness reasons.

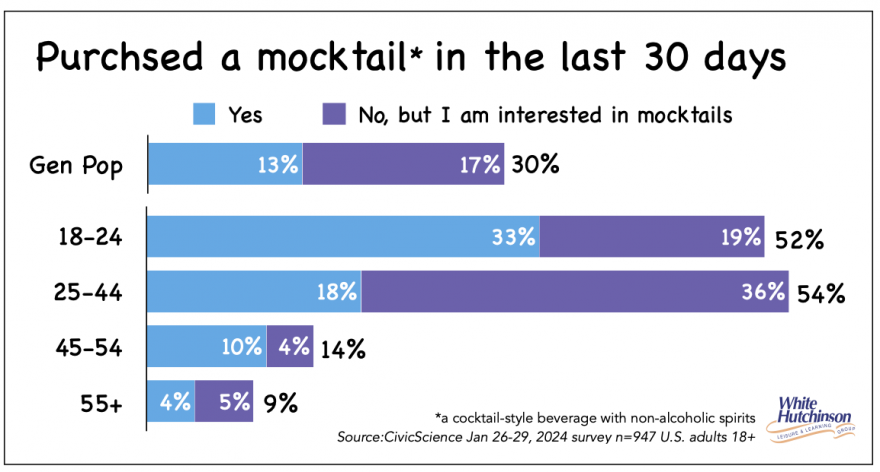

The trend to sobriety or drinking in moderation has led to a growth in sales of mocktails (a cocktail-style beverage with nonalcoholic spirits). And Gen Z is driving the charge. One-third of Gen Z purchased a mocktail in the previous 30 days compared to only 18% of Millennials and less than 10% of adults age 45+.

A quarter of Americans 21+ are interested in living a sober lifestyle. The data show that sober-curious individuals are driving the mocktail trend alongside moderate drinkers. 56% of 'very' sober curious Americans 21+ have purchased a mocktail in the last 30 days. Those who are 'somewhat' sober-curious are half as likely to have purchased a mocktail (28%),

According to a recent CivicScience poll, Americans 21+ are most interested in ordering mocktails from restaurants (26%), followed by bars/nightclubs (16%) and sporting events (13%). These figures jump tremendously among Gen Z adults - 42% are interested in ordering mocktails at restaurants, and 26%-27% would have one at a bar/nightclub or sporting event.

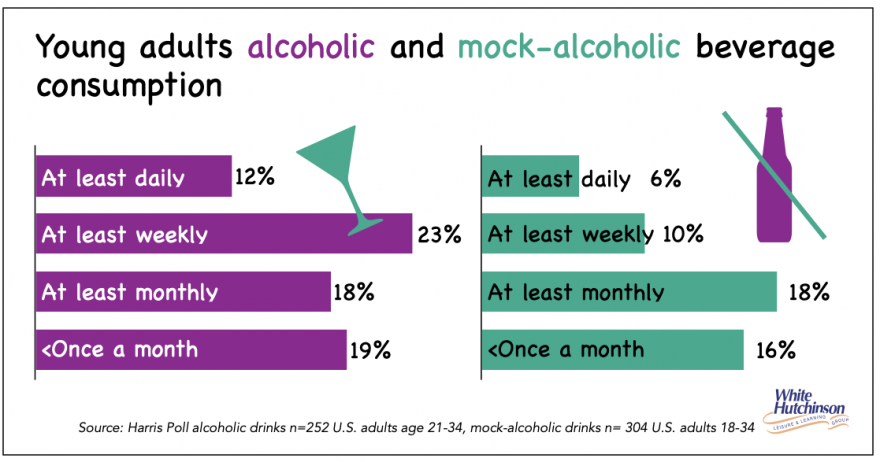

Young adults ages 18-34 still consume alcoholic drinks about twice as often daily or weekly as mock-alcoholic beverages.

Young adults who drink mock-alcoholic beverages most often enjoy fresh-mixed mocktails (i.e., made at home, at a bar or restaurant) (53%). After mocktails, young consumers typically reach for nonalcoholic wine (48%), nonalcoholic beer (42%), or nonalcoholic spirits (e.g., Seedlip, Ritual) (34%).

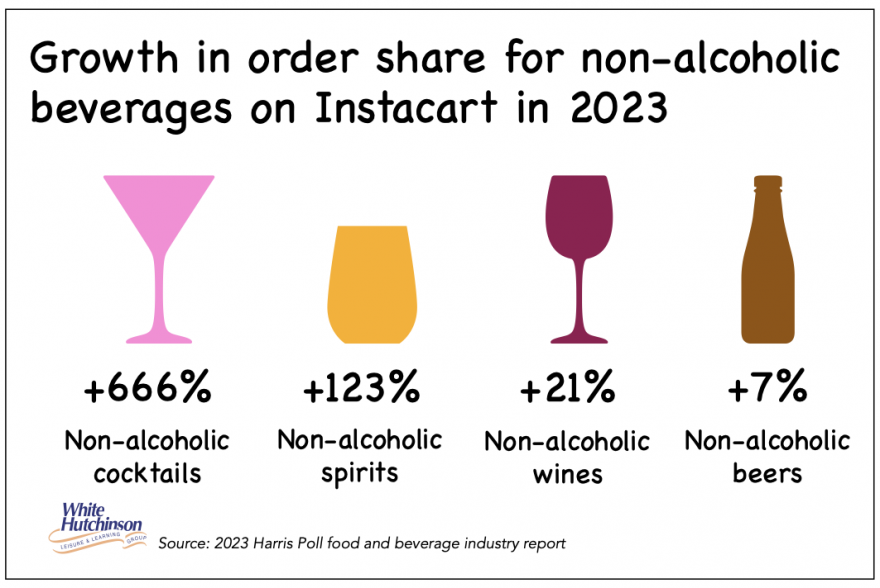

Instacart 2023 order data shows a significant year-over-year growth in the order share of nonalcoholic beverages, with mocktails showing the greatest increase.

Non-alcoholic beer sales in U.S. grocery, convenience, and liquor stores have nearly tripled since 2019. The hottest beer in America now doesn't have alcohol. Athletic Brewing has become the country's king of non-alcoholic beers, recently passing Heineken and Budweiser as the No. 1 brand by sales in U.S. grocery stores. In fact, at Whole Foods Market, Athletic now sells more than any other beer, including the ones with alcohol.

Mocktails and other alcohol alternatives are more than a passing fad; they are a long-term trend.

With more conscious consumers adopting mindful drinking habits, bars and restaurants are expanding their menu offerings to cater to a growing demographic of a more sober social drinking culture by now embracing N.A. beverages - mocktails, and non-alcoholic beers and wines. One that recently made the news is Uno Pizzeria & Grill, a national and international restaurant chain. They partnered with Ritual Zero Proof, the best-selling nonalcoholic spirit brand, to offer customers spirit-free cocktails, including margaritas, hurricanes, peach mules, and the old-fashioned.

In many restaurants, non-alcoholic alternatives are priced similarly to the alcohol-based options they replace.

If your venue doesn't have a good selection of N.A. options, it'll likely lose customers to venues that do.

When a venue with good cocktails has a blah mocktail menu, it can signal that it doesn't care much about its sober (or "sober-curious") customers. Non-alcohol drinkers are now accustomed to having options when they go out, and they're no longer impressed by just a seasonal January offering of a good selection of N.A.s. Not wanting to drink alcohol shouldn't prevent customers from having an over-the-top, high-end beverage with all the bells and whistles good cocktails provide. Venue operators need to care about the whole experience and about the entire spectrum of what people are interested in drinking.

Location-based entertainment venues must stay ahead of drinking trends and consumer preferences to remain relevant to customers and competitive.

Subscribe to monthly Leisure eNewsletter