Vol. XVII, No. 4, April 2017

- Editor's corner

- Board games are making a comeback

- Developing experiential CVs

- Only 2 weeks left to register for Foundations Entertainment University to be held in New Jersey

- Increasing adult appeal with slick road course go-kart tracks

- There are 3 elephants in the room: Is a CLV/FEC bubble on the horizon?

- More grandparents than ever

- Less capacity but higher quality increases attendance and revenues

- The difference between failure & success

There are 3 elephants in the room: Is a CLV/FEC bubble on the horizon?

We see the future of community-based leisure venues (CLVs) that include entertainment, and it's not pretty.

There's a confluence of three elephants in the room (yes three) that most people in the industry refuse to recognize that are coming together to cause a perfect storm.

Same fate as bricks-and-mortar retail?

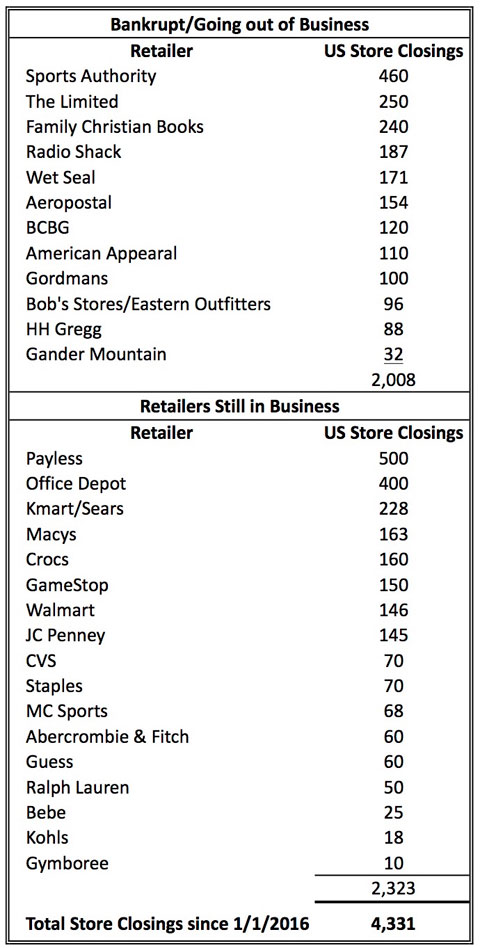

We're sure you've seen the recent news reports of all the retail and department stores closings, with many going bankrupt.

Here's a breakdown of all the major retail and department stores that have closed over just the past 15 months. Yes, over 4,000 and this count doesn't include any before January 1, 2016 - there were a lot more. Almost 800 were large department stores. And it seems like just about every day there is some new closing announcement.

So is bricks-and-mortar retail going extinct? Not exactly. But it is a sure thing that the shrinking of its footprint will continue.

There are a number of reasons for this. One is that for years the U.S. has been overstored. There is way more square feet of retail than is needed based on consumer spending - 48 square feet for every person in the U.S. to be exact compared to 22 in the U.K. Therefore many stores were staying open with lackluster sales, barely profitable.

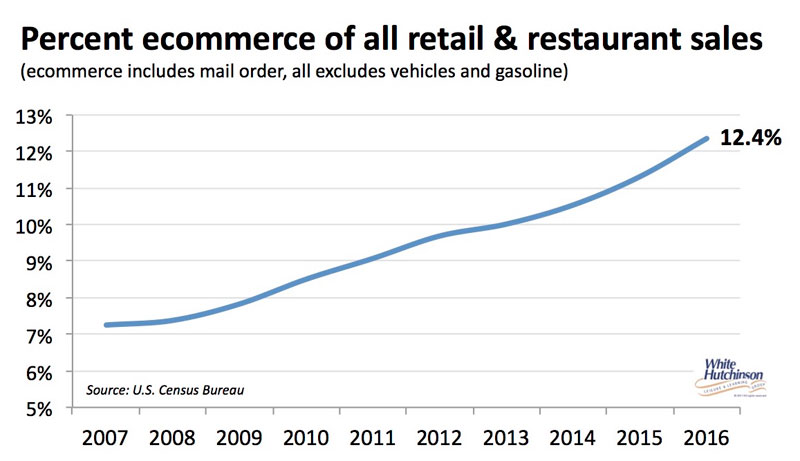

In more recent years it's e-commence that's doing bricks-and-mortar retail in. We're seeing a massive growth of online ordering of just about anything you can imagine. Today eight-in-ten Americans are online shoppers. One of the greatest culprits is the massive growth of the Amazon Prime subscriber base. Now we even have Amazon, Dash's, soon Uber and others delivering groceries. It's expected that up to 18% of grocery spending will occur online by 2023. Even the foodservice industry is starting to lose destination dining trips with home delivery from UberEATS, Grubhub, Doordash and others.

In 2016, e-commerce retail sales accounted for 12.4% of all retail and restaurant sales (excluding vehicles and gasoline)

So now, with shrinking bricks-and-mortar retail sales, the marginal stores and the ones with outdated retail models (especially the department stores), as well as entire retail companies are no longer profitable. So stores are being closed, retailers are going bankrupt and the remaining retailers are shrinking their footprints to adjust to today's retail reality as well as anticipating the continued growth of ecommerce. And this is only the beginning. With e-commerce's continuing growth, more stores will be closing in the future. The square footage of dark stores and big boxes is rapidly growing.

The fate of retail sales shifting to the digital world is analogous to exactly what is also happening in the location-based entertainment landscape. That's the first ![]() elephant in the room. A greater and greater share of entertainment spending is migrating to the digital world, what we call the digitalization of entertainment. It's just that we may be a little earlier in the cycle, so it's impact hasn't yet been fully felt, or at least reported, to the degree that has already occurred with retail. Think of bricks-and-mortar entertainment being about where retail was maybe two or three years ago.

elephant in the room. A greater and greater share of entertainment spending is migrating to the digital world, what we call the digitalization of entertainment. It's just that we may be a little earlier in the cycle, so it's impact hasn't yet been fully felt, or at least reported, to the degree that has already occurred with retail. Think of bricks-and-mortar entertainment being about where retail was maybe two or three years ago.

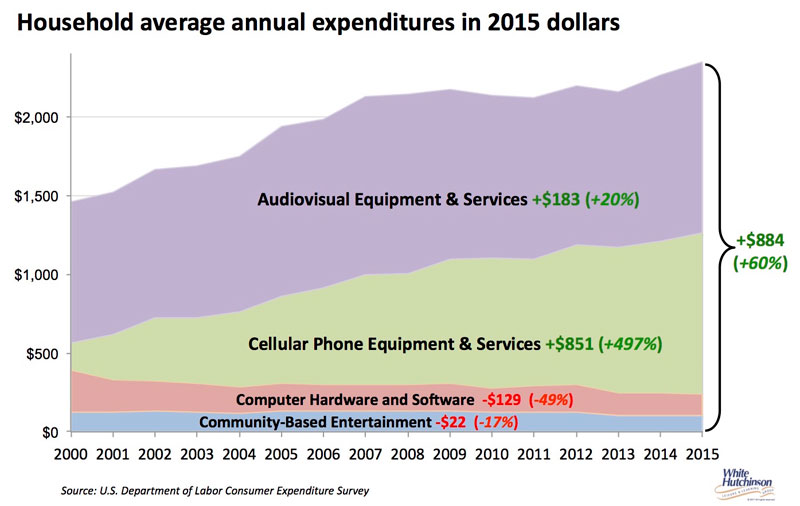

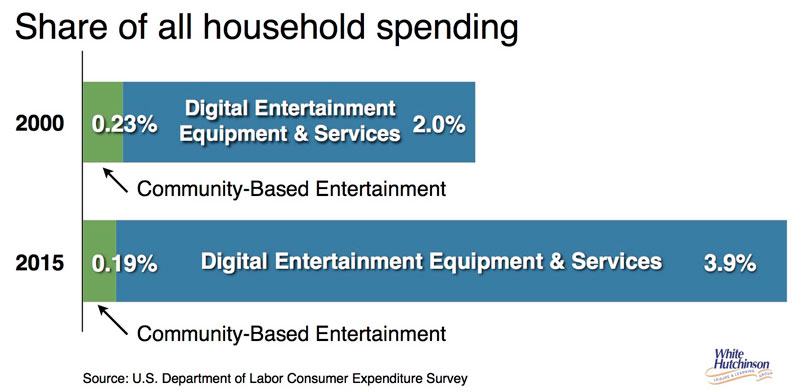

Think this is a crazy analogy, especially in the experience economy where people are reportedly shifting their spending from stuff to experiences? Well, here's some solid statistics on exactly what has been taking place since the turn of the century when we look at average household entertainment spending at CLVs versus spending on digital entertainment. Yes, the overall spending on entertainment is on the increase, but all the growth is for at-home and personal-screen digital entertainment experiences, not entertainment at brick-and-mortar community entertainment and leisure venues. Here are two graphs that show you what has been happening with CLV and digital entertainment spending since the turn of the century (inflation-adjusted).

Over those 16 years, average household digital entertainment spending has increased by two-thirds (+68%) while community-based entertainment spending declined by one-sixth (-17%). The share of all household spending going to digital entertainment has almost doubled while the share for bricks-and-mortar community entertainment has declined. So not only are consumers devoting all their increasing entertainment spending to the at-home and screen-based digital options, but they are shifting some of their spending away from CLVs. Our studies on changes to how consumers spend their time also bear this out; they're spending less time visiting entertainment venues and more time on their digital screens and devices.

Sound familiar? It's exactly what's been happening to retail, the shift of spending away from bricks-and-mortar to the digital realm. The exception is that average household overall retail sales have basically remained flat, while consumers are increasing their overall spending in the overall entertainment realm.

What this means for CLVs in a nutshell is a shrinking market, with the possible exception of venues in fast growing trade areas.

Expanding out-of-home entertainment options

Expanding out-of-home entertainment options

The second elephant in the room is all the new out-of-home entertainment options popping up everyday. Not that long ago, trampoline centers emerged and their number continues to grow. Now we have escape rooms appearing throughout the country. There are other nascent concepts built around such things as ping pong, bocce, board games and other forms of interactive entertainment. Bars are adding vintage arcade and other type games to broaden their appeal. We have retailers such as Bass Pro Shops, Cabela's and Jordan's Furniture incorporating entertainment into their stores, often for free, to attract shoppers. And there are all the museums with their changing exhibits, festivals and live entertainment.

This wide and growing variety of entertainment options is feeding into a phenomenon we are seeing with 20- and 30-somethings who use experiences to check off boxes on their “experiential CVs” (See article in this issue). They are always in search of new experiences to add to their collections as well as to enhance their social capital by sharing them on social media. Collecting experiences leads consumers to feel they are using their leisure time productively, as they are adding items to build their experiential CVs.

The lure of vacant stores

The lure of vacant stores

Finally, the third elephant in the room has been born out of the digital retail disruption. All the vacant retail space appearing in every market in the U.S. presents a great opportunity for entrepreneurs and existing CLV and FEC chains of all types to scoop up these spaces, and many are.

However, what might seem like an opportunity is laying the groundwork for possible doom and gloom. All the growing vacant retail space will be attracting new CLV entrepreneur developers who will pursue what looks like a golden opportunity to get space cheap from hungry landlords looking to fill their vacancies with entertainment and restaurant businesses to drive traffic to their shopping centers and malls. Many of the landlords are even offering generous tenant finish allowances to attract entertainment tenants. So that will only add to the CLV supply.

And in addition to all the entrepreneurial startups, we have many existing chains such as Main Event, Dave & Buster's, Round1, Top Golf, Punch Bowl Social and many others continuing their expansions.

The problem is, the market potential for CLVs isn't large enough to support all this growth. In reality, the market potential is shrinking due to the first elephant in the room, digital entertainment competition. So we see a bubble on the near horizon with a shakeout of all but the very best, highest quality and market niche-focused CLVs surviving. Frankly (you might not want to hear this), in many markets there is already over expansion.

So just like retail stores, some CLVs and FECs will survive and prosper, while unfortunately many others will join the roadkill graveyard.

Survival analogy

We can draw an analogy to the shopping center industry to understand which CLVs will survive. Along with many retail stores, malls are dropping dead throughout the country. The better retailers are in the process of, if they haven't already, migrating to the best malls, known as “class A” malls in the industry. And that's were shoppers are visiting. Meanwhile, the “B” malls are struggling and the “C” and below malls are being demolished or repurposed for other uses. What is happening is the premium, the High Fidelity centers in the better markets with contemporary design and amenities are winning and the mediocre ones are becoming history.

The big AH-HA

That's the big AH-HA that CLVs and FECs need to understand. Digital disruption and increasing bricks-and-mortar entertainment competition will cause the mediocre and outdated business model CLVs and FEC to fail, while the High Fidelity and new school business model ones will survive and prosper. What worked a few years ago, what might even work today, will not necessarily work in the future in a much more competitive and overbuilt market. The ones that will prosper need to stand out from a crowded marketplace. That means a lot more than the attractions and entertainment. That requires a high quality overall experience including the design and ambiance, the hospitality, great food and drink and facilitating an enjoyable and repeatable social experience, what is know as a High Fidelity social experience.

Addition reading:

- First mover doesn't succeed unless its also best mover

- New School consumers are flocking to eatertainment restaurant & old-school game venues

- Trading up, splurging on high fidelity premium experiences

Vol. XVII, No. 4, April 2017

- Editor's corner

- Board games are making a comeback

- Developing experiential CVs

- Only 2 weeks left to register for Foundations Entertainment University to be held in New Jersey

- Increasing adult appeal with slick road course go-kart tracks

- There are 3 elephants in the room: Is a CLV/FEC bubble on the horizon?

- More grandparents than ever

- Less capacity but higher quality increases attendance and revenues

- The difference between failure & success