Vol. XVI, No. 1, January 2016

- Editor's corner

- Hedonic adaption - the curse of family entertainment centers

- Sometimes you just need to have a whole lot of patience

- Birthday University scholarship

- Time is the new luxury - a new competitive strategy

- The rise of tech-kids

- Corporate social responsibility - Its growing importance

- The scoop on service dogs; the law and your rights

Hedonic adaption - the curse of family entertainment centers

In our recently published white paper, The Evolution of Socialization: Our social behaviors are changing, and with it the need to go out. Examining the root cause of location-based entertainment disruption (download as PDF), we briefly mentioned the concept of hedonic adaption. This article expands on that topic.

Too many family entertainment centers (FEC) and other location-based entertainment (LBE) venues just stay the same with little variety. This creates what is known in psychology as hedonic adaptation - been there, done that. The appeal to visit fades over repeat visits, as nothing is really different on each visit. What was perhaps amazing on the first visit just becomes humdrum after a few visits. That is why fixed entertainment attractions alone don't hold long term repeat appeal.

The impact of hedonic adaption has forced most family entertainment centers into the treadmill of continually chasing after and spending capital investment on the next big thing - new attractions - in order to maintain their attendance. Even for gamerooms, it is well established that some new games need to be purchased and rotated in to replace ones with declining play, or overall gameroom revenues will decline. This is really counter to the industry's investment objective -develop and operate venues that have long-term repeat appeal.

If a project produces a 20% return on investment when it first opens, and if that return is maintained for five years, the project will only break even. Only the initial investment will have been paid back (5 x 20% = 100%). There would not yet be any profit on the investment. The project would have to maintain the 20% return much longer than five years in order to generate a return on investment.

The problem is that most FECs start experiencing revenue declines after a few years due to hedonic adaption by their customers. So the 20% return is not maintained. In order to maintain repeat visitation and revenues, the centers need to add some new attractions as well as bring in some new games for their gamerooms. So with the addition of additional capital investment, even if the revenues are maintained, the return on the increased total investment drops below 20% (increased investment, same revenues). That is not a very attractive investment scenario.

Today's highly competitive entertainment landscape includes not only many more out-of-home options than we had just a decade ago, but also a wealth of new forms of digital at-home and mobile entertainment. With so many other options for our leisure time and discretionary spending, hedonic adaption occurs even faster then back in the industry's early years - been there, done that, moving on to something new as there is so many new options. So today FECs can't maintain their repeat business as long as in the past. Today, it's an entirely new competitive ballgame. The original FEC formula that relied predominately on fixed attractions is now definitely obsolete as an investment model.

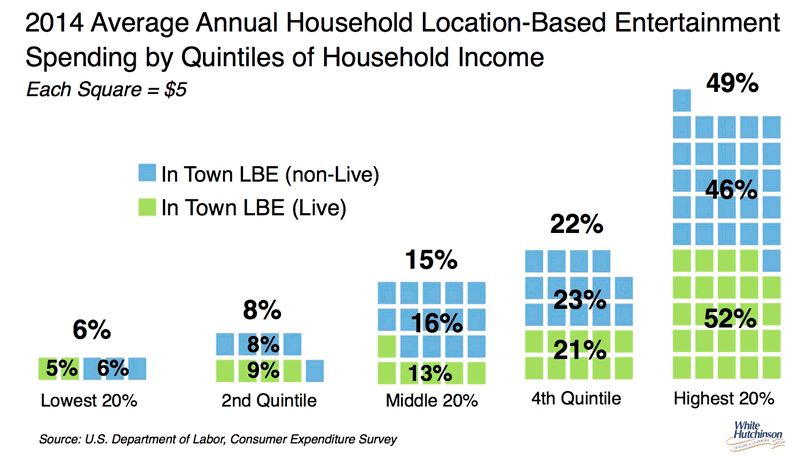

Offering live and limited time events is becoming increasingly important to generating continuing attendance. It harnesses the power of FOMO, fear of missing out. Customers share their limited time experiences by posting their attendance of the events on social medial, mostly in photos, to gain social capital and that in turn becomes powerful marketing for the center. Over half of all Millennials and Gen-Xers consider unique and limited experiences better if they can share them on social media. Live events including concerts, traveling exhibits and wine, beer and food festivals are growing to become a large share of out-of-home leisure spending, especially for the higher socioeconomic households.

Half of all community-based entertainment spending by households in the top 40% of incomes is now for live entertainment, not passive or attraction spending that is typical at most LBEs and FECs. Those 40% of higher income households account for 71% of all community-based entertainment spending. They are the market to target and attract.

And when it comes to repeat appeal, there is nothing more powerful than dining out. Americans eat out an average of around four times a week. And we never get tired of eating, whereas we can easily get tired of some attraction. In fact we are eating more frequently than in the past, around five times a day when you count snacking. Compared to the most popular form of out-of-home entertainment, the movies, dining out trumps moviegoing by multiple times. On average, people eat out more times a week than they go to the movies in a year.

Unlike an attraction, investment in kitchen and bar equipment has total flexibility. The menu and bar offerings can continually change with no need for new capital investment. So the food and beverage offerings can be continually changed and updated to stay attractive and exciting - the perfect hedonic adaption counter strategy.

Food and beverage offers an opportunity to hold limited time specials and food, beer, wine and liquor events. Likewise, offering other special events and limited time live entertainment is increasingly important to not falling victim to hedonic adaptation.

This is the reason why the new school eatertainment venues that have destination dining and bars combined with evergreen social gaming options are so successful. The F&B accounts for half or more of the revenues and is as much a driver of attendance as the entertainment. The combination creates a strong synergistic appeal. And the interactive social games such as bowling create a great social experience.

Destination dining and bars combined with interactive social games and limited time events create a repeatable social experience that doesn't lose its long-term appeal. That is the new future proof success formula for hedonic adaption prevention and long-term financial success in the FEC and LBE industry.

Vol. XVI, No. 1, January 2016

- Editor's corner

- Hedonic adaption - the curse of family entertainment centers

- Sometimes you just need to have a whole lot of patience

- Birthday University scholarship

- Time is the new luxury - a new competitive strategy

- The rise of tech-kids

- Corporate social responsibility - Its growing importance

- The scoop on service dogs; the law and your rights