Vol. XXVI, No. 1, January 2026

- Editor's corner

- LBE strategy of investing in attractions to last for decades has come and gone

- Dave & Buster's continues its downward slide

- What makes experiences special and memorable?

- Changes to location-based entertainment spending in 2024

- A new value equation

- Birthday University February 3rd & 4th

Dave & Buster's continues its downward slide

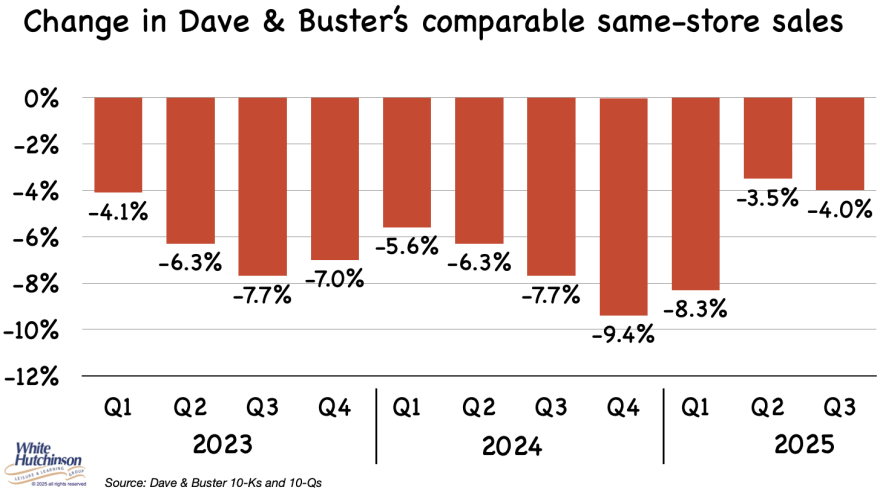

Dave & Buster's reported that its 2025 3rd quarter (Q3) comparable same-store sales declined 4.0% year over year. Their comparable same-store sales have declined for 11 consecutive quarters since Q1 2023.

Compared to pre-pandemic Q3 2019, D&B's Q3 2025 comparable same-store sales have declined by 9.1%. However, financial results don't tell the whole truth during periods of high inflation. The U.S. Bureau of Labor Statistics reports that inflation between August 2019 (midpoint D&B's Q3 2019) and August 2025 (midpoint Q3 2025) was 26.3% (restaurant inflation was higher at 34.8%, which accounts for slightly over one-third of D&B's revenues). So, just to stay even, D&B's comparable same-store sales should, at a minimum, be 26.3% higher than Q3 2019, not lower. If we factor in the impact of 26.3% inflation, D&B's comparable same-store sales are now down 38% compared to 2019 (inflation-adjusted).

As we wrote in this October's issue, Dave & Buster's decline could very well be "a canary in the coal mine" warning for many older model location-based entertainment (LBEs) and family entertainment centers (FECs) - see that article for a discussion of probable contributing factors.

Subscribe to monthly Leisure eNewsletter

Vol. XXVI, No. 1, January 2026

- Editor's corner

- LBE strategy of investing in attractions to last for decades has come and gone

- Dave & Buster's continues its downward slide

- What makes experiences special and memorable?

- Changes to location-based entertainment spending in 2024

- A new value equation

- Birthday University February 3rd & 4th