Vol. XXVI, No. 1, January 2026

- Editor's corner

- LBE strategy of investing in attractions to last for decades has come and gone

- Dave & Buster's continues its downward slide

- What makes experiences special and memorable?

- Changes to location-based entertainment spending in 2024

- A new value equation

- Birthday University February 3rd & 4th

LBE strategy of investing in attractions to last for decades has come and gone

The following is an extract from an article in Bob Cooney's VR Insider enewsletter.

In the first part of the article, "One big thing, Netflix House is a content platform for Location-based Entertainment Experiences. What do you get when you combine a streaming content platform with a department store? A new model for LBE", Bob discusses the history of Netflix, including its 40 IP-based live and touring virtual reality experiences and partnership with Sandbox VR for IP experiences.

After half a decade of testing what works and what doesn't, Netflix announced its most ambitious LBE strategy yet: Netflix House - a 100,000-square-foot entertainment palace dedicated to experiences designed to immerse guests in the most popular Netflix stories. The first two locations, outside of Philadelphia, Pennsylvania, and Dallas, Texas, took over defunct department stores in malls.

The article said there's a synergy to Netflix House's takeover of a department store. Because Netflix House isn't a typical location-based entertainment center, it's a platform, or a department store, for immersive experiences.

The following is verbatim from the last part of the article:

"A New Model for the Short Attention Economy

The typical location-based entertainment facility requires a massive capital expenditure in fixed attractions. Go karts, bowling lanes, mini-golf, laser tag, and even arcades are investments in fixed attractions designed to remain in place for a decade or more. This model has not changed since the late 1980s when FunPlex opened in Denver. But over the last 40 years, two whole generations, consumer preferences have evolved dramatically. Our attention spans began to shorten with the advent of MTV and the 3-minute music video. Now the TikTok and YouTube algorithms measure our attention in seconds.

"Approximately 50 new titles show up on Netflix every week. And new attractions open in every major city continuously, too. Fever, the global ticketing platform for experiences, features over 150,000 experiences across 200 major cities, with new openings launching every week. For a fixed LBE business, it becomes almost impossible to compete with the constant onslaught of new competition. We live in an age where people expect and value novelty.

"So, it only makes sense that when Netflix designed and built a permanent location-based entertainment location, it would treat it as a platform. So they worked with the global architecture firm Gensler to create a modular design that would let them move new attractions in and out, rotating them between Netflix Houses. Where most LBE chains design the same attractions into every location, Netflix's first two, and likely their third, include very different experiences at each one.

"Programming Attractions Like Content

"The Philly location features immersive experiences based on the Addams Family spinoff, Wednesday, and One Piece, a record-breaking adaptation of Eiichiro Oda's manga, which reached No. 1 in 84 countries. It also has a 9-hole mini-golf course, with each hole themed to a different show. The Philly location also features a Netflix Theater, where they can premiere films and host special events.

"The Dallas location has a Stranger Things escape room, and RePLAY, a Netflix-themed arcade with 21 different games aligned with the themes of shows like Love is Blind and The Floor is Lava.

"Both locations offer the Sandbox VR Netflix experiences, as well as Netflix Bites and Now Pouring bar and restaurant (the prototype of which opened at MGM Grand in Las Vegas in early 2025. They also feature a retail shop and lots of photo opportunities with bigger-than-life props. Netflix has decades of analytics on consumer content consumption. It knows that trends can emerge suddenly, like the explosion of K-pop Demon Hunter. If they were to build a typical LBE facility, they could not keep up with the trends and risk fading into irrelevance, just as department stores have today.

"[The Dallas Netflix House is] currently planning to replace at least one of the existing attractions in Sept of 2026, less than a year after they opened. Most FECs might buy a few new games a year; Netflix is looking to move in a new anchor attraction after just 9 months.

"Scarcity Drives Demand

"This speaks to another strategy that Netflix uses online, which I've been encouraging VR arcade owners to employ: driving urgency. If you log into Netflix, you'll find a category of shows called "Last Chance to Watch" and with a "Leaving Soon" banner on each. They rotate content on and off the platform to create a sense of continuous discovery. When something is going to be gone, it triggers our loss aversion or FOMO. In early 2025, Mission Impossible: Dead Reckoning hit the top 10 list with nearly 4 million views in its last week after being on the platform for a year.

"Touring exhibitions use this strategy successfully. You'll see billboards for shows promoting "last shows - get your tickets now" as a standard marketing tactic. If you have multiple locations, this tactic is feasible. But even a single location can employ this strategy with downloadable attractions. VR arcade platforms offer dozens, and some even hundreds of titles, which can be overwhelming for customers to choose from. Whittling down the offering, rotating out some titles monthly or quarterly, adding new ones, and even bringing back popular old ones gives customers a reason to put on pants, get in the car, and visit your establishment.

"The 40-year-old LBE strategy of investing in attractions designed to last for decades has come and gone. It's time to look at your LBE as an experience platform. And the easiest and cheapest way to do this is with XR experiences."

Our commentary

We totally agree with Bob's opinion that most fixed attractions have lost their repeat appeal and long-term staying power, and that there is a paradigm shift in what now works for LBEs to achieve repeat appeal. There are many reasons for this, including:

Commoditization of experiences

One overall shortcoming of any attraction is that it quickly becomes commoditized. The 2nd time you have an experience, it is not as good as the first. The 3rd time you have an experience, it is not as good as the 2nd. The experience loses appeal after a few visits, and customers say, "Been there, done that." Instead of repeating it, they move on to something new.

Novelty seeking

It's human nature to seek new experiences rather than repeat ones. Our brains are hard-wired by evolution to crave novelty. The desire for novelty, to explore something new, is rooted in enabling us to learn something new about our environments and how to survive. Novelty triggers the production of dopamine, making us feel good, which, in turn, increases a person's motivation to seek more novelty.

Recent research by PGAV confirmed that "visitors are increasingly drawn to new experiences, prioritizing exploration and discovery over revisiting familiar destinations… 'Been there, done that' shows a growing aversion to repetition."

Change to what is OOH entertainment

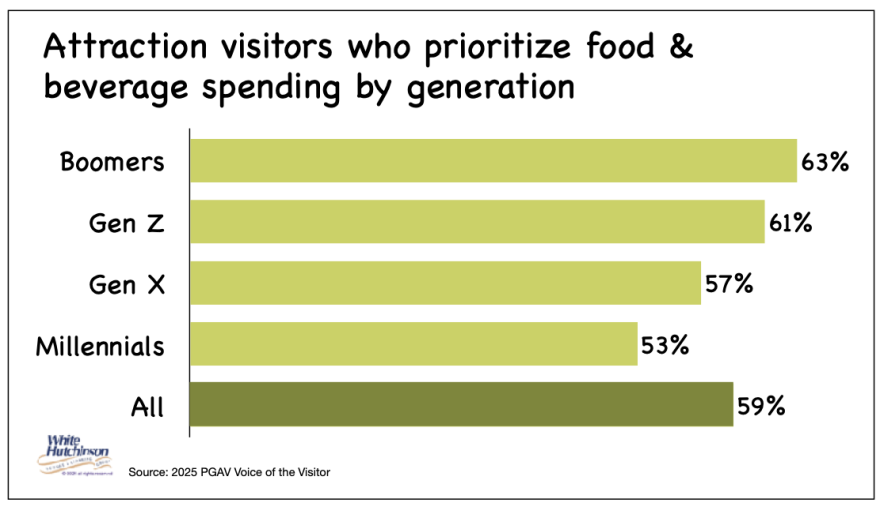

There is a cultural shift in what is considered and valued as out-of-home (OOH) entertainment. More than half of Americans consider themselves foodies (53%). More than two-thirds of people aged 18-44 have foodie behaviors. Foodies love food and are very interested in trying different types. They are on a culinary quest for adventure and discovery and the latest food and beverage trends. Recent surveys by PGAV found that satisfaction with food quality at an attraction was the number one factor influencing guests' intent to return.

Along with restaurant dining, there has been a growth in the number of live and special events and festivals where the focus or a significant component is food, beer, and wine. 62% of Americans would attend an event just for the food. The craft brewery boom has resulted in many destination breweries. The number of destination cideries, wineries, and distilleries is also growing nationwide. These beverage-based destinations are now considered attractions, competing with entertainment venues.

Conspicuous leisure and social media

Another influence is the drive to seek new experiences rather than repeat them. In the experience economy, priorities for participation in leisure and entertainment experiences have changed. The dimension of status and self-identity, the measure of social capital, has shifted from owning enviable material goods and stuff to participating in enviable experiences. Two-thirds of Americans would rather be known for their experiences than their possessions. Especially for young adults, an impressive selfie capturing a memorable leisure experience is as sought after as a new car or fancy watch was to their parents. Social media has transformed conspicuous consumption. Conspicuous consumption of goods is out; conspicuous leisure consumption is in.

This experience economy means that the pursuit of experiences, including entertainment, has taken on a more prominent role in people's lives than in the past. People use experiences as "social signaling" to express who they are or want to be, and to build their identity, status, and social capital on social media. Experiences are the ultimate status symbol. 48% of Millennials and 61% of Millennial parents say they attend live events to have something to share on social channels. Experiences, including out-of-home entertainment, are the new social currency.

Postings on social media can be viewed as important as the experiences themselves. For 20- and 30-somethings especially, if it isn't Instagrammable or shareable, it's probably not worth doing.

This means that once you've participated in an LBE experience and shared it with your friends and followers on social media, there is no longer any status value in repeating and sharing it again.

Productive use of time

We live in a time where we want to make the most productive use of our leisure time, so we have an insatiable desire to pursue and experience as many options as possible from the vast array of leisure opportunities the world now offers. As a result, we are seeking a variety of collectible leisure experiences that we only do once. PGAV's surveys have found that younger generations (18-54) are more likely to build a diverse portfolio of unique and new experiences rather than revisit old ones. We want to check off items on our experiential checklist, move on to the next one, and add them to our collection to build our experiential CVs. This also makes us feel that we have used our time productively.

Influence of envy and FOMO

Experience postings on social media trigger FOMO (fear of missing out), creating a desire and motivation to participate in the same experiences others do to "keep up with the Joneses." This has increased conspicuous leisure, participation in, and posting as many unique, novel, and admirable experiences as possible to avoid missing out on anything. Conspicuous leisure consumption, amplified by social media postings and resulting FOMO, has become a primary motivation for participating in as wide a variety of OOH experiences as possible, rather than repeating a few.

A shift in the cultural meaning of entertainment

For many people, especially those in higher socio-economic households (those with a household member with a bachelor's or higher degree and who account for 74% of all attendance spending at entertainment and cultural venues), entertainment is no longer just about fun and amusement. The bar has been raised. Along with a shift to seeking transformational experiences, entertainment experiences now need to be meaningful, relevant, and engaging.

Almost limitless OOH leisure options

Amplifying the desire for new and unique attractions is the growing explosion of OOH leisure options, which are now almost limitless.

At the beginning of the 21st Century, LBE attractions were limited in number, so the fixed attraction model worked. In the last several decades, we have seen a massive expansion of new types of LBEs, including trampoline parks, iFly, adventure parks, escape rooms, zip line experiences, bar arcades, eSport lounges, axe throwing, social gaming venues with destination-worthy food and drink, eatertainment venues where you can bring your dog, VR, corn mazes/pumpkin patches, golf swing suites, indoor mini golf with cocktails, to name just a few. We've also seen the growth of the number of festivals, live events, foodie-worthy restaurants, breweries, distilleries, and wineries. One- and limited-time events (O<Es), such as live events, festivals, and concerts, are now winning a greater share of guests' time and wallets.

Now, there is little reason to repeat a visit to any one attraction, LBE, or event, given the growing variety of OOH options.

Brick-and-mortar, fixed-attraction entertainment venues have lost their repeat appeal (been there, done that) to all the O<Es and new type OOH venues that are social media posting-worthy and can satisfy the appetite for conspicuous leisure.

Take away

There will always be a segment of the population that will repeatedly visit certain attractions. However, that segment has significantly decreased and will no longer generate the attendance needed to sustain fixed attractions, except in the largest markets where those people are sufficient in number.

Although attractions, such as bowling and other social games, are still an important part of the mix as they help facilitate socialization, the primary reason that people go out, they alone no longer work. They need to be mixed in with changing limited- and one-time events (L&OTEs) to offer continuous uniqueness, harness the power of FOMO, and offer guests the opportunity to build their social capital and add to their experiential CVS. Different programming and unique events fit the model that has become a contemporary primary decision criterion for where people go when they do go out.

Bob recommends VR attractions with changing experiences as one way for LBEs to create repeat appeal. That is certainly one solution. If you're interested in exploring VR options, contact the industry's top expert, Bob Cooney, at bob@thevrcollective.com.

As we've discussed in previous issues, there are other ways to give people reasons to return to an LBE for something new. L&OTEs for LBEs not only include changing VR experiences, but also many other L&OTEs such as food limited-time offerings (LTOs), Karaoke, silent disco, singles mixers, speed dating mixers, different types of classes, live music - the possibility for programmed events is limitless.

Success with LBEs now requires heavy programming of L&OTEs. Operators of LBEs now need to become producers of continually changing experiences to be successful

You can read Bob's entire article online HERE and subscribe to VR Insider HERE.

Subscribe to monthly Leisure eNewsletter

Vol. XXVI, No. 1, January 2026

- Editor's corner

- LBE strategy of investing in attractions to last for decades has come and gone

- Dave & Buster's continues its downward slide

- What makes experiences special and memorable?

- Changes to location-based entertainment spending in 2024

- A new value equation

- Birthday University February 3rd & 4th