Vol. XXIV, No. 8, December 2024

The new reality for bar beverages

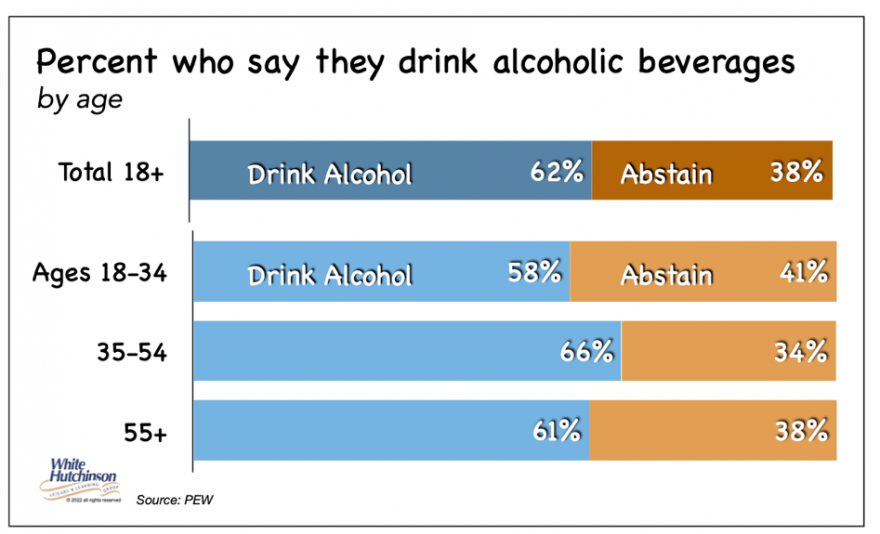

Back in the mid-1970s (1976-1978), 71% of adults drank alcoholic beverages. This year (2024), it has decreased to 62%. Among younger adults, a primary target market for most location-based entertainment venues (LBEs), the drinking rate this year was only 58%.

A large percentage of alcoholic-drinking adults are curious about living a sober-curious lifestyle. This group expresses interest in reducing or eliminating their alcohol consumption. The sober-curious movement has gained strength over the last year. In 2024, 41% of all Americans plan to drink less, up from 34% in 2023.

The percentage of drinking adults who are curious about switching to a sober lifestyle has increased from 12% in 2020 to 19% in recent surveys.

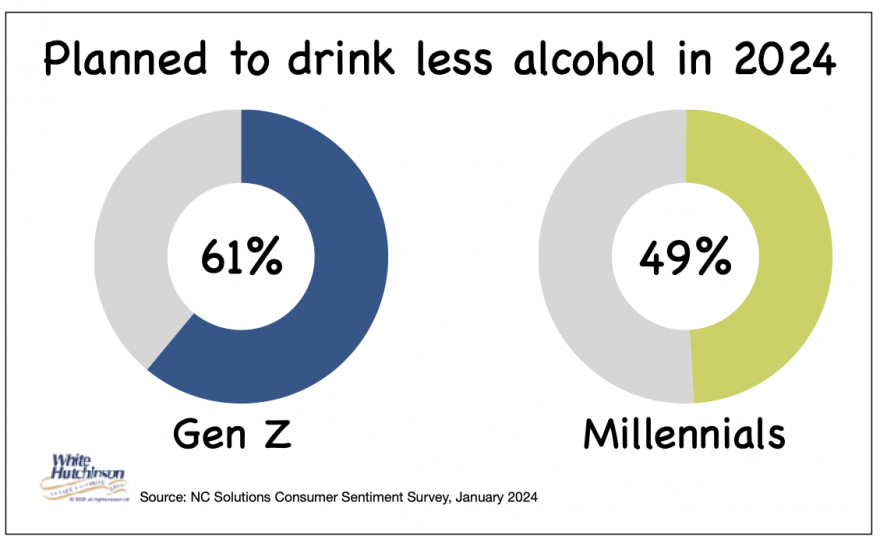

The sober-curious movement is strongest among young adults. Generation Z (born between 1997 and 2002) shows the highest interest in reducing alcohol consumption, with 61% having planned to cut back in 2024, a 53% increase from 2023. Millennials (born between 1981 and 1996) also show increased interest, with 49% having planned to drink less in 2024, up 26% from the previous year.

These statistics indicate a growing trend toward alcohol reduction and abstinence among U.S. adults, particularly among the younger generations.

When we combine those young adults who don't drink alcohol (41%) with those who were sober-curious about abstaining, assuming one-half of those intending to do so did (one-half of 19% = 9.5%), we estimate that 50% of young U.S. adults now abstain from alcohol. If we add the approximate 50% of Gen Z and Millennials drinkers who are interested in reducing their alcoholic consumption, which means on many occasions they are looking for nonalcoholic alternatives, we have around 70% of young adults who don't drink, have stopped drinking in 2024, or are reducing their alcoholic consumption. This is now the majority of young adult attendees at LBEs.

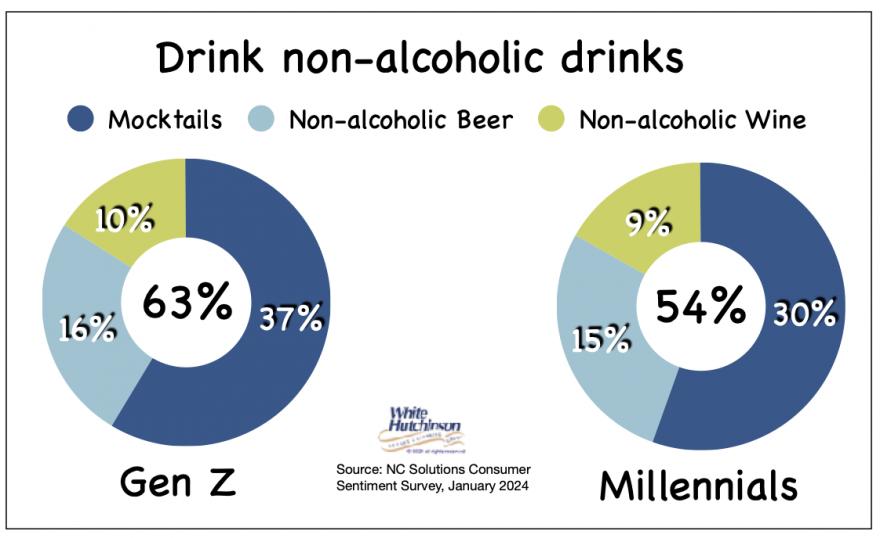

Nonalcoholic alternatives, once a niche category, have become mainstream. Mocktails are twice as popular as nonalcoholic beer. Sober-curious consumers surveyed by NCSolutions are twice as likely to choose a mocktail than a nonalcoholic beer. One in five (19%) Americans said they drank a mocktail in 2023, compared to one in 10 who drank nonalcoholic beer. More than one-third (37%) said they drank mocktails most often.

Mocktails were especially popular among younger generations in 2023. 37% of Gen Z said they drank mocktails last year, compared to 16% who said they had nonalcoholic beer and 10% who said they drank nonalcoholic wine. Among millennials, 30% said they drank mocktails in 2023, compared to 15% who drank nonalcoholic beer and 9% who had nonalcoholic wine.

These non-alcoholic drinking statistics confirm the growing trend toward sober-curious alcohol reduction and abstinence among U.S. adults, particularly the younger generations, as the percentages of non-alcoholic young drinkers are higher than the 38% of young adults who are not drinkers.

Bottom line

The new reality is that the non-drinkers plus the sober-curious are now the majority of adults, even more so among young adults. For LBEs to maintain their appeal and profit margins, their bar menu needs to offer a wide selection of nonalcoholic beverages, with most being zero-proof imitations of the alcoholic versions.

Subscribe to monthly Leisure eNewsletter