Vol. XIX, No. 9, October 2019

- Randy's travelogue

- Innovation is creating new customer experience (CX) benchmarks

- Upcoming presentations & conferences

- The customer is always right, or maybe?

- The self-commoditization of OOH entertainment experiences

- Is your website ADA compliant? The Supreme Court rules it better be

- Our basic instinct of imitation is not always so beneficial

- Fast growing plant-forward flexitarian trend

- Video games a force for sustainable social change; it's time for CLVs & FECs to join

- Refreshing kids' menus

The self-commoditization of OOH entertainment experiences

In its broadest sense, to become commoditized means that something that once had higher appeal and economic value due to its superior, unique and/or scarcity attributes ends up becoming something that no longer has any distinctive value and appeal compared to the competition. From the consumers' point of view, when it becomes commoditized, it becomes relatively indistinguishable from and interchangeable with competitive offerings. What once stood out from the competition no longer does. As a result, it loses its attractiveness and pricing power, consumers just seek out the cheapest alternative, so it becomes a race to the bottom in a price war to try to attract sales.

Raw products like soybeans and oil are commodities, as they are the same no matter who the seller. Pricing becomes highly competitive with slim profit margins for commodities. Goods and services can become commoditized and often do, resulting in declining profit margins. So too can out-of-home (OOH) experiences of all types, including entertainment experiences. In fact, OOH entertainment experiences may be the easiest consumer offerings to become commoditized.

What happens with OOH entertainment experiences is that consumers enjoy them less and less the more times they repeat the same one. The second time you enjoy an entertainment experience, it isn't as good as the first. The third time is not as good as the second. Ultimately, people become satiated with it. This is a phenomenon known as hedonic adaption or the hedonic treadmill - the enjoyment of an experience, the satisfaction with it, decreases when the experience is repeated. The more consumers become satiated with a particular experience, the more likely they are to get bored with it, "been there, done that," and the more likely they are to move on to some new entertainment experience to enjoy. As a result, OOH entertainment experiences "self-commoditize" through peoples' repeat visits.

Back around the beginning of 21st Century, self-commoditization of entertainment experiences was less of a problem, especially for community leisure venues (CLVs) such as family entertainment centers (FECs), whose very business models are dependent on repeat business. They enjoyed a reasonable level of repeat business as there were few other options to move onto. In other words, although the enjoyment with repeat visits declined, there were few alternative OOH entertainment experiences that would have been as (or more) enjoyable. Something doesn't become a commodity if there aren't comparable alternatives.

However, a lot has changed since then that has transformed the culture of out-of-home entertainment and arts (OOH E&A) participation and disrupted the financial viability of the traditional business model based on repeat appeal of entertainment attractions. A number of major fundamental cultural, technology and competition changes have resulted in an acceleration of the commoditization of entertainment experiences, including for CLVs and FECs. In fact, in many situations, OOH E&A experiences become commoditized after just one visit. Entertainment venue repeat appeal is no longer what it used to be. Yesterday's CLV and FEC business model no longer works in today's OOH leisure culture.

The basic underlying megatrend that has led to this change is the experience economy. Although first identified as a major shift in our economy by Joe Pine and James Gilmore in 1998 in their Harvard Business Review article Welcome to the Experience Economy and then a year later in their book The Experience Economy (2011 updated edition), the experience economy really didn't take off until around a decade ago.

In the experience economy, our priorities for participation in leisure and entertainment experiences have changed. Our dimension of status and self-identity, our measure of social capital has shifted from owning envious material goods and stuff to an immaterial means, sharing our experiences on social media. Today, what you do now matters way more than what you own. Today, two-thirds of Americans would rather be known for their experiences than their possessions. Especially for younger adults, an impressive selfie capturing a memorable experience at a unique OOH E&A is as enviable as a new car or fancy watch was to their parents. Conspicuous consumption is out, and conspicuous OOH leisure and entertainment is in.

From a consumer perspective, what the experience economy means for entertainment is that the pursuit of experiences has taken on a more prominent role in people's lives than in the past. People are using experiences to express who they are, to build their identity and status. Experiences are the new social currency.

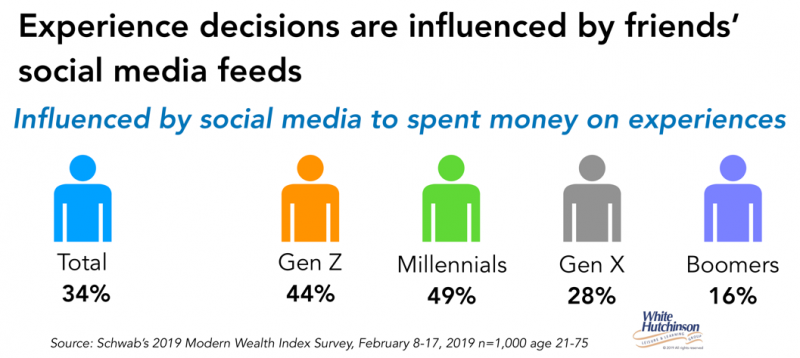

The importance of experiences as social currency has been amplified by the adoption and growth of social media, and especially, the introduction of the smartphone just twelve years ago. Now you can instantly broadcast the experience you are having on Facebook, Instagram and other social apps to increase your status. In fact, especially for 20- and 30-somethings, if it isn't Instagrammable, if it isn't sharable, and it's probably not worth doing.

This means that once you've participated in some OOH entertainment experience and shared it with your friends and followers on social media, there is no longer any social capital value to repeating it again. Instead you want to move on to new experiences to add to our Experiential CV.

Social media also exposes us to all the experience choices we have. Postings on social media create our desire to participate in as many OOH experiences as possible, to not miss out on anything, what is known as FOMO (fear of missing out). We want to consume more experiences and do them more quickly so we don't miss out on anything.

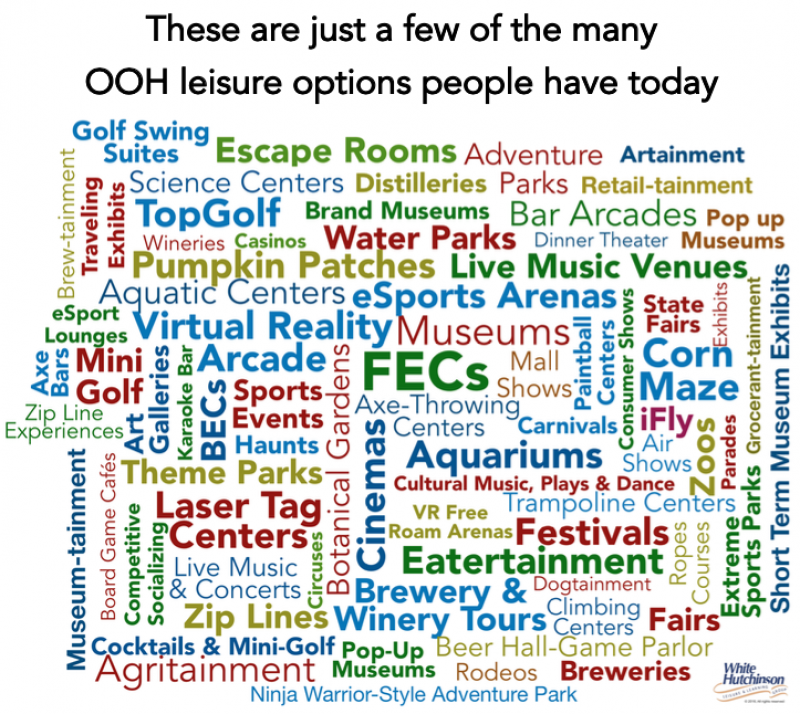

Another important change from the past is that the OOH entertainment landscape has ballooned in size since the turn of the century. We now enjoy an almost unlimited number and choices of different and expanding types of OOH leisure and entertainment, more than any one person can every do.

Today people want to enjoy, share and collect as many different experiences as possible in their limited leisure time, increasing their social capital and bragging rights. Now it's all about a culture of novelty-seeking and the pursuit of new, unique and sharable OOH experiences, which are unlimited in supply, with new unique ones being added almost every day. Been there, done that, let's move on to collect as many other shareworthy OOH experiences as we can.

Today there are far too many OOH E&A venues and experiences (think about all the one-time festivals, concerts, etc.) chasing our limited discretionary leisure time. It's an incredibly crowded OOH E&A landscape. There is never a lack of new, unique and shareworthy experiences to more onto.

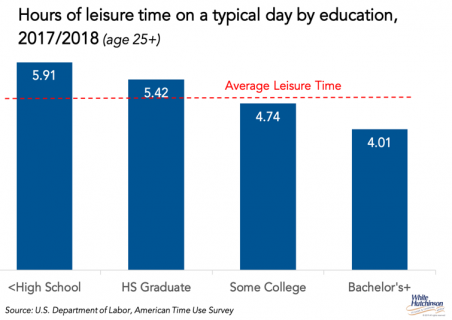

The higher socioeconomic population who have the discretionary income to spend on OOH E&A have the least amount of discretional leisure time, so they experience leisure time famine - so many things to do and not enough time to do them all. As a result, they want to use their limited leisure time to the fullest, to make it as productive and efficient as possible, so they engage in that is called voracious consumption of leisure, fast-paced and intense participation in multiple types of OOH leisure, what you might call optimization of out-of-home leisure time. Voracious leisure consumption involves participation in a wide variety of different out-of-home leisure activities and a high frequency of participation. One driving force of why the income rich, time poor pursue voracious leisure consumption is that being busy is now seen as a marker of social distinction, as a "badge of honor."

Research shows that those harried adults who have high levels of social status are generally more highly educated with higher incomes. In addition to cramming more and more different activities into their leisure time (their voraciousness), they also spend more time with their spouse and with other adults in social leisure and entertainment experiences than lower status adults. Voracious consumption of OOH E&A is particularly characteristic for single adults and younger childless couples.

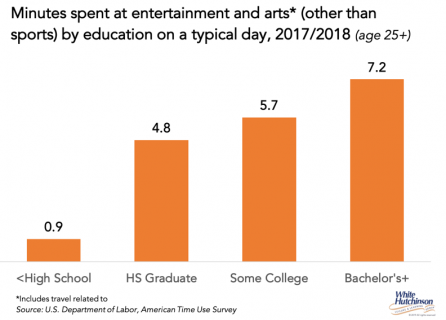

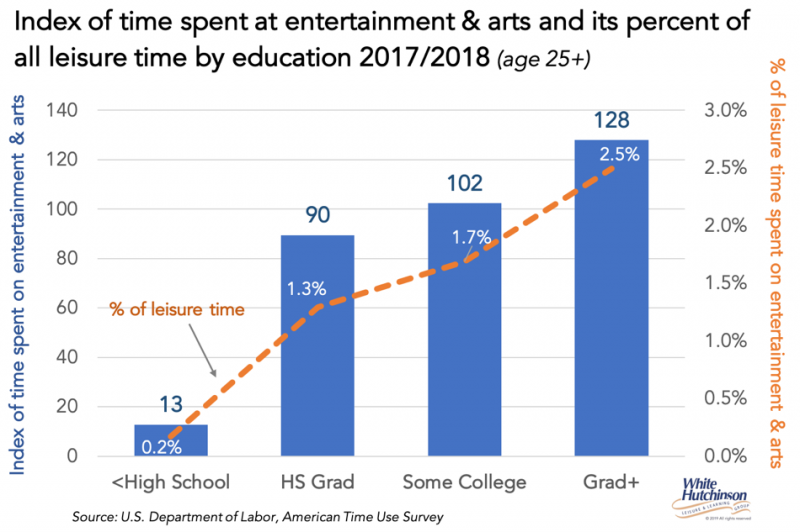

What we now have is leisure inequality. It is a bifurcated leisure market, especially when it comes to OOH E&A experiences. Lower-socioeconomic people who have the most leisure time can least afford to visit OOH E&A venues, if at all, while those with the higher incomes, generally the high-educated, can afford OOH entertainment experiences. Since the higher income, high-educated feel the most time pressured, they voraciously pack the most activities into the leisure time they do have. They spend more time and a higher percentage of their leisure time at OOH E&A venues than the low socioeconomic who have the most leisure time. Adults with a bachelor's or higher degrees spend 50% more time at OOH E&A, 2.5% of their total leisure time, compared to high school graduates who have 35% more leisure time but only spend 1.3% of it at OOH E&A.

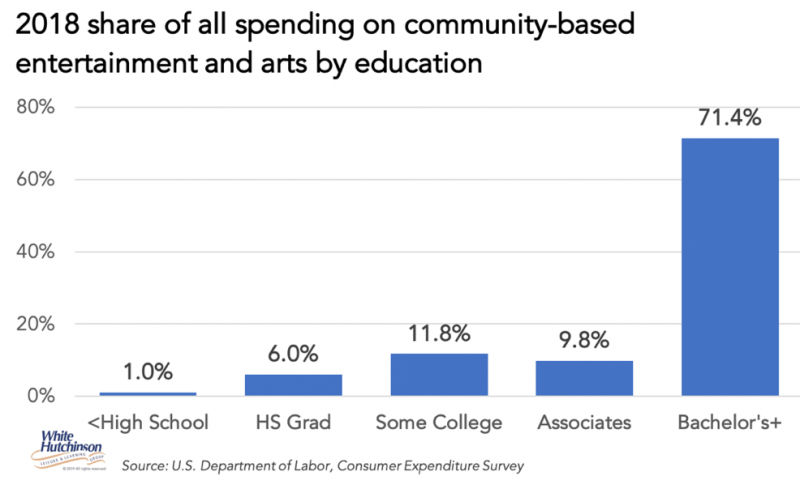

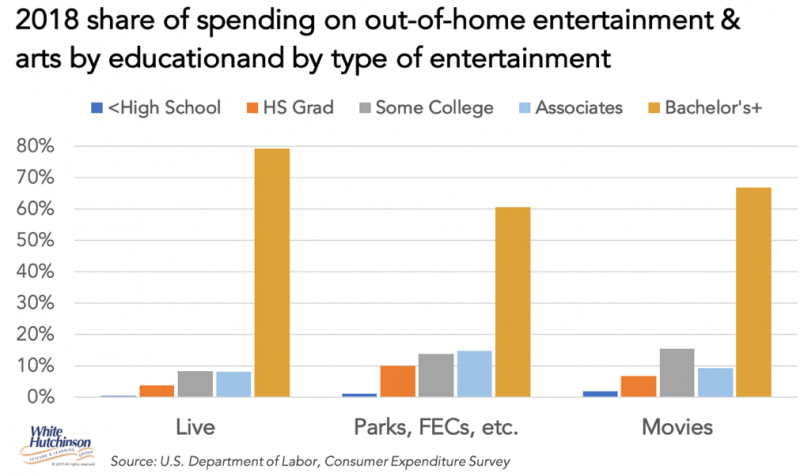

This bifurcated OOH E&A market appears to also be borne out by spending data. Bachelor's and higher degreed households now account of 71% of all community-based OOH E&A spending. That's an increase from 47% of all spending back in 2000.

Community-based OOH E&A has become gentrified, regardless of the type, as the following graphs show.

The bottom line is many people, especially the higher socioeconomic, who are the majority of the OOH E&A market, want to collect new experiences rather than repeat them. Been there, done that, let's move on to something new. Fixed attraction OOH E&A experiences become instantly commoditized and lose almost all their repeat appeal except for a small hard core of loyal fans.

This commoditization after one visit, this loss of repeat appeal for fixed attraction OOH E&A, requires a completely new business model. Although fixed attractions, things that especially facilitate socialization such as social games, can still be part of the mix, the mix now requires continually changing programming of live, limited- and one-time events. Food and drink becomes a far more important part of the mix than in the past due to the rise of the foodie movement and the opportunity to include culinary adventure and discovery as part of the visit experience, as well as to enhance socialization. A variety of menu offerings, including craveable offerings and LTOs (limited-time offerings) and other food and drink experiences help drive repeat appeal.

To overcome commoditization of OOH E&A experiences, to overcome "been there, done that," there needs to be continually changing new and unique reasons to return, ones that are not only enjoyable, but IRL social and sharable as social currency. Programming one- and limited-time unique events are more important to the OOH E&A business model than the fixed attractions. Elevated pleasurable, fun and enjoyable food and drink experiences are now an essential part of the mix. Both customized and transformational experiences are also important to creating repeat attendance.

What many existing OOH E&A operators and entrepreneurs seem to not understand is that the leisure and entertainment consumer, their preferences, expectations, values, behaviors and culture, has dramatically changed, so you are not dealing with the same person you might have only a few years ago. There is a whole new leisure culture for OOH E&A that has totally disrupted the classic business models and requires a totally new approach to developing sustainable OOH E&A brick-and-mortar venues. It is going to be difficult for many existing OOH E&A operators to accept and make a major mind shift from the old attraction-based operating paradigm to the new business models that future success will require.

Vol. XIX, No. 9, October 2019

- Randy's travelogue

- Innovation is creating new customer experience (CX) benchmarks

- Upcoming presentations & conferences

- The customer is always right, or maybe?

- The self-commoditization of OOH entertainment experiences

- Is your website ADA compliant? The Supreme Court rules it better be

- Our basic instinct of imitation is not always so beneficial

- Fast growing plant-forward flexitarian trend

- Video games a force for sustainable social change; it's time for CLVs & FECs to join

- Refreshing kids' menus