Vol. XIX, No. 2, February 2019

- Editor's corner

- Two of our continuous long-term clients

- The first Instagram food photos

- What's old is still relevant

- North American movie theater attendance trends

- Committed consumption impacting out-of-home entertainment

- Rise in visits to non-traditional experiential food & beverage venues

- Gentrification of out-of-home entertainment

- The mindful low- and no-alcoholic trend

- Changes in educational attainment

Committed consumption impacting out-of-home entertainment

Consumer spending for out-of-home entertainment is limited by available discretionary income, income that is left over after paying for taxes and necessities such as food, shelter, transportation and clothing. This includes necessities that are automatically reoccurring household expenses such as the mortgage or rent, a car payment and insurance.

But now people have more automatically reoccurring obligations that are not necessarily necessities that fall into a category known as “committed consumption.” Its growth is now taking chunks of spending power away from consumers' disposable income. The added committed monthly reoccurring spending includes such things as smartphone services, music subscriptions, streaming video subscriptions such as Netflix and Hulu, Internet services, wholesale club memberships, health club memberships, satellite radio services and software subscriptions.

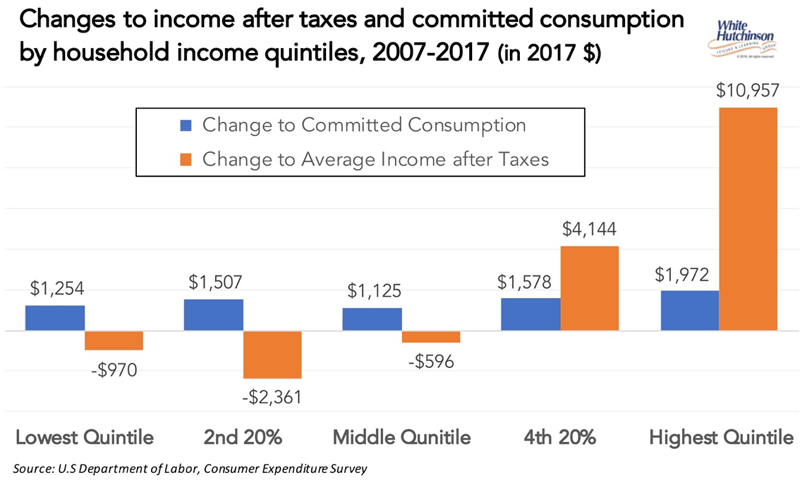

We analyzed the average total committed consumption spending for each quintile of household income for 2007 and 2017 and also analyzed changes to the average incomes of each quintile (both inflation-adjusted) to see what impact any increase to committed consumption might have had.

As the chart shows, compared to just before the start of Great Recession, average after tax incomes for the lowest 60% of income households has declined while their spending for committed consumptions has increased. This has left them with no or less discretionary income for occasional spending on such things as out-of-home entertainment. This probably helps explain why we have lost much of the middle class as customers for a significant share of business for out-of-home entertainment, and especially for community-based leisure (CLV), which includes family entertainment centers (FECs).

Vol. XIX, No. 2, February 2019

- Editor's corner

- Two of our continuous long-term clients

- The first Instagram food photos

- What's old is still relevant

- North American movie theater attendance trends

- Committed consumption impacting out-of-home entertainment

- Rise in visits to non-traditional experiential food & beverage venues

- Gentrification of out-of-home entertainment

- The mindful low- and no-alcoholic trend

- Changes in educational attainment