Vol. XVIII, No. 10, December 2018

- Editor's corner

- Is virtual reality the next BIG THING?

- Ocean5 wins Best New Center - Lounge/Restaurant design award

- Google is updating Maps as a B2C app

- Recent articles and in the press

- Construction cost increases challenging feasibility

- Most loved non-alcoholic drinks & their fastest growing flavors

- Home-basing - the new competition

- Miniature golf design for tomorrow

- A new generation of moms in on the way

- Willingness to spend time and money in a restaurant based on the noise level

- Update on the Tchotchke Index - what does it really tell us?

- eSports growing in popularity and coming to Walmart

- Trends reshaping dining out

Home-basing - the new competition

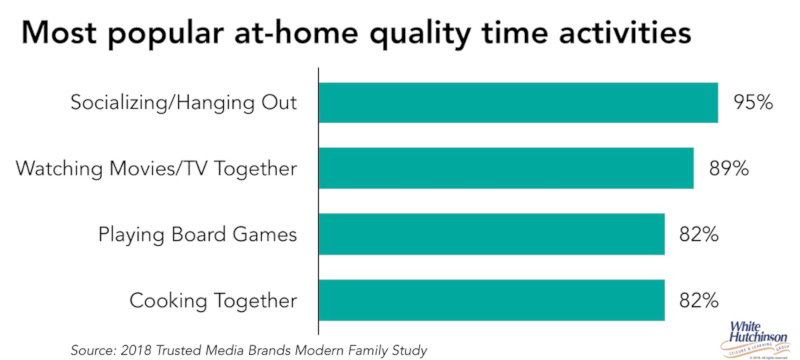

Consumers are venturing out of their homes less often than in the past for dining, entertainment and shopping. This is not only being driven by the pursuit of convenience by just staying home and using all their at-home digital options for entertainment, ordering meals to be delivered and e-commerce, but also by the home-basing trend - staying in the comfort of their own homes (vs. going out) to share experiences with family and friends. The 2018 Trusted Media Brands Modern Family Study found that “staying in is the new going out” - 80% of families and 78% of millennials would rather stay in with their family or friends than go out. The study found the reason for this lifestyle trend is not only due to the explosion of on-demand entertainment and delivery options at home, but also stagnant wages and people feeling frazzled, whether they're exhausted from constant digital connection or anxious about where society and the world is headed, or all these factors.

As we've reported in the past, Faith Popcorn and her BrainReserve company describes the trend as “bunkering,” uber-cocooning at home. She sees Americans seeking safety and escape from permanxiety - the near-constant state of anxiety that exists today from worries about terrorism, racial tension, Trumpism, climate change, neo-isolationism, the widening economic gap, culture wars and other issues - by retreating into the seclusion and safety of their homes. The home has become the sanctuary for modern families.

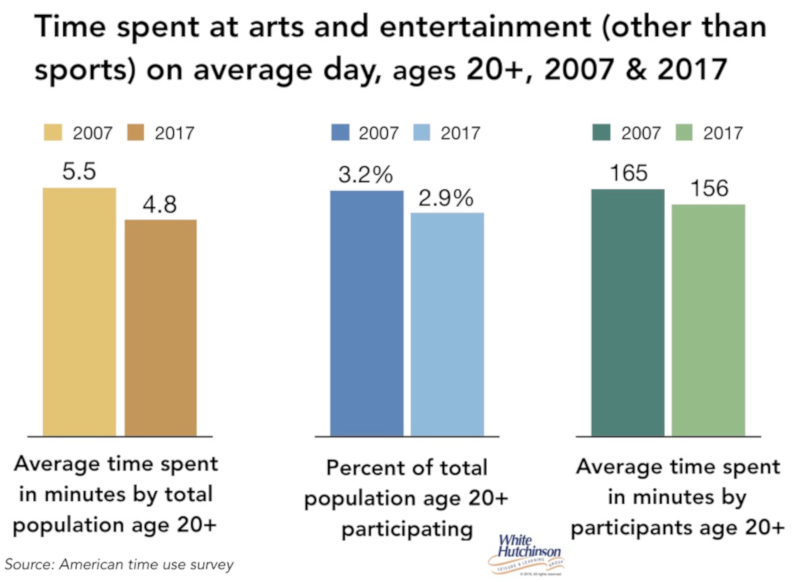

The data clearly shows that home-basing, bunkering or whatever you want to call it is having a negative impact on community leisure venues (CLVs). The percent of consumers visiting entertainment and arts venues in their local community on the average day is on the decline and those visiting are spending less time there. Consumers now have a nearly endless and expanding menu of accessible at-home digital entertainment options for streaming movies, binging shows, playing video games, and on the horizon, virtual and augmented reality.

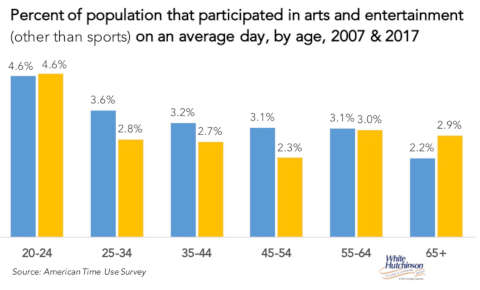

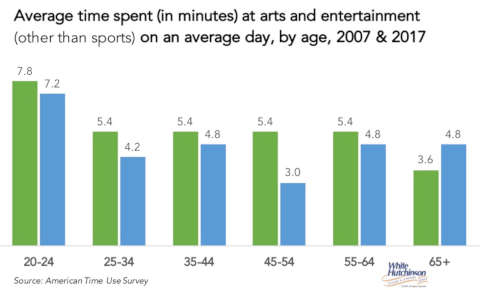

When we dig into the data, the participation rate of 20-24 and 55-64-year-olds has held steady while it has increased for ages 65+. It is the 25-54 age group, the prime target market for out-of-home location-based entertainment (LBE), who are showing significant declining participation in and time spent at arts and entertainment venues.

Today the decision-making choice for consumers has become very bifurcated; either convenience or experience. It's the choice of time saved, or time well spent. You either have to be at one extreme or the other to win. And with the at-home digital entertainment and home delivery of food convenience options expanding exponentially and becoming more attractive, the bar for time well spent at leisure and entertainment experiences that get people out of their homes is high and getting higher every day. What worked a few years ago no longer works as well or at all today. Today, any out-of-home experience has to be high quality, what we call high fidelity, far more so for the time spent than the money cost, as many people are willing to pay a premium for time well spent.

Yes, people have always enjoyed their homes. But today, welcome to the homebody generation. Now just staying home has become the new going out and serious competition to any out-of-home leisure venue.

Vol. XVIII, No. 10, December 2018

- Editor's corner

- Is virtual reality the next BIG THING?

- Ocean5 wins Best New Center - Lounge/Restaurant design award

- Google is updating Maps as a B2C app

- Recent articles and in the press

- Construction cost increases challenging feasibility

- Most loved non-alcoholic drinks & their fastest growing flavors

- Home-basing - the new competition

- Miniature golf design for tomorrow

- A new generation of moms in on the way

- Willingness to spend time and money in a restaurant based on the noise level

- Update on the Tchotchke Index - what does it really tell us?

- eSports growing in popularity and coming to Walmart

- Trends reshaping dining out