Vol. XIII, No. 10, December 2013

- Editor's corner

- Why are many FEC attractions so mediocre?

- Local, healthy top the 2014 restaurant menu forecast

- Bowling in transition

- Foundations Entertainment University announces three programs for 2014

- Wine now more popular than beer

- 5 ways to rethink your queue strategy to keep customers satisfied

- Is Chuck E. Cheese's declining comparable store sales the result of digital Darwinism, KGOY or what?

- Do "Digital Natives" exist?

- Raising the bar on grilled cheese sandwiches

- Jab, Jab, Jab, Right Hook: How to tell your story in a noisy social world

Bowling in transition

Bowling is a classic. Invented over 5,000 years ago in Ancient Egypt as a  way for the Pharaohs to pass the time between cat-embalming and pyramid construction, bowling has been around for as long as people had arms and a desire to knock things down with a ball. Over the many, many years since it was invented, bowling has undergone many major transformations.

way for the Pharaohs to pass the time between cat-embalming and pyramid construction, bowling has been around for as long as people had arms and a desire to knock things down with a ball. Over the many, many years since it was invented, bowling has undergone many major transformations.

In the past few years the bowling industry is undergoing its latest major transformation from once being dominated by league bowlers to one that now must attract the casual bowler to prosper. Many old and worn-out bowling alleys are closing. Between mid-2008 and mid-2013, the number of commercial bowling centers declined by 11% and the number of lanes declined by the same percentage. As of June 2013, the U.S. was down to 4,800 commercial bowling centers.

Of the centers that did not close, a number were renovated and others were turned into multi-anchored entertainment centers. Meanwhile a whole new breed of upscale bowling-anchored and multi-anchored centers are being developed that solely target an upscale, casual, social bowler. These range from adult-oriented boutique bowling centers with bars to larger bowling lounges to centers with destination dining.

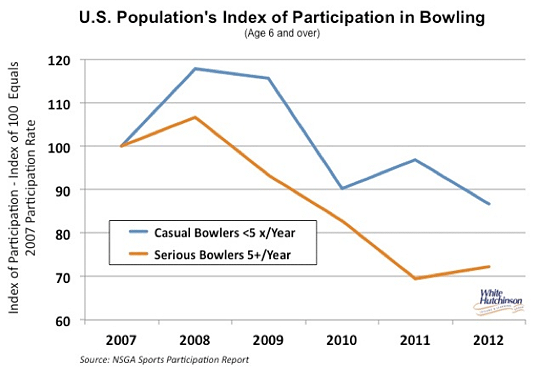

The number of bowlers has also been on the decline. Between 2007 and 2012, the number of bowlers has declined by a little over one-fourth (27%), from 20% of the population 7 years and older to 16% of the population in 2012. The greatest decline has been to serious bowlers (5+ time per year).

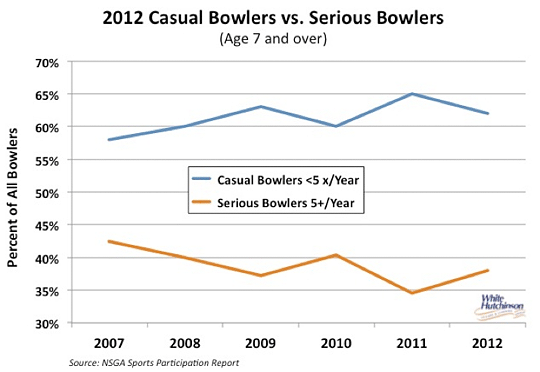

Bowling centers have not been closing as fast as the bowling population has been on the decline. As a result, in 2012 there were one-tenth less (-11%) bowlers per lane than in 2007. And since a greater percentage of those bowlers were casual bowlers in 2012 than in 2007, the number of games played per lane has declined even faster. Since the casual upscale bowlers favor the newer upscale centers, this is sure to accelerate the closure rate of old alleys in the coming years.

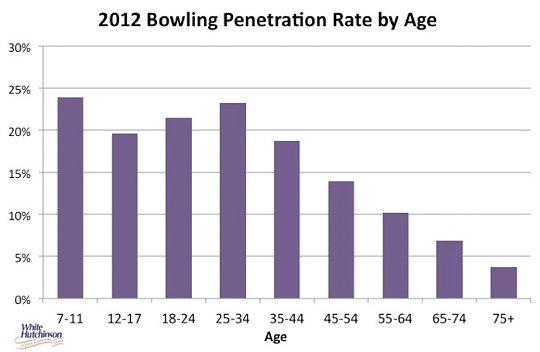

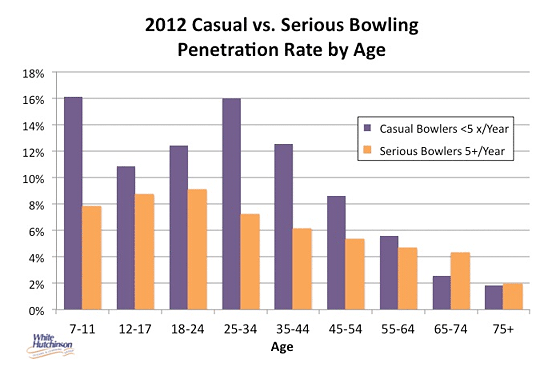

The prime age group of bowlers for bowling participation is the 7 to 44 age group. In 2012 one-fifth (21%) of that age population bowled at least once.

The composition of all bowlers have also changed since 2007 with the percentage of casual bowlers (4 or less times a year) growing and the percentage of more serious bowlers including league bowlers declining.

Casual bowlers skew younger in age while serious bowlers skew older.

The decline in bowlers of all types does not mean bowling is dying. What is dying is the older breed of bowler, the league bowler, and the old tired bowling alleys that catered to them. Meanwhile, the new upscale bowling centers that are catering to the 44 and under age group of upscale casual bowlers who come for the social experience, the food and beverage and not primarily to bowl are thriving.

This also indicates there is an elastic demand for upscale casual bowling. Many, in fact most, areas throughout the country don’t have any upscale bowling facilities. Even large metros still have very few. So much of the population does not yet have the option of frequenting one of the newer concepts where they would want to go. So as more new facilities are opened, we should see an increase in casual bowling participation rate.

It's a whole new ball game for bowling. Those centers that cater to the expectations of the new upscale bowler will prosper.

Vol. XIII, No. 10, December 2013

- Editor's corner

- Why are many FEC attractions so mediocre?

- Local, healthy top the 2014 restaurant menu forecast

- Bowling in transition

- Foundations Entertainment University announces three programs for 2014

- Wine now more popular than beer

- 5 ways to rethink your queue strategy to keep customers satisfied

- Is Chuck E. Cheese's declining comparable store sales the result of digital Darwinism, KGOY or what?

- Do "Digital Natives" exist?

- Raising the bar on grilled cheese sandwiches

- Jab, Jab, Jab, Right Hook: How to tell your story in a noisy social world