Vol. XXV, No. 1, January 2025

What's happening with community-based LBE revenues?

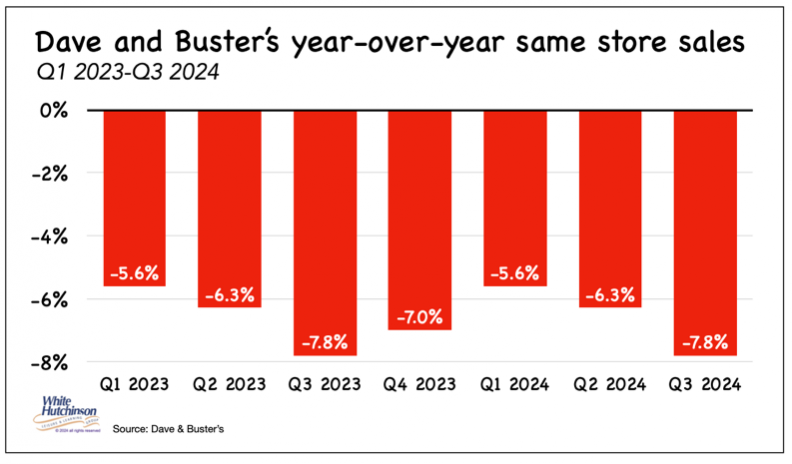

After a post-pandemic spike due to pent-up demand following the pandemic lockdowns, traditional community-based LBE revenues generally appear to be on the decline. This trend is exemplified by Dave & Buster's and its sister chain Main Event, where comparable-store revenues have consistently declined since their fiscal 1st quarter (Q1) in 2023.

Using Dave & Buster's reported Q3 comparable-store sales changes (compared to the same Q3 in previous years), we calculated comparable store sales to be 6% lower since their pre-pandemic Q3 in 2019. However, there was significant inflation over that time period of 20%+. When adjusted for inflation, Dave & Buster's Q3 2024 same-store sales are down 23% compared to the same period in 2019.

Over the last months, many LBE operators have reported a decline in sales of 5% to 15%, with most reporting at least a 10% decline. Among the LBEs who have reported increased sales since 2019, many of their sales have actually decreased as well when adjusted for inflation, just like those of Dave & Buster's. While other LBEs, such as the Lucky Strike chain (previously Bowlero), report that their same-venue sales have increased, exceeding inflation since 2019.

So, what is going on? What could be the root cause(s) of this trend of declining sales for so many LBEs while some others are thriving? There are several possible explanations we will explore.

Overall declining LBE participation & time

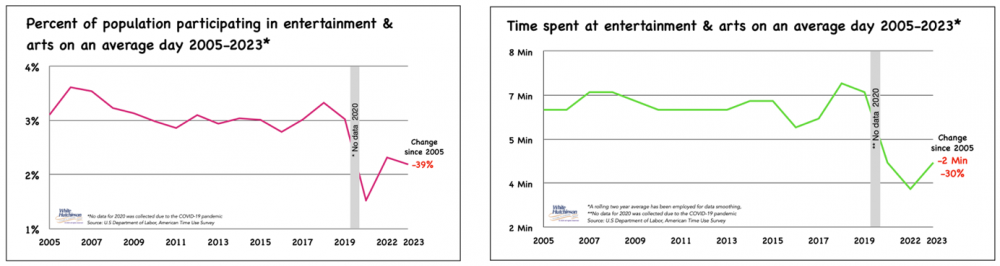

Peoples' participation rate and time spent at community entertainment (LBE) and art venues has been on a long-time decline, which accelerated after the pandemic. Participation has declined by 39% and time spent on an average day has declined by 30%.

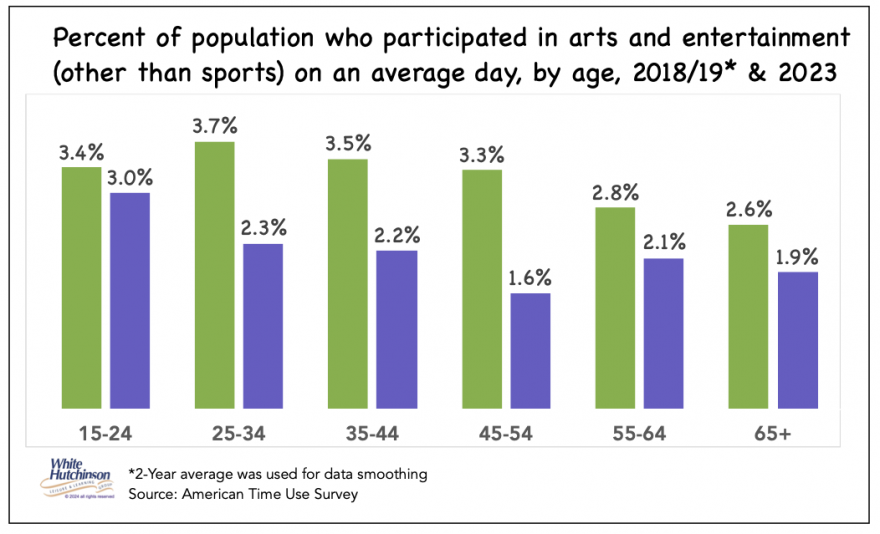

LBE participation has declined significantly for every age group since 2019.

Spending less time away from home?

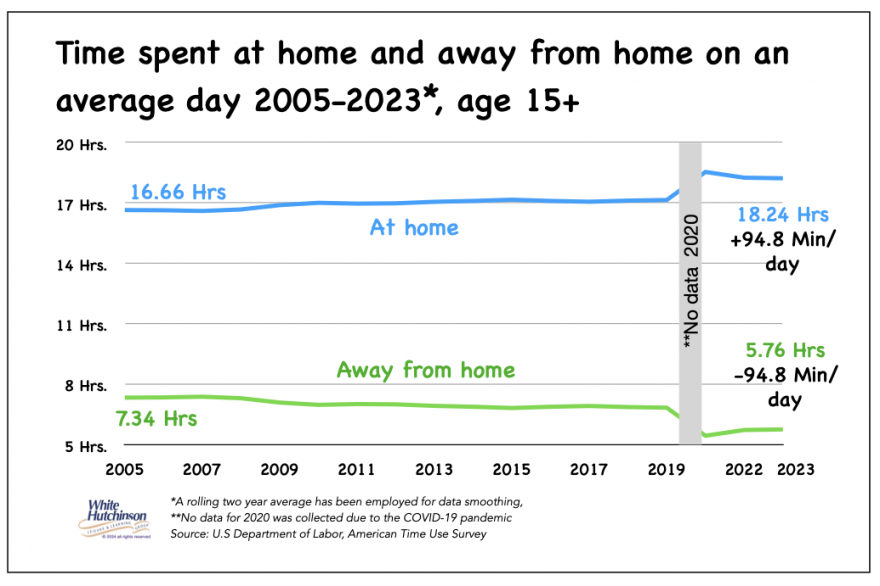

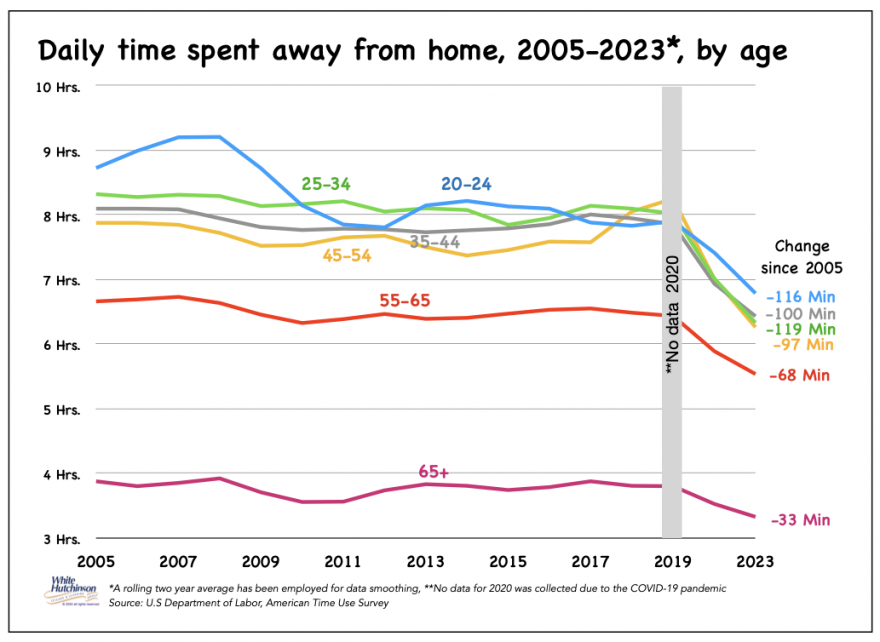

There has been a long-term trend of people spending less time away from home, which the pandemic accelerated. Since 2004, the average person age 15+ spent more than 1.5 hours less time a day away from home (-95 minutes).

This was true across all age groups, with the 20-34 age group, a primary target for many LBEs, showing the most significant decline in time spent away from home, more than 1 hour 40 minutes less time a day.

Is more screen time a factor?

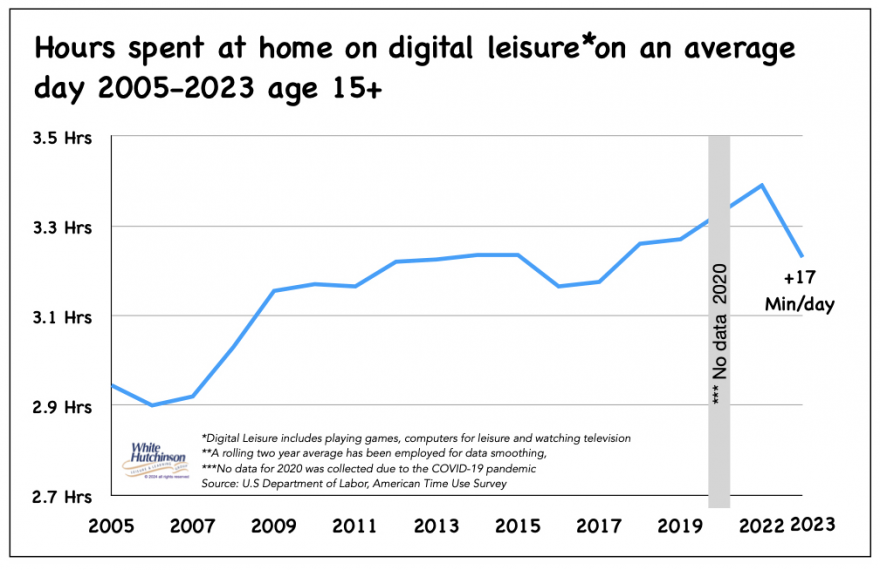

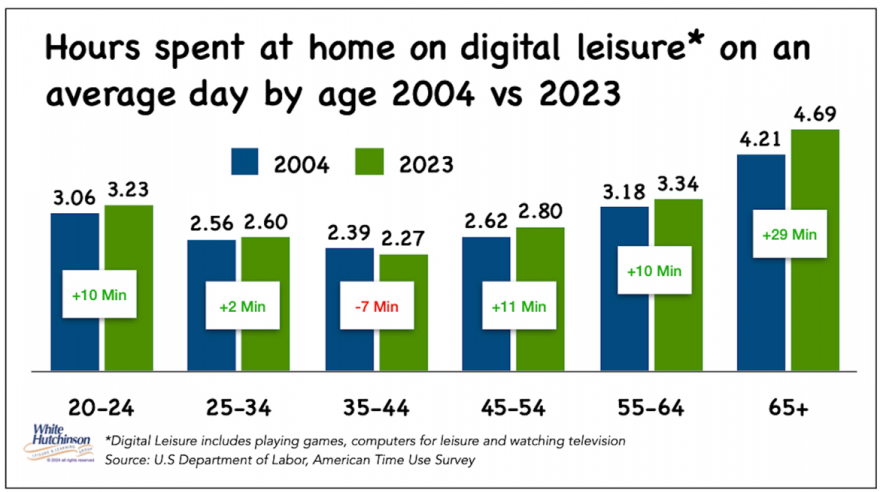

Is spending time on digital screens hurting LBE attendance.? There has been a long-term trend of increasing time spent on digital leisure at home (playing games, computers for leisure, and watching television). Still, after a temporary spike during the pandemic, digital leisure time hasn't seen an increase anywhere as significant as the conventional wisdom believes.

The 65+ age group accounts for the largest share of increased digital leisure time. For the younger age group of 20 to 54, who account for almost all LBE attendance, the most significant increase in digital leisure time was for ages 45-54, but it was only 11 minutes more per day from 2004 to 2023. The 35-44 age group saw a 7-minute decline in digital time. The 25-34 age group saw only a 3-minute increase since 2004.

What has been happening with digital leisure time is less time spent on television and more time on other screens. For example, the 25-34 age group spent 19 fewer minutes watching television in 2023 than in 2004 while spending 22 more minutes on other screens, almost an equal swap of time.

Changes in leisure at-home screen time don't account for why people spend far less time away from home, more than an hour less, and more than 1.5 hours less for the younger ages, nor do the changes account for declining attendance and time at LBEs.

Do people have less leisure time?

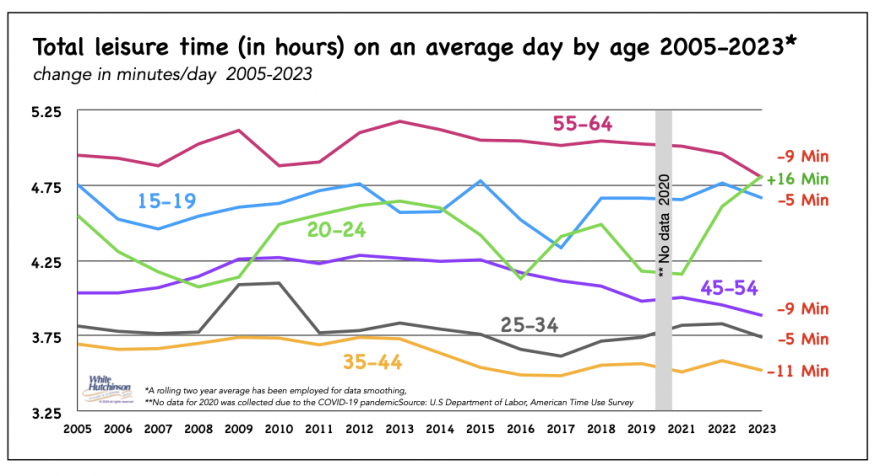

Could the decline in away-from-home time and LBE revenues be attributed to people having less leisure time to go out and visit LBEs?

Here again, the data doesn't support that. For the younger age groups, the greatest decline in leisure time since 2004 was for ages 25-34, and it was only a decline of 9.6 minutes a day. The 20-24 age group saw an increase of 13 minutes a day in leisure time.

People basically have as much leisure time as they had two decades ago. It's their allocation of it that has been changing over time.

Economic factors

Since 2019, inflation has been a significant factor for LBE declines, especially among lower-income households. One economist calculated that lower-income households had experienced 6.7% inflation over the past year based on adjusting their mix of goods and service purchases. That's more than twice the overall inflation rate in the low 2%. Lower-income households have also lost the pandemic economic support that helped prop up their discretionary spending in 2021 and 2022. Lower-income households are being pinched by high grocery prices, rents, and interest rates and falling behind on their credit card bills. Discretionary spending at LBEs is no longer an option for them.

Examining household participation and spending data validates that lower-income households have declined attendance and spending at LBEs. Average annual household spending by the lower 40% of income households (<$54,500 in 2023) for fees and admissions to community LBEs such as LBEs, theme parks, and family entertainment centers (FECs), and to museums has declined by 37% from $19.15 in 2019 to $12.00 in 2023 when adjusted for inflation.

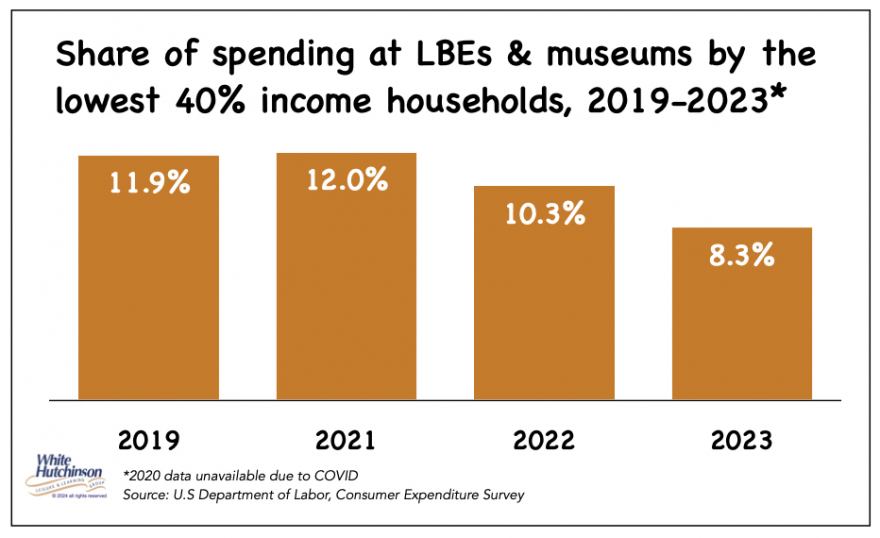

The spending share of fees and admissions to LBEs and museums by the lowest 40% of income households has declined by nearly 30% from 11.9 % of all such spending in 2019 to 8.3% in 2023, with the greatest decline in 2023.

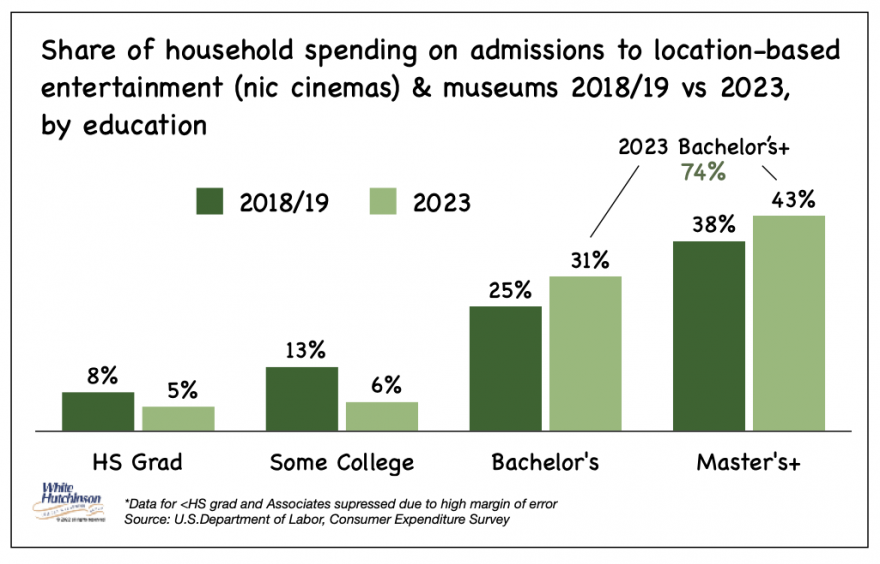

High school graduates and some college households have declined by almost half from 21% of spending for fees and admissions at LBEs and museums in 2019 to only 11% in 2023.

LBEs and museums have seen a significant gentrification of their attendees since the pandemic. In 2023, bachelor's and master's degree households accounted for three-quarters of all such spending (74%), up from 63% pre-pandemic.

In 2023, total spending for fees and admissions at LBEs and museums was slightly higher than in 2019. Higher socioeconomic households have more than made up in spending for the loss by lower-income households by paying premium prices for high-quality LBE experiences. So why are many LBEs seeing declining sales?

A shift in venue preferences

Since the pandemic, there's been a significant shift in people's preferences for the type of LBE experience they choose, which has caused the growth in market share for several categories of LBEs. This is causing many legacy LBE models to be losing market share and experiencing declining inflation-adjusted sales.

One factor is the gentrification of attendees. Higher socioeconomic households have grown from 63% of pre-pandemic spending to the vast majority of all such spending (74%). Higher socioeconomic households seek more upscale premium experiences, shifting the market to LBEs that offer a high-quality, what we call a high-fidelity experience that includes the ambiance and vibe of the venue, its customer service, the entertainment/attractions, and elevated food and beverage offerings.

As we discussed in an article in our November 2024 issue, family entertainment centers (FECs) that cater to families with children and often try to cater to adults as well have a declining appeal due to a decline in families with children attributable to the long-term trend of declining births that began in 2007. In 2023, less than one-fifth of all households had children under age 18 living in the household (19.4%).

"Family time" has taken on a new meaning for households with children. Millennial parents want to pursue their passions while they spend their free time with their kids. Doing things with their children is no longer about kid-specific activities. They want new, exciting experiences that fulfill them personally while bringing their kids along for the ride.

This "we" to "me" love shift even appears when dining out. Family fun is no longer the number one emotional reward parents seek from dining out with their family. There is now less importance in having fun together as a family and much more significance in parents choosing foods they feel good about eating.

This "entire family" to "adult-parent" preference shift changes the type of LBEs parents choose to take their families to. In many cases, it's to LBEs designed for adults with adult-appealing entertainment, food, and beverages in upscale surroundings.

Examining the primary reason people visit an out-of-home leisure or entertainment activity is counterintuitive to what most people in the LBE and FEC industry think. Research finds that the primary reason most people visit a live performance, live sporting event, and arts and crafts fair isn't for the entertainment aspect of the experience; it's for socialization. Socialization is the 2nd top reason Millennials attend food, wine, and beer festivals. Most of the time, the social nature of the occasion is the primary driver of the visit decision, not the activity, entertainment, or food and drink. They are all only excuses for and facilitators of socialization.

One type of community LBE appears to be thriving and taking market share away from older model LBEs is "social gaming" venues (mistakenly called competitive socializing, as it is not about the competition). Social gaming venues appeal to adults' desires for rich and meaningful social experiences accelerated by the pandemic's IRL social isolation.

At social gaming venues, people simultaneously enjoy elevated high-quality food and beverages while playing social games that are not highly competitive. While one person plays, the other group members watch, converse, comment on the play, and enjoy elevated food, typically sharable dishes, and beverages. The combination of enjoying and sharing the food and drinks while playing a social game creates a high-fidelity "social bonding" and memorable experience.

One example is Lucky Strike (previously Bowlero), whose same-store sales have increased 48% since the pandemic, double the inflation rate (although same-store sales were basically flat their quarter ending September 29, 2024). The bowling, combined with their craft cocktails, hand-crafted pizzas, and gourmet burgers, is just one example of a social gaming venue.

Meanwhile, older LBE concepts such as Dave & Buster's are struggling, mainly due to being highly dependent on an arcade game room, which is not predominantly a social experience and doesn't include food and drinks while playing. Plus, D&B's food offerings and quality don't meet contemporary standards. Another issue is that D&B has a separate dining room, which no longer works as a dining destination when part of an LBE (admitted by D&B's CEO, Chris Morris). Interestingly, D&B is becoming aware of some of the root causes of their declining revenues by incorporating some social gaming areas they call "interactive social bays" in their "Store of the Future" remodels and new builds, as well as improving their food offerings. In addition to having game rooms, most older-formula LBEs have attractions that don't offer high-fidelity social experiences, with games where everybody can play and have fun and where people take turns playing. At the same time, other party members socialize while watching and enjoying elevated food and beverages, the formula that social gaming LBEs offer.

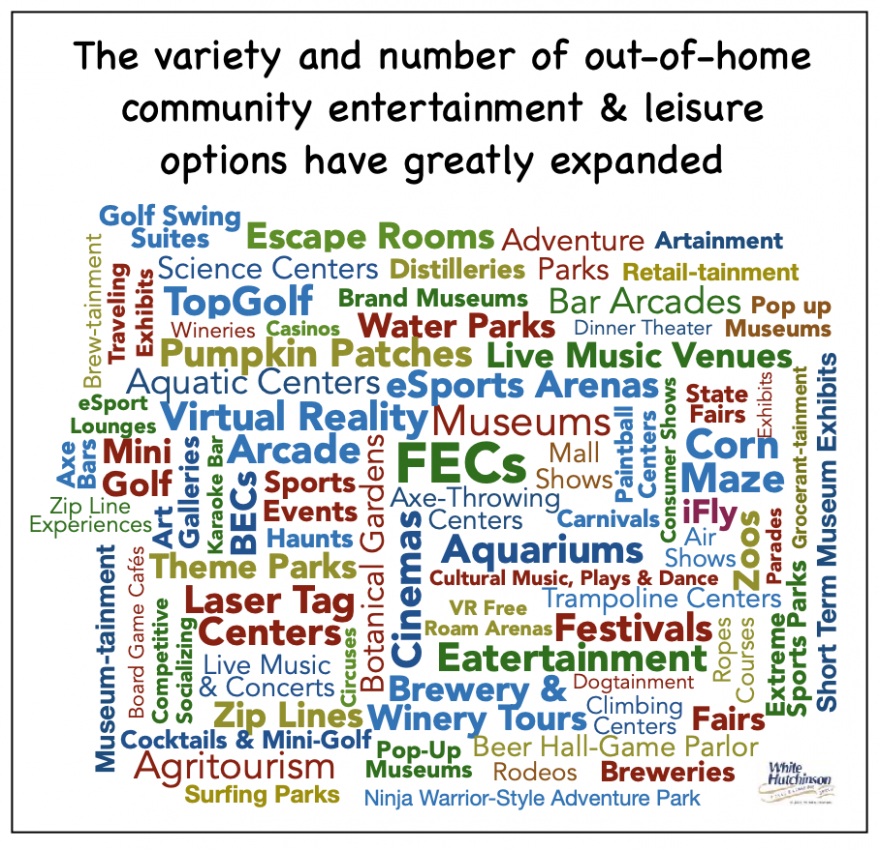

Competition

Community-based LBEs don't compete with each other. Instead, they compete with everything people can do with their leisure time, both at home and away from home. The away-from-home options have grown enormously. This includes food and drink festivals, agritourism, and immersive museum experiences such as Meow Wolf, to name just a few examples. Additionally, the appeal of live sporting events has increased, and people are spending more time to attend them.

Many LBE experiences that were appealing just a few years ago no longer measure up to the many new and higher-fidelity away-from-home options. Today, most people would rather be known for their experiences than their possessions. And the more status-worthy and unique experiences they can have and post, the greater their social capital. So, people are constantly seeking new and unique experiences that their friends and social media followers haven't yet enjoyed, so they will envy them. People are looking for unique new experiences rather than repeating the same old thing, such as attending most LBE venues such as family entertainment centers or theme parks. With so many away-from-home options, especially limited-time offerings (LTOs), there is no reason to repeatedly visit the same LBE unless it has high appeal. This has raised the bar for the quality and type of experience an LBE must offer to compete. Many LBEs have lost their repeat appeal.

Conclusion

Neither a decline in leisure time nor increasing digital leisure screen time is causing declining revenues for many LBEs. Contributing factors are people spending less time away from home with the greatly expanded and improved and unique options competing for what people can do with that decreased away-from-home time.

Since (and because of) the pandemic, peoples' increased desire for away-from-home venues with high-fidelity experiences that combine socializing with elevated food and beverages in adult-oriented venues benefits new model social gaming venues. This is taking market share away from older model LBEs. The gentrification of attendees is also causing a shift to high-quality venues, including most social gaming venues.

Hockey legend Wayne Gretzky famously said that his father told him to "skate to where the puck is going to be, not to where it has been." It's a quote repeated often in the business world and advice that all types of LBEs need to heed in the fast-evolving out-of-home community entertainment and leisure marketplace.

To ensure our clients' projects are aiming for where the puck will be in the future long-term and not for what worked in the past or for some short-term fad, our company spends extensive time not only researching and studying the location-based entertainment and leisure industry but also many consumer industries including food service and restaurants, hotels, and resorts, and retail, to name just a few,. We also follow all the research in multiple fields, including food service, sustainability, travel, recreation, consumer culture, technology, social media, marketing, design, branding, time use, demographics, and consumer expenditures. We also conduct our own proprietary consumer research. If you follow our Leisure eNewsletter, you've read about some of our findings.

We practice what is known as evidence-based design and production of our client's projects - making decisions based on solid research findings rather than just opinions, beliefs, and conventional wisdom, which are typically based on what worked in the past, not what will work in the future. Yes, this is a significant investment of time and money on our company's part, but it allows us to identify and sort the emerging macro trends from short-term fads to make sure our clients' projects are on target, not just when they open, but for many years after.

Subscribe to monthly Leisure eNewsletter