Vol. XXIV, No. 7, November 2024

Why the market share for family entertainment centers will continue to decline

For this article, a family entertainment center (FEC), a subsection of the community location-based entertainment (LBE) market, is defined as an entertainment venue with attractions, games, and food and beverages designed to appeal to families with children. They typically have multiple attractions but might just have one attraction and a game room, like many bowling alleys. They try to attract both families with children and adults who are not accompanied by children. Some of the larger ones will have both a family area and an area designed more for adults. Centers intended for children, children's entertainment centers, and centers designed for adults, such as Dave & Buster's and the newer social gaming venues, are not FECs.

Many nails are slowly being driven into the coffin of FECs as their market appeal and out-of-home leisure market share declines. Here are four:

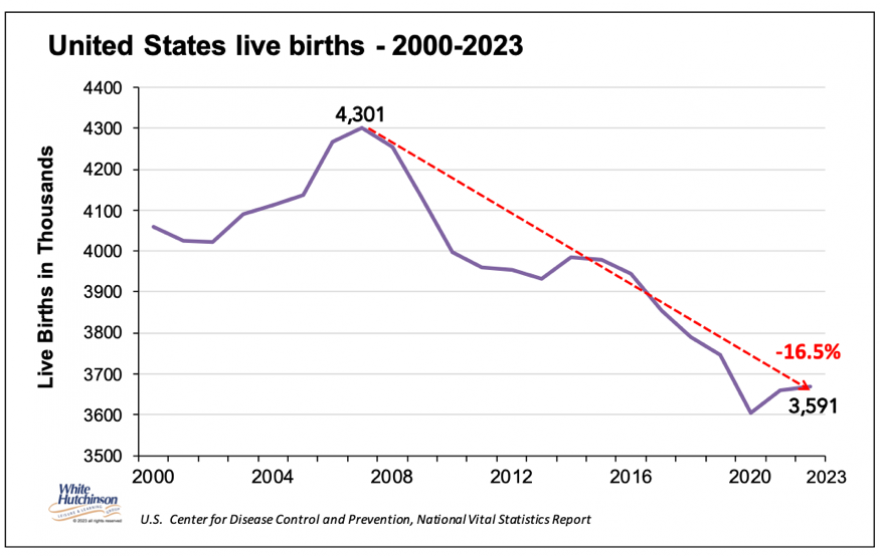

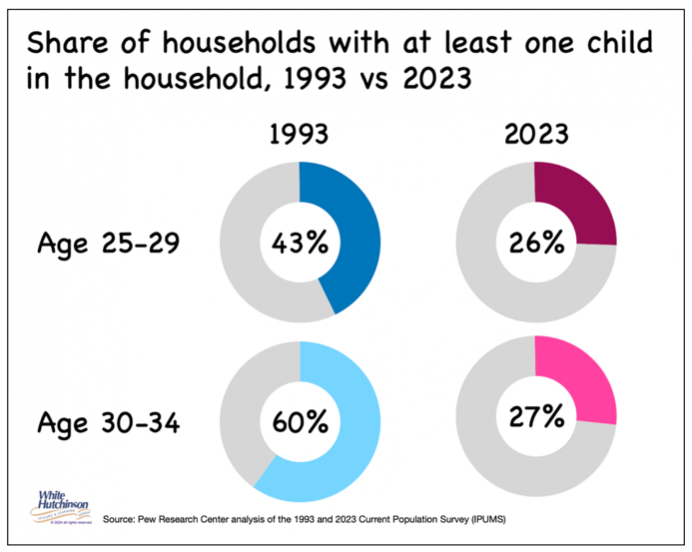

Baby bust - as a result of a declining birthrate, the percentage of households with children is declining, along with the size of the family market. The percentage of households in 2023 with an adult ages 24-45 with children ages 5-14 was only 29%. The percentage of young adult households with children, a primary market for FECs, has declined by almost half over the last three decades and is projected to continue declining.

"We Love" to "Me Love" - The coronavirus pandemic has caused major behavioral shifts in our priorities and how we go about our lives. Some behavioral changes have been temporary, lasting only as long as the pandemic. However, some behavioral shifts remain, primarily driven by emotional changes in our priorities, and become part of our emotional DNA.

One of those emotional, behavioral shifts is an acceleration of a trend that began several years before the pandemic - parents increasingly putting themselves first instead of their kids unlike their parents did.

Research by the Family Room consultancy has identified an emotional shift - a change from "We Love" to "Me Love" - parents prioritizing themselves over their kids. Parents now feel they can't be good to their kids unless they're good to themselves. "Family time" has taken on a new meaning. Millennials' parents want to pursue their passions while they spend their free time with their kids. Doing things with their children is no longer about kid-specific activities. They want new, exciting experiences that fulfill them personally while bringing their kids along for the ride. Four in ten dads said they have no problem bringing their kids to bars. Evidence of this trend is Dave & Buster's, a totally adult venue, still gets 30% of its business from households bring their kids.

This "we" to "me" love shift even appears when dining out. Family fun is no longer the number one emotional reward parents seek from dining out with their family. There is now less importance in having fun together as a family and much more significance in parents choosing foods they feel good about eating.

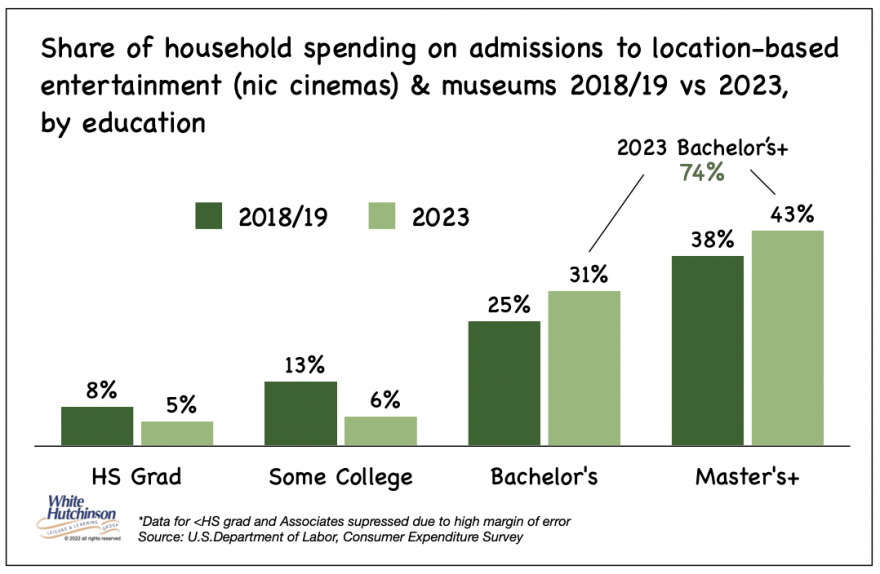

Gentrification of LBEs - the growing socioeconomic bifurcation of spending on community location-based entertainment (LBE) where a larger and larger share of spending comes from higher socioeconomic households. In a sense, you might call this the gentrification of LBEs.

Pre-Covid, households with a bachelor's or higher degree, 48% of all households, accounted for 63% of all spending on admissions and fees to community LBEs (excluding cinemas) and museums. That share has grown to 74% in 2023.

Adults in these higher socioeconomic households have high expectations. This includes a higher level and quality of architecture, finishes, landscaping, and attractions, the quality and trendiness of food and beverage offerings, and a high standard of customer service. This is where most family entertainment center-type venues fail, perhaps as most of these factors are not decisive for children (see article in this issue on premiumization).

Social gaming LBEs - The rapid growth of adult-oriented and sometimes adult-only social gaming LBEs (often erroneously called competitive gaming by the LBE industry. See note on social gaming in the premiumization article) is offering adults, especially younger and higher-socioeconomic adults, a more appealing adult, high quality, and participatory, social, entertainment and food and beverage experience, a vast improvement over the experience that family entertainment centers offer. More and more community LBE market share will continue to shift from old-model FECs to these new-model social gaming venues as they penetrate even medium size markets.

Subscribe to monthly Leisure eNewsletter