Vol. XXIV, No. 5, September 2024

- Editor's corner

- Premiumization, the next phase in leisure spending

- Attendance patterns for location-based entertainment venues

- How the immutable laws of marketing are changing the location-based entertainment industry

- Is a backlash against digital culture underway?

- Flavor-forward foods

- Topgolf's sales decline

- Important factors for deciding what experiences to spend money on

- Homebound: The long-term rise in Americans' time at home

- Sports activities now exceed pre-pandemic levels

Premiumization, the next phase in leisure spending

What is premiumization?If I were to tell you that U.S. cinema box office sales for the second quarter of 2024 were down 27% from the same period last year, you probably wouldn't be surprised. After all we have all seen the headlines and felt the pinch from stagnating wages and inflation hitting essential categories such as healthcare, housing, and groceries. It's not surprising that people aren't willing to spend $11.90 (the average U.S. ticket price in 2023) to spring for a movie, and that isn't even including the popcorn, especially when they have the option to watch thousands and thousands of movies at a negligible cost in the comfort of their homes.

But we found something interesting when we dug into the details of this movie spending. Although movie-going spending has generally decreased, spending on premium cinema options such as IMAX has not experienced the same decrease. The provider of large-format exhibition technology reported that IMAX second-quarter revenue fell only 9% year over year to about $89 million, and their share of all movie purchases has increased. Ticket sales for larger premium formats like IMAX accounted for over 14% of all box office ticket sales as of the end of June 2024. In 2019, sales for these formats during the same period only accounted for 10% of sales. So why are income-strapped consumers splurging for IMAX tickets? The answer may be premiumization.

Premiumization refers to elevating products, services, or experiences to a higher quality, offering both luxury and exclusivity, and it isn't just happening at the movie theater. For instance, a recent report by Circana found that the prestige beauty industry category saw revenue grow by 9% year over year in Q1 2024. In comparison, the mass market beauty category - typically drugstore brands - grew by 2% during the same time period.

Premiumization and the middle class

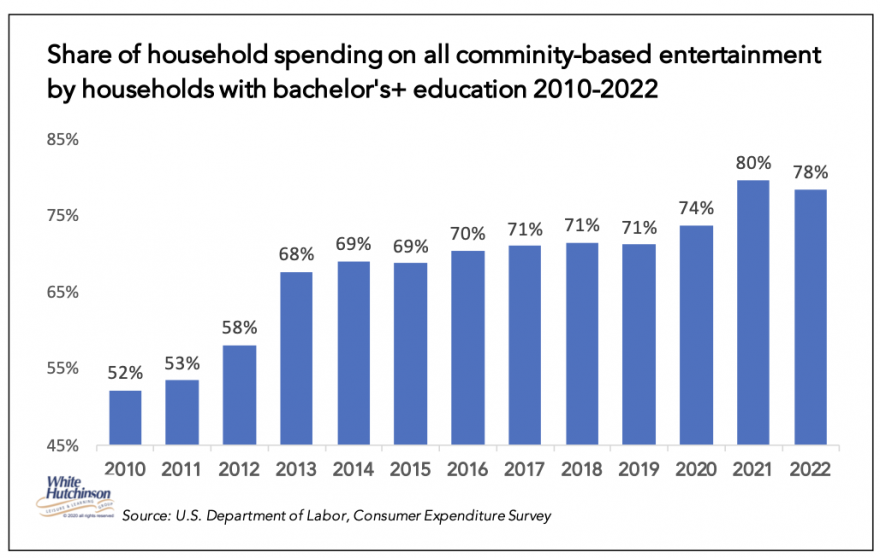

We have talked a lot in this enewsletter about the increasingly bifurcated landscape of the out-of-home leisure market, that college-educated, higher-socioeconomic households have been steadily making up a larger share of out-of-home entertainment spending. In 2019, 44% of all bachelor's and higher degree households accounted for 71% of all community-based out-of-home entertainment and arts spending on fees and admissions. That's a 50% increase from 47% of all spending in 2000. That trend continued post-pandemic; in 2022, their share increased to 78%.

However, the interesting thing about premiumization is that it isn't just a by-product of this established trend of upper-income household spending; it is also occurring among the middle class.

According to McKinsey & Company's 2024 State of the Consumer report, the "squeezed but splurging middle class" is one of the consumer groups uniquely poised for growth in 2024. "We expect that cost-of-living increases in advanced economies will continue to pressure middle-income consumers. Conventional wisdom suggests that these consumers should clamp down on discretionary spending. Our data reveals something different: instead, middle-income consumers in Europe and the United States plan to splurge on discretionary items at a rate comparable to that of high-income consumers.

"This intent to splurge appears across various categories, including experience-based categories such as travel and dining out, groceries, and discretionary goods. Middle-income consumers might typically be expected to delay purchases during economically challenging times, but our research shows that they're only slightly more inclined to delay purchases than wealthier consumers. They're also less likely to trade down than higher-income consumers."

The following examples illustrate how the entertainment industry leverages premiumization to enhance consumer experiences and increase revenue by targeting customers willing to pay more for added value and exclusivity.

Concerts and Live Events: Many music artists and event organizers offer VIP packages for concerts and festivals. These packages often include front-row seats, backstage access, exclusive merchandise, and meet-and-greet opportunities with performers, all at a higher price point.

Cinematic Experiences: Movie theaters have embraced premiumization by offering luxury seating, enhanced sound systems, and gourmet food options. Premium formats like IMAX or 4DX provide an elevated viewing experience that justifies higher ticket prices.

Theme Parks: Parks like Disney World and Universal Studios offer premium experiences such as fast passes, private tours, and exclusive dining options. These services allow guests to skip lines and enjoy a more personalized visit at a higher cost.

Stadiums: Modern stadiums are generating substantial revenue from premium seating options like suites and VIP hospitality, which, although limited in number, contribute significantly to overall revenue. This trend highlights the growing importance of premium offerings in the venue experience.

Premiumization is also playing a factor in what and where we eat. 72% of consumers say quality is the most important attribute when shopping for foods and beverages, tied only to price. This underscores the importance of great value and alignment with consumers' values and aspirations.

The bottom line

People are no longer satisfied with mediocre experiences. Consumers have countless free, or nearly free digital entertainment options available to them in the comfort of their own homes at the touch of a button. If they put in the effort to leave their home, drive somewhere, and part with some of their hard-earned money and limited leisure time to be entertained, they want the experience to be better than mediocre, they want it to be premium, special, and exceptional.

For some people, this may mean staying home and streaming some of this year's new releases so they can splurge on IMAX tickets to see the blockbuster movie of the summer in style. Others who can afford it only want to spend their discretionary money and time on a premium experience. For others, it may mean purchasing the fast pass option at Disneyland and reducing their vacation (and therefore their hotel bill and food budget) by a day or so since they can do more in less time.

The implications for leisure venues

Consumers are looking for something special and premium, and many are willing to spend more on it, even if it means cutting costs elsewhere. This is good news for leisure and entertainment venues who have taken our advice and targeted the higher socioeconomic consumers in their furniture and finishes, entertainment offerings, and food & beverage, as this means the market for their offerings expands beyond the upper and upper-middle class patrons who expect that level of experience to the middle class who are choosing to save and splurge on premium experiences as well.

Subscribe to monthly Leisure eNewsletter

Vol. XXIV, No. 5, September 2024

- Editor's corner

- Premiumization, the next phase in leisure spending

- Attendance patterns for location-based entertainment venues

- How the immutable laws of marketing are changing the location-based entertainment industry

- Is a backlash against digital culture underway?

- Flavor-forward foods

- Topgolf's sales decline

- Important factors for deciding what experiences to spend money on

- Homebound: The long-term rise in Americans' time at home

- Sports activities now exceed pre-pandemic levels