Vol. XXI, No. 2, February 2021

The entertainment view towards tomorrow

by Kevin Williams, guest author

Covering the immersive out-of-home entertainment scene, leading industry specialist Kevin Williams of KWP, in this special feature and from his unique global perspective takes a collective look at the opportunities and issues that will face the re-emerging location-based and entertainment destination sector from the following trends and tech .

It has been an aberration for many executives, during the over 11-months of enforced quarantine at home, to see that all was lost and that things will never be the same again. In part this is correct, it is impossible for things to "ever return to normal". Especially as there is no such thing as normal (unless on a washing machine), when describing the constant innovation in the commercial immersive entertainment mainstream.

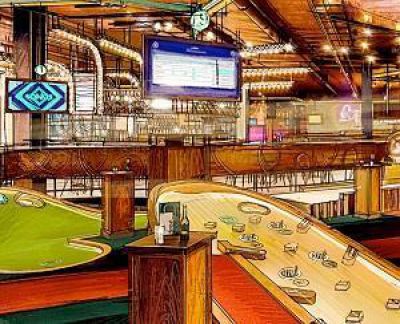

Credit: KWP

It has become more than obvious in the last few months, that the pessimism that fueled the "doom-n-gloom' speculation of the end of 2020 has been superseded by a sudden influx of investment and restructuring. Best described as a preparation to benefit from an industry about to #Springback. We have seen acquisitions, mergers, and restructuring on a unprecedent scale. And it feels like we are only seeing the tip of the iceberg, and inevitably along with the emergence of the industry, we are also seeing the hard impacts brought on it.

From the perspective of both my consultancy, but also from my research in populating the pages of our news service (The Stinger Report), I have defined these interesting factors defining the new business opportunities into these four groups.

1. Emerging Trends

There has been a major development emphasis taking place while most of the industry has been in Lockdown. With developers, investors, and owners looking at how best they will address the needs for new leisure entertainment going forward. Terms like "Mixed Use Leisure Entertainment" have been bandied about, and the blending of hospitality and entertainment has been given more emphasis than ever before.

Credit: Puttshack

One of the major trends leading up to the first impacts of the Global Health crisis was that of Social Entertainment venues. Sites that aimed at a young audience but offered a strong hospitality element supporting a new interpretation of a proven entertainment formula. This included the rise in "Crazy Golf" concepts ranging from "Holey Moley" to "Puttshack". But also saw new immersive entertainment systems that built on a social element, such as "Swing Suite" and "X-Golf".

While destination entertainment venues needed to look at offering a more diverse selection of attractions, the dream of the LBE VR venue seemed to be suffering its baptism-of-fire just as the Lockdown measures suspended the experiment. While the entertainment industry woke to the harsh realisation that they would have to grow up and adopt adult ways. Moving to guest registration systems, frictionless payment on property, and appropriate marketing and media promotion, all based around the dark arts of CRM.

2. Mergers, Partnerships & Acquisitions

The inevitability that those in the industry with liquid capital would look to use this to better their position against those operations that were already in debt going into the Lockdown of business, was inevitable. The biggest surprise has been that we have (at this point) not seen more entertainment corporations seriously impacted by the suspension of business. The impact on the restaurant, cinema and location-based entertainment scene has been palpable, but the market has proven resilient and works hard to ready itself for the next phase.

Examples of the upheavals in the market are personified by the major developments witnessed. While some industry pundits proclaimed the end of VR entertainment venues, the market has proven surprisingly strong, most recently we have seen investors show commitment to this sector in buying into the future of the market. This includes the ownership of the means of distribution. Such as with the announcement that Vertigo Games had acquired Springboard VR. Taking control of their extensive library of 400 VR titles, that serve some 500 VR arcade venues Globally.

Credit: SPREE Interactive

Immersive entertainment seems to be a target for major investment as seen with the news that SPREE Interactive, developers of a LBE VR arena scape entertainment portfolio had successfully secured a multimillion-euro investment, from two strategic and two financial investors in a second seed round. This funding part of the planning leading to the operations Series A round of investment later this year. The company developing partnerships with VR headset manufacturer Pico Interactive, along with VR eSports competitive content developer VR Nerds. All to secure their position in the market going forward.

3. Landgrabs

It is this securing of a dominating position in the market once the business opportunities recommence that has focused a lot of the thinking during lockdown. Those operations that have established leading positions intend to use their capital and experience to grow their business, looking at much wider investment. While, for those operations that had amassed large debt going into the Global Health crisis, the situation has been compounded by the inability to depend on facility business to manage the debt and left vulnerable. Not all opportunities are based on acquisition, and some operations are being faced with removal from the market, totally changing the balance of power.

Regarding entertainment businesses that were already in debt dependant positions but used their facility dominance to continue expansion. Operations such as Punch Bowl Social are a good example of once the taps were turned off then a spiral of collapse ensued that no one could stop. Even seeing their tentative buyout by Cracker Barrel abandoned as they focused on survival of their own. Likewise, established operations like Chuck E. Cheese and Dave & Buster's, all undertook debt refinancing and pivoting to "Dark Kitchen" business to prop up their operation, moving to restructure to accommodate the changed business landscape.

Credit: HOLOGATE

For many that are looking to enter the opportunities of Social Entertainment facility business, the hope is that the post-COVID market will see drastic restructuring of landlord rent and business rates to prop-up the sector. Creating a fertile landscape for new businesses that build on the latest thinking and technology to entice out of their homes, a "stir crazy" audience hungry for entertainment. It is this landscape that will see the birth of a new generation of entertainment chains. Recent announcement including HOLOGATE, the industry leader in LBE VR amusement products announcing the commencement of the build on "HOLOGATE WORLD". Partnering with P&P Group, working on the new and modernized FLAIR urban marketplace, in Fürth, Germany. The "HOLOGATE WORLD" will be State-Of-The-Art, the largest "Extended-Reality" entertainment facility, opening this September 2021.

But not all immersive entertainment will depend on VR headsets - the investment in immersive environments using projection systems has also seen a phenomenal growth. New start-ups such as "Electronic Gamebox" - that has up to six-players within unique fully immersive rooms, competing in motion tracked game experiences, has already rolled out new venues in the UK and US. While "Illuminarium Experiences", is an operation offering an audience-based immersive digital environment. Using the latest 4K laser projectors and beamforming sound, to create a 360-degree, sensory space of sight, sound, and scale. Running specially created experiences such as their 'Wild: The World's First Virtual Safari'. This operation looks to open a chain of 30-facilities in the next five years. The first site opened in Atlanta, Georgia, this year.

4. Collateral Damage

The growth of investment interest in Location-based entertainment and Social Entertainment venues is dependant on the realities of the Post-COVID landscape. Many investors are doubling down on the hunger seen in those territories that have reopened their business, such as the UAE and areas of Asia, where a return to the entertainment venue has been immense, seeing record attendances. Some facilities in Dubai reporting 80-per-cent guest attendance, breaking same year-on-year records. But this was before a halt to live entertainment was called following a surge in this territory. A need to be flexible if the face of the situation is needed, and not all are opportunities, when the doors fly open again are positive.

With the level of this "Black Swan" event (a term used by financial houses to describe a once in a generation upheaval of commerce), there are winners, but obviously also losers. Most severe impact has come with the reversal in the power structure of the businesses, ranging from the loss of dominance by the facility landlords, the established chains, and even the trade organizations in dictating the status quo. What some define as a period of the loss of the "Gate Keepers" - now allows new ways of looking at problems and influencing the best solutions for an industry to embrace.

Credit: EMBED

This loss of those that once dictated, will be matched by a growth of new faces and voices, previously held back by the entrenched power structure, the impact of the business upheaval will be such that months of suspended business will be as if years have passed in the generational shifts in business practise. One of the best examples of this has been the forced adoption of ePayment and frictionless guest transactions. For years attempts had been made to get the amusement and attraction industry to seriously look at smart card payment, and even pre-registration online booking. But it took the impact of the pandemic to force this opportunity on the industry, and with that certain Gate Keepers loss their control.

In conclusion, what I have endeavoured to place before you are only the briefest of snapshots of the tectonic upheaval that we have researched and charted. Accelerated by the business changes brought upon the entertainment and hospitality markets by the Global Health crisis, but also forced on a market that had previously been anemic to change, especially if it impacted the status quo. Fundamentally for me, the biggest change in the perspective going forward for the amusement and attraction sector is the new focus on its offering to its guests. Where previously corporations had been fixated on the investors. The new need to retain the audience in a market saturated with other businesses desperate to grab the elusive disposable income, coming out of lockdown. A new understanding is being looked for to comprehend the buying habits of a new audience.

It is fair to say that some entertainment facility corporations took the attendance of the guests for granted. Famously, a chief executive of a leading entertainment corporation stated that there would be no need to promote a new project, as the very fact of opening it would negate the need to market it much - so confident in their brand. This level of arrogance would later bite the said executive hard in the butt as their plans were obliterated by the impact of the new business landscape. And it is this arrogance that some executives feel there is a given right for their profitability and survival in the market that they do not need to exert any effort in ensuring their position of dominance.

What 2021 represents for the entertainment industries is a coming to terms that these operations are not immortal. The cinema and restaurant industries may have been slow to adapt, and many will pay the price, but there is also a danger that the "New Normal" that the amusement and attraction industries will be struggling towards in the coming weeks and months, will be equally as harsh as the period experienced during lockdown. Many who depended on their business intel from trade shows and contacts have been forced to seek new lines of information. or be left in the dark.

We will have to face that things will not be returning to how they were, and this is not a bad thing. But for those that are not prepared to do their research and embrace change, a baptism of fire awaits.

About the Author - Kevin Williams is a widely-respected expert on entertainment and technology. A regular presenter at international conferences, Kevin is also a regular speaker at the Foundation Entertainment University (FEU), a bootcamp for FEC investors. He also holds the role as one of the senior judges of the VR Awards.

Kevin's consultancy KWP Ltd specialises in helping international clients develop immersive and interactive entertainment. Kevin has recently become Co-Founder and Technology Director for Spider Entertainment, a Global leader in Out of Home Entertainment for retail destinations.

Kevin is editor of the Stinger Report, a-must-read for those working or investing in the amusement, attractions, and entertainment industry. He is also a prolific writer with regular columns for the leading trade publications in this market, along with presenting numerous conference sessions on the sector and its global impact. He is also the co-author of the only book on this aspect of the market - currently working on the next edition, scheduled for publication soon. Kevin can be reached at kwp@thestingerreport.com. To subscribe to his weekly news service, click here.