Vol. XI, No. 5, Sept-Nov 2011

- Editor's corner

- Site selection: a combination of art and science

- IAAPA is just around the corner and we'll be there

- Is the staycation trend on the decline?

- September's Foundations Entertainment University a sell-out

- Don't miss Randy White's blogs & tweets

- Alcohol: To serve or not to serve; that is the question

- Pricing commercial parties & group events for maximum ROI

Is the staycation trend on the decline?

Our December 2010 article, Is the staycation trend a real phenomenon, detailed how the staycation phenomenon was indeed real and was a long-term trend that started a number of years before the Great Recession. Since 2010 spending data has recently become available, we analyzed it to see if the staycation trend is continuing. What we found is a possible reversal of the trend.

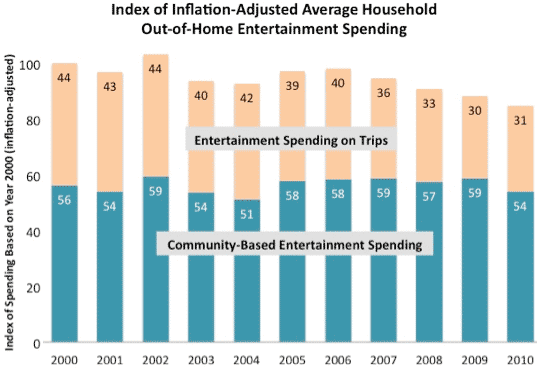

First let’s look at entertainment venue spending. Average household spending for out-of-home entertainment both in the local community and on trips saw a 4% decline from 2009 in inflation-adjusted dollars. When we break it down between community-based and on-trip entertainment, we find that community-based entertainment spending saw an 8.0% spending decline, almost constant across all incomes, while entertainment spending on trips increased by 3.9% with the households with the lowest 20% of incomes decreasing spending by 19% and the middle 20% by income increasing spending by 25%. In 2009, entertainment spending on trips represented 34% percent of all household out-of-home entertainment spending. In 2010 it increased to 36% as well as grew in the amount spent by the average household.

This graph illustrates the changes that have occurred to average household out-of-home entertainment spending based on year 2000 spending, inflation-adjusted. Spending peaked in 2002 at 103% of what it was in 2000. 2010 average total household out-of-home entertainment spending decreased to 85% of what it was in 2000. Community-based entertainment spending in 2000 represented 56% of all such spending. In 2010, such spending had decreased 4% (index of 54 compared with 56), but had grown to represent 64% of all out-of-home entertainment spending. Entertainment spending on trips decreased 30% over the same decade.

We’re seeing the same trend in inflation-adjusted spending to attend sporting events. Average household 2010 spending for admissions to sporting events was down 4% compared to 2009. Household sports admission spending in their local town was down 12% while spending on trips was up by 2%, again with the largest spending percentage increase by households with the middle 20% of incomes. Admission spending on trips grew from 21% to 24% of all sports admission spending.

So it appears that in 2010 Americas continued to cut-back their overall out-of-home entertainment and sports attendance spending while shifting more of that spending to entertainment and sports attendance on trips. If what we saw in 2010 continues for another year, we will be able to definitely say that the staycation trend is reversing.

Vol. XI, No. 5, Sept-Nov 2011

- Editor's corner

- Site selection: a combination of art and science

- IAAPA is just around the corner and we'll be there

- Is the staycation trend on the decline?

- September's Foundations Entertainment University a sell-out

- Don't miss Randy White's blogs & tweets

- Alcohol: To serve or not to serve; that is the question

- Pricing commercial parties & group events for maximum ROI