Vol. X, No. 2, March 2010

- Editor's travelogue: six Middle East cities

- Recession creates rare opportunity for start-ups

- Three immutable laws for location-based entertainment

- A new reality for out-of-home entertainment

- Reinventing the shopping center for the age of the grounded consumer

- Current projects

- Upcoming presentations by Randy White

A new reality for out-of-home entertainment

What effect will the Great Recession and the decline in out-of-home entertainment spending have on the location-based leisure industry when the economy finally recovers? Read on for our in-depth analysis – and learn why we're referring to the New Normal as the New Reality.

The numbers on entertainment expenditures in the U.S. aren’t yet in for 2009. But we do have data for 2008, a year in which the Great Recession started. What we find from analyzing that year’s data (and numbers from earlier years) is a trend under way for a decline in household out-of-home entertainment spending. At the same time, spending has been increasing for electronic entertainment – the Internet, TV, computers, game consoles, videogames, smart phones and other electronic equipment and content. In both cases, this holds true in inflation-adjusted dollar amount and share of consumers’ household expenditures.

Household expenditures for electronic equipment and services increased by one-third (34%) in inflation-adjusted dollars from 2000 to 2008, capturing a whopping 25% more of total average household expenditures. During the same eight years, expenditures for out-of-home entertainment decreased by 3%, capturing a 7% smaller share of average total household expenditures. When you look at the overall combination of household expenditures for electronic entertainment and out-of-home entertainment, household entertainment expenditures increased. But all that increase was in electronics, with some expenditures shifting from out-of-home to electronic entertainment.

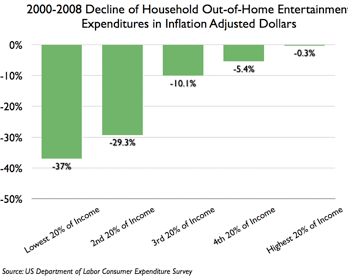

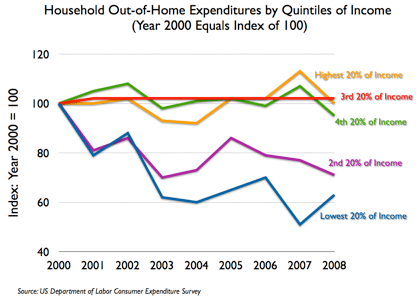

Digging deeper into the data shows that the greatest decline in out-of-home entertainment spending has been in lower income households. The lowest income quintile (20%) of households saw a 37% decline in spending in inflation-adjusted dollars, whereas the highest quintile’s spending decreased by only 0.3%. And that decline is totally attributable to 2008.

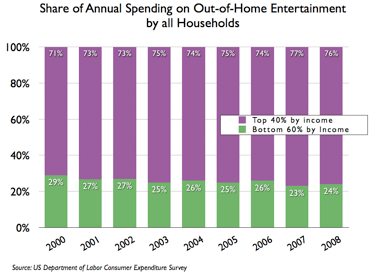

The top 40% of households by income accounted for 76% of all out-of-home entertainment spending in 2008, an increase of 5% since 2000.

When we examined electronic entertainment spending, it increased for all income quintiles in inflation-adjusted dollars over the eight-year period. The lowest quintile’s spending increased 18%, while the other four quintiles increased their spending rather consistently between 56% and 61%.

The news on the long-term trend of declining spending on household out-of-home entertainment isn’t as bad as it might seem. Although the amount of household spending is down, total spending is up, due to population increases. Between 2000 and 2008, inflation-adjusted total spending for out-of-home entertainment in the entire U.S. increased 36%, and as described above, became more concentrated in higher income households. In 2008, households with $80,000 and greater incomes accounted for 62% of out-of-home entertainment spending. It should also be remembered that we are discussing macro trends. Markets are all different, and many still have a shortage of attractive out-of-home entertainment offerings to capture potential demand. In fact, demand for community-based entertainment is to a certain degree elastic, meaning that more and/or better offerings can increase expenditures.

The preceding data and analysis does not reflect 2009 expenditures, which are sure to have been affected by the Great Recession. Recent research by many polling and marketing companies indicates the recession’s impact on out-of-home entertainment has been multifold:

- Consumers have cut back their overall out-of-home entertainment spending and have found many at-home entertainment replacements.

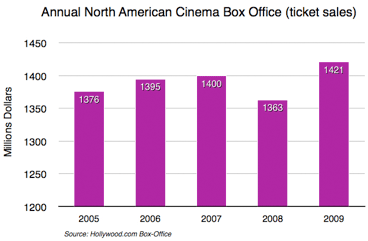

- Community-based and affordable entertainment options, including movies, museums and family entertainment centers (FECs) are faring better than extreme entertainment and major tourist destinations, due to the staycation phenomenon. This is evidenced by a 2009 15% increase in per capita North American movie attendance (box office) and 57% of U.S. museums reporting increased 2009 attendance, many at higher admission prices than the prior year. In addition, the Association of Leading Visitor Attractions in the UK reported a 2009 median 10.9% increase in attendance at its members’ attractions (81% had increased attendance).

- When consumers do spend on out-of-home entertainment, they are demanding more value for their dollar. This does not necessarily mean that price is the number-one determining factor; rather, the perceived value has to be there. An illustration of this is moviegoers have been willing to pay a premium price to see quality 3D movies, such as Up and Avatar.

The greatest recession-driven declines in out-of-home entertainment spending are sure to be with lower income households, no different than in the past. We are sure to see the highest income households commanding an even greater share of the spending.

What does this mean long-term for location-based entertainment? The Great Recession has rewritten the rules. Consumers have developed new learned behaviors of what they do with their time and how they spend their money. There is no evidence to suggest these new behaviors will reset to pre-recession levels even after a full economic recovery; most of the trends were already under way before the recession started. Some researchers and commentators are calling it the New Normal.

We think it is better described as the New Reality. First, consumers will continue to remain frugal from a value perspective. Second, consumers have learned that at-home entertainment can be less expensive or have no cost and be just as or even more satisfying than some out-of-home entertainment options. So to attract consumers out of their homes and get their money out of the purses and wallets, location-based entertainment businesses will have to offer higher quality and better value than in the past. They will also need to be more focused on targeting the higher income households who control most of the spending. This includes appealing to their aspirations for improving themselves and their children and strengthening their family and social connections, as much as having fun. As a result, the models for out-of-home entertainment will need to evolve, with edutainment and eatertainment derivatives growing in attractiveness.

Attracting higher socioeconomic guests means all aspects of the business need to be at a high standard, both the quality and finish of the facility as well as operations. To achieve this means greater front-end capital investment and better customer service.

The bar has been permanently raised and will continue to go higher. Consumers will still continue to leave their homes for entertainment. However, they will be much more discriminating and demand more than in the past. Many older formula businesses will become part of the industry’s history. Those facilities that reinvent themselves to the new consumer value equation will prosper.

Vol. X, No. 2, March 2010

- Editor's travelogue: six Middle East cities

- Recession creates rare opportunity for start-ups

- Three immutable laws for location-based entertainment

- A new reality for out-of-home entertainment

- Reinventing the shopping center for the age of the grounded consumer

- Current projects

- Upcoming presentations by Randy White