Vol. IX, No. 8, September 2009

At-home options and electronics taking entertainment market

Consumers are spending more of their leisure time - and more of their money - on in-home entertainment options. Yet this trend doesn’t spell complete doom and gloom for location-based-leisure businesses. Read on to find out why.

Over the past year we have been analyzing and sharing with you our findings about trends in both leisure time and consumer entertainment and restaurant expenditures. Some trends we have identified in Leisure eNewsletter articles:

- The amount of leisure time available on weekends and holidays for college-educated adults is decreasing, while it is increasing for non-college-educated adults.

- Families with children 12 years and younger are seeing a decrease in their amount of leisure time on weekends and holidays.

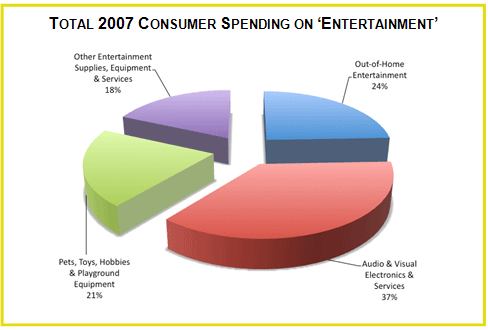

- The average household’s share of income spent on electronic equipment and services (electronics) is increasing, while the share spent on out-of-home entertainment is decreasing.

- Households at all income levels are increasing the share of their income spent on electronics.

- Households with the lowest 60% of household incomes have decreased their share of expenditures for out-of-home entertainment; the 4th quintile of income is unchanged; and the highest 20% of households by income have increased their share of expenditures on out-of-home entertainment.

- The top 40% of households by income now account for 77% of all out-of-home entertainment spending, but only 57% of electronics.

- There have been no significant changes through 2007 on the distribution of spending for away-from-home food among the different household income groups. The top 40% of households by income accounted for 63% of such spending in 2007.

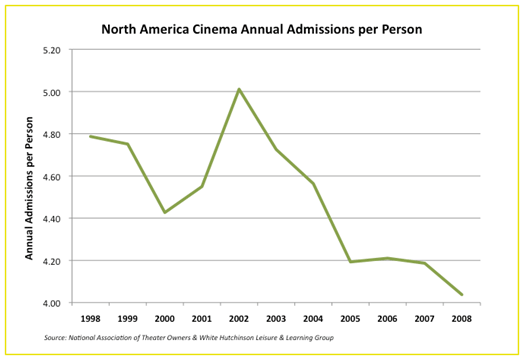

We decided to dig a little to see if we could find evidence of these trends in industry specific data. First, we took a look at 1998 to 2008 movie theatre attendance, also called movie theater “box office.” Rather than look at total annual attendance by year, which wouldn’t accurately reveal a trend since the population has increased each year, we looked at average attendance per person. As the graph below shows, movie theater attendance per person in the U.S. and Canada decreased 16% over the 11-year period.

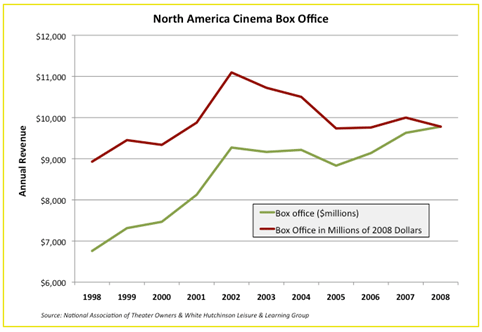

Not only has attendance per person declined over the 11-year period, but box office (ticket) sales have also declined starting in 2003 if you adjust for inflation. This is one of the problems with data. On the surface, it might look good (the total box office has been increasing over the 11 years), but when you adjust for things like population increases or inflation, it’s a whole different story.

Movies without a doubt are the most popular form of out-of-home entertainment. This data shows people are attending the movies less, as they have probably switched some of their viewing to DVDs on their home televisions or just switched some of their leisure time to the Internet, MP3 players and video games. In other words, electronic expenditures have been replacing some of their out-of-home movie experiences.

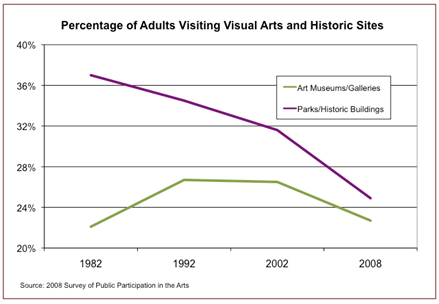

We found data on the percentage of adults who attended art museums and galleries and parks and historic buildings for 1982, 1992, 2002 and 2008. The percentage has been decreasing since 1992.

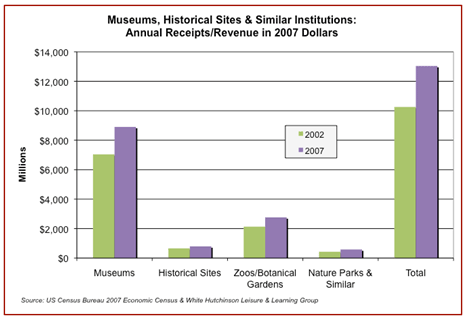

Unlike the decrease for movie theaters, inflation adjusted revenues increased from 2000 to 2007 for museums, historical sites, zoos/botanical gardens and nature parks.

Whether the increased revenue was due to fewer attendees visiting more frequently, an increase in admission and other prices, or a combination of both cannot be determined. We do know the number of museums, historical sites, zoos/botanical gardens and nature parks did increase 7%, by 457 facilities, between 2002 and 2007, perhaps generating attendance in areas of the country where the option was not previously available.

So the movie theater data confirms the trends, while the informal learning facility data is more anecdotal.

If the trends we have identified continue, it implies a gloomy future for location-based, out-of-home entertainment. But all is not as bad as it many seem. Even though consumers now have less leisure time on weekends (at least those with higher incomes and families with children 12 years and younger) and are shifting more of their entertainment spending to technology and at-home entertainment, they are still seeking out-of-home experiences.

In fact, using discretionary income for experiences brings more pleasure than material purchases, according to research published earlier this year by San Francisco State University. “Wonderful experiences remind us of the thrill of being alive, whereas purchasing something inevitably leads to comparisons,” says Ryan Howell, the author of the study. “You love your 27-inch plasma TV until you see your friend’s 60-inch one.”

The size of the slice for out-of-home entertainment time and spending might be getting smaller, but there appears to be a redistribution occurring within that slice. We’ve already seen it happening with “staycations.” Instead of taking long expensive vacations, consumers are seeking out local entertainment options. Throughout the country we are seeing increased attendance at zoos, museums and many types of local family destinations, such as family entertainment centers (FECs).

Research by Trajectory, a consumer trends forecasting company, found a trend to accumulate experiences in addition to material possessions was underway before the current recession, but has now gained an even more solid footing. Within that trend, they identified a shift away from extreme experiences that some consider expensive, frivolous, risky or environmentally destructive, such as driving a racecar or even excess recreational air travel. They predict extreme experiences will continue to decline in popularity. They said, “Part of the appeal of extreme experiences, our consumer research shows, is that people feel that the experience differentiates them. But conspicuous consumption is now out of favor, and as the simplicity and discretionary thrift trends suggest, is unlike to rebound soon.” Basically what Trajectory is saying is people now and in the future will be spending less of their money and time on extreme and more expensive experiences, leaving more of their discretionary income and leisure time for local out-of-home entertainment options.

People are social by nature. They want to spend time together and get away from the day-to-day stresses of life. Families want to spend quality time together with shared experiences. The basics are still the same. The only difference is the recession has raised the bar, as consumers are now demanding better value before they are willing to part with their money and time. Out-of-home entertainment venues that offer good value will continue to give consumers reasons to get out of their homes and away from their electronics to enjoy the real thing: non-virtual entertainment. Yes, the overall slice of the pie may be smaller, but the individual bite a community-based entertainment venue can capture by offering a good value, quality experience can in fact be bigger.

Additional reading:

- The shifting nature of leisure time and expenditures

- The future of location-based leisure: suddenly a new scenario

- Demise of the stuffed; birth of the grounded consumer

- The future of leisure time; a new value equation