Demise of the stuffed; birth of the grounded consumer

Oh, for the good old days! If your short-term memory isn't so good, here's a capsule summary of what life was like just a little over a year ago. Home prices were rising. Need some money? Just take out a home equity loan. Heck, it could be for even more than the amount of equity in your home. Want to buy a home or trade up to a larger, more expensive home? No problem! Lenders couldn't care less about your income or a down payment. Interest rates were ridiculously low on many mortgages, at least during their first few years. Some people referred to their homes as ATM machines. And if you didn't want to hock your home, credit card borrowing was easy. Spending beyond your means? No sweat! Consumers and lenders didn't worry. With rising home and stock prices, there would be plenty of equity down the line. Heck, the loans effectively paid for themselves. There was no need to save for the future.

Disliked your job? No problem, unemployment was low. Businesses were always looking for workers. Even if you did like your job, why keep it when you could trade up for a better one?

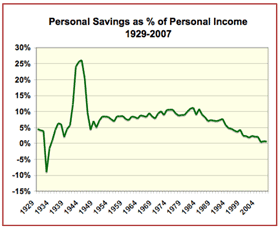

From 2001 to 2007, household debt in the U.S. rose from 97% of disposable income to 133%. During the pre-crash days, the typical family saved less than one-half of 1% of after-tax income. The need to save was a non-issue as consumers leveraged their ballooning home equity and tapped seemingly unlimited credit card limits to trade up to a more extravagant lifestyle. Spending more than you earned didn't seem all that crazy.

Those days are now nothing but memories. Here we are in the middle of a major recession, what the Sage of Omaha, Warren Buffet, has called an "economic Pearl Harbor." Home values continue to plummet. The stock market has tanked. Retirement savings have shriveled. Businesses are going bankrupt and closing. Layoffs are everywhere. Unemployment is rising. Many consumers are hurting economically, and the rest are stressed, anxious and uncertain about their economic futures. Consumers have pulled in their reins and are saving more. Thrift is in, as former power-shoppers become frugal bargain hunters.

There isn't a business today that isn't in survival mode, treading water until the economy gets back to normal. And the problem is, the "normal economy" is history. Unlike in past recessions, it won't be back. This time, post-recession consumers and the economy will be far different than before the downturn. The era of conspicuous consumption is dead. For businesses to have any sort of long-term future, they need to start adapting now to the new consumer landscape that is emerging.

"The future ain't what it used to be."

Yogi Berra

Our company spends considerable time and money constantly researching trends within the location-based leisure (LBL) industry, as well as nascent and mega societal trends that impact the industry. In other words, we pay attention to what is happening with the trees, while keeping an eye on what's going to affect the whole forest. This enables us to design and produce LBL venues for our clients that will be successful not only today, but in the future. With some projects taking two to three years to complete, it's important to our clients that we design their projects to be successful by the time they're ready to open. Conditions then will be different than conditions today – count on it.

Here's some of what our research has revealed about conditions we can expect after the recession.

Meet the grounded consumer

The culture of consumerism will be far different. The new consumers rising from the ashes of the economic meltdown will have been shaped by a number of nascent trends that started several years ago, as well as the shock of the sudden and severe recession. Dubbed "grounded consumers," they will have a new and different value equation. This new grounded consumer and the economy they will shape have important implications to the future of LBL businesses.

Our research indicates grounded consumers will:

- No longer live beyond their means.

In the past, consumers measured their worth based on the cash they brought in plus the value of their credit. They bought what their credit could support, rather than what they could afford. The unleveraged, grounded consumer will make the distinction between what they want, what they need and what they can afford. The culture of debt will become history. - View "less" as the new "more."

Grounded consumers won't define themselves by what they buy and own. They'll firmly believe consuming is not the reason for living. Further, they will remove unnecessary stuff from their lives and replace it with an emotional and social sense of themselves. The Homo Economicus species that defined itself by "shop' til you drop" consumerism will be extinct. - Place a higher value on family and community, shifting from an egocentric Me Economy to a socially conscious We Economy.

The social and emotional bonds in peoples' lives will have far greater importance than in the past. The needs of family, community, society and the Earth will weigh heavily in peoples' lives -- and in their purchasing decisions. - Maintain fun in their lives through fun experiences and luxuries that don't exceed their means.

They will want to enjoy life and make time for fun, shared experiences. They will be looking for simple pleasures that don't break the bank -- or take them to the mall. The grounded consumer will still try to obtain personal gratification through trading up to small and larger luxuries.

Becoming grounded consumers is a step-by-step cultural transformation. Different people are currently at different stages in the transition. Some are just starting to re-evaluate their economic condition and purchasing decisions, while others have realized they are not what they buy. Many now understand the inherent dangers of living on credit. Some now measure the value of their purchases differently as they weigh those purchases' larger societal impact. Others are removing excess stuff from their lives and replacing it with family and social currency.

And some have already evolved into grounded consumers. Consumer households with incomes of $50,000 and under are furthest along the path of the transformation, but higher-income consumers are fast catching up.

Implications for LBLs

So what are the implications of grounded consumers for LBLs? The first thing to recognize is grounded consumers will spend less. They will borrow less and save more, which will leave them with less money to spend.

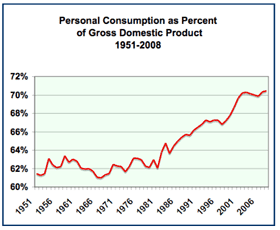

This paradigm shift has already emerged. The consumer savings rate increased from below zero the past few years to 3.6% in December 2008, and Goldman Sachs predicts it could grow to as much as 6% to 10%. In November 2008, consumer credit fell by $11 billion, its largest fall since reports began in 1943. The fall continued for its fifth month in December 2008 with a drop of $6.6 billion. Consumer spending as a percentage of the gross domestic product (GDP) has been increasing from 61% in the early 1950s to a peak of 72% about a year ago. Marie Driscoll, director of consumer discretionary retail for Standard & Poor's Equity Research, predicts consumer spending will fall until it reverts to about two-thirds of the economy, which is where it was about 10 years ago.

Mark Zandi, chief economist of MoodysEconomy.com, says, "We are entering the beginning of a 15- to 20-year period of lower consumer spending in general." Lee Scott, Wal-Mart's president and CEO, sees the consumer going through a fundamental change with new patterns of frugality that will live on after the recovery. Wharton marketing professor Stephen Hoch sees consumers as embracing a new logic. He says, "There will be a premium placed on seeking value."

So the bad news for retailers is grounded consumers will be spending less on stuff. Therefore, retail material goods sales likely will suffer the most, not rebounding from recessionary spending levels. However, there is good news for LBLs, as grounded consumers will shift more of their spending to experiences that align with their new value equation of family, community and society as a whole.

Here are some characteristics you can expect of grounded consumers:

- They will plan purchases in advance, taking time to make conscious, strategic decisions about the value of their purchases and the impact of those purchases on society and the environment.

- Businesses' charitable outreach will be important to them. They will want to deal with transparent companies that make it easy to learn about their products and services. They'll want to know how these companies address the needs and wants of family, community and society, as opposed to the needs of just the individual consumer.

- A business' environmental efforts also will be important to the grounded consumer. Companies need to have an ethical environmental position and walk the talk. "Green washing" will only turn off the grounded consumer.

- They will value expenditures that deliver long-term outcomes, things that make them smarter, better off and healthier.

- They will desire offerings with greater meaning. They will be part of a collective-driven notion of community and working for the greater good.

LBLs have an opportunity to align themselves with the grounded consumer's new value equation to continue to capture their disposable dollars, and just as importantly, their disposable time.

Here are a few pointers from our research on how LBLs of all types can capture business from the grounded consumer, starting now, as consumers are either in the transition phase of becoming grounded or have already arrived.

Societal and environmental issues

Grounded consumers will care about the world around them and place greater value on expenditures of both their time and money that will contribute to the greater good. Businesses that contribute to the greater good, and let consumers know about it, will have a competitive advantage with consumers. Walmart's Lee Scott says businesses need to get involved in broader societal issues such as health care, immigration, energy independence and environmental sustainability. Doing so, he says, will resonate with consumers and improve the bottom line.

These social issues continue to gain importance with consumers. Research in late 2008 by both the Boston Consulting Group and the Hartman Group found the majority of consumers factor in environmental and social aspects when making purchase decisions. Even the current tough economic times are not changing that behavior. This is confirmed by February 2009 research by EnviroMedia Social Marketing finding 82% of consumers are still buying green products, and half are buying just as many green products now as they did before the economic downturn. Another of firm's surveys earlier this year found 75% of consumers consider environmental and social aspects in making their purchase decisions. Alison Worthington of the Hartman Group put it this way: "During these tough economic times, sustainable products create that 'sweet spot' that make consumers more optimistic about the choices they are making."

An LBL's involvement in these societal and environmental issues could easily make the difference in whether grounded consumers choose not to cook at home or leave their high-definition TV and Wii and venture out to your LBL. This is an area where most LBLs have been behind the curve. With the exception of a few women-owned play cafés, we have not seen a green and greater good movement with LBLs.

The local economy

The grounded consumer will want to support neighboring businesses. This can be a definite advantage for community-based LBLs. But being local is not enough by itself. LBLs also have to support the local economy by buying locally and letting consumers know about it. This includes having a food service operation that participates in sustainable agriculture by buying from local farmers.

Education

Educational and edutainment experiences resonate with the grounded consumer. However, there has to be a real learning component to create that value. Parents will be placing even greater importance on having their children participate in enriching experiences. Children's edutainment centers and enrichment centers should continue to grow in popularity. The greatest marketing impact is made by positioning the learning experiences as permanent investments in people's lives rather than as just passing experiences.

Family and friends

The social aspects of life will have an increased importance to grounded consumers. They will be interested in strengthening their bonds and enjoying good times with family and friends. LBLs should focus on and market offerings that promote social relationships, rather than just focus on the food, fun and entertainment components. It's all about people socializing. Building social experiences around food and beverage is important, as dining out will continue to be an integral part the consumer's social and family life. The grounded consumer will grow to prefer eatertainment venues with destination dining versus entertainment-only venues. The former offer more of a tribal campfire experience than the latter.

Health

Health will be an important segment of grounded consumer spending. They will want to eliminate anything from their lives (and their family's) that is toxic. This includes food they consume, environments they occupy and visit and products they buy and use. Sustainable, natural and organic are important aspects of health. So are green facilities. LBLs that offer opportunities to maintain and improve health will be attractive to the grounded consumer.

Transparency

Grounded consumers will plan purchases in advance by first researching, mostly online. They will want to know everything about an LBL in order to make an informed decision about whether it offers a meaningful value for their expenditure of time and money. This includes its hiring practices (does it pay a living wage?), sustainability practices, charitable outreach, green factor, healthiness of food offerings, etc. LBLs should make all this information available on their websites in a straightforward, easy-to-find manner.

Community

Activities, services and experiences that promote community and bring like-minded people together will have appeal.

All these considerations will enter into the grounded consumer's value calculation for an LBL visit. Price is just one component, and not necessarily the deciding one. Cheapness does not equate value. Grounded consumers will first ask what the product or experience will do for their families, their lives and themselves in the long run. Then they will ask what its greater impact is on society and the environment. LBL experiences that can offer positive outcomes for some or all of these considerations will deliver real value to grounded consumers and gain their business.

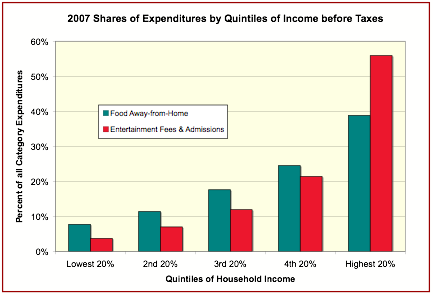

Not all grounded consumers are equal. Those in the lower income levels will see a far greater reduction in their discretionary income than will higher income households. In 2007, households with the top 40% of incomes were responsible for 63% of all food-away-from home and 77% of all out-of-home entertainment spending. In the future, their percentage share of spending in these categories will likely increase. And for families with children, which in 2007 accounted for 46% of all out-of-home entertainment spending, there is a tendency not to decrease spending on treats and good times for their children. Research by Synovate, a market research company, found that only 1% of Americans have cut spending on treats for their children during the economic downturn.

Time factor

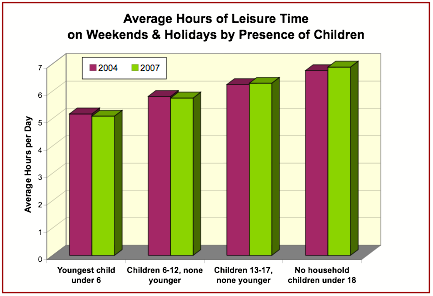

Discretionary time also will be an important part of the value equation for grounded consumers. With experiences becoming more important and stuff less important, available discretionary time will take on even greater value than in the past. Both households with higher levels of education and those with children have less leisure time than less educated and childless households. And the younger their children, the less leisure time they have (see Time for leisure, the latest data). This means the most time-starved households, which also tend to have higher incomes and discretionary spending, will not hesitate trading money to gain time, especially if it gains them social bonding experiences with their families. Again, this bodes well for the one-stop shopping that eatertainment offers.

LBLs that resonate with the grounded consumer's values and shifted priorities will prosper in the future, despite the grounded consumer's decreased overall spending. Success will be all about transforming the LBL business paradigm of design, offerings, management and marketing into an experience that aligns with the values and priorities of the new grounded consumer.

A version of this article is being published in the March 2009 issue of RePlay Magazine.