Vol. VII, No. 2, February/April 2007

- Editor's corner

- Restaurant and entertainment expenditures

- New "networked" consumer more fluid and connected

- Knuckleheads eatertainment center opens in Wisconsin Dells

- Never old

- Foundations Entertainment University - April 24-26

- Wannado reduces prices

- Cultural differences

- American food goes upscale

- Visible glove use gives good impression

- Hero's The Party Experience

- Restaurant failures: The truth and the reasons

- Starbucks' 5 core principles for success

- McLattes on the way

- The silliness of most surveys

- New projects

Restaurant failures: The truth and the reasons

You've heard the statistics - 9 out of 10 new restaurants close within the first year. But new research debunks the myth and spells out the reality. Find out what the true figures are, and more importantly, the key factors that make or break a restaurant's success.

There are a lot of misconceptions about restaurant failures. In 2003, NBC television network broadcast a program entitled Restaurant: A Reality Show. During the show, an advertisement by American Express claimed that "90% of restaurants fail during the first year of operation." Is that reality or a myth?

A new research study published in the Cornell Hotel and Restaurant Administration Quarterly examined both restaurant failure rates and the reasons for failure. Rather than just look at bankruptcy statistics as did many past studies, the researchers examined 2,439 restaurant operating permits from the Columbus, Ohio, health department over a three-year period. This allowed the research to examine closures and ownership changes (considered as a failure in the study, although some of the restaurants may have been successful but sold by their owners for personal reasons), as permits had to be renewed each year and any change in ownership required a new permit.

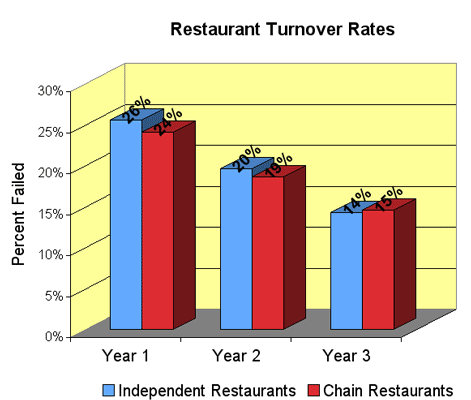

The graph and chart below show the research findings for restaurant turnover rates:

Cumulative Restaurant Turnover Rates

| Year 1 | Year 2 | Year | |

|---|---|---|---|

| All Restaurants | 26.2% | 45.4% | 59.7% |

| Independent Restaurants | 25.5% | 45.1% | 59.4% |

| Chain Restaurants | 24.1% | 42.7% | 57.2% |

During their first year of operation, slightly over 25% of all restaurants closed or changed ownership. By the end of their third year, just short of 60% of all restaurants closed or changed ownership. The turnover rate varied little between independent and chain restaurants

The study also examined restaurant turnover rates based upon the density

of restaurants compared to population in different areas of the city.

Restaurant turnover was highest in areas with higher concentrations of

restaurants. In other words, the greater the number of restaurants for

a given population, the greater the failure rate.

The study also examined restaurant turnover rates based upon the density

of restaurants compared to population in different areas of the city.

Restaurant turnover was highest in areas with higher concentrations of

restaurants. In other words, the greater the number of restaurants for

a given population, the greater the failure rate.

An analysis of various restaurant segments showed differences in turnover rates.

Cumulative 3-Year Restaurant Turnover

| Mexican | 86.8% |

|---|---|

| Subs & bakeries | 76.7% |

| Coffee & snacks | 70.0% |

| Pizza | 61.2% |

| Chicken | 57.9% |

| Casual dining | 53.1% |

| Asian | 51.4% |

| Family dining | 45.0% |

| Steak | 42.9% |

| Buffers & cafeterias | 38.5% |

| Italian | 35.3% |

| Burgers | 33.7% |

| Seafood | 33.3% |

The research not only examined quantitative data, but also conducted a qualitative study to determine reasons for both success and failure. Twenty independent full-service restaurant operators who had been in business for at least five years and 20 failed full-service restaurant operators were interviewed.

The key finding of the qualitative study was that a successful restaurant

requires focus on a clear concept that drives all activities. Concept

is different than strategy. Whether or not operators had elaborate strategic

plans was not a determining factor for success, but clarity of concept

was. Successful restaurant owners all had a well-defined concept that

not only provided a food product also included an operating philosophy,

which encompassed business operations as well as employee and customer

relations. Failed restaurant owners, when asked about their concept,

discussed only the food product. The researchers concluded it was obvious

from the interviews that food quality does not guarantee success; the

concept must be well defined beyond the type of food served.

The key finding of the qualitative study was that a successful restaurant

requires focus on a clear concept that drives all activities. Concept

is different than strategy. Whether or not operators had elaborate strategic

plans was not a determining factor for success, but clarity of concept

was. Successful restaurant owners all had a well-defined concept that

not only provided a food product also included an operating philosophy,

which encompassed business operations as well as employee and customer

relations. Failed restaurant owners, when asked about their concept,

discussed only the food product. The researchers concluded it was obvious

from the interviews that food quality does not guarantee success; the

concept must be well defined beyond the type of food served.

The researchers summarized their findings on the many forces that impact restaurant success or failure. Although these findings are from interviews of restaurateurs, the findings are just as applicable to any location-based leisure concept, especially those incorporating food and entertainment.

Elements of Success

- Have a distinctive concept that has been well researched.

- Ensure that all decisions make long-term economic sense.

- Adapt desirable technologies, especially for record keeping and tracking customers.

- Educate managers through continuing education at trade shows and workshops. An environment that fosters professional growth has greater productivity.

- Effectively and regularly communicate values and objectives to employees.

- Maintain a clear vision, mission and operation strategy, but be willing to amend strategies as the situation changes.

- Create a cost-conscious culture, which includes stringent record keeping.

- Focus on one concentrated theme and develop it well.

- Be willing to make a substantial time commitment both to the restaurant and to family.

- Create and build a positive organizational culture through consistent management.

- Maintain managerial flexibility.

- Choose the location carefully.

Elements of Failure

- Lack of documented strategy; only informal or oral communication of mission and vision; lack of organizational culture fostering success characteristics.

- Inability or unwillingness to establish and formalize operational standards; seat-of-the-pants-style management.

- Frequent critical incidents; managing operations by "putting out fires" appears to be a common practice.

- Focusing on one aspect of the business at the expense of others.

- Poor choice of location.

- Lack of match between restaurant concept and location.

- Lack of sufficient start-up capital or operational capital.

- Lack of business experience or knowledge of restaurant operations.

- Poor communication with customers.

- Negative consumer perception of value; price and product must match.

- Inability to maintain operational standards, leading to too many service gaps.

- Poor sanitary standards -- almost guaranteed to kill a restaurant.

Vol. VII, No. 2, February/April 2007

- Editor's corner

- Restaurant and entertainment expenditures

- New "networked" consumer more fluid and connected

- Knuckleheads eatertainment center opens in Wisconsin Dells

- Never old

- Foundations Entertainment University - April 24-26

- Wannado reduces prices

- Cultural differences

- American food goes upscale

- Visible glove use gives good impression

- Hero's The Party Experience

- Restaurant failures: The truth and the reasons

- Starbucks' 5 core principles for success

- McLattes on the way

- The silliness of most surveys

- New projects