Vol. XXV, No. 12, November 2025

- Editor's corner

- Netflix comes for the competitive socializing market

- The growing trend of smaller restaurant entrees

- Meet Randy at IAAPA

- Are LBE chains taking over the industry?

- Leisure time is a zero-sum game; how much of it will your LBE get?

- Young adults are switching from nightlife to coffee raves & soft clubbing

- Nostalgia is driving menu innovation and appeal

- Are we seeing a permanent post-pandemic redistribution of OOH demand?

Leisure time is a zero-sum game; how much of it will your LBE get?

Zero-sum game: a situation in which a gain for one side entails a corresponding loss for the other side.

That's precisely the situation that occurs with our leisure time. It is a fixed amount, so if one activity takes up more of our time, another gets less.

For young adults ages 20-44, the primary target market for most location-based entertainment venues (LBEs), total available leisure time has hardly changed since 2015. In 2024, the duration was 4 hours and 5 minutes a day, just 8 minutes less per day than 10 years ago.

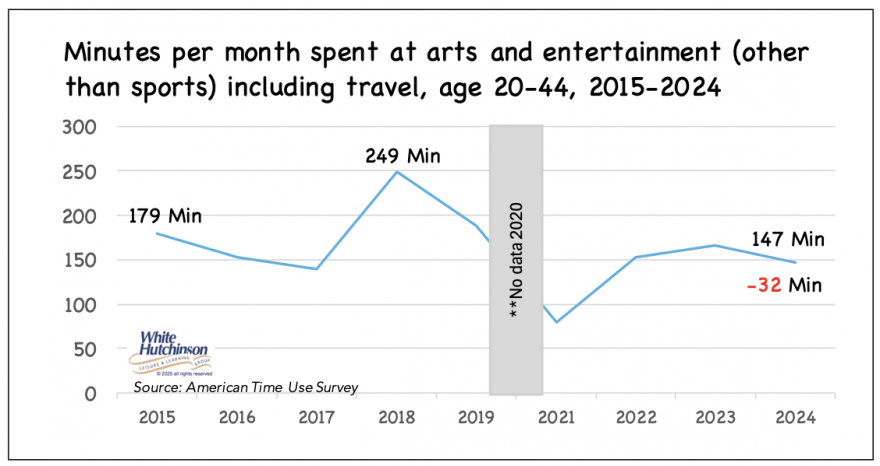

In 2024, the amount of time adults aged 20-44 spent traveling to and from and attending entertainment and art venues (E&A), which includes zoos, museums, live performances, theme parks, and LBEs that include family entertainment centers (FECs), only captured 2% of that leisure time, or 5 minutes a day, 35 minutes a week, or 2.45 hours a month.

That is:

- Half an hour less (-32 min) than the nearly 3 hours a month (179 min) they spent 10 years ago.

- Over 1.5 hours less (-105 min) than a peak in 2019, right before the pandemic.

To put it another way, adults 20-44 spent nearly one-fifth less time (-18%) attending E&A venues in 2024 than 10 years ago and 42% less time than in 2019.

Since most visits to entertainment and art venues, including travel times, average around 2.5 hours (theme parks, of course, are longer), this means adults aged 20-44 typically visited only one entertainment or art venue per month.

This downward trend is consistent across all data sources and surveys our company has analyzed on spending, participation, and time spent at E&A venues. In terms of the size of the slice of leisure time spent at E&A venues, it's on the decrease.

The only good news is that the 21-44 age group grew by 5% during those ten years. However, that still fails to offset the significant decline in average attendance time.

Not only has the time spent attending E&A venues declined, but the number of other types of businesses competing for that limited time has been steadily increasing. This includes businesses that traditionally didn't offer entertainment, such as retail stores and even museums, which now directly compete with LBEs. Many retailers are blending shopping with entertainment. Pop - up events, live product demonstrations, and collaborations with local artists are designed to turn shopping from a transactional experience into an entertaining one.

One example is Dick's new House of Sport in Leawood, Kansas. It includes a cage simulator that tracks soccer, baseball, field hockey, and lacrosse balls; golf simulators; a putting green for test shots; and a three-story, 10-belay rock climbing wall.

3-story climbing wall at House of Sports in Leawood, KS

For Gen Z, retail shopping is also competing with attendance at E&A venues on another front.

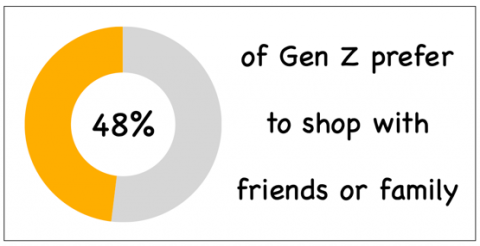

Research reported in MIT Management found that Gen Z "stands out for its growing interest in in-store shopping. . . In-store shopping isn't just about picking up a needed item - it's a social experience and an opportunity to gather with friends physically." A Euclid survey found that 48% of Gen Z shoppers prefer to shop with friends or family. In-store shopping becomes an opportunity to hang out, seek opinions, and enjoy communal activities. Over 40% of Gen Z consider it a fun, social activity, and they frequently visit malls or stores specifically for group experiences. Gen Z's in-store retail experiences are now competition for E&A venues, as socializing is most often the primary motivation for attendance at LBEs.

It's a zero-sum game for LBEs. Today's challenge is to offer a location-based leisure venue that will outshine all other options for where people can spend their out-of-home entertainment time. As new venues, particularly newer concepts and retail, expand to offer more entertainment, it will take business away from existing LBEs, especially older, more traditional models. Only the highest fidelity LBEs meeting the contemporary preferences of young adults for both entertainment, socialization, and food and beverage will survive.

Subscribe to monthly Leisure eNewsletter

Vol. XXV, No. 12, November 2025

- Editor's corner

- Netflix comes for the competitive socializing market

- The growing trend of smaller restaurant entrees

- Meet Randy at IAAPA

- Are LBE chains taking over the industry?

- Leisure time is a zero-sum game; how much of it will your LBE get?

- Young adults are switching from nightlife to coffee raves & soft clubbing

- Nostalgia is driving menu innovation and appeal

- Are we seeing a permanent post-pandemic redistribution of OOH demand?