Vol. XXV, No. 3, March 2025

2025 Voice of the Visitor Report

PGAV has released its 2025 Voice of the Visitor Report on the state of and trends in the attraction industry, which includes family entertainment centers (FECs).

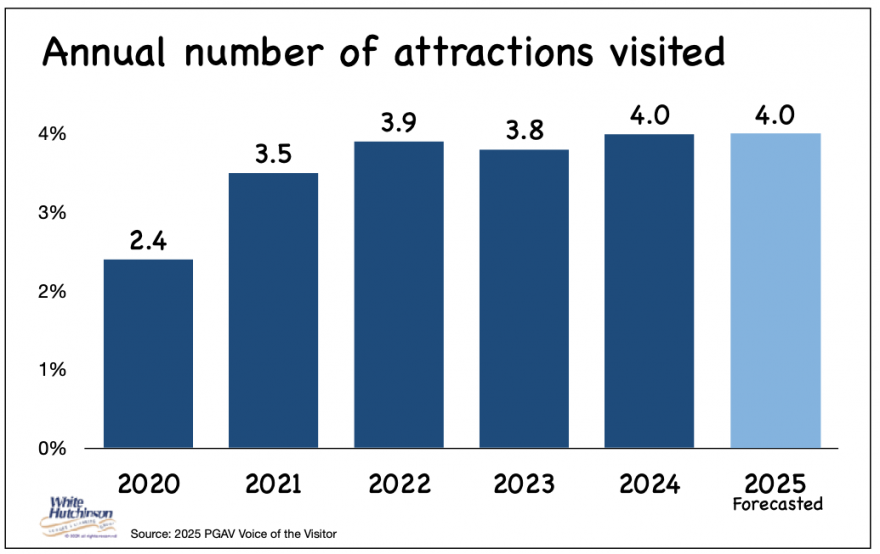

The good news is that PGAV has found that the average number of attractions visited annually has increased since the pandemic and is projected to hold steady in 2025.

One key finding was a rising trend of "visitors are increasingly drawn to new experiences, prioritizing exploration and discovery over revisiting familiar destinations… ' Been there, done' that shows a growing aversion to repetition." The report found that attraction visitors are less likely to return to the last attraction they visited than a decade ago, a four-point increase from 67% less likely to 72% currently. Non-returning visitors "are motivated by the excitement of trying something new and the value they place on unique and fresh experiences." PGAV found that younger generations (18-54) are more likely to build a diverse portfolio of unique and new experiences over visiting old ones.

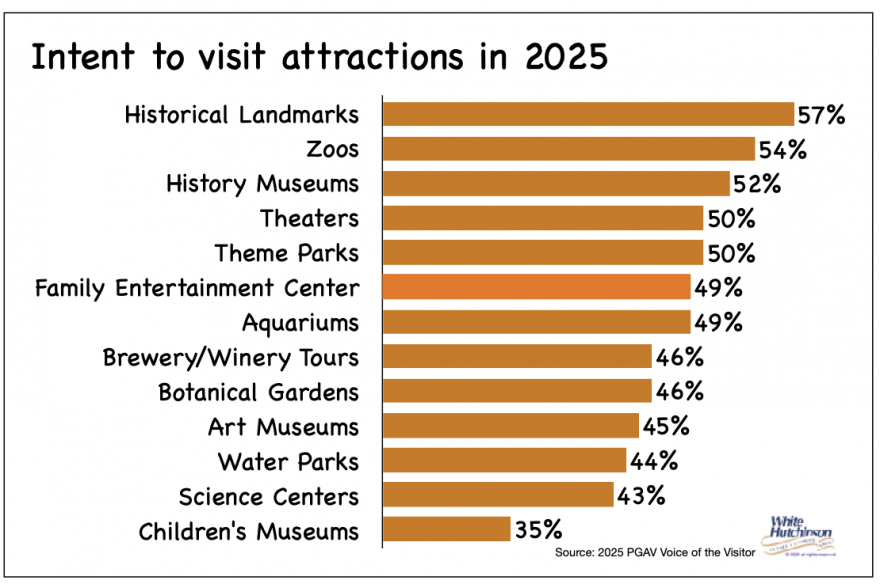

The report found that family entertainment centers have a lower intent to visit in 2025 than many other attractions, only 49%.

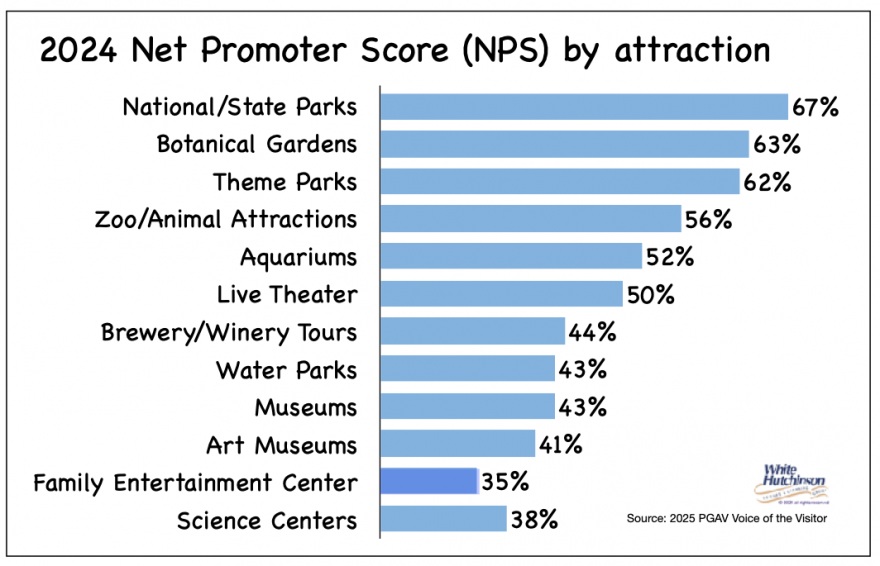

The report also found that family entertainment centers had the second-lowest Net Promoter Score of any attractions.

The Net Promoter Score (NPS) is a metric used to measure customer loyalty and satisfaction. It is based on asking a single survey question: "On a scale from 0 to 10, how likely are you to recommend this attraction to a friend or family member?" Answers are categorized into three groups:

- Promoters (scores of 9-10): Loyal and enthusiastic customers who are likely to continue attending and refer others.

- Passives (scores of 7-8): These customers are satisfied but not enthusiastic enough to promote the product or service.

- Detractors (scores of 0-6): Unhappy customers may discourage others from buying and can damage the brand through negative word-of-mouth.

The NPS is calculated by subtracting the percentage of detractors from the percentage of promoters. The score can range from -100 (if every customer is a detractor) to +100 (if every customer is a promoter).

Whereas the NPS for the entire attraction industry increased slightly from the previous year, the 35 NPS for family entertainment centers dropped significantly from 45 in last year's report, clearly indicating that FECs are losing their appeal and any positive word-of-mouth recommendations.

Many factors contribute to the decline in the repeat appeal of many attractions, including family entertainment centers.

Commoditization of experiences

One overall shortcoming of any attraction is that it quickly becomes commoditized. The 2nd time you have an experience, it is not as good as the first. The 3rd time you have an experience, it is not as good as the 2nd. The experience loses appeal after a few visits, and customers say, "Been there, done that." Instead of repeating it, they move on to something new.

Novelty seeking

It's human nature to seek new experiences rather than repeat ones. Our brains are hard-wired by evolution to crave novelty. The desire for novelty, to explore something new, is rooted in enabling us to learn something new about our environments and how to survive. Novelty triggers the production of dopamine, making us feel good, which, in turn, increases a person's motivation to seek more novelty.

Change to what is OOH entertainment

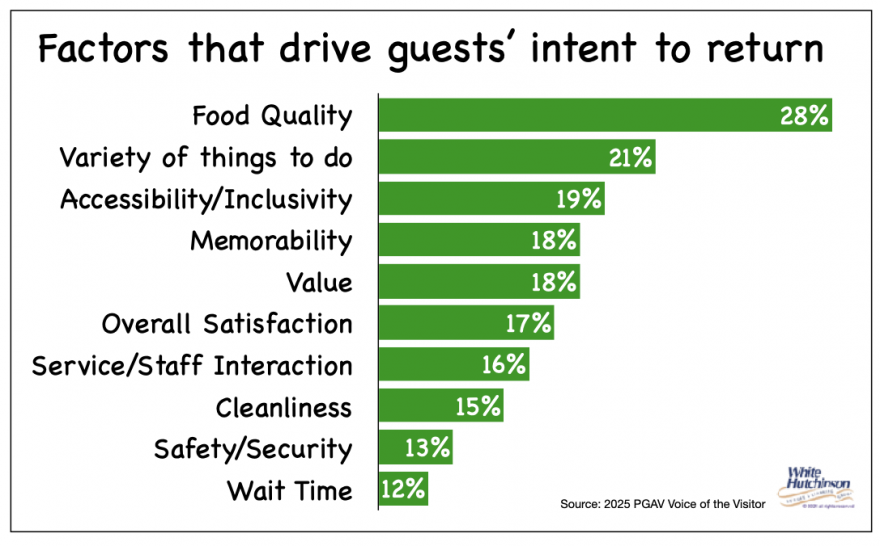

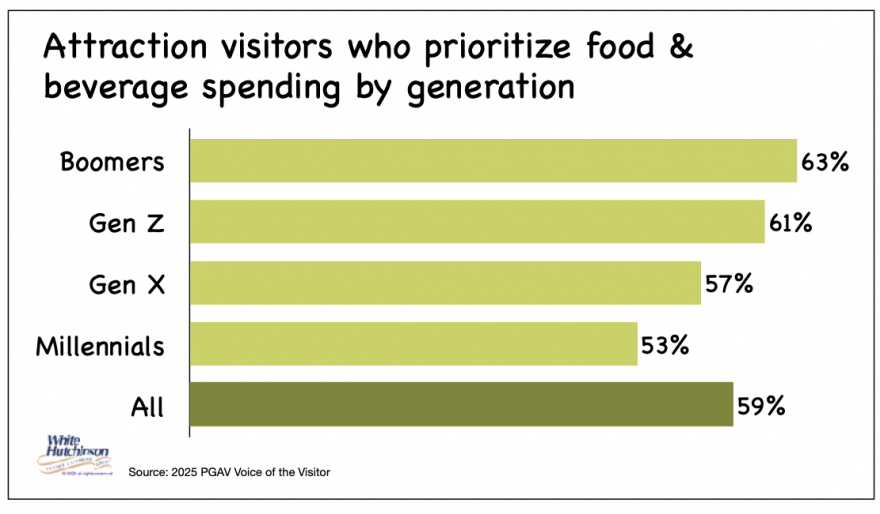

There is a cultural shift in what is considered and valued as out-of-home (OOH) entertainment. More than half of Americans consider themselves foodies (53%). Foodies love food and are very interested in trying different types of food. They are on a quest for adventure and discovery with food and drink and the latest culinary trends. PGAV found that satisfaction with food quality at an attraction was the number one factor influencing guests' intent to return.

Almost two-thirds (62%) of millennials, the prime age group for many forms of OOH entertainment, especially location-based entertainment (LBE), including family entertainment centers (FECs), now consider a good night out as more about the food, three times the percentage that rate live music as a good time out.

Along with restaurant dining, there has been a growth in the number of live and special events and festivals where the focus or a significant component is food, beer, and wine. 62% of Americans would attend an event just for the food. The craft brewery boom has resulted in many destination breweries. The number of destination cideries, wineries, and distilleries is also growing nationwide. These destinations are considered attractions, now competing with entertainment-type venues.

Conspicuous leisure and social media

Another influence is driving seeking new experiences rather than repeating ones, especially for teenagers and younger adults, including millennials. In the experience economy, priorities for participation in leisure and entertainment experiences have changed. The dimension of status and self-identity, the measure of social capital has shifted from owning envious material goods and stuff to participating in envious experiences. Today, what you do now matters way more than what you own. Nearly three-quarters of Americans (74%) prioritize experiences over products. Especially for younger adults, an impressive selfie capturing a memorable leisure experience is as enviable as a new car or fancy watch was to their parents. Social media have transformed conspicuous consumption. Conspicuous consumption of goods is out; conspicuous leisure consumption is in.

This experience economy means that the pursuit of experiences, including entertainment, has taken on a more prominent role in people's lives than in the past. People use experiences as "social signaling" to express who they are or want to be, and to build their identity and status, and social capital on social media. Two-thirds of Americans would rather be known for their experiences than their possessions. Experiences are the ultimate status symbol, especially for millennials. 48% of millennials and 61% of millennial parents say they attend live events to have something to share on social channels. Experiences, including out-of-home entertainment, are the new social currency.

Postings on social media can be viewed as important as the experiences themselves. For 20- and 30-somethings especially, if it isn't Instagrammable or sharable, it's probably not worth doing.

Productive use of time

In her book Pressed for Time,Judy Wajcman argues that we live in a time where we want to make the most productive use of our leisure time, so we have an insatiable desire to pursue and experience as many options as possible from the vast array of leisure opportunities the world now offers. As a result, we are seeking a variety of collectible leisure experiences that we only do once. We want to check off items on our experiential checklist, move on to the next one, and add them to our collection to build our experiential CVs. This also makes us feel that we have used our time productively.

This means that once you've participated in some OOH entertainment experience and shared it with your friends and followers on social media, there is no longer any status value to be gained by repeating and sharing it again.

Influence of envy and FOMO

To get people to spend their leisure time and then their money at any OOH entertainment venue requires getting their attention in an increasingly distractible world amidst an increasingly wide array of options available for spending that time. Seeing peoples' conspicuous leisure postings on social media generates that attention and motivates people to experience things they otherwise might never have known about.

Experience postings on social media result in FOMO (fear of missing out), creating the desire and motivation to participate in the same experiences people do to "keep up with the Joneses." This has increased conspicuous leisure, participation in, and posting as many unique, novel, and admirable experiences as possible to avoid missing out on anything. Conspicuous leisure consumption amplified by social media postings and resulting FOMO have become primary motivations for participating in as wide a variety of OOH experiences as possible rather than repeating a few.

A shift in the cultural meaning of entertainment

For many people, especially those in higher socio-economic households (those with a member with a bachelor's or higher degree who account for 80% of all attendance spending at entertainment and cultural venues) entertainment is no longer just about fun and amusement. The bar has been raised. Along with a shift to the transformational economy, entertainment experiences now need to be meaningful, relevant, and engaging.

Almost limitless OOH leisure options

Amplifying the desire for new and unique attractions is the growing explosion of OOH options that are now almost limitless.

At the beginning of the 21 st Century, OOH attractions were limited in number. In the last several decades, we have seen a massive expansion of new types of LBEs, including trampoline parks, iFly, adventure parks, escape rooms, zip line experiences, bar arcades, eSport lounges, axe throwing, social gaming venues with destination-worthy food and drink, eatertainment venues where you can bring your dog, VR, corn mazes/pumpkin patches, golf swing suites, indoor mini golf with cocktails, to name just a few.

Now, there is little reason to repeat the visit to any one LBE or event due to the growing expansion of the wide variety of OOH options, including the growth of the number of festivals, live events, foodie-worthy restaurants, breweries, distilleries, and wineries that satisfy conspicuous leisure consumption and for posting on social media.

There is a significant shift to variety-seeking rather than repeat visits to the same OOH experience. One- and limited-time events (O<Es) such as live events, festivals, and concerts - are now winning a greater share of guests' time and wallets.

Many brick-and-mortar, fixed-attraction entertainment venues have lost their repeat appeal (been there, done that) to all the O<Es and new type OOH venues that are posting-worthy on social media and can satisfy the appetite for conspicuous leisure.

Take away

There will always be a segment of the population who will repeatedly visit certain attractions. However, that segment will no longer generate the attendance needed to sustain most attractions. The decline in the repeat appeal with most consumers to many attractions, including legacy FEC models, is not due to increasing participation in or time playing video games, as many believe. Instead, the consumer's preferences, expectations, values, and behaviors have dramatically changed. As a result, there has been a transformative and seismic change in out-of-home entertainment culture that is shifting market share away from attraction models focused on fixed attractions with their focus on fun to experiences that are more meaningful and relevant to the modern higher-socioeconomic consumer including the expanding selection and variety of one- and limited-time, live, new, and unique OOH experiences and the many food and beverage options now considered as entertainment. Heavily influenced by the values of the experience economy, conspicuous leisure, and social media, repeat appeal has lost out to "been there, done that" and the desire to move on to the greatly expanded landscape of all the new and sharable OOH leisure options that are now capturing consumers' attention, time and money.

Subscribe to monthly Leisure eNewsletter