Vol. XXI, No. 3, March 2021

When will location-based entertainment fully recover?

The pandemic's impacts on life, the rate of infections and vaccinations, how long immunity will last, the emergence of new coronavirus variants, and consumers' comfort returning to different public activities are almost all daily moving targets. But some general trends have emerged for predicting when and to what extent location-based entertainment (LBE) might recover.

One thing is for sure. The old normal will not be the new normal. We won't be going back to the way things were in 2019. Different segments of LBEs will be affected differently. Based on our company's continuing research, here's our predictions on how recovery may unfold.

To the extent it happens, the recovery won't be like a light switch turning it on. It will emerge gradually in different phases over probably the next three years.

Phase 1 - Infection transition phase

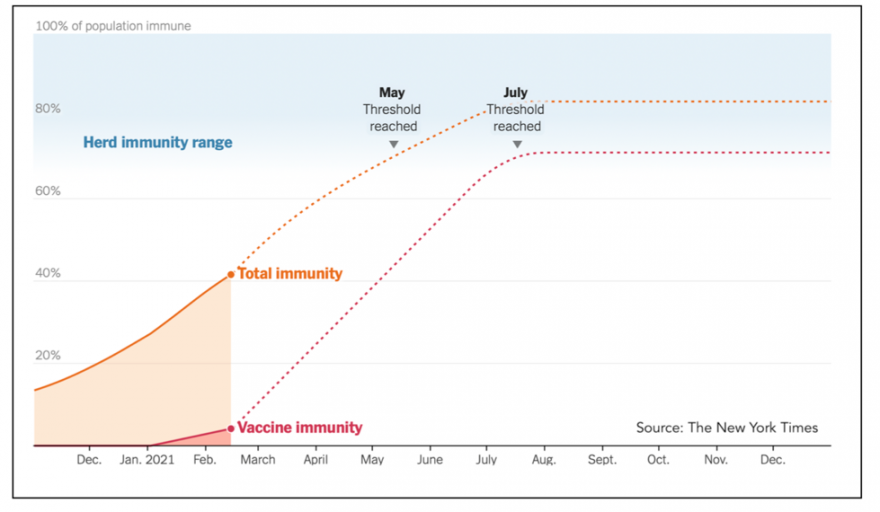

The first phase is likely to occur this year in the U.S. It's timing will be based on how fast the population is vaccinated and how low new infections become. It is an "infection transition phase," basically when we will reach or get close to herd immunity. There are predictions that herd immunity could occur as early as April 2021, according to an opinion piece published in The Wall Street Journal by Dr. Makary, a professor at the Johns Hopkins School of Medicine and Bloomberg School of Public Health. Another prediction is it will be anywhere from May to October 2021, as reported by The New York Times' using a model developed by PHICOR, a public health research group. You can use NYT's interactive tool to see how factors like the vaccination rate can affect how fast we get to herd immunity.

Other experts worry people and politicians may look at the dropping case numbers and, after a year of quarantine and economic turmoil, be eager to get life back to normal as soon as possible and become too complacent about resuming public activities and relaxing social distancing and capacity restrictions (as we already see in some states). We're already starting to see this happen in parts of the country. It's a pattern we saw last year when states started reopening businesses even while public health experts warned the virus wasn't contained. The dips didn't last, and cases rose again. That will protract reaching herd immunity and the end of the pandemic

The New York Times article warned that there's a chance a mutation (variant) could lead to a version of the coronavirus that immunity developed by infection from earlier versions of the virus or the vaccines doesn't protect us from, possibly starting a new pandemic. That would mean we'd have to start the journey to herd immunity all over again with a surge in infections and reinfections, and new versions of the vaccine. That could result in herd immunity being much further into the future. For this article, we will be optimistic and assume that will not be the case.

The most current thinking among many epidemiologists is that herd immunity could require as much as 90% of the population to be vaccinated, which may not be achievable due to:

- That would require that children also get vaccinated. There is no approved vaccine for children younger than age 16, and it is not anticipated there will be one approved for younger children until sometime in the Fall. Only 80% of the population is 16+

- due to vaccine refusal, 100% of the 16+ population would never all be vaccinated. The February Kaiser Family Foundation Covid-19 Vaccine Monitor found that 15% of adults say they will "definitely not" get the Covid vaccine. That would reduce the potential vaccinated percentage of the population to 68% under the most optimistic scenario

- the emergence of new variants of the virus that are more resistant to prior infection or vaccine immunity

- uncertainly whether immunity is less effective against transmission than against the disease

- poor access to vaccines in large parts of the world

As a result, we may never reach herd immunity, and the coronavirus will become an endemic disease. We'll have to learn to live with the illness in its endemic phase forever. The virus will still circulate similar to the flu and still cause deaths just like the flu. Life with the coronavirus will look a lot more normal. However, things like social distancing and wearing a mask in public may continue for quite some time.

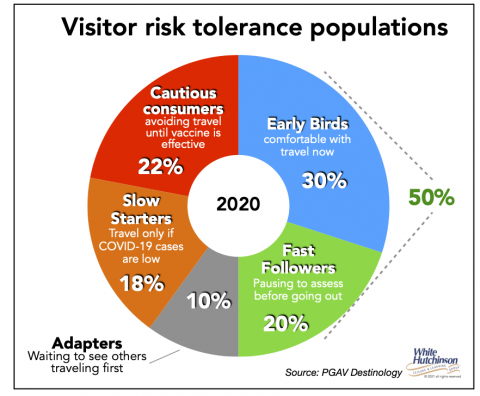

There is wide variation among population segments on how comfortable and when they will return to public events such as attending LBEs. PGAV developed an analysis of the risk tolerance for travel by different attraction visitor segments. Polls show that peoples' risk of traveling is similar to visiting different LBEs and sporting events, so their research is a good indicator for LBEs. They found that 30% of people, the Early Birds, are comfortable traveling now, and another 20%, Fast Followers, will soon follow. These two segments make up one-half of consumers and will be the first to return to LBEs. They tend to be millennials with families.

The next two segments, Adapters and Slow Starters, are more cautious. When they decide to go out, they will likely stay close to home and revisit attractions they have attended before.

The last segment, Cautious Consumers, is slightly over one-fifth of Americans (22%). They tend to be older, have higher disposable incomes, and were previously the heaviest travelers. Although PGAV didn't mention it, this group would also include people at high risk of serious illness or death from Covid-19 due to underlying medical conditions. According to the CDC, in addition to everyone over 65, nearly 40% of the younger age population has one or more chronic medical conditions. For the prime target market for many LBEs, the 25-44 age group, over one-third are at high risk (37%).

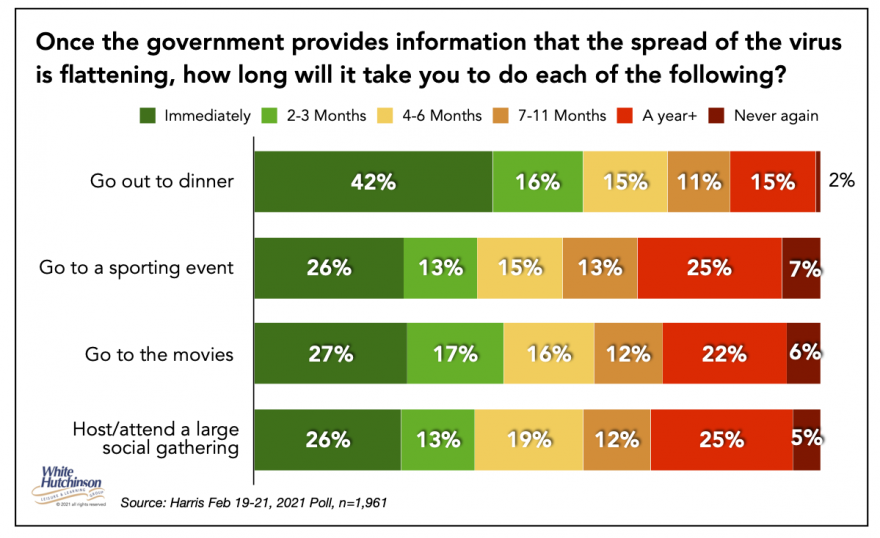

PGAV's research parallels findings from the February 12-14 Harris Poll on when people plan to return to different activities.

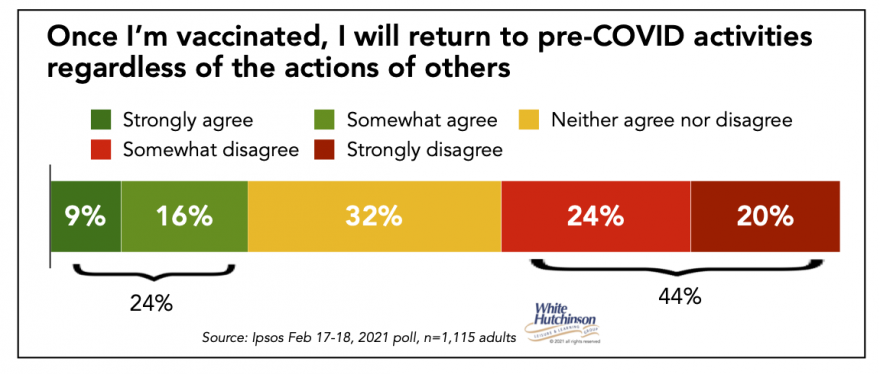

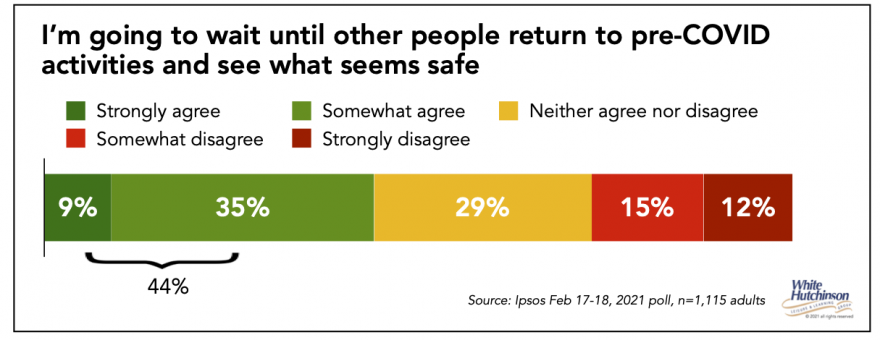

An Ipsos poll examined whether vaccination alone will get people to return to pre-Covid activities regardless of other people's actions, such as mask-wearing. Only one-quarter of people (24%) said it would

More than four-in-ten people (44%) are in a wait and see mode.

Even if herd immunity is reached, there will still be a segment of people in all age groups who will always be hesitant to return to LBEs.

Significantly, the poll found a single-digit percentage of people who report they will never again return to these activities, possibly due to the development during the pandemic of a permanent fear for their health and safety in public places.

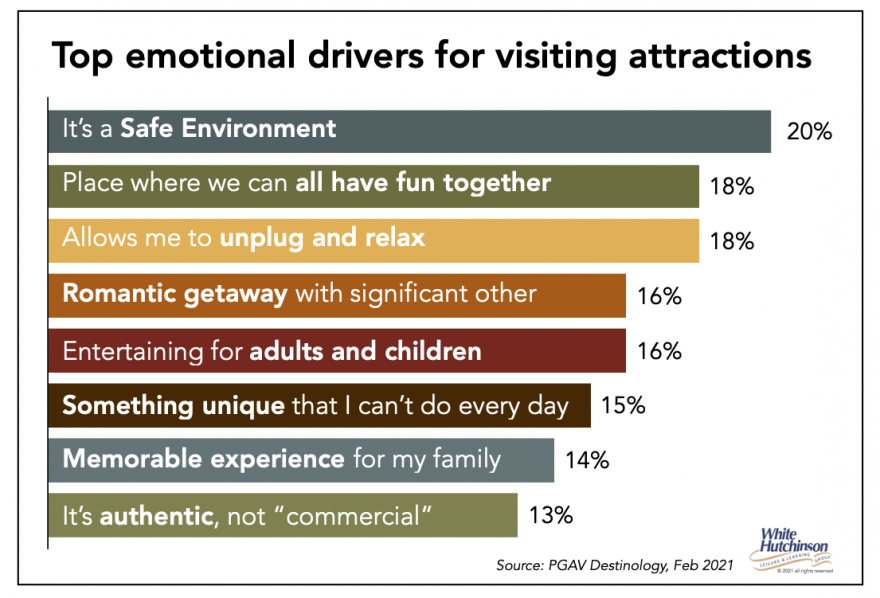

As people return to LBEs, there is likely to be a redistribution of demand based on several factors. PGAV found these to be the top emotional drivers for travel to and visiting attractions.

Based on the criteria of safety and a social experience at community-based LBEs, an outdoor miniature golf course could be highly attractive. It is both outdoors, a safer environment from catching the virus, and a social activity. Attending a venue like Top Golf might come in next, as it is semi-outdoors and social. Still, the social group is in closer proximity and often eating or drinking, increasing the risk of spreading the coronavirus. Although social and incorporating eating and drinking, bowling might be considered less desirable, as it is indoors. Different people will make different choices based on their risk tolerance and what they missed the most.

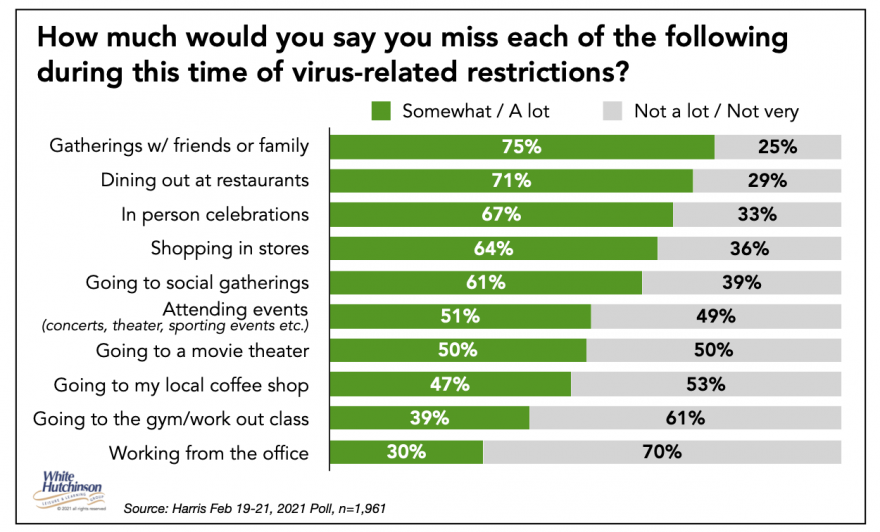

Here's the results from a February Harris poll on what people miss the most.

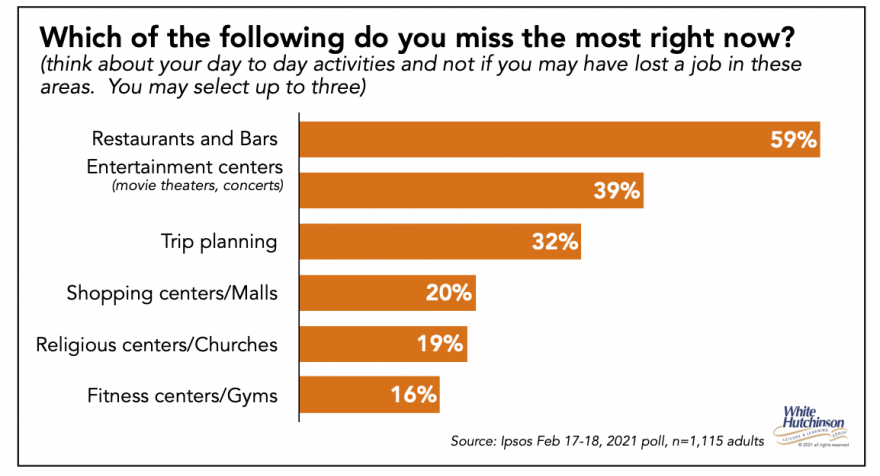

An Ipsos February poll found that entertainment centers were the second most missed activity next to restaurants and bars.

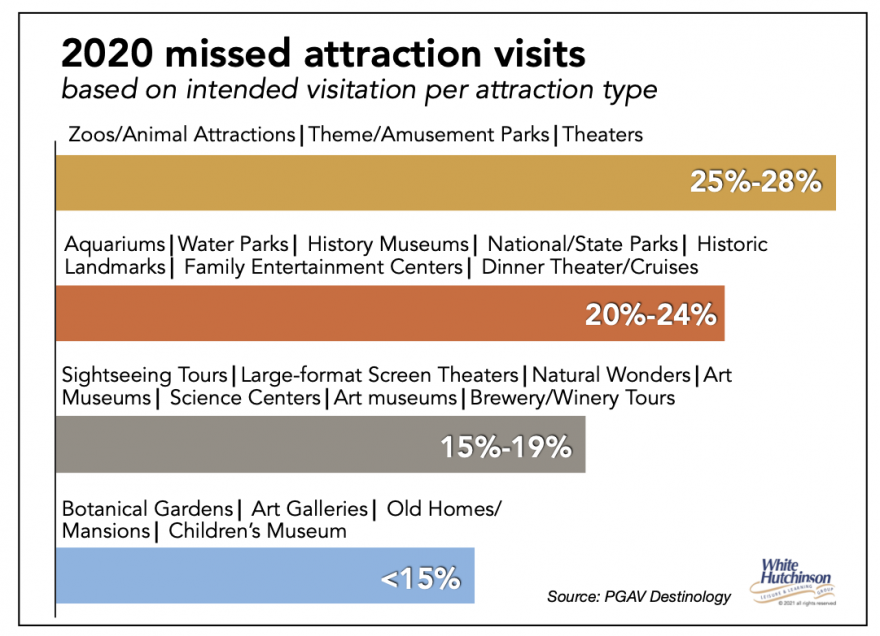

PGAV's poll this year found that family entertainment centers fall in the second most missed category of attractions.

Phase 2 - Economic recovery phase

The decline or elimination of the risk of catching the coronavirus is not the only factor that will impact how soon, how often, and which LBEs people will return to. A large segment of the population experienced an economic setback during the pandemic. This will constrain their discretionary spending for a number of years, including for out-of-home leisure such as LBEs.

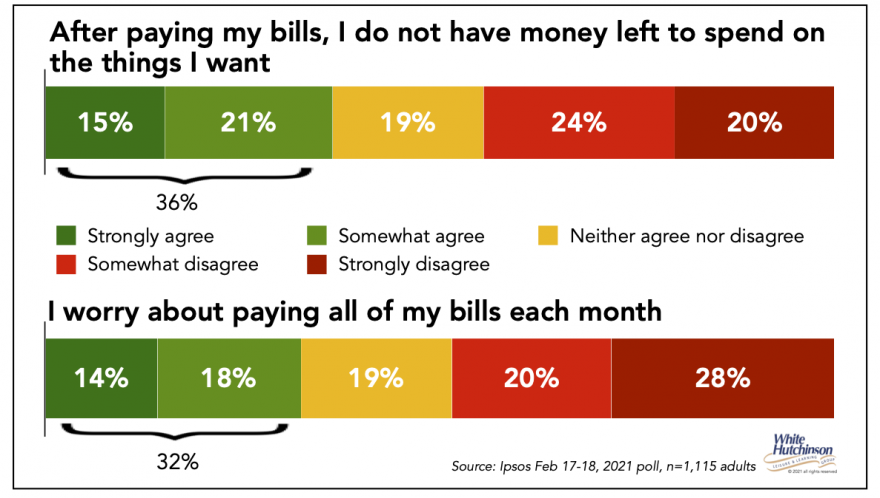

About 42% of Americans said their financial situation had worsened since the start of the pandemic because of job losses or drops in income, according to a survey by the financial website NerdWallet. According to the survey Harris Poll conducted in November, nearly half of those in worse shape said they had taken on debt to pay bills and cover necessities. An Ipsos poll found that approximately one-third of adults report the lack of discretionary income after paying their bills.

A recent poll by Datassential asked people what was preventing them from visiting or ordering from restaurants more often. Nearly one-third (31%) reported, "my financial situation has changed, so I am trying to spend less."

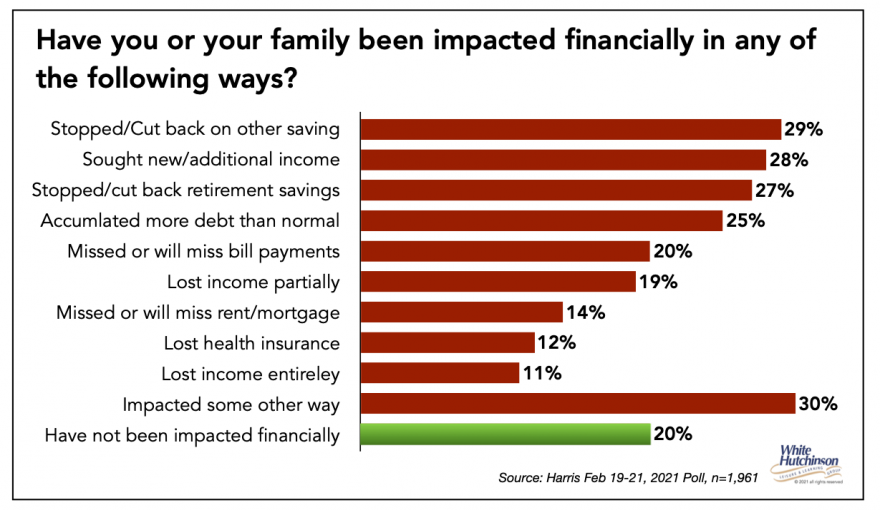

A February Harris poll found that only one-fifth of the population has not been impacted financially.

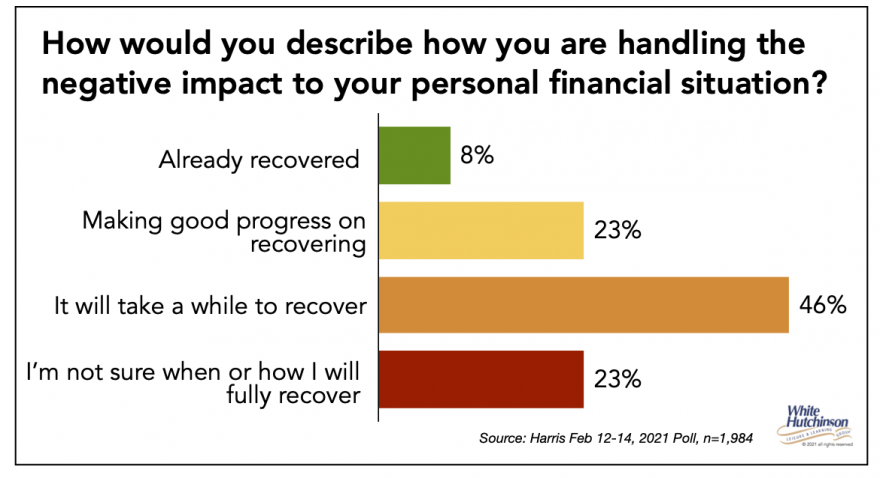

Another February Harris poll found that nearly half of people with a current negative financial situation (46%) report it will take a while to recover. Roughly one-quarter (23%) report they are not sure when or how they will fully recover.

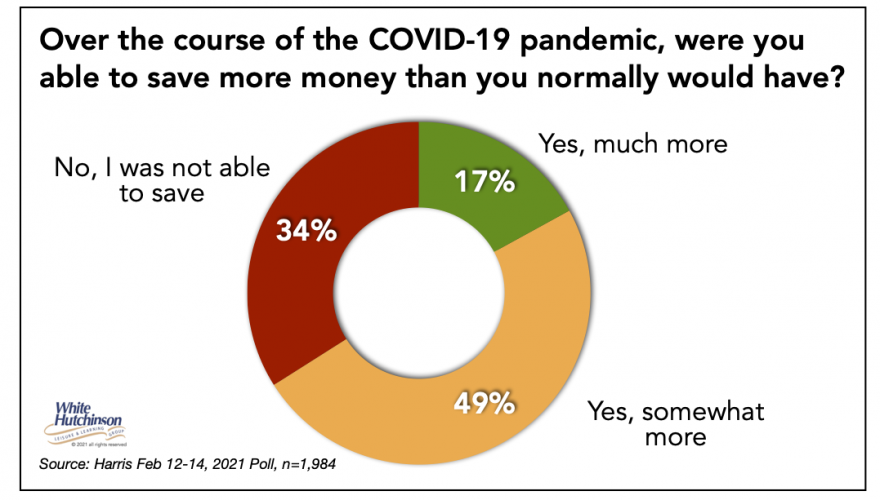

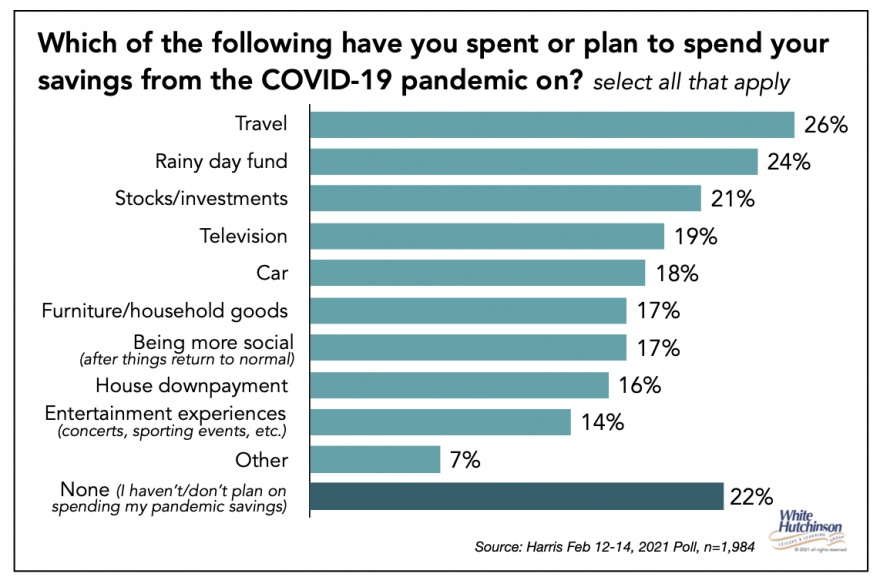

The other two-thirds of people were able to save money during the pandemic.

Only one-seventh (14%) report they have or plan to spend their savings on entertainment experiences

A December NielsenIQ study identified four consumer groups relative to their spending behaviors:

- Existing Constrained - were already watching what they spent before Covid-19, and this has not changed

- Newly Constrained - experienced worsening household income/ financial situations and are consciously watching what they now spend

- Cautious Insulated - limited impact to income/ financial situation, but are watching what they spend a lot or much more than before

- Unrestricted Insulated - similar or improved income/ financial situation and do not feel the need to watch what they spend

Nielsen found that over one-quarter of U.S. consumers (27%) were not restricting their spending, leaving nearly three-quarters of cost-conscious consumers (73%) constraining their spending.

Phase 3 - The new normal

There is pent-up demand for out-of-home leisure activities. There will be a surge of spending and attendance by people as they return to public activities such as to LBEs. Data from a recent Mastercard poll found that consumers who have put some money away during the pandemic as savings are anxious to start spending on the things they've been denied over the last year-like travel, dining, and in-person entertainment.

The surge doesn't mean that if they had previously gone bowling once a month, they would try to make up for all the lost visits by going every week. It is much more likely that if they return, they will continue their previous attendance frequency. The surge is more a return to doing things rather than a spike compared to 2019 attendance.

The overall surge in spending by people with financial well-being will be a phase-in over the previous two phases as people gradually return to public life and LBEs. But it will not be by the entire population. With the possible exception of a single-digit percentage of people who have become virus-phobic and people who still haven't recovered financially, with a robust economic recovery, probably by 2024, the constraints to attending LBEs will be gone for the vast majority of Americans. But will this result in a roaring 2020's, much like after the Spanish Flu pandemic?

In his recently released book Apollo's Arrow (we highly recommend the book), Dr. Nicholas Christakis, a professor at Yale University, draws on long-forgotten pandemics to remind us that societies usually go on a spending spree when the austerity of a pandemic panic lifts.

Despite a global flu pandemic that killed 675,000 Americans in 1918 and 1919 and a depression that gutted the economy in 1920 and 1921, the United States not only recovered but entered into a decade of unprecedented growth and prosperity. Americans began a spending spree - the Roaring Twenties was on. The 1918 virus that killed more people than the deadliest war humanity had previously experienced did not reduce humanity's determination to socialize.

On the contrary, in his book Ten Lessons for a Post-Pandemic World (also highly recommended), Fareed Zakaria says that after the Spanish Flu pandemic, the U.S. settled into the Roaring Twenties and the Jazz Age. But, there is little evidence that people worked differently or socialized less after that gruesome outbreak. There was no new normal. It was a "return to normalcy."

Fareed points out, "But history doesn't always repeat itself. Sometimes one is struck as much by the discontinuities as the continuities. And that might be the case when comparing the Spanish flu to the novel coronavirus. In the 1920s, people went back to their farms, factories, and offices because there was no alternative. To work, you had to be at work. If you sought entertainment, you would find it only in the theaters and music halls. If you wanted to buy food or clothing, you need to go to a brick-and-mortar store. That is no longer true … Today, life can be lived digitally."

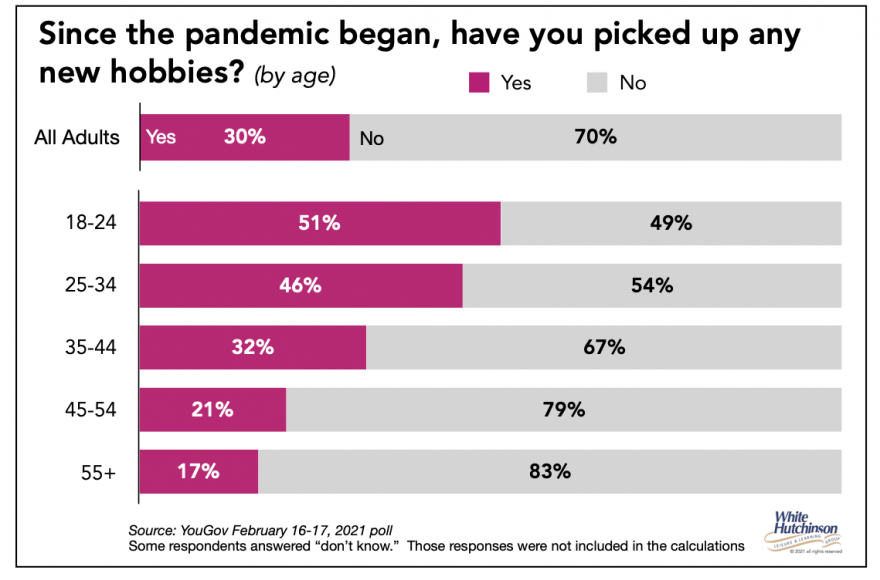

Fareed suggests that during the current pandemic, we developed new behaviors, new habits, new hobbies, and have adopted new virtual leisure options, many of which may remain with us well into the post-pandemic world.

Research shows that people have been taking up new or returning to at-home hobbies with abandon, including arts & crafts, cooking, gardening, sewing, candle making, jewelry making, calligraphy, even playing a musical instrument. A recent YouGov poll found that nearly half of adults age 18-34 have found new at-home hobbies and pastimes they've enjoyed during coronavirus.

American adults are so happy with the newfound hobbies that nearly 8 in10 of them (79%) plan to stick to these activities long-term, according to a survey by StorageCaf

Trajectory out of the U.K. has labeled the at-home digital activities we adopted as the new Fourth Place. They explain that last year while we were stuck in our homes, we recreated many of the leisure activities and interactions that used to sustain us away from our homes with the help of digital technologies. These activities previously took place in the real world, known as Third Places, common spaces, from cafes to bars to parks to social entertainment centers. The pandemic moved leisure activities from the real world and put them in Fourth Place virtual spaces. Their research found 59% of people have participated in at least one Fourth Place experience.

Trajectory defines the Fourth Place as "a digital space the recreates real-world leisure or interaction [socialization], and in doing so, changes it," actually creating a new category of leisure and social experiences. They suggest that post-pandemic, some people will stay online in these Fourth Places, replacing some leisure time in the real world. They also point out that with the eventual mass adoption of virtual reality, the Fourth Place will evolve into a Virtual World that will be even more attractive.

A Deloitte study found that more than two-thirds of consumers who have tried a new digital activity or subscription during the pandemic say they are likely to continue their new activity or subscription.

This pandemic has given birth to new forms of entertainment and socialization in the Fourth Place, as well as the adoption of hobbies that will compete with out-of-home leisure and entertainment in the post-pandemic world. Yes, there might be a roaring 2020s, but what people do for enjoyment and pleasure may be different than what they did in 2019.

The Fourth Place's convenience and low cost and the enjoyment of at-home hobbies will be a new and formidable competition to pre-Covid LBEs in the post-pandemic world. The appeal of hobbies, virtual experiences, and the coming mass adoption of Virtual Worlds raises the bar for what it will take going forward to get people to leave their homes to visit LBEs. Location-based entertainment venues need to evolve their business models now to meet this new competition.