Vol. XXI, No. 1, January 2021

Trends that will shape post-pandemic out-of-home entertainment & arts

There is no doubt that the novel coronavirus has upended just about every facet of life as we knew it, including causing a total disruption to out-of-home entertainment and arts (OOH E&A). Covid has acted like a time machine, propelling 2020 5 to 10 years into the future. It has been an accelerant to many trends that were already underway, as well as creating some new ones.

Here's a recap of 21 of the most significant trends and changes we have identified that will be impacting and shaping the post-pandemic OOH E&A landscape. Our CEO, Randy White, wrote about many of these in his blogs last year. Where his blogs went into more detail than our summaries of trends that follow, we have included links back to that subject's blog.

Increasing bifurcated market

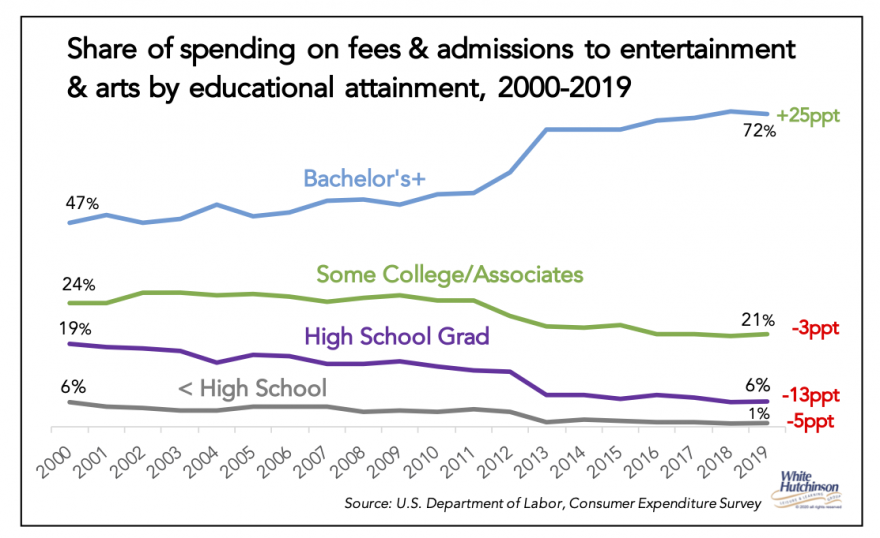

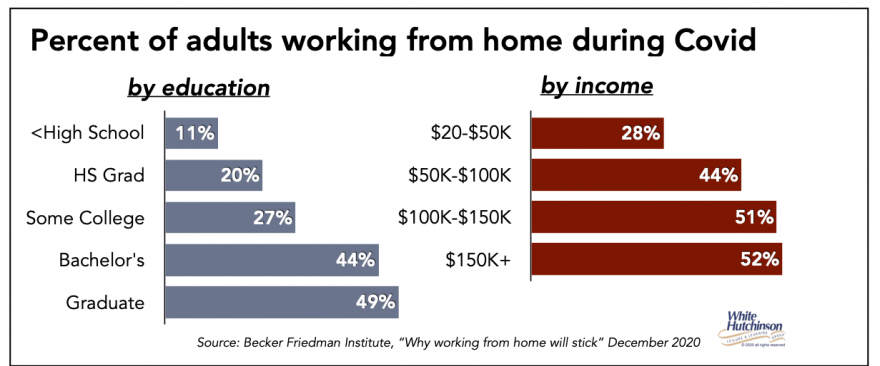

Before Covid, the OOH E&A market was already becoming very bifurcated, more gentrified, with higher socioeconomic consumers accounting for an increasing share of fees and admissions. Bachelor's and higher degreed households grew from 47% of all such spending in 2000 to 72% in 2019. Meanwhile, the spending by all other educational level households declined.

The pandemic's K-shaped economics have significantly increased income and financial inequality. The lower socioeconomic were most impacted by a loss of income while the higher socioeconomic kept their jobs and increased their wealth in stocks and homeownership.

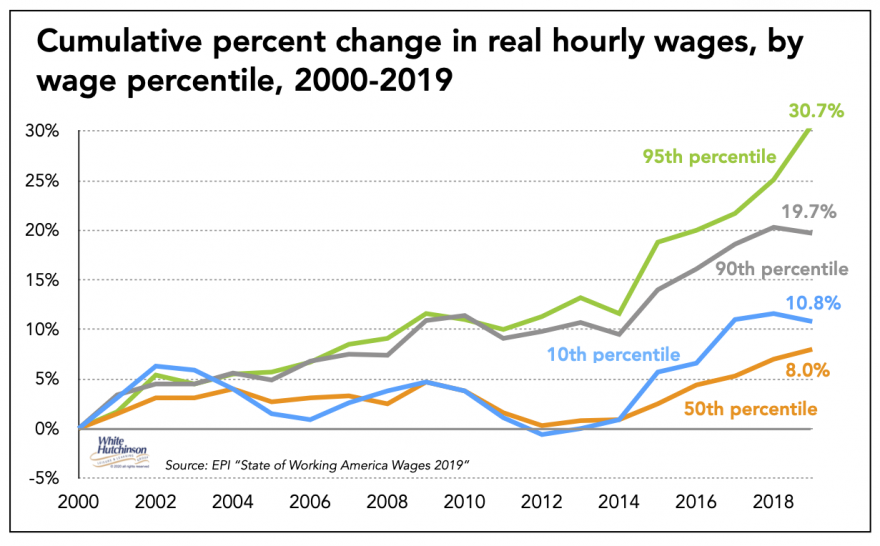

Another trend also likely to continue and further increase economic inequality is that many living costs are growing faster than wages. Since 2000, college education costs have risen by 57% (inflation-adjusted), health care costs by 56%, and housing costs by 31%. During the same period, wages have only grown on average by 10%.

Wages for higher-income workers are growing faster. Since their total incomes are higher, cost increases have far less impact on higher-income workers than lower-income workers whose wages are growing slower, resulting in a decrease to lower-income workers' discretionary funds, if any, available for leisure activities.

Randy's blog on increasing economic inequality - click here

Migration to the virtual world

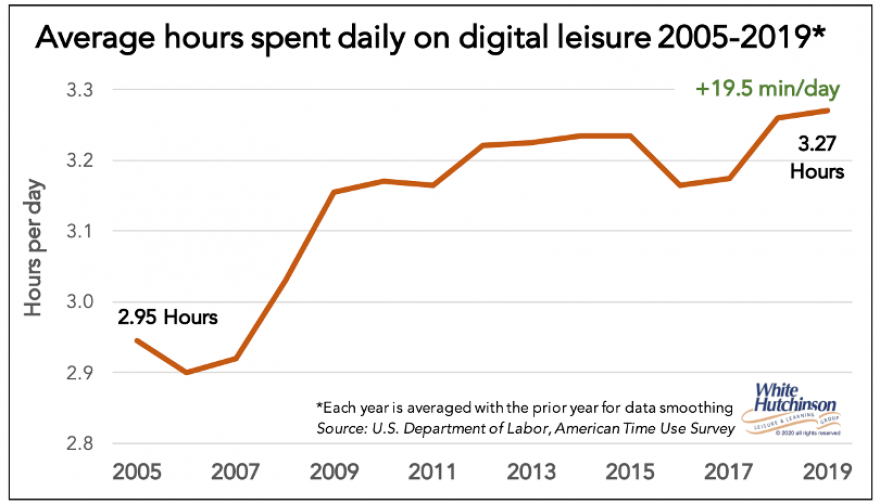

Pre-pandemic, time spent on digital leisure has been increasing. For all Americans age 15+, time spent on digital leisure (mostly at home) has increased by 11%, nearly 20 minutes a day over the 15 years before the coronavirus.

The impact of Covid acted as a catalyst, speeding up consumers' digital adoption and new virtual habits at a rate few could have predicted. The pandemic forced Americans to collectively swap the physical for the digital world in a matter of months, accelerating the migration of entertainment and socialization from the real to the digital world. We've seen:

- The development of many new and improved at-home entertainment and social digital virtual experiences

- Their adoption by many people who have never used them, the "virtual immigrants", and

- Their increased use by the already digital and virtual natives.

The at-home virtual technology evolution that took place over the past months has facilitated finding new routines. It gave us so many new ways to occupy and enjoy ourselves at home.

One big area of growth has been with video chat. During the lockdown and at-home isolation, video chat became the closest substitute we had for in-person socialization.

The pandemic has also clearly affected how people enjoy entertainment and video games. Social simulation games, a video game species where you control a character's life inside a simulated world, such as Animal Crossing: New Horizons, boomed. Video games such as Fortnight hosted concerts and talk shows, transforming themselves from just a video game into a social platform. In many respects, the gaming aspect became secondary to a place where people could connect and spend time together.

The coronavirus has been the catalyst for creating various digital alternatives for all types of IRL events in virtual shared spaces, including happy hours, crafting parties, concerts, nightclubs, weddings, graduations, playdates, birthday parties, and memorial services.

Many of these virtual experiences fall into a trend called "fantasy IRL", the phenomenon of imagined worlds (virtual, in-game, or fictional worlds) colliding with the real world. The virtual space becomes, for its inhabitants, almost as real as the real world, something like the metaverse. During the Covid-19 lockdown, the real world became the virtual world. Our face-to-face interactions became virtual. Our social "third places" were only found in the virtual world.

Virtual alternatives to IRL experiences have many advantages. No need to get dressed - attend in your PJs. No need to spend time traveling to the event. No lines to the restroom at virtual concerts.

Virtual alternatives to some IRL live entertainment added a new dimension. Watching a movie at the cinema together with other people is a shared experience, as is attending a live cultural performance. The new virtual alternatives people had at home allowed those experiences to become socially shared experiences. People could socialize with people-watching with them at home and with their friends anywhere in the world. Many streaming platforms added extensions where people could have "watching parties", use text, audio, and even video chat while watching synced content.

A Deloitte study found that since the pandemic began, 38% of consumers surveyed have tried a new digital activity or subscription. The most popular are viewing live-streamed events and watching a video with others through a social platform, web application, or video conference.

Two of Randy's blogs with more on migration to virtual worlds - click here and here

New at-home hobbies

In addition to at-home digital, people have been taking up new or returning to other at-home activities with abandon, including old hobbies such as arts & crafts, cooking (see below), gardening, sewing, candle making, jewelry making, calligraphy, even playing a musical instrument. The August 21-23 Harris poll found that nearly half of adults (49%) have found new at-home hobbies and pastimes they've enjoyed during coronavirus. American adults are so happy with the newfound hobbies that nearly 8 in10 of them (79%) plan to stick to these activities long-term, according to a survey by StorageCafé.

Increased cooking

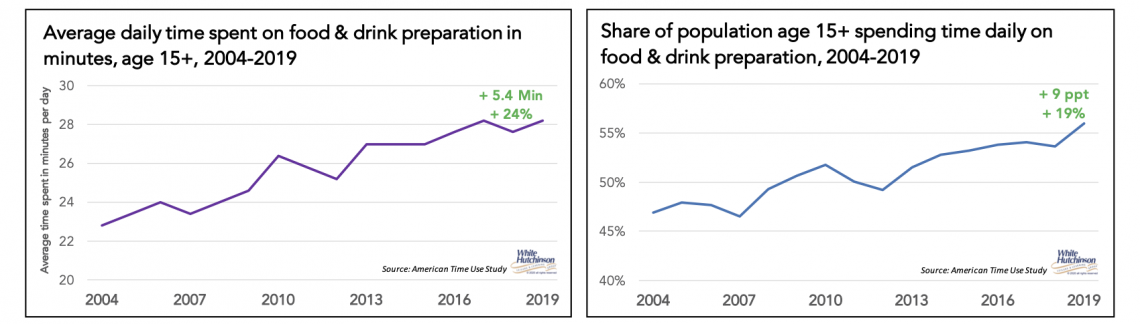

Data from the American Time Use Survey strongly suggests that the increase in cooking meals at home during Covid-time is not a new trend. Instead, the pandemic has accelerated a trend that started at least 15 years ago. From 2004 to 2019, people increased the amount of time they spent at home on food and drink preparation by 24%. On a typical day in 2019, one-fifth more people (19%) were preparing meals than in 2004.

Nesting & hometainment

Homes took on a new character during the pandemic. Homes used to be considered a home-base, a place you operate out of, take care of some people and things and then head out to work, recreation, and other social and leisure activities. Data from the American Institute of Architects points to the idea that Americans are now thinking about their homes as immersive experiences - a place they're a part of versus a place where you touch down.

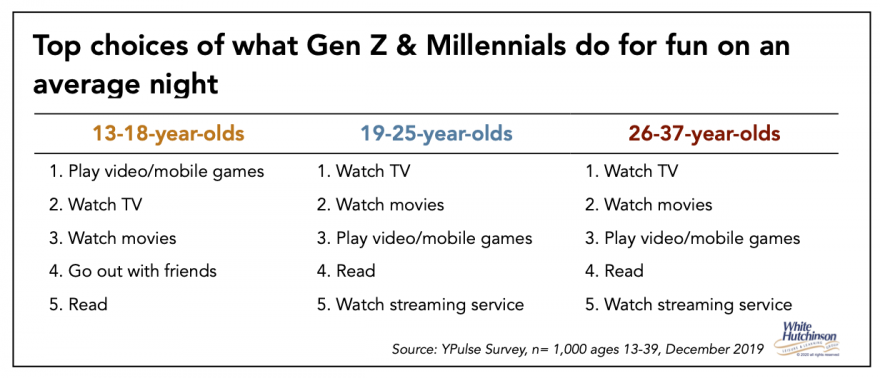

Covid-time nesting at home with hometainment is not new. It's the super acceleration and continuation of a long-term trend of people spending increasing time at home. The 2018 Trusted Media Brands Modern Family Study declared, "staying in is the new going out". It found that 80% of families and 78% of Millennials said they would rather stay in with their family or friends than go out. The most popular at-home quality time activity for 95% of people was socializing/hanging out. YPulse found that nearly 7 in 10 adults age 19-37 would rather stay in on weekends than go out, and the same amount say going out is more effort than it's worth. Their December 2019 survey found that the top things Gen Z and Millennials do for fun on an average night (with one exception for 13-18-year-olds) were sweatpants activities you do at home, with nearly three-quarters being digital screen activities.

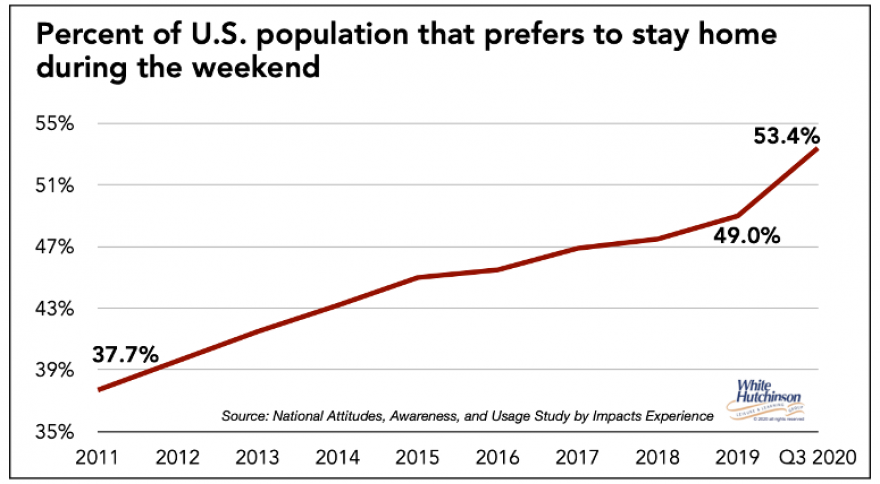

Another survey found a continual increase over the past decade in the percentage of people preferring to stay home on the weekends, growing from 37.7% in 2011 to 49% in 2019, and peaking at 53.4% in Q3 this year.

A December 10 - January 5, 2020 survey by CivicScience asked over 4,000 adults what defined happiness for them. Family came in first, followed by home life. Family and home life came in the same order when adults were asked what most defines success for them. Peoples' lives at home are very important to them.

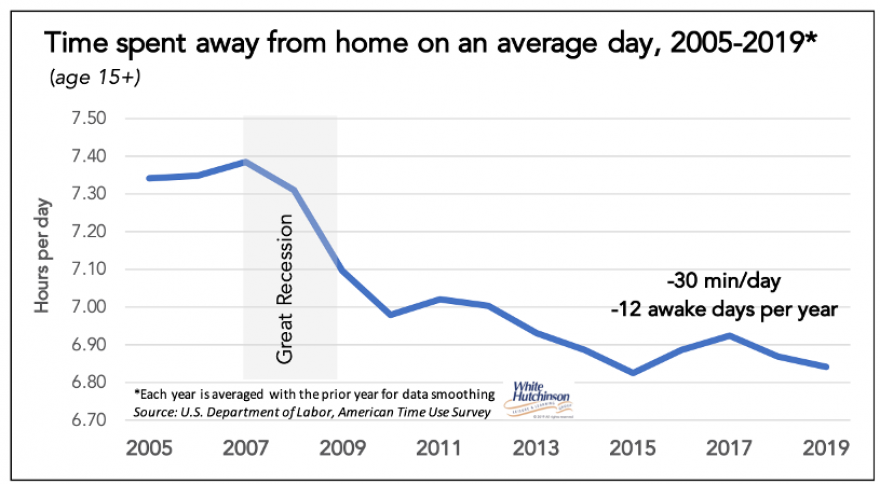

Americans have, on average, increased their awake time spent at home by 16 minutes per day. This translates into an annual increase of 6.4 days' worth of at-home awake time (averages 15 hours and 10 minutes a day) since 2004. People are also sleeping 14 minutes more per day, increasing the average time at home to 30 minutes every day. As a result, people spent one-half hour less time each day away from home in 2019 than in 2005.

Randy's blog on uber-bunkering - click here. Blog on hometainment - click here.

Spending more time in nature

Americans took up new outdoor activities in significant numbers during the pandemic.

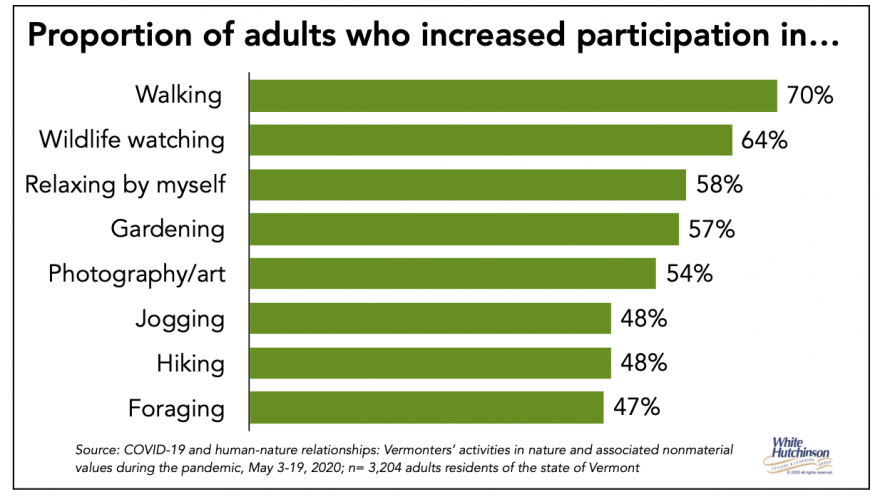

During the last two weeks of the stay-at-home orders in May, a study of Vermont adults found a significant increase in many nature-based activities. Participation increased nearly or greater than 50% for all the activities.

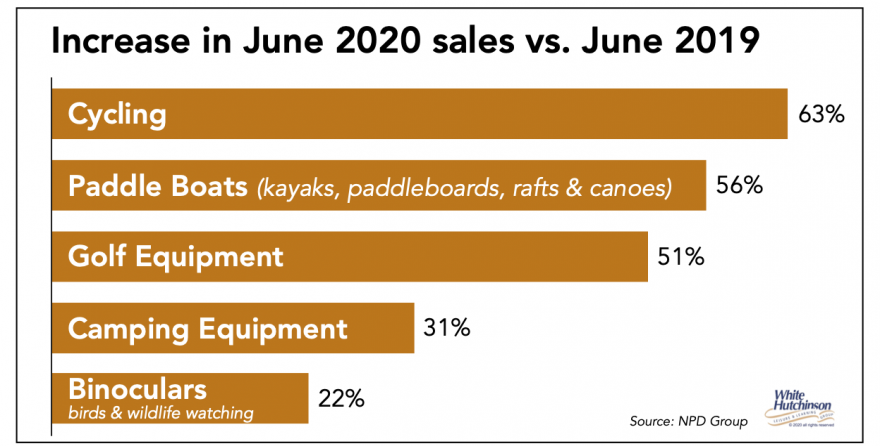

In July, a survey by Hub Research found that nearly one-quarter of people (24%) were spending more time outdoors. The number of people visiting parks has increased during the pandemic. Over one-quarter of people visiting parks during Covid's early months rarely had, or never, visited nature in the previous year. Prior visitors increased their visitation. It became hard to find a trailhead parking spot, not to mention purchasing new bikes, hiking boots, canoes, and camping gear. Campgrounds were packed and hiking trails crowded. Among the biggest activity gainers were running, cycling, and hiking. State and National park attendance spiked. The number of hunting licenses issued increased from previous years.

Using anonymized GPS data from mobile phones, Google estimates visits to parks, including everything from public beaches, dog parks, marinas to national parks, saw an 80% increase in September since January.

Another outdoor activity, gardening, also saw a large increase in participation.

The appreciation and connection to the outdoors many people discovered for the first time resulted in many people adapting the Norwegian lifestyle concept of "friluftsliv" (pronounced free-loofs-liv). Friluftsliv translates in English as "free air life", an appreciation of being outdoors and incorporating outdoor activities into your life.

Baby bust

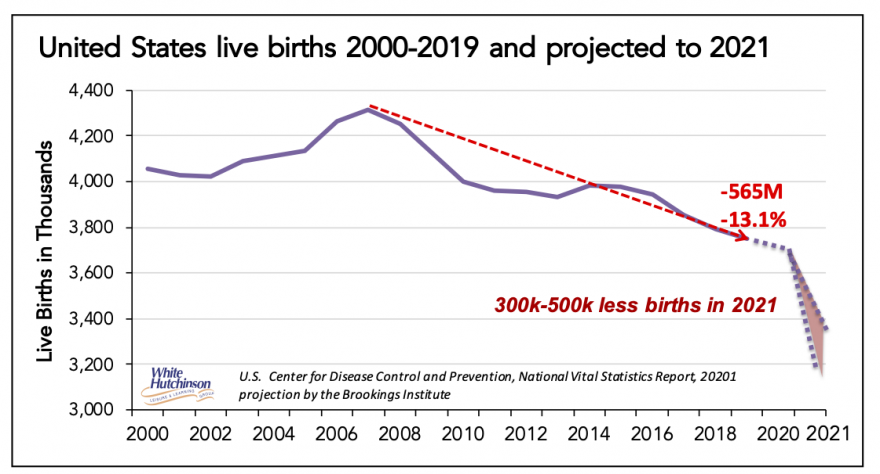

The baby bust that started back in 2008 continued through 2019. In 2019, there were 565,000 fewer births than before in 2007, a 13% decline.

Brookings' researchers estimate that the economic downturn caused by the pandemic could result in a dramatic decline in births on the order of 300,000 to 500,000 fewer births in 2021 than would typically occur.

The researchers went on to say that additional future reductions in births may happen if the labor market remains weak beyond 2020 [in June when the research was conducted, it was expected the pandemic would end much sooner than now anticipated]. The researchers expect that many of the births will not just be delayed but will never happen.

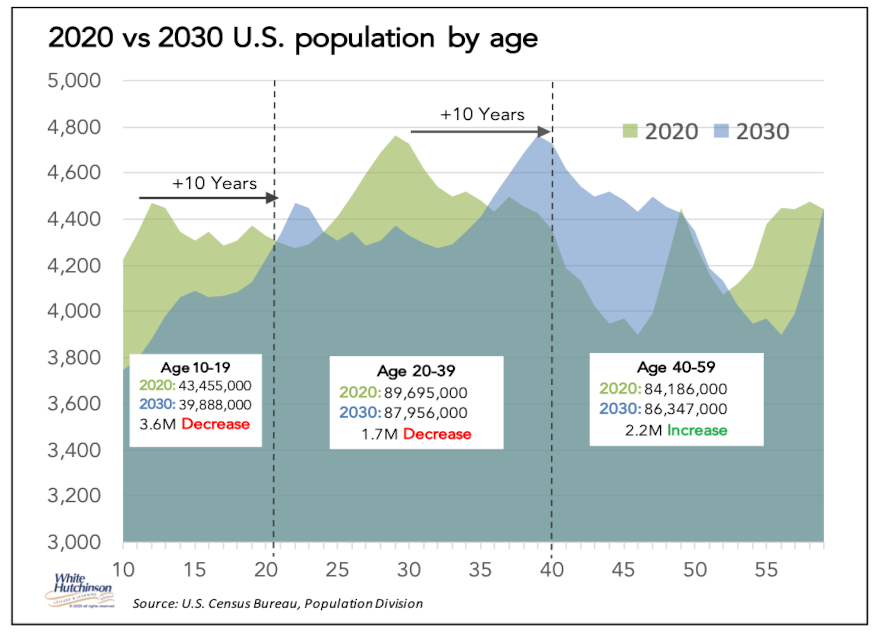

Shrinking number of older children & younger adults

In addition to a very likely continuing decline of births and a resulting decline in young children, moving forward into the future to 2030, the number of age 10-19 children will decline by 3.6 million, and the number age 20-39 adults will decrease by 1.7 million. Meanwhile, the number of middle age 40-59 adults will increase.

Childless households

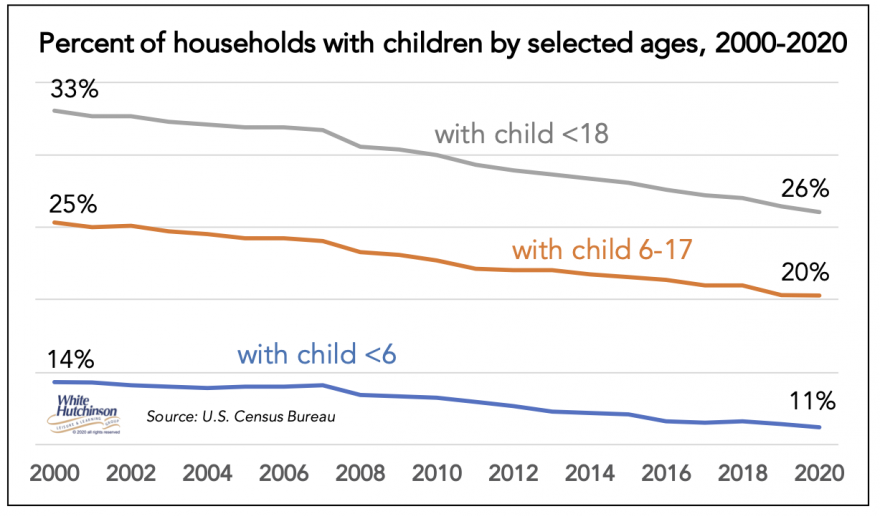

The percentage of households with children is currently at a historic low, down from one-third in 2000 (33%) to only one-quarter of all households in 2019 (26%). The percentage of households with children five and younger are down by one-fifth.

Not only is the percentage down, but the actual number of families with children is down by two percent compared to an almost one-quarter increase (23%) in the number of all households over the same two decades.

The decline of families with children means that, on average, a smaller share of households in any market have children. The accelerated decline in the birth rate will likely accelerate the continuing decline of families with children.

Work from home

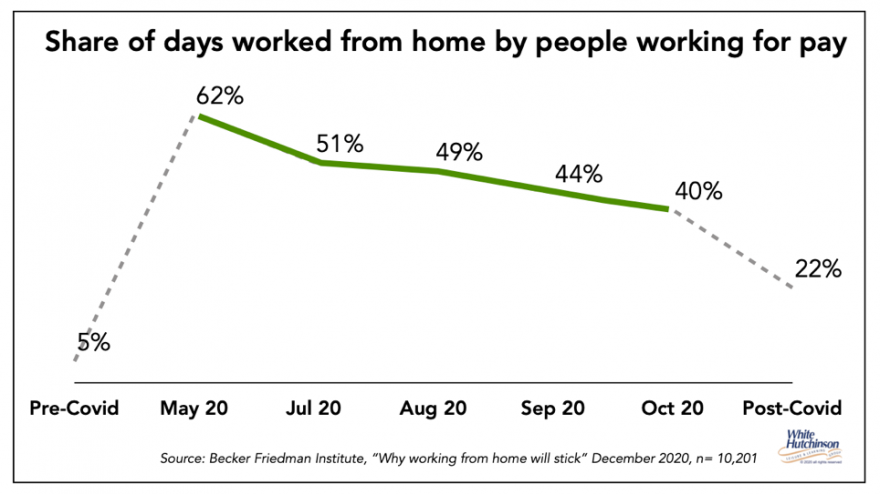

Before Covid, research shows that 5% of paid workdays took place at home. During the pandemic, that increased to 62% in May. As of the end of October, it was down to 40%. The research projected that work from home (WFH) would continue at a 22% post-pandemic rate.

300 U.S. employers polled in October by Willis Towers Watson said they expect 30% of their full-time employees will be working from home in three years, up from 5% three years ago. Abolfazi Mohammadian, director of the Transportation Laboratory at the University of Illinois in Chicago, estimates 18% of workers will likely WFH every day in the post-pandemic era.

WFH skews heavily higher socioeconomic during the pandemic and is projected to remain that way post-Covid.

WFH increases available time for other activities by nearly one hour a day (56 minutes on average) due to the elimination of commuting. WFH also results in transportation cost savings.

Even after offices fully reopen, people that return to work full or part-time should also expect some time savings. With fewer people commuting to work each day and with workers having more flexibility to commute at off-peak times, commute times should be less than pre-pandemic.

Retreat from cities

Millions of Americans have fled big cities in droves to escape the virus. The main driver is that people want more space, prompting moving to luxury, suburban, and rural homes. Others have been moving from expensive megacities like NYC and San Francisco to mid-tier, less expensive cities like Madison, WI, and Austin, TX. Many of them are relocating permanently.

Gallup found in their surveys that when adults were asked, "If you could live anywhere you wished, where would you prefer to live?, the percent answering in a town or rural area climbed from 39% in 2019 to 48% in 2020.

Marketing firm 'Known' found that 6% of adults were planning to move due to Covid-19. Their survey found people are looking for more space and being in a community more aligned with their values.

With the K-shaped recovery, more affluent people are doing well, they are more able to work remotely, and they are mainly the ones relocating. This means that in some larger urban areas, the business OOH E&A was getting from these people is lost, while business will be gained in other cities and areas.

Sustainability

The devastation wrought by Covid has had an impact on consumer attitudes regarding environmentally responsible behavior—their own and that of companies they expect to patronize.

A BCG survey found that in the wake of the pandemic, people are more concerned—not less—about addressing environmental challenges and are more committed to changing their behavior to advance sustainability.

Some 70% of worldwide survey participants said they were more aware now than before Covid that human activity threatens the climate and that degradation of the environment, in turn, threatens humans. Nearly two-thirds of U.S. respondents (64%) said environmental issues are as concerning as or more concerning than health issues. Nearly three-quarters in the U.S. (72%) said private companies should integrate environmental considerations into their products and services and the way they operate.

Research shows that people with higher education levels and Millennials are more concerned with sustainability and environmental issues and behave in environmentally-friendly ways.

Dining out experiences

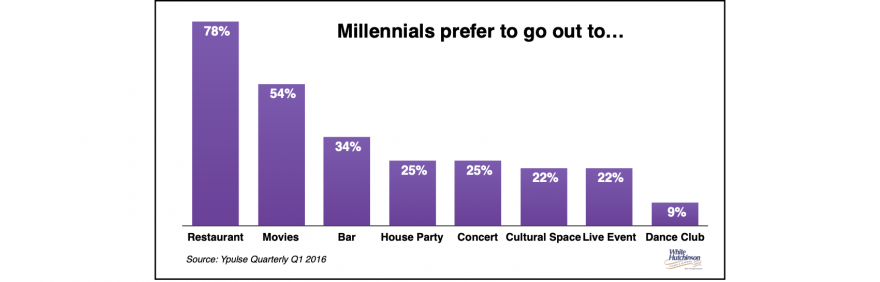

Pre-Covid, dining out had elevated to an experience that many younger adults considered more desirable than an entertainment offering. A YPulse 2016 survey found that nearly 8 in 10 Millennials (78%) prefer going out to a restaurant more than other options, including various entertainment venues.

Pre-pandemic, some of the fastest-growing and most successful location-based entertainment (LBE) concepts were eatertainment venues that incorporated high quality, foodie-worthy food and drink as their anchor attraction, with the entertainment being secondary.

Research by Technomic before Covid found that in a world where technology often replaces face-to-face interactions, consumers seek greater connection to others and the world around them. They're looking at restaurant experiences as a way to forge deep, meaningful social connections with friends and family, no different than our ancestors did. Three-quarters of surveyed adults (75%) agreed, "I enjoy the social aspects of dining out at restaurants". Three-quarters (76%) also agreed that "Visiting restaurants is a form of entertainment for me".

Datassential reports from their recent December survey that when people were asked what they were looking forward to once vaccinated, 58% said "going out to restaurants". It was only second to "getting with friends and family at somebody's house" and much higher than OOH leisure events such as going to the movies, attending a live show at a club or music hall, or attending a live sporting event. Two-thirds reported they plan to visit restaurants more once vaccinated (67%). One-third of Millennials (34%) said they plan to go right away.

A December 31-January 6, 2020 survey by CivicScience also found that people missed going out to restaurants and bars second only to gathering with friends and family. Physical contact and hugging, which goes hand in hand with seeing loved ones, came in third.

During the pandemic, people were cooking more and introducing new international spices such as turmeric, saffron, and cumin to their dishes to add variety to their meals, travel with their taste buds, and add adventure to their meals. McCormick & Co reported a 35% increase in the sale of spices and herbs.

When consumers start dining out again, the predictions are they will quickly move past an initial desire for comfort food back to adventure and discovery food and drink exploration. There is nothing more social than eating and drinking together.

Covid increased people's concerns with health and wellness, which translates into the choice of healthier and functional foods (have a positive effect on health beyond basic nutrition, such as increased immunity) for many people. Many people also discovered plant-based meats when regular meat supplies disappeared from supermarkets during the pandemic's early days. Plant-based meat sales have since continued to grow.

Post-pandemic, restaurants should continue to have strong appeal, probably heightened appeal for many years as they check off so many boxes - they offer food and drink discovery and adventure and are an in-person, socially shared experience and sharable on social media, so missed during the pandemic. Evolution did not program us to bowl, whack golf balls, play escape games, visit a museum, or watch a theatre performance. Although some of those activities are social, they lack the primal "gather around the campfire while you dine, drink and socialize" predisposition evolution programmed us to do.

Residual fears

The coronavirus can change our societal norms as our fears will linger long after a crisis like the pandemic fades.

When people worry about something long enough, new institutions and cultural patterns form, making it more likely for them to worry about the same thing in the future. Before 9/11, 24% of Americans were very or somewhat worried about being harmed by terrorists; that percentage increased to 58% after 9/11. Over the next two decades, though the U.S. experienced relatively few deaths due to terrorism, the level of worry never receded to its pre-9/11 levels. In late 2019, the percentage of Americans who were very or somewhat worried about terrorism stood at 46%, nearly double the pre-9/11 level.

Fears that might linger after the pandemic crisis fades include residual fears of physical proximity around strangers and touching communal surfaces. People are conditioned to worry about viruses and germs lingering on just about everything involved with the once-ordinary experiences - doorknobs, ketchup dispensers, bathroom surfaces, even tabletops. We may have a generation of virus-phobes.

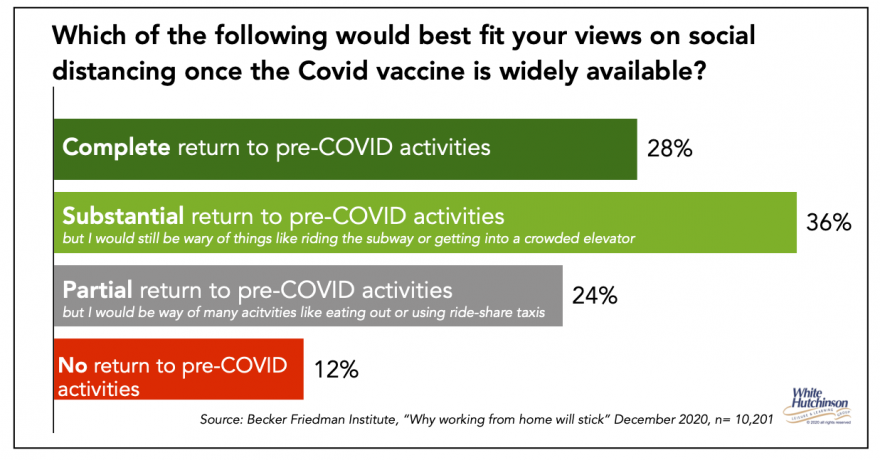

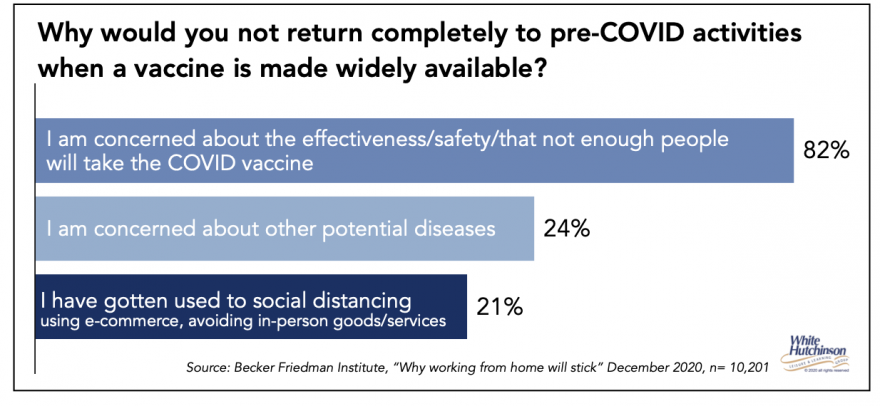

According to surveys of 15,000 Americans reported in the research paper Why Working from Home Will Stick, about 70% of survey respondents expressed a reluctance to return to some pre-pandemic activities even when a vaccine for Covid-19 becomes widely available, for example, activities like riding subways and crowded elevators, or dining indoors at restaurants.

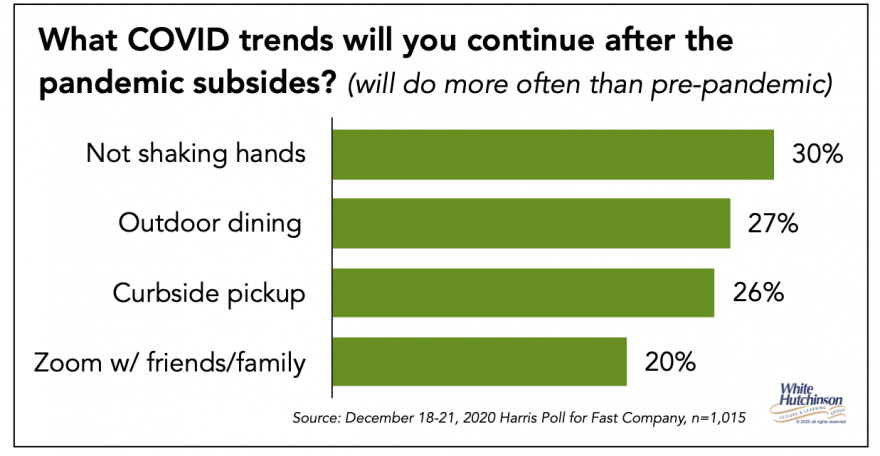

A December 18-21, 2020 Harris Poll found many people are planning to continue many of their acquired pandemic behaviors post-pandemic.

We've seen many new practices and equipment adopted by businesses centered around hygiene, such as self-cleaning surfaces, ultraviolet capabilities introduced on appliances, and completely new technologies like hygiene haptics promise mid-air interaction. Regular disinfection of shared surfaces is an SOP for most consumer businesses. The adoption of these has raised the bar for what is considered a safe environment for your health.

It's easy to see how heightened concerns about disease brought on by Covid could calcify into American culture, customs, and institutions. Hygiene, health, and physical distance will be primary concerns.

Increase in transformative experiences

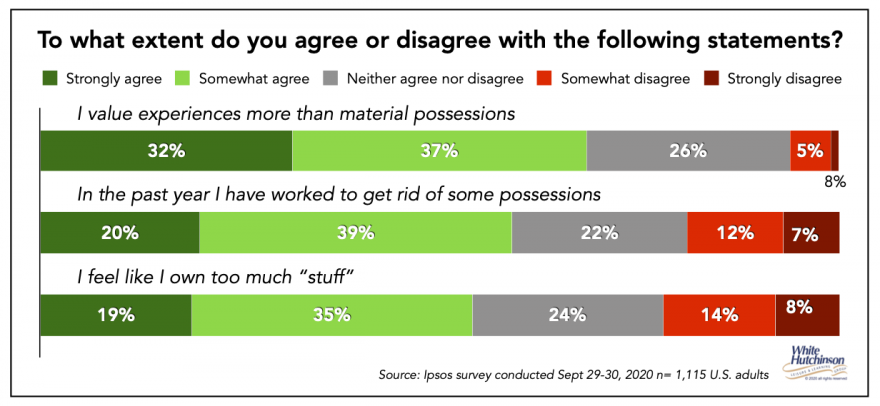

We are moving from a materialist society to an experiential one. This accelerated during the pandemic.

In their book The Experience Economic, Joseph Pine and James Gilmore tell us that we are moving into the Transformation Economy in which we desire experiences that are not only enjoyable and create great memories, but that transform and leave us improved in some way. There are many types of transformational experiences. Working out at a gym to be in better physical condition is one example. Another major area is learning new things of personal interest. The popularity of beer, wine, and food festivals in the past has been partially driven by people's desire to discover and learn about foods and drinks.

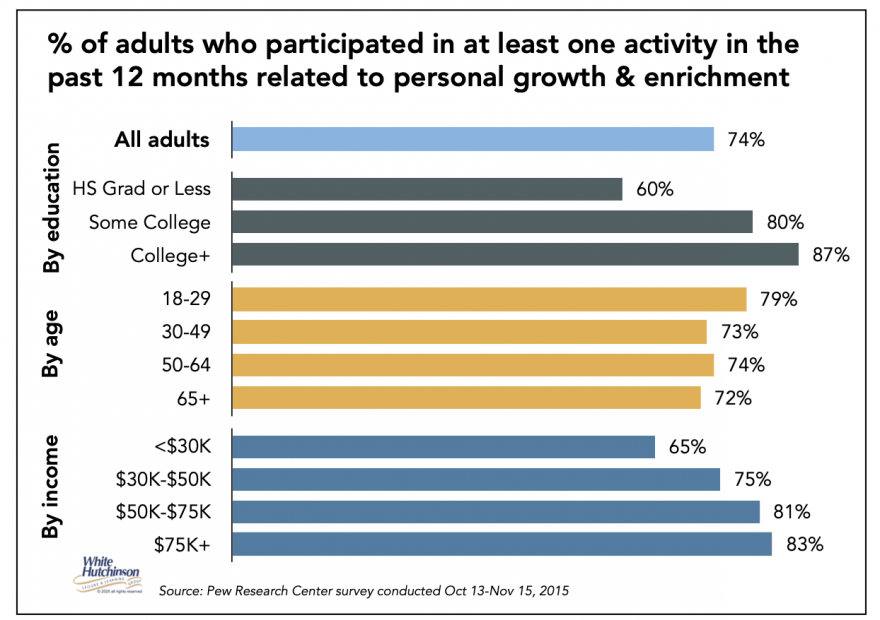

Many people today want to improve themselves in their leisure time. Pure mindless relaxation and entertainment are no longer adequate. This learning-based leisure trend is evident with the attendance increases at cultural institutions, children's museums, aquariums, botanical gardens, and zoos; the growth of for-profit edutainment venues, and the growth of eco-tourism and similar self-enrichment type vacations.

A Pew Research Center survey found that 73% of adults consider themselves lifelong learners. 74% of adults participated in at least one activity in the prior 12 months to advance their knowledge about something that personally interests them. These activities included reading, taking courses, or attending meetings or events tied to learning more about their personal interests. The survey found that adults with more formal education and higher incomes are more likely to engage in lifelong learning. It found that 87% of adults with at least a bachelor's degree participated in personal learning activities in the past year compared with 60% of those with high school degrees. More than 8 in 10 adults living in households earning more than $75,000 (83%) are personal learners, compared with 65% of those living in households earning under $30,000.

Lifelong learning is really about pursuing Maslow's fifth level of Hierarchy of Needs - Self-actualization.

Many people had a renewed interest in learning something new in the face of the pandemic's disruption to our regular lives. Online learning sites like Skillshare, Duolingo, and Coursera saw extraordinary growth. Enrollments in online art and music classes spiked while novice bakers flooded Vermont-based flour company King Arthur Baking's helplines.

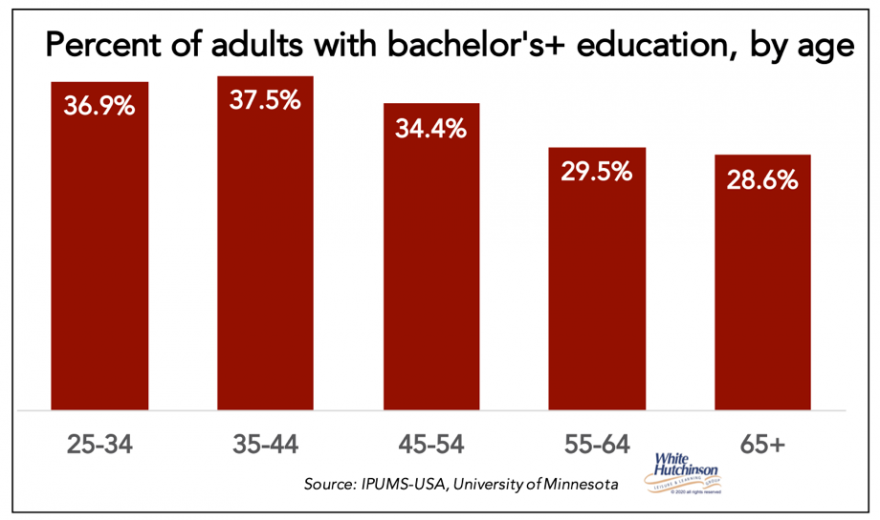

As the Pew study found, lifelong learners, people seeking transformational experiences, are more likely to be more educated and better off financially. They are also more likely to be younger, probably because a greater percentage of younger adults have higher education levels than older adults.

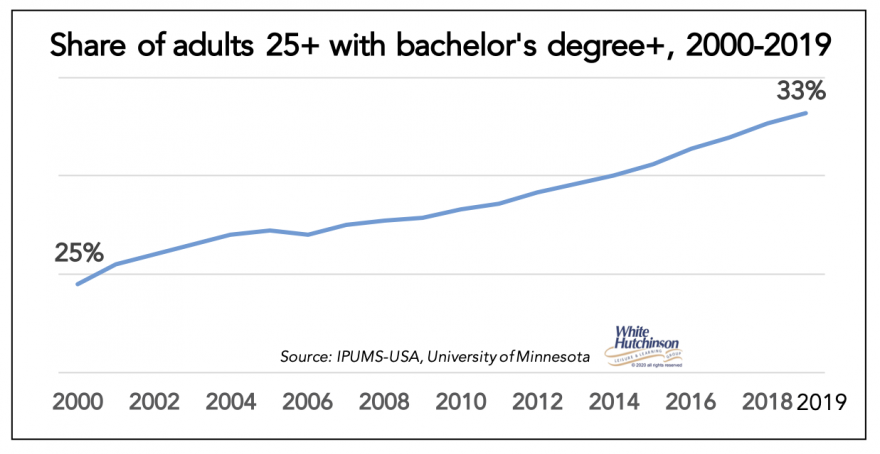

Since 2000, the percentage of adults age 25+ with a bachelor's or higher degree has grown from one quarter (25%) to one third (33%) in 2019. It is projected to increase, further driving growth in lifelong learners and people seeking transformative experiences.

Shift in parents' emotional drivers

Some behavioral shifts that will remain with us well into the post-pandemic world will mostly be driven by emotional changes in our priorities and become part of our emotional DNA. One of those emotional, behavioral shifts is an acceleration of a trend that began several years ago - parents increasingly putting themselves first instead of their kids as their Gen X parents did.

"Family time" has taken on a new meaning. Millennials' parents want to pursue their passions while they spent their free time with their kids. When doing things with their children, it's no longer about kid-specific activities. They want to have new, exciting experiences that fulfill them personally while bringing their kids along for the ride. Four in ten dads even said they have no problem bringing their kids to bars.

Research by the Family Room consultancy has identified a pandemic-driven emotional shift they say will outlast the pandemic - a change from "We Love" to "Me Love" - parents now prioritizing themselves over their kids. Parents now feel they can't be good to their kids unless they're good to themselves. One "me love" shift places a higher priority on devoting time to making and keeping good friends over their children's happiness. This "we" to "me" love shift even shows up in dining out. Family fun is no longer the number one emotional reward parents seek from dining out with their family. There is now less importance on having fun together as a family and much more significance on parents choosing foods they feel good about eating.

The great extinction event

Pre-pandemic, we saw the over-expansion of OOH E&A in many markets. Supply was exceeding demand. The demand for OOH leisure is not elastic. It does not expand with additional options.

Sadly, government-imposed closures and restrictions on capacity plus the public's fear of catching the coronavirus in public places have resulted in many OOH E&A venues' permanent closure. With the continued closures during the peak Winter indoor season, many more are sure to close permanently.

Retail uber-apocalypse

There was already a retail brick-and-mortar apocalypse underway with the growth of e-commerce taking sales from in-store shopping. Covid dramatically accelerated that trend. There were 11,000 permanent store closures in 2020, an all-time high. Mall and shopping center landlords are hungry to attract entertainment and restaurant tenants to fill empty stores and drive customer traffic to their centers. There will be many highly attractive rent, and tenant improvement allowance offers available.

The convenience of e-commerce has produced another positive for consumers along with its convenience, less time visiting brick-and-mortar stores frees up more time for leisure.

Reservations

When OOH E&A was allowed to reopen after government-mandated closures, most venues switched to a reservation-only model to control capacities restricted by government regulations. For many venues, this new operating model proved successful, as it distributed demand over a wider time frame, reduced crowding, and often resulted in higher per capita revenues.

Redistribution of demand

When people ventured out of their homes after lockdowns to visit OOH leisure destinations, the perceived risk of catching the virus resulted in a changed competitive landscape with a redistribution of attendance among all the various OOH options compared to pre-crisis times. Outdoor venues benefitted while indoor ones were considered riskier to attend.

Roaring 2020s

In his recently released book Apollo's Arrow about the impact of the coronavirus on the way we live (I highly recommend his book), Dr. Nicholas Christakis, a professor at Yale University, draws on long-forgotten pandemics to remind us that societies usually go on a spending spree when the austerity of a pandemic panic lifts.

Somehow, despite a global flu pandemic that killed 675,000 Americans in 1918 and 1919, and a depression that gutted the economy in 1920 and 1921, the United States not only recovered but entered into a decade of unprecedented growth and prosperity. Americans began a spending spree - the Roaring Twenties was on. The 1918 virus that killed more people than the deadliest war humanity had hitherto experienced did not reduce humanity's determination to socialize. After years of isolation, of being afraid to hug and kiss their loved ones, of being separated by war, people went absolutely apeshit. F. Scott Fitzgerald, the patron saint of the Roaring Twenties, said it best: "A whole race going hedonistic, deciding on pleasure".

Nicholas says that "If history is a guide, we should eventually make it to our own Roaring 20s when consumption and out-of-home socialization will come back with a vengeance". He doesn't think we'll reach herd immunity until early 2022, which is why he puts economic recovery even farther down the line in 2024. After that, he predicts a sort of free-for-all reminiscent of the Roaring '20s when "people will relentlessly seek out social opportunities in nightclubs and bars and political rallies and sporting events and musical concerts and so on".

Fareed Zakaria, in his book Ten Lessons for a Post-Pandemic World (also highly recommended), says that after the Spanish Flu pandemic that killed over 50 million people worldwide and 700,000 Americans, the U.S. settled into the Roaring Twenties and the Jazz Age . . There is little evidence that people worked differently or socialized less after that gruesome outbreak. There was no new normal. It was a "return to normalcy".

"But history doesn't always repeat itself. Sometimes one is stuck as much by the discontinuities as the continuities. And that might be the case when comparing the Spanish Flu to the novel coronavirus. In the 1920s, people went back to their farms, factories, and offices because there was no alternative. To work, you had to be at work. If you sought entertainment, you would find it only in the theaters and music halls. If you wanted to buy food or clothing, you need to go to a brick-and-mortar store. That is no longer true … Today, life can be lived digitally."

So, Fareed is suggesting that post-pandemic, digital options may replace many IRL ones.

Trend implications for OOH E&A

Once herd immunity is achieved and the fear of the virus fades, and we approach some degree of normality, hopefully by sometime towards the end of 2021, what will the post-pandemic world be for OOH E&A? We will not be going back to our 2019 OOH social and E&A normal. Here are how some of the trends cited earlier may shape the "new normal".

Some of Covid's behavioral changes will only be circumstantial and temporary, lasting only as long as the pandemic. For example, wearing face masks is probably not a long-term trend that will continue after infection from the virus is no longer a concern. However, some behavioral shifts will remain with us well into the post-pandemic world.

If the pandemic had lasted, say, one to two months, it is likely society would snap back quickly to "the way things were", back to "normal". But Covid has stuck around for a long time, now over 10 months since the pandemic was declared. Consumer habits that started or accelerated during Covid are now so long-lasting that they may become permanent habits even when Covid is no longer considered in our behaviors. The longer people do something, the longer it becomes their norm.

Consumer habits can change after someone tries a new way of doing things two or three times out of necessity. Research on habit formation has found that it takes a minimum of 18 days to a little over two months (66 days) on average, and no more than 254 days for a new habit to form. We're now 307 days into the pandemic, well past the 254 days. Many of our new behaviors have passed two other tests for a habit to continue - first, it needs to bring some benefits, and second, the constraints of keeping up with the habit need to be low, it is easy to continue. New pleasure-based habits are tough to break because enjoyable behavior prompts our brains to release dopamine. Dopamine is the reward that strengthens the habit and creates the craving to do it again.

The competitive landscape will be different for all types of leisure activities than in pre-crisis times. There will be a redistribution of leisure time and spending amongst all the leisure options people now have. Some will gain share while others lose share.

Migration to the virtual world - A Deloitte study found that more than two-thirds of consumers who have tried a new digital activity or subscription during the pandemic say they are likely to continue their new activity or subscription. In September, a ForgeRock survey of Americans found nearly half of consumers said they would use more online services and apps post-pandemic than they did pre-pandemic.

Due to their convenience and low cost, our new virtual worlds, opportunities, and habits will be new formidable competition to OOH E&A that existed pre-Covid. The virtual experiences raise the bar for what it takes to get lots of people to leave their homes again to visit OOH E&A.

Hometainment - The pandemic accelerated the hometainment trend. Many people will continue to embrace the at-home virtual social and entertainment behaviors and routines they developed during the pandemic. Leisure time is a zero-sum game. More leisure time at home leaves less leisure time away from home, possibly replacing some of the time they spent pre-Covid at OOH E&A.

Faith Popcorn says one thing is for sure; we will not be going back to 2019. She's predicted, "Covid-19 will redefine our homes forever - favoring bunkers and self-sustainability". Post-pandemic, the home is likely to remain a major hub for more social and leisure time and activities than pre-coronavirus.

Hobbies & outdoor activities - No different than the new digital options people took up during the pandemic, many people have enjoyed renewed and newly discovered hobbies and outdoor activities and will likely continue them post-pandemic. As such, they will be increased competition for OOH E&A.

Increasing bifurcated market - As a result of the pandemic's disproportionate economic impact and living costs rising faster than wages, for a large share of the middle and lower socioeconomic, their discretionary spending will be severely limited for many years, causing these financially-challenged households to restrict their discretionary spending and further increase the bifurcation of OOH E&A - the audience will become even more gentrified.

The growing share of all attendance and spending at OOH E&A coming from the higher socioeconomic in the post-pandemic era means the venues will need to cater to their higher standards, tastes, values, and preferences. The middle-class will no longer be a viable market to target.

The baby bust is reducing the market potential for children-oriented venues.

The "We" to "Me" trend has profound implications for the future of not only children's entertainment centers (CECs) that are focused exclusively on children, but also on family entertainment centers (FECs) that are focused on both children as well as the family as a whole. Now there needs to be a primary focus on the adults rather than the children, which isn't the operating model for CECs.

The shrinking number of families with children will also negatively impact those OOH E&A venues that target the family market. The declining number of younger adults will also affect OOH E&A, as they have traditionally been the prime market for many attractions. The growing number of older adults offers new opportunities for business models that target them.

Work from home - The permanent increase to WFH has several implications for OOH E&A. Many entertainment venues located near professional and white-collar office concentrations, as well as in the heart of major city centers, especially the eatertainment ones, captured considerable lunchtime and after work business from workers. With many people working part or all of the time at home, that portion of the business will be decreased. Willis Towers Watson's research found that worker spending in major city centers could decline by 10% post-pandemic.

Conversely, both the community savings and additional time saved from WFH and shorter commutes might be used for attendance at OOH E&A, especially for higher socioeconomic workers who will be the large majority of WFH workers and who are the most time-pressured with traditionally the least amount of leisure time

Another possible positive result of increased WFH is that many companies may find a need to hold more corporate events at OOH E&A to bring all their workers together for social and team-building activities.

The great extinction event will make supply and demand be much more in balance post-pandemic. Even then, if the demand for OOH E&A is less than pre-pandemic due to all the new behaviors and habits people have, there could still be an oversupply in some markets.

Residual fears - Depending on the degree to which residual fears survive the pandemic, there could likely be a redistribution of demand amongst different types of OOH E&A compared to pre-pandemic. The ability to control your distancing from strangers and outdoor versus indoor environments could be influencing factors.

There will be an expectation for higher levels of cleanliness. This means that the newly adopted hygiene standards at businesses will likely have to remain in place in perpetuity, no matter the cost increase to sustain them. People will almost irreversibly uphold a heightened sensitivity for proper cleaning practices in public areas or practically any other space utilized by strangers. And they will inevitably judge your property on this, whether consciously or not. A lack of pristine sanitization SOPs will lead to strongly negative reviews, unlike in months or years past where a guest may have let it slide or only docked a single star

There will be an increased emphasis on in-person socialization. Peoples' priorities for what type of OOH experiences they choose are likely to change. Having been physically and socially isolated from friends and family for so long, one decisive deciding factor will be a craving for highly social IRL experiences. This will include food and drink experiences, which are very social. The social aspect of meeting up and sharing food and drink together is typically more important than the food and drink itself. When asked to remember their most memorable meal, most people can't remember everything they ate, but they remember who they were with.

Retail uber-apocalypse - The availability of vacant retail stores at attractive locations on financially attractive rental terms could spur entrepreneurs to open new entertainment centers on the mistaken belief the "old normal" will return or in anticipation of a roaring 2020s. Some might be successful if they are new business models for the "new normal". However, too many new centers could again result in an oversaturation in many markets.

Although the number of OOH E&A venues that survive will be fewer, the demand for them could be less due to the increased time spent with at-home and nature-based experiences. With less OOH E&A visits and spending to go around post-pandemic, those venues that survive will need a winning formula, a compelling reason to visit.

So, what will that winning formula be to get people to leave their homes? There will be a number of essential elements.

First is high quality, craveable food and drinks that include the elements of adventure and discovery, food and drink that you can't easily make or enjoy at home. Of all OOH leisure venue experiences, restaurants are missed the most. They were the most frequent OOH experiences people had pre-pandemic and are sure to continue post-pandemic. A significant majority of people prefer visiting restaurants over attending entertainment venues. Health, wellness, and sustainability will have heightened considerations for the venues people choose to visit and the foods they select. Plant-forward menus, functional food, and reduction of food waste are just a few of those considerations.

The second essential element is highly social experiences, not the shared ones like going to the movies sitting side-by-side, but ones where people do things IRL face-to-face, such as interactive social games. The perfect formula is when food and drink can be enjoyed while participating in social games. Think of social eatertainment experiences such as boutique bowling and social driving ranges such as Top Golf.

A third element that will drive a redistribution of demand is the desire for transformational experiences. Zoos, aquariums, museums, and other cultural venues should see increased demand. During the pandemic, many cultural institutions developed new, very elaborate virtual options, introducing people to their institutions, which is likely to contribute to people now wanting to visit them physically. For-profit edutainment venues will also appeal to the desire for lifelong learning opportunities.

Environmentally-friendly behavior by businesses is a fourth element that will drive many peoples' OOH leisure choices. Millennials and higher educated people show the greatest environmental concerns, and they are the overwhelming majority of the now bifurcated OOH E&A market.

Many of our new and increasing non-OOH E&A behaviors and habits are likely to stick and continue even post-pandemic, permanently replacing some of the prior OOH ones. Yes, most people will return to visiting OOH E&A, but probably less frequently, as leisure time is a zero-sum game. You only have so much of it. More of it will continue to be enjoyed as it was during the pandemic.

Instead of asking, "Is there a reason to do this online or at home?" people will now be asking, "Is there a good reason to do this away from home?" The new at-home and virtual opportunities and habits will be formidable competition to the forms of OOH E&A that existed pre-corona. The at-home options are far more convenient and less costly. The virtual experiences, hobbies, and nature-based activities have raised the bar for what is required to get people to leave their homes again to visit OOH E&A. Many OOH experiences that were attractive in the past will be less relevant and compelling than the at-home ones we have gotten comfortable with and are regularly enjoying.

Only time will tell how these trends and other affects from the coronavirus will reshape the future of out-of-home entertainment and arts. There is one certain thing; the future isn't what it used to be.