Vol. XX, No. 2, February 2020

- Editor's corner

- The growing kid foodie movement

- Randy White featured in Canvas8's Expert Outlook 2020 report

- Growing agritourism

- Topgolf introduces a new 3rd concept

- Why 2006-2007 was a pivotal date for the disruption of the attraction-based entertainment venue business model

- New social eatertainment concepts coming to Chicago

- An over the top children's entertainment center

- Esports venue coming to Southeast's largest mall

Why 2006-2007 was a pivotal date for the disruption of the attraction-based entertainment venue business model

On February 11th, Randy White, our CEO, gave the opening keynote speech at the Entertainment Experience Evolution conference in Las Angeles on "The Changing Landscape & Culture of Out-of-Home Entertainment." The conference was attended by over 500 top shopping center/mall and location-based entertainment executives. His presentation received accolades from attendees. Many commented that it was the best presentation of the entire conference. This article is based on some of the content in Randy's presentation.

A number of pivotal events and trends that first emerged in 2006-2007 have evolved and converged to transform the culture of out-of-home leisure and entertainment (OOH E&A). The culture has become something a whole lot different than what is was back then, resulting in the need for completely new business models.

You might consider 2006 as the beginning of the cultural foodie revolution. That was the year that social media began to take off (although we didn't yet have foodporn). That was when food television shows like Top Chef and No Reservations made the idea of being a chef cool. That year marked the rise of food bloggers like Eater and Serious Eats, which gave restaurants a 24/7 news cycle, made chefs into celebrities and raised the publics' interest in new culinary experiences.

In his book Burn the Ice , James Beard Award-winning food journalist Kevin Alexander postulates that 2006 marked the beginning of the golden age of American dining "when a generation of bold, innovative, even reckless young cooks started expanding the frontiers of trailblazing restaurants all over the U.S. He pegs that as the year that Gabriel Rucker opened Le Pigeon in Portland where he introduced a new aesthetic that became cool for diners "to care about where things were grown, and to know if restaurants got their Cornish game hens from small farmers, or made the bar they built out of discarded ceramic tubs by hand."

Two years later in 2008, the food revolution continued to evolve when then unknown chef Roy Choi launched the first 'foodie' food truck featuring Korean-Mexican fusion tacos called Kogi BBQ in Los Angeles and started using Tweeter to let people know where the Kogi truck was going to be serving: posting multiple times per day, even per hour about their location and specials.

Then in 2010, we saw the first foodporn photos posted on Instagram. Since then, the public's pursuit of adventure and discovery with food and drink has mushroomed to where we are today with the majority of Americans (53%) now considering themselves foodies. The culture of dining and drinking was changed forever.

The second pivotal event took place June 29, 2007 with the sales of the first personal digital hand-held device that connected to the internet - the iPhone. With the iPhone, for the first time, consumers could view and post to their social media accounts anywhere, anytime. Social media was no longer a location-restricted, home-bound activity on a computer.

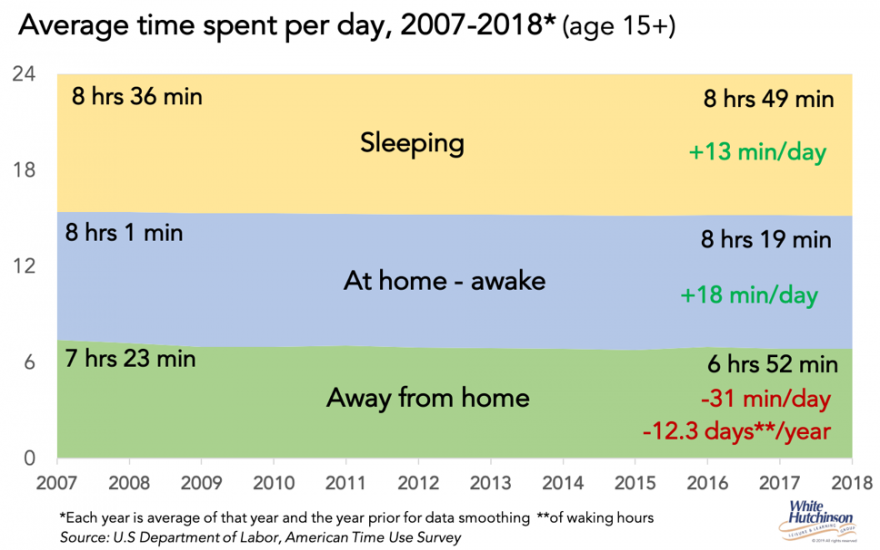

The third pivotal event was the Great Recession that began December 2007 and continued until June 2009. The Great Recession and the resulting financial distress and anxiety consumers experienced brought on an abrupt sea change of an increase in their time spent at home and a decrease in time spent away from home, which hasn't recovered since. Between 2007 and 2010, consumers age 15+ decreased their time away from home by 24 minutes a day and it continued to decline to over one-half hour (31 minutes) less time per day away from home in 2018 compared to 2007. That's the equivalent to more than 12 less waking days a year away from home.

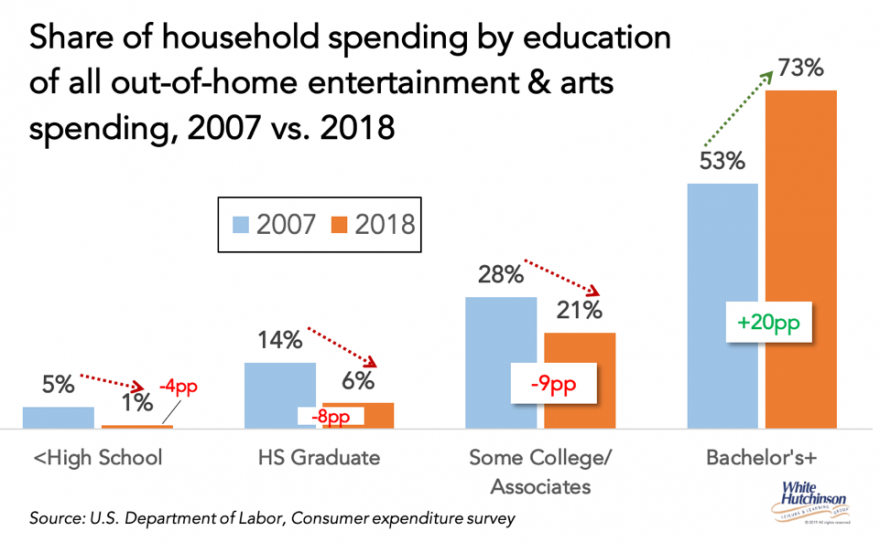

In addition to the impact of e-commerce, telecommuting, mobile banking and other activities that can now be digitally accomplished at home contributing to the increase in time spent at home and decrease away, people also increased the time they spend on at-home digital entertainment and decreased the time they spend attending OOH E&A. The OOH E&A time still hasn't recovered to pre-recession levels. As a result, annual attendance for age 15+ is down by one-half less visit per year than in 2007. As with entertainment expenditures, time spent has not recovered for the middle class and lower socio-economic, while it has for the higher socio-economic. Bachelor's and higher degree age 25+ adults now account for half of all time spend at E&A venues by age 25+ (49%), yet they are only one-quarter of 25+ adults.

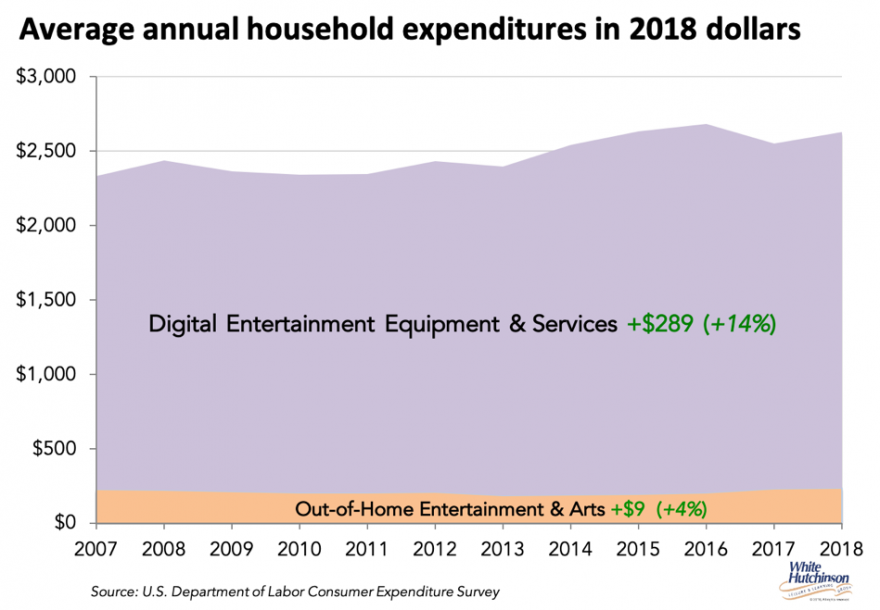

The Great Recession also brought on more frugal entertainment spending. Consumers shifted more of their spending and time to less expensive, at-home, digital entertainment options - watching their big screen TVs and playing video games - rather than visiting OOH E&A venues. The cost of streaming movies or a TV series or playing video games is only a few cents per hour whereas OOH E&A cost many dollars per hour. And you didn't have to spend any of your leisure time traveling to and from some OOH E&A venue. Since 2007, digital entertainment spending for equipment and services has continued to grow at multiples of the growth in OOH E&A. A-home and personal screen entertainment spending is now more than ten times the spending on OOH E&A fees and admissions.

It's only in the past couple of years that average household spending for OOH E&A has recovered to its pre-recession level, but even then, no different than for time, it hasn't recovered for the middle- and lower socio-economic classes. Average household spending is up solely due to an increase in spending by higher-socioeconomic households. Bachelor's and higher degree households have grown from a little over half of all OOH E&A spending in 2007 (53%) to almost 3/4s in 2018 (73%). Spending continues to be down for the middle class and lower-education households.

As significant as the shift for entertainment time and spending from out-of-home to at-home entertainment has been since 2007, a seismic change in the culture of out-home-entertainment brought on by these pivotal events is even more impactful.

The fourth level of Maslow's Hierarchy of Needs is "esteem, recognition and respect." Prior to the introduction of the smartphone and its use for social media, conspicuous consumption of things was the predominant way people gained status, whether it was some logo on their clothing, the car they parked in their driveway or the purse they carried. Gaining status for owning status-worthy things took time as it took time for a person's social signaling group to be exposed to and see those items. At the same time, there was the nascent emergence of the experience economy. The smartphone and with it the ability to instantly post, broadcast to all your followers on social media photos of envious experiences you are having simultaneously while you are having them accelerated the transition to the experience economy and a shift from the conspicuous consumption of stuff to conspicuous leisure.

There was a shift of peoples' identity from "I am what I own" to "I am what I do." Now, two-thirds of people would rather be known for their experiences than their possessions. Signaling your identity and gaining social capital has shifted to the experiences we have and post on social media. Today, a majority of people are collecting experiences to add to their Experiential CVs, which are documented by their social media postings, predominately on Instagram and Facebook. In fact, for many people, especially younger adults, if some entertainment experience isn't Instagrammable, it probably isn't worth doing.

The more status-worthy experiences you can post, the greater your social capital. So, people are constantly seeking new and unique experiences that their social media followers haven't experienced and will be envious of, will want to do due to FOMO (fear of missing out).

In addition to the social capital value of unique experiences, evolution wired our brains to crave novelty, as new experiences cause the release dopamine, the feel-good neurotransmitter that gives us pleasure.

People today are looking for the perfect 'Gram.' Research shows that they are willing to visit and spend more money than they otherwise would have on some experience that has a high conspicuous leisure Instagrammable value, especially ones that will trigger FOMO with their followers.

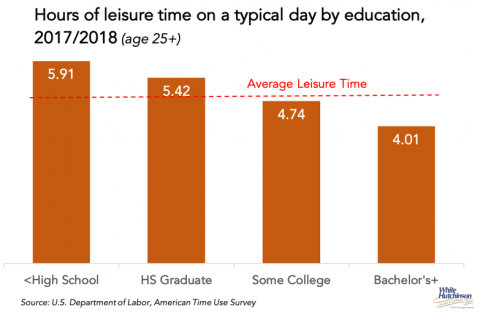

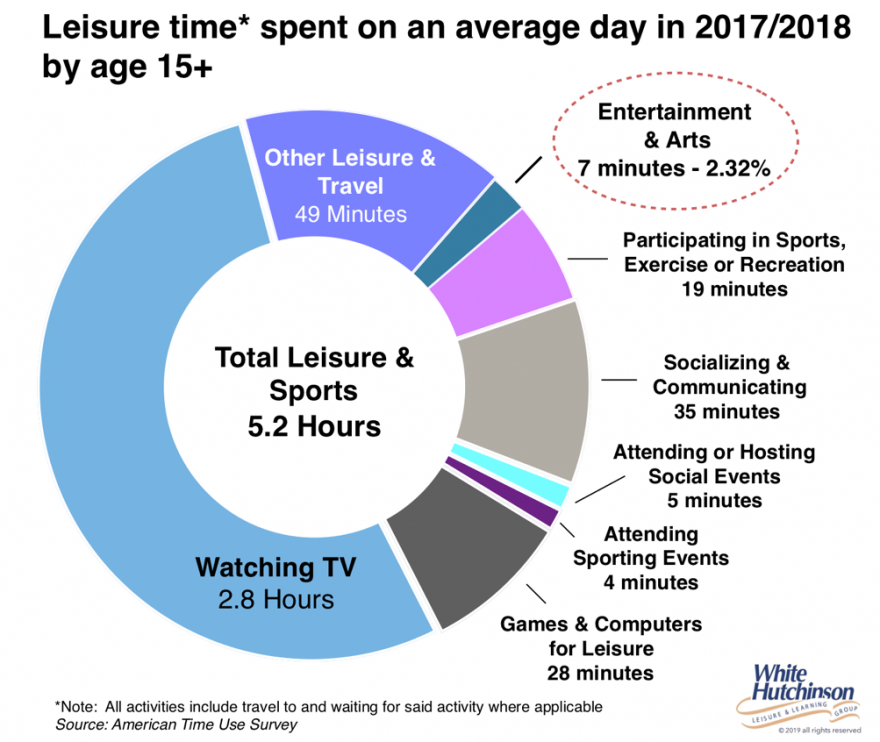

Many people today are experiencing time pressure. The truth is that the amount of leisure time people have, on average 5.2 hours a day, hasn't really changed for decades other than minor fluctuations of a few minutes from year to year. One theory of why people feel time pressured is that there are so many options of what they can do today, but not enough time in which to do them all. People who are the most time pressured are the higher socioeconomic who have the least amount of leisure time each day.

People with higher status engage in what is called 'voracious leisure consumption,' making the most productive use of their leisure time, using their leisure time 'to its fullest,' pursuing and experiencing as many of the vast variety of OOH leisure options the world now offers at the highest frequency possible. Professionals, adults living alone and post-college, pre-kids younger couples tend to be most voracious in their leisure participation.

Of all the 5.2 hours of leisure time people age 15+ have each day, only a small portion, only slightly more than 2%, or an average of 7 minutes a day, is devoted to OOH E&A. And that time is inelastic. More options does not increase the share of their total leisure time they will spend for OOH E&A. As previously shown, that time and their number of visits to OOH E&A has actually decreased since 2007. So, for OOH E&A, it's a zero sum game.

Over the past few years money chasing deals, shopping center and mall landlords trying to fill vacant retail stores and generate foot traffic and entrepreneurs thinking location-based entertainment is the road to riches have brought on a massive explosion in variety and the number of location-based entertainment options in almost all markets. These include trampoline parks, FECs, indoor sky diving, adventure parks, escape rooms, zip line experiences, bar arcades, eSport lounges, axe throwing, social eatertainment centers with participatory games and destination-worthy food and drink such as Punch Bowl Social and Top Golf, eatertainment venues where you can bring your dog, VR, corn mazes/pumpkin patches, golf swing suites, cocktails and mini golf, to name just a few. Additionally, there has been a growing explosion in the number and variety of non-attraction OOH entertainment with festivals of all types, live events, foodie-worthy restaurants, food truck meet-ups, breweries, distilleries and wineries, all that satisfy conspicuous leisure consumption and compete for the zero-sum game of OOH entertainment time and spending. Today, many millennials, as well as other age adults, prefer to go to a restaurant over the movies, concert, cultural or live events. Restaurants, breweries, distilleries and wineries to a large extent have become a new form of OOH entertainment. More than half of people (51%) now consider dining in a restaurant as entertainment.

As a result of the change in consumers' preferences for new, unique, socially-shareable out-of-home leisure experiences, a whole new category of OOH E&A experiences have emerged - immersive pop-up museums and art exhibits specially designed to offer highly interactive andInstagrammable experiences. Examples include Meow Wolf, The Ice Cream Museum, Snark Park, Natura Obscura , Candytopia and themed pop-up cocktail bars.

As a result of conspicuous and voracious leisure driving Instagram -worthy variety seeking, the culture of OOH E&A has shifted from the repeat appeal that attractions had not that many years ago to unique and one- and limited-time events such as live events, festivals and concerts that are now winning a greater share of peoples OOH time and wallets. Attraction-based venues have lost much of their repeat appeal - been there, done that - so many new unique experiences to do instead.

PGAV in recent research found that every type of attraction, whether they are museums, zoos theme parks, FECs, water parks, aquariums, science centers, to name just a few types they researched, have declined in repeat appeal. Rather, they found a growing appeal of what they call "the attraction of the non-attraction," the growth in attendance to live, one- and limited-time events.

There is one additional phenomenon that is contributing to the decline in repeat appeal. People enjoy OOH E&A experiences less and less the more times they repeat the same one. The 2nd time you enjoy an E&A experience, it isn't as good as the first. The 3rd time is not as good as the second. The more people do a particular experience, the more likely they are to get bored with it, "been there, done that," and the more likely they are to move on to some new entertainment experience to enjoy. As a result, OOH E&A experiences "self-commoditize" through people's repeat visits. Social media postings of all the new unique entertainment options and the FOMO it creates now accelerates the commoditization of E&A experiences. Today, in many situations, OOH E&A experiences, especially ones based on attractions, become commoditized after just one visit and have no repeat appeal since there are so many new and unique experiences people are trying to do in their limited leisure time.

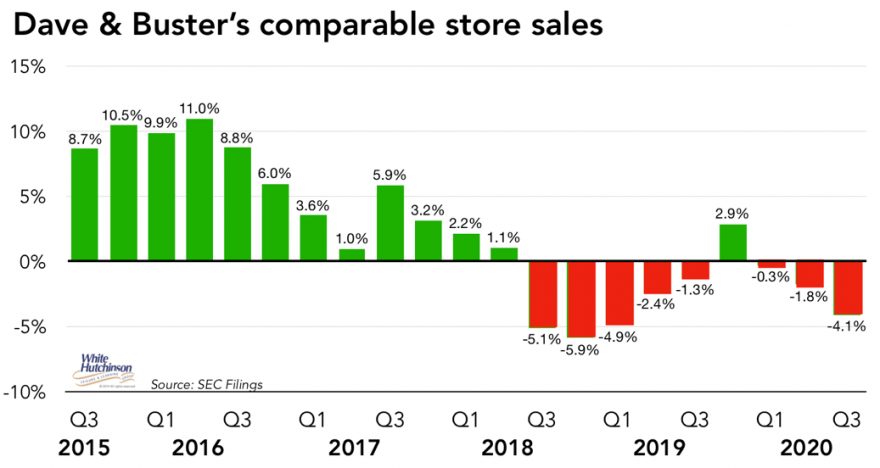

Over the past couple of years, our company has been hired by a number of existing attraction-based entertainment venues to advise them on growing their attendance and revenues. We've analyzed the attendance and revenues of thirteen different centers open at least two years. For every one, including one well-respected chain, we found a decline in overall attendance, predominately attributable to a decline in repeat attendance. Even evergreen chains such as Dave & Buster's are experiencing the disruptive shifting culture of OOH E&A to variety seeking rather than repeat visits. Adjusted for inflation, D&B's same store sales were down 3.4% in 2018 and are projected to be down around 4.0% in 2019. D&B reported that in the third quarter of their 2019 fiscal year, 45% of their stores open more than one year have seen declining sales due to either new competition or cannibalization by their own expansion.

The OOH entertainment and arts consumer, their preferences, expectations, values and behaviors have dramatically changed from only a little over a dozen years ago. As a result, there has been a transformative and disruptive sea change to out-of-home entertainment and art culture that is shifting market share away from traditional brick-and-mortar business models focused on fixed attractions to an expanding variety and number of new type venues, and even more so to one- and limited-time, live, new and unique OOH experiences, including many food and beverage experiences now considered as entertainment. Heavily influenced by the values of the experience economy, conspicuous and voracious leisure and social media, repeat appeal is losing out to "been there, done that" and the desire to move on to the greatly expanded landscape of all the new and sharable OOH experiences options that are now capturing consumers' attention, time and money. As the result, the traditional business model for permanent E&A venues with a predominate focus on attractions as the draw is no longer viable. Yes, people might come the first time, but attractions have lost the long term appeal they once had. Today, the winning formula for OOH E&A has gotten a lot more complex.

Vol. XX, No. 2, February 2020

- Editor's corner

- The growing kid foodie movement

- Randy White featured in Canvas8's Expert Outlook 2020 report

- Growing agritourism

- Topgolf introduces a new 3rd concept

- Why 2006-2007 was a pivotal date for the disruption of the attraction-based entertainment venue business model

- New social eatertainment concepts coming to Chicago

- An over the top children's entertainment center

- Esports venue coming to Southeast's largest mall