Vol. XIX, No. 6, July 2019

- Editor's corner

- Rising educational attainment

- Art-inspired mini-golf and eatertainment by Linda Beckring

- NAFDMA agritourism farm tour

- A different point of view. Can FECs be all things to all people? A response

- What are the implications of the low birth rate for entertainment centers?

- When more is not "More" by Frank Price

- Payment methods that consumers are using

- What's new with community leisure venues?

- Human contact Is becoming a luxury - The rise of participatory social eatertainment

- Suddenly the world (and out-of-home entertainment) is a different place

Rising educational attainment

Education levels have a correlation to incomes, and as a result also to spending for entertainment fees and admissions at community leisure venues (CLVs). In fact, households with an adult with a bachelor's or higher degree account for 72% of all such spending.

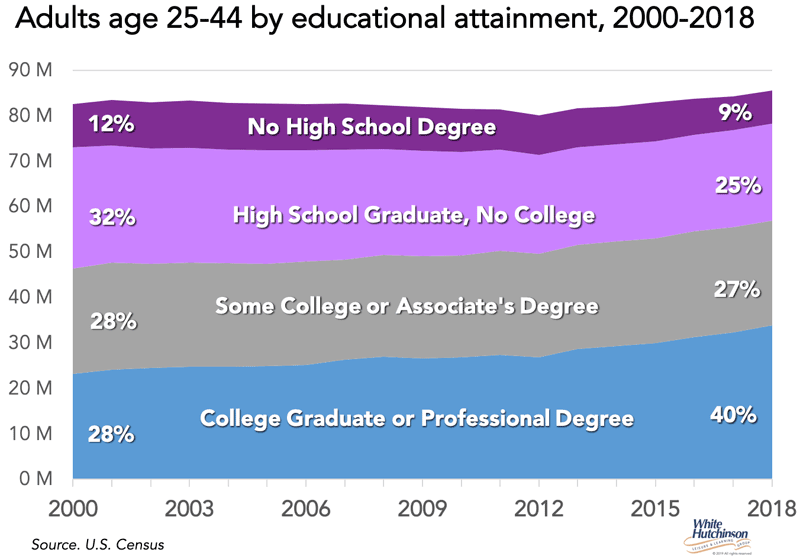

Since adults age 25-44, which includes Millennials and younger Gen-Xs, are approximately the age range that account for the majority of adults' attendance at CLVs, such as social eatertainment venues and family entertainment centers (FECs), we analyzed how education levels for this segment of the population have changed since the turn of the century.

Adults ages 25-44 with a bachelor's or professional degrees have increased from 28% of those age adults in 2000 to 40% in 2018. Their number has increased by almost one-half (46%) since 2000, while the number of adults without a bachelor's degree have decreased in number for all the other educational levels. Adults ages 25-44 with bachelor's+ have accounted for all the growth in the number of 25- to 44-year-olds since 2000.

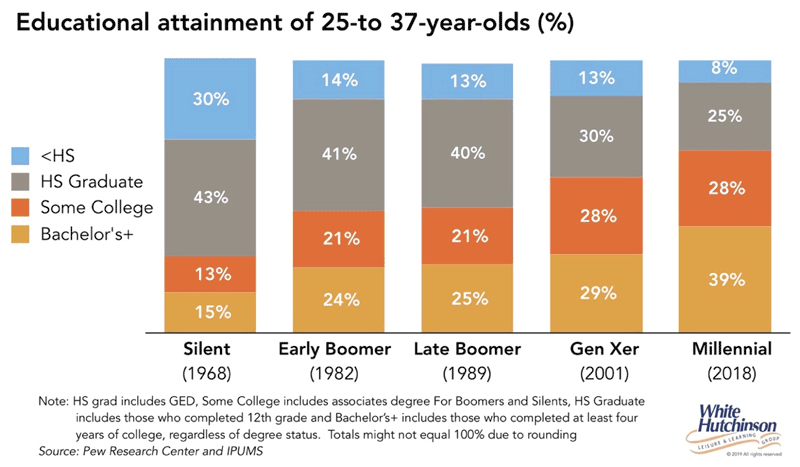

Millennials (here defined as age 25-37 in 2018) are far better educated than earlier generations during equivalent dates for their generations.

In 2018, 39% of Millennials had a bachelor's or higher degree compared with only 29% in the next oldest generation, Gen X.

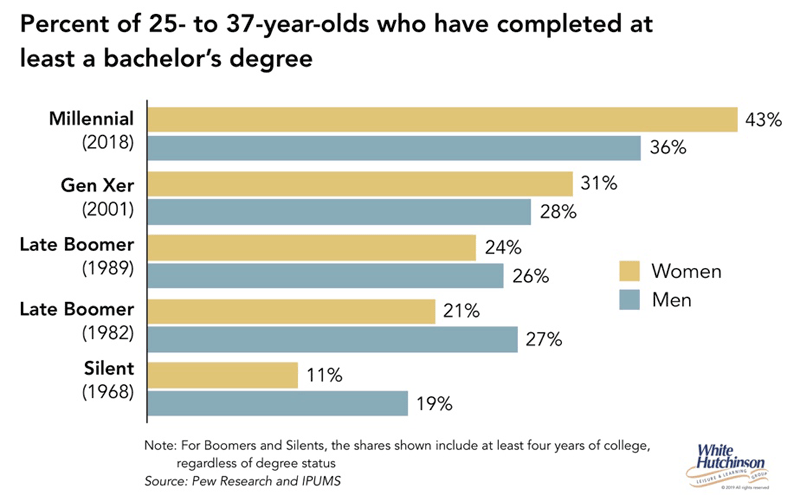

Women's rate of college graduation is now far surpassing that of men by one-fifth, 43% have a bachelor's or higher degree compared to 36% for men. Millennial women are now graduating at a rate almost four times greater than for the Silent Generation (11% vs 43% now) whereas men have not quite doubled their graduation rate (19% to 36%).

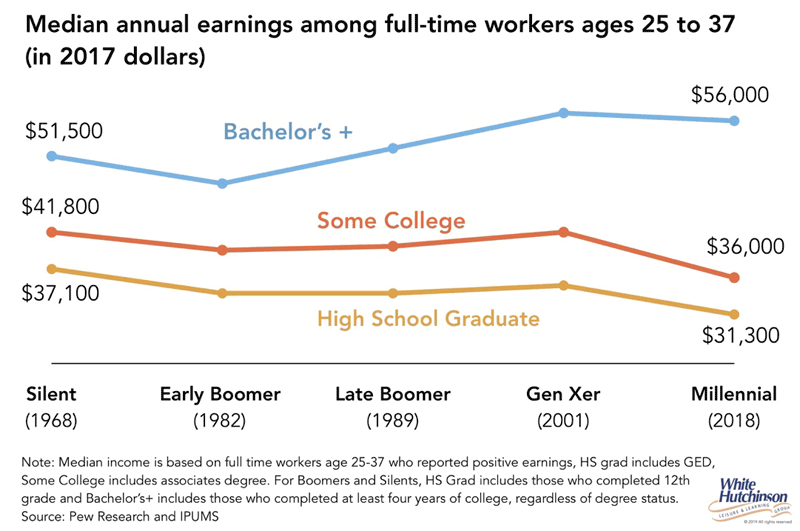

Over time, incomes for bachelor's+ adults have increased (inflation-adjusted), while those for less educated adults have declined, partly explaining why households with bachelor's+ adults now account for the lion's share of out-of-home entertainment spending (72%).

These trends show that there is a definite gentrification for out-of-home entertainment spending.

Implications for CLVs

College graduate adults are increasing both in number and as a percentage of all adults. They account for the vast majority of all spending for entertainment fees and admissions. They are the prime target market for CLVs. These adults generally have more sophisticated tastes and skew much higher as conscientious consumers with their social and environmental values. This socio-demographic group have far higher expectations for food and beverage quality, healthiness and appeal, design of facilities and customer service. They require higher-quality venues that provide higher-quality offerings and experiences then in the past when the middle class was the primary market for CLVs, FECs and similar venues. And they have the incomes and are willing to pay a fair price for the higher quality.

What this means is that for CLVs to be successful today and into the future, they need to target the upper-middle and higher-income households. Many predominately middle-class markets that might have been viable locations a number of years ago are no longer feasible markets for CLVs.

Vol. XIX, No. 6, July 2019

- Editor's corner

- Rising educational attainment

- Art-inspired mini-golf and eatertainment by Linda Beckring

- NAFDMA agritourism farm tour

- A different point of view. Can FECs be all things to all people? A response

- What are the implications of the low birth rate for entertainment centers?

- When more is not "More" by Frank Price

- Payment methods that consumers are using

- What's new with community leisure venues?

- Human contact Is becoming a luxury - The rise of participatory social eatertainment

- Suddenly the world (and out-of-home entertainment) is a different place