Vol. XVIII, No. 6, July 2018

The great entertainment bifurcation

Starting in 1892 and up until around a decade ago, The Eastman Kodak Company owned the photography market and what was known as the 'Kodak moment,' the time when you captured that one-time perfect moment with a photograph on their film. Unfortunately for Kodak, digital photography emerged and they failed to realize how consumers and the market were changing and ultimately evolving in new directions without them. The downfall of Kodak is now known as the 'New Kodak Moment,' the moment when you lose market relevance to consumers, something many other businesses such as Blockbuster's, Borders, RIM, et. al. also learned all too well.

We live in a fast-changing world with fasting-changing consumers and their values, habits and preferences. Why are so many companies falling victim today to the New Kodak Moment? The answer is surprisingly human. First it comes down to change which is psychologically and physically daunting for people. Status quo seems safe and change is scary. Second, a sense of urgency to change is unappreciated or frankly nonexistent among many profitable businesses. In either case, the oft-surprising New Kodak Moment looms on the horizon for complacent and apathetic companies.

If you keep doing what you're doing, you'll soon stop getting what you're getting.

Many community leisure venues (CLVs), especially traditional family entertainment centers (FECs), are about to fall victim to the New Kodak Moment if they haven't already as the leisure, entertainment and social landscape and its options continue to rapidly evolve.

Just as digital photography made film irrelevant, what might be called the at-home “Chill & Binge” phenomenon is making many out-of-home entertainment experiences irrelevant to consumers. Many consumers today consider chilling out at home, binging on some Netflix or HBO series, playing video games, watching sports and/or socializing with friends via social media a better option than going out to some leisure venue. Heck, with Uber Eats, Grubhub, Doordash and other delivery services, you can even have restaurant quality food delivered to your home to enjoy in front of your large screen HDTV while you sit in your lounge chair in the safely of home. Yes, cocooning, hyggeling at home is the new going out.

Many people in the FEC industry don't want to hear this - that the digital world has brought consumers many new and convenient leisure options, which have enormously raised the bar for what it takes to get people out of their homes. As a result, many, in fact most of the FEC business models that aren't even a few years old, are now fast approaching their New Kodak Moment. They no longer have the appeal they used to.

Consumer economic forces are partially driving entertainment and leisure experiences to be at two extremes, either expensive and high fidelity out-of-home or inexpensive and convenient at home. The in-between, neither high fidelity nor convenient, has lost its market. Basically, what is happening is the rich are getting richer with more discretionary incomes and the poor are getting poorer.

Between 2007, right before the impact of the Great Recession, and 2016, the 20% of consumers with the highest incomes ($100,000+) experienced a 4% growth of their discretionary income. Middle-income consumers (the 40% earning $50,000 to $100,000) remained flat and the low-income consumers (the 40% earning less than $50,000) saw a one-sixth dip in their discretionary income. Since the Great Recession, virtually all income growth has gone to the top 20% by income.

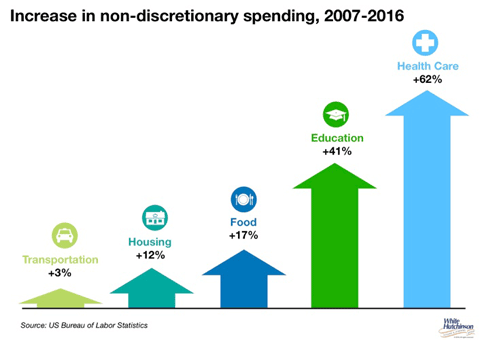

Meanwhile, the 80% middle- and lower-incomes consumers with stagnant or reduced incomes have seen the cost of nondiscretionary items skyrocket: health care expenditures have risen 62% since 2007, education 41%, food 17% and housing 12%. Increased expenditures in these categories have left far less income, if any for other expenditures, including discretionary ones such as out-of-home leisure and entertainment. In fact, for the lowest income group, basic essentials now take up more than 100% of a low-income family's budget. In 2016, their nondiscretionary expenditures were 123% of their income.

At the same time, mobile phones and data plans have become consumer essentials and are taking up an increased portion of discretionary spending, stealing share from other things such as out-of-home entertainment. Low-income consumers now spend 3.6% of their income on digital devices and data, compared with just 0.7% for high income earners.

The bifurcation of consumer income levels and disposable incomes is dividing the entertainment market along economically-driven divides. The more affluent consumers can afford the more expensive out-of-home leisure and entertainment options, while lower-earning consumers, faced with growing expenses and less disposable income have turned predominately to at-home, less expensive digital entertainment options.

We now have a bifurcated entertainment and leisure market. At one extreme are all the digital and highly convenient digital options that have minimal cost per use and can be enjoyed at home. At the other end are the high fidelity, more expensive and inconvenient out-of-home experiences, whether it's visiting Disney World or a live music concert or food, beer and wine festivals. Mediocre experiences, those not at either end of the extremes, no longer have appeal. When they do leave their homes for some entertainment and leisure experience, even the less affluent consumers will save up to enjoy the higher quality, high fidelity ones rather than waste their hard-earned money on some mediocre experience.

And the bar for out-of-home experiences is going higher and higher every day, as the at-home digital options get better and better. One example is sports events, which are seeing a decline in attendance. It's no longer satisfactory to just have a ticket to sit in a seat and be a spectator when the at-home big screen sports viewing experiences has gotten so much better. You can be a spectator at home in your PJs without all the hassle that's involved in parking and going to some stadium. In fact, a 2017 study by YouGov found that 59% of Americans prefer to watch sports games on TV.

In January 2017, Populous ran a survey of consumers who attended sports games to determine what changes it would take to make sports venues more inviting. The survey found that 70% said the single most important thing for them was having an experience, a unique experience and they are willing to pay for it. They're looking to be able to move around to different seats, to migrate around the venue and get two to three different experiences, such as being able to have a drink in a premium club and then wander to another club for a different viewpoint of the game. They want more social experiences. Brian Mirakian, a principal at Populous, said, “Viewing the action is just going to be part of the in-venue experience. This is a fundamental shift.”

We've also written about how the movie theatre industry has had to up their bar with electric lounge chairs and restaurant quality food and drink to compete with the lounge chair, movie viewing option at home. And when they do go to the cinema, consumers are willing to pay a premium for the more quality and higher fidelity experience.

Yes, it's a bifurcated entertainment market. If you don't offer a high fidelity, premium out-of-home experience, the consumer just stays home with their convenient and inexpensive digital options.

No one needs to leave home to visit a community leisure venue such as a family entertainment center or an eatertainment venue. Today, to get people to leave the safety and comfort of the home cocoons, the experience needs to be a high quality, premium and unique experience, one that is sharable with your friends or family, both in person and on social media. And it better include top notch food and beverage.