An early version of this article first appeared in a two part article in the June and July 2009 issues of the White Hutchinson Leisure & Learning Group’s Leisure eNewsletter.

Download a PDF copy of this article by clicking here.

![]()

The feasibility study, the blueprint for success

by Randy White

© 2009, White Hutchinson Leisure & Learning Group

The feasibility study is one of the most misunderstood aspects of developing a location-based leisure (LBE) business, whether the LBE is a family entertainment center (FEC), children’s entertainment or edutainment center, bowling center, eatertainment facility, or any of the multitude of hybrid combinations of entertainment, edutainment, recreation, dining and leisure. Yet, the feasibility study is the most important step in developing an LBE, because it lays the foundation for everything else that follows for the project’s design, development and management. Omissions or mistakes at this early stage will permanently handicap a project’s success, perhaps fatally. A good feasibility study is more than just a set of financial numbers. Done properly, it becomes the market-driven strategic plan that is the road map for a project’s entire development, including its brand development. A well-executed feasibility study doesn’t just address the question, “Is this project feasible?” It determines what is most feasible, identifying exactly who the center’s target market should be, as well as defining the mix, positioning in the marketplace, design and other necessary attributes to result in maximum success.

Feasibility studies are far more complicated than just getting a set of demographic numbers and doing some financial projections. They are not a job for novices, especially LBE developers who can easily seduce themselves with numbers based on their lack of feasibility expertise and the many inherently human biases (read Beware of roadkill traps).

The Market Area

The first step of feasibility is to define and examine the market area to evaluate both direct and indirect competition and determine the characteristics of both the resident population and tourists (if applicable). This is often where several mistakes are commonly made:

- Defining a single market area rather than both a primary and secondary market area

- Defining market areas by concentric circles, based upon some set of mileage distances, such as 5 and 10 miles, rather than drivetimes and other market dynamics

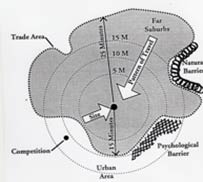

Market areas are amoeba-shaped. |

The further away consumers live from a project, the less the market penetration—the percentage of residents the project will capture and the frequency of their visits. Consumer behavior isn’t based on “rule-of-thumb” mileage distances. Instead, they decide which location-based businesses the will visit based on the location and the quality of competition, drive times, their normal travel patterns, physical and psychological barriers and many other factors. True trade areas end up being amoeba-shaped and often extend much further in one direction than another. In some markets, the primary trade area might extend a 10-minute drive in one direction and a 20-minute drive in another. In densely developed areas, a 10-minute drive might cover only 2 miles, whereas in less dense areas, with few traffic lights and good road access, 10 minutes might extend 6 miles or more. We have studied market areas for existing facilities that extend only 10 minutes, while we have seen others that reach 1.5 hours in one direction and only 15 minutes in another. Defining market areas is both a science and an art, and requires years of experience and know-how. If the market areas are not accurately defined, all analyses and decisions that follow will be flawed.

Market Penetration

Market penetration varies by distance or drive time. So primary and secondary markets are defined to calculate probable attendance, as the primary market area will have a higher market penetration rate than the secondary. As part of the process of determining penetration rates, it is important to also examine exactly where residences (and sometimes workplaces and hotels) are located within the market areas. This is done using dot density maps. If the bulk of residents are located near the perimeter of the primary market versus near the project site, this has an impact on the market penetration (this is also a useful tool to evaluate site options before a site is chosen).

This site has population to the west and south, but little to its east.

The Site

Another feasibility issue that trips up many developers is trying to define and analyze a market without a specific site. Yes, you can do a general evaluation of a market to see if looks like a project will be feasible, but without a site-specific analysis, you can’t do an accurate market feasibility analysis. The site has an impact on both the location of the market areas and the market penetration rate. One site might be feasible, whereas a site just one mile away might generate only 70% as much business and ultimately not be feasible. The site’s characteristics, including visibility, access, and adjacent uses and businesses have a significant impact on both the size of the market area and on market penetration.

Demographics and Socioeconomic/Lifestyles

Once primary and secondary market areas are determined, competition within and near those areas must Once primary and secondary market areas are defined, competition within and near those areas must be researched and evaluated to determine what populations they are capturing and their market share. No matter how superior the new LBE might be, existing competitors will continue to capture a piece of the pie.

Both the demographic and socioeconomic/lifestyle (SEL) characteristics of residents and tourists (if the tourist market is significant) need to be analyzed. Just looking at demographics rarely results in a clear picture of the potential market size. The best demographics can do is provide a picture of the population in aggregate, averages and medians. It’s sort of like trying to describe a rollercoaster by its average height, a straight horizontal line. It really doesn’t let you understand what a rollercoaster is. Suppose the proposed project is targeting families with children between the ages of 5 and 12. Yes, you can determine from demographics the number of children in that age range. What demographics can’t tell you, however, is the number of children who belong to families in specific income brackets, or the educational attainment of their parents or the lifestyles and behaviors of those families.

SELs cross-match demographic variables with values, behaviors and lifestyles. SEL analysis provides a precise breakdown of the market population. It can give you a breakdown of families with children between the ages of 5 and 12 so you can understand their distribution by income level, education, employment and lifestyles. It also allows you to do something very important — determine exactly which group of families your facility needs to target. Should it target middle-income, blue-collar families; upper-middle income, college-educated, white-collar families; or higher level socioeconomic families? A location-based leisure facility can’t expect to attract all SEL families, any more than an IHOP restaurant expects to attract the same customer as a McCormick & Schmick’s restaurant or a Nordstrom department store expects to attract a Walmart customer.

An LBE needs to be developed to attract a particular market niche as its primary target market. This is a critical first step in defining the business’ brand. Without a clear understanding of the core customers you want to attract, you can’t create a brand that matches their tastes, needs and values. In today’s competitive market place, building a strong emotional brand connection with the customer is essential to success. This is why SEL analysis becomes so important. Most LBEs can’t expect to appeal to more than 20% of the overall population. Some types of LBEs are successful by attracting as small a market niche as 5% of a market area’s population. Many times, the more highly targeted an LBE is, the more successful it will be. Trying to make an LBE appeal to all people only results in delivering mediocrity to everyone. The successful formula is to gain a large market share from a clearly defined niche market, known as focused assortment.

SEL analysis also can be used to segment workers in the area who might generate a significant portion of revenues, whether it is for lunch business, corporate parties or after-work activities.

Refining the Concept

The next step is to examine the demographic and SEL data, compare it to what the competition offers and who they are attracting, and from that information, define what the center will be, its mix, its features and its target market niche. Many LBE developers start with a particular center type and mix and never change, despite the market analysis findings. This can be a big mistake, as it could end up with a center that is a mismatch for the market’s potential.

Refining the concept requires more than just looking at the demographic and SEL numbers and selecting the largest segment with similarities. It also requires looking at participation rates for different attractions and activities and at spending by the different demographic and/or SEL groups. Our company uses a lot of published and original proprietary behavioral and spending research when working with a client to refine an LBE’s concept. Targeting a smaller niche market with a high participation rate for the center’s offerings can generate more revenue than targeting a larger population segment that has a low participation rate. In terms of spending, higher socioeconomic households spend more on away-from-home leisure and food away-from-home than do lower socioeconomic households. They also have higher visitation rates to museums and informal-learning institutions. Developing new concepts and what are known as white space projects also requires studying consumer trends. Consumers are constantly evolving, as are their likes, dislikes, values and tastes. Location-based experiences also need to evolve to keep pace with those changes. All these parameters need to be considered in defining the LBE’s target market niche, concept, mix, brand and design.

There are many ways the original center concept might need to be changed. For example, suppose the LBE was originally planned to be a family entertainment center with a destination restaurant, rides and games for families with children. The market study might find a significant number of upper-middle and higher income families with children. It might also find a large number of bowling centers, but they are all older “bowling alleys” with league bowlers that don’t attract a family market. This opens the possibility of modifying the mix to include some open-play family bowling to strengthen the center’s appeal. There is no such thing as a standard FEC or LBE formula. A center needs to be customized to its market area to enjoy the greatest attendance, revenues and profit.

Right Sizing

Once the basic mix is worked out, the center needs to be right sized. Attendance projections need to be made for each type of activity at the center. This includes general admission, birthday parties, other groups, school field trips, etc. This boils down to accurately determining the LBE’s operating capacity, which is the number of customers a center needs to accommodate at its peak period time on its design day, usually a Saturday. This results in a center big enough to reasonably accommodate the large number of guests who come on busy days, while at the same time not expending unnecessary capital to make the center larger than necessary. It also prevents the development of a center that is too small, resulting in overcrowding that can drive away business and leaving room in the trade area for a competitor.

Once the basic mix is worked out, the center needs to be right sized. Attendance projections need to be made for each type of activity at the center. This includes general admission, birthday parties, other groups, school field trips, etc. This boils down to accurately determining the LBE’s operating capacity, which is the number of customers a center needs to accommodate at its peak period time on its design day, usually a Saturday. This results in a center big enough to reasonably accommodate the large number of guests who come on busy days, while at the same time not expending unnecessary capital to make the center larger than necessary. It also prevents the development of a center that is too small, resulting in overcrowding that can drive away business and leaving room in the trade area for a competitor.

Right-size calculations are critical to properly designing every component of the center, including the needed entertainment capacity — the number and size of rides, number of bowling lanes, number of miniature golf courses, the length of the go-kart track, capacity of play areas, capacity of laser tag arena, number of games, size of the redemption counter, etc. If there is not adequate entertainment capacity, guests end up standing around with nothing to do or waiting in long lines. In either case, they are unlikely to return. The number and size of party rooms needs to be right sized to meet market demand both for the size and number of birthday parties. There needs to be the right number of restroom fixtures and parking spaces. Right sizing impacts even the kitchen design. At peak times, how much food needs to be produced per hour? What size should the ovens be? How much refrigeration and freezer space is required for storage? How many seats does the restaurant need? Does there need to be one or more POS stations? The list of right sizing issues is endless.

The Preliminary Plan

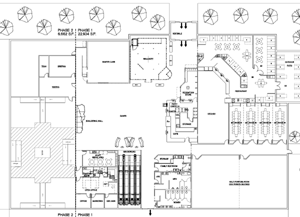

The cost of a center can't be determined without a preliminary plan. |

Now it’s time to design the schematic or preliminary plan. This is a step many LBE developers skip, which gets them in serious trouble with both their investors and bankers. Without a preliminary site and floor plan, it is impossible to determine the LBE’s size, or if the LBE is to be located in an existing building space, whether everything will really fit. The preliminary plans are also needed to accurately estimate the LBE’s construction cost as well as the cost of furniture, fixture and equipment (FF&E). Most LBE developers miss accounting for the cost of significant FF&E components without a preliminary plan that details them. In many LBEs the FF&E can cost as much as the construction. FF&E costs also are underestimated by inexperienced LBE developers, as they are not even aware of a lot of the equipment a center requires.

Construction Cost Estimate

Developing preliminary floor and site plans along with general finish specifications is absolutely essential to accurately estimate a project’s construction cost, including its interior finish cost. The construction estimate should be developed by a general contractor experienced in LBE-type projects and their unique design requirements. (At a minimum, the contractor should be experienced in restaurant and specialized retail construction.) Preliminary floor and site plans don’t reflect many details of the construction and finishes. Building codes requirements vary throughout the country, and code requirements also vary, based on the size of the project and the type of building construction. Only a contractor experienced in location-based entertainment (or restaurant and specialized retail) and who understands local code requirements can accurately anticipate what will go into the project and be able to prepare a realistic construction cost estimate.

If site development is involved, then a preliminary site plan needs to be developed that reflects local governmental zoning and other requirements for such items as mandated green space, set-backs, storm water retention, fire truck access, etc. All these requirements can have a dramatic impact not only on what will fit on the site, but the site development cost, as well. For example, in many areas of the country, storm water retention is required. Depending on the elevation of the storm retention pond outfall, 15% or more of the land may be required for just this. Or underground retention storage may be needed if the site is too small for aboveground ponds. Some governmental jurisdictions require a large percentage of the land to be dedicated to green space (grass, trees and bushes). Some jurisdictions restrict the removal of large trees. The list goes on and on.

Where many LBE developers go awry in construction cost estimates is by using rule of thumb per square foot cost estimates, such as $140 per square foot of building area. This number is multiplied by the floor area of the building to estimate the cost. Unless the developer constructed an identical project within the last few years in an area with similar governmental regulations and building code requirements, using rule of thumb estimates will definitely result in an inaccurate cost – most likely too low. This applies not only to new building construction, but also to an existing store or a leased building in which only interior build-out and finishes are involved.

Other Cost Items

The other areas of cost estimation filled with potential minefields are the hundreds of other items, including POS and debit card systems, other software, security systems, licenses, use taxes, shipping and temporary storage. An inexperienced LBE developer is sure to miss many items that will add up to sizable dollars. Even getting cost estimates from suppliers of major attractions can result in missed costs. Sometimes attractions require additional equipment for installation or to make them operate that the supplier does not sell. Then there are the installation and hook-up costs, some of which the general contractor might have to do.

One big area of cost often overlooked or underestimated are soft costs, which can be 15% to 20% of total cost, depending on the nature of the project and how it is being financed. Soft costs include not only financing fees and expenses, but also design, consulting, legal and accounting fees; development of marketing collateral and websites; and preopening operating and labor costs. You get the picture.

There are a multitude of items a cost estimate needs to include. A properly prepared cost estimate can include 100 or more line items, some of which are only totals of more line items. On one FEC our company produced, we counted 620 cost line items.

No matter how detailed and accurate the cost estimate may be, it still needs to have an added contingency factor. The size of the contingency percentage depends on whether it is new building construction or renovation of an existing space, in addition to the comfort level with the more uncertain cost line items.

Cost Estimate Gone Awry

Without a preliminary plan, a contractor’s construction cost estimate and a very detailed cost estimate; the project’s cost isn’t accurate (usually too low). The LBE developer secures funding from its investors and bankers based on the faulty estimate, the center is designed, and the construction goes out to bid. When the bids come in and all the FF&E costs are finally accounted for, the cost of the project is determined to exceed the funding. At that point, the developer can:

- Go back to investors and banker and ask for more money, either resulting in the developer’s ownership share of the project being reduced or the debt service exceeding a comfortable amount, or

- Delete components or finishes (the very things that matter most to a center’s guests), which will compromise the success of the center, or

- Cobble together a combination of both of the above.

These are usually the only practical options after the design plans are completed, because the clock is running on interest and project carrying costs.

Matching the Budget to the Guest Experience

Setting a realistic construction and FF&E budget at the very beginning stage of developing an LBE has implications besides just project funding. The construction and FF&E budget needs to reflect the appropriate level of quality and finishes required to attract the targeted socioeconomic/lifestyle (SEL) groups. How cheap can I build it? no longer works in the marketplace of high customer expectations. Consumers judge LBEs based not only on other LBEs, but on all the other location-based businesses they frequent, including restaurants, stores, malls, airports, hotels, etc. Each SEL group has different expectations for quality and finishes. Not spending enough on quality and finishes is actually more risky than overspending, as the targeted SEL group may well stop visiting if the LBE doesn’t meet their expectations. Where restaurant chairs might be available for $75 each, a $150 chair could be required to attract the targeted SEL group. If the construction and FF&E budget is not matched to the target market’s expectations, the LBE’s performance will be sub-optimal, or worse, it may fail.

Attendance and per capita expenditures

Professional pro forma financial projections do not just jump directly to forecasting LBE revenues. There is a proven step-by-step process to arrive at the revenues. First, attendance figures must be determined for the different categories of LBE attendance, such as general admission, birthday parties, groups, school field trips, etc. Then the average per capita expenditure for each has to be determined. For each category, the attendance multiplied by the per capita expenditure equals its line item revenues in the projections. Revenues for each category of attendance also need to be separately determined, as the cost of goods sold (COGS) for each will be different and must be calculated individually in the projections.

How do you project attendance and per capita expenditures? The answer is complex. Factors to examine include the project’s mix and level of finishes, its targeted market, the performance of comparable projects, the demographics and SELs of the project’s trade area compared to other similar projects, competition and its location in the market area, the value-price equation for entertainment in that market, possibly seasonality factors, whether a tourist market exists, whether schools operate on a typical summer vacation schedule or on a track schedule, etc. This is where the skill of a knowledgeable and experienced professional can make all the difference in accurately predicting the LBE’s revenues.

Pro Forma Financial Projections

In addition to the revenues, the other line items in the pro forma financial projections include cost of goods sold, labor costs, utilities and the various other ongoing operating expenses. An often overlooked category involves replacements, whether for updating games or attractions to keep the LBE fresh, or for replacing things that just wear out or begin to look too worn. The total costs for replacements become more sizable after the first year of operation.

Projections are much more meaningful if initially prepared on both the basis of EBITDA (earnings before interest, taxes, depreciation and amortization) and cash flow rather than on profit and loss. A business can be making a profit, but still not have enough cash to pay its bills. For a new project, what is most important is to determine the cash flow available for debt services and to generate a return for the investors and owner. Projections also need to address issues like return on investment, debt coverage ratios and the return to investors.

Projections are much more meaningful if initially prepared on both the basis of EBITDA (earnings before interest, taxes, depreciation and amortization) and cash flow rather than on profit and loss. A business can be making a profit, but still not have enough cash to pay its bills. For a new project, what is most important is to determine the cash flow available for debt services and to generate a return for the investors and owner. Projections also need to address issues like return on investment, debt coverage ratios and the return to investors.

The feasibility study is the foundation for an LBE’s success. Mistakes or omissions in any aspect of preparing the feasibility study can seriously handicap or possibly even doom a project.

Randy White is the CEO of the Kansas City, Missouri- and Doha, Qatar-based White Hutchinson Leisure & Learning Group. The company specializes in the feasibility, design and production of location-based entertainment and leisure venues. Randy can be reached at +1.816.931-1040, ext 100 or via the company’s website www.whitehutchinson.com

Additional reading:

- Size Does Matter: Selecting the Right Size for Your Center

- Not All Populations Are Created Equal: Understanding the Differences to Maximize Success

- Niche Marketing: The Difference between Hitting and Missing your Target Market

- Pink slips create entrepreneurs; beware of the roadkill traps

- Beware of roadkill traps