The Grounded Consumer: Changing the Paradigm of Shopping Center Entertainment

by Randy White, CSM CEO of White Hutchinson Leisure & Learning Group

Download the article by clicking here.

In the 19th century, economist Thorstein Veblen coined the term conspicuous consumption, which he defined as acquiring valuable possessions visible to all as a signal of one’s wealth, success and status. During the 53 years since Victor Gruen launched America’s first enclosed shopping mall, conspicuous consumption has been the key driver for retail and shopping center growth in the United States.

What is now being labeled the Great Recession is having a profound and lasting impact on consumers. Most businesses are currently in a survival mode, trying to tread water until the recovery when the economy returns to normal. What they don’t realize is the “normal economy” as we knew it is history. Unlike past recessions, and similar to the lasting impact the Great Depression had on consumer behavior and attitudes for a generation, the post-recession culture of consumerism will be far different. The normal economy is being redefined. The new consumer rising from the ashes of the economic meltdown has been shaped by a number of nascent (but now accelerated) trends that started a number of years ago -- as well as the shock of the sudden and severe recession. The new Grounded Consumers have a different value equation. They will:

No longer live beyond their means.

In the past, the majority of consumers measured their worth based on the cash they brought in plus their credit limit. They bought what their credit could support, rather than what they could afford. The unleveraged Grounded Consumers make the distinction between what they want, what they need and what they can afford. The culture of the highly leveraged consumer is history.View “less” as the new “more.”

Grounded consumers don’t define themselves by what they buy and own. They firmly believe consuming is not the reason for living. Buying less and being thrifty is the new status symbol. Furthermore, they are removing unnecessary stuff from their lives and replacing it with an emotional and social sense of themselves. The Homo Economicus species that defined itself by “shop till you drop” consumerism is becoming extinct. Grounded consumers may avoid the mall for all but needed purchases. Why invite temptation?Place a higher value on family and community, shifting from an egocentric Me Economy to a socially conscious We Economy.

The social and emotional bonds in peoples’ lives now have far greater importance than in the past. The needs of family, community, society and the Earth weigh heavily in peoples’ lives — and in their purchasing decisions.Maintain fun in their lives through experiences and luxuries that don’t exceed their means.

Grounded Consumers want to enjoy life and make time for fun and shared experiences. They are looking for simple pleasures that don’t break the bank — or take them to the mall. The Grounded Consumer will obtain personal gratification through trading up to small and larger luxuries and maintain fun and enriching experiences in their life.

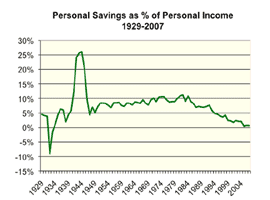

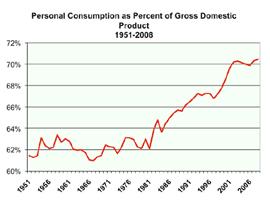

Grounded Consumers also will borrow less and save more than in the past. What this means for retailers and shopping centers is the Grounded Consumer will spend less on stuff. This paradigm shift is already well under way. The consumer savings rate has increased during the past few years from below zero to 6.9% in May 2009, the highest since February 1995. Most economists predict it will continue to go even higher. Consumer revolving credit, made up of credit and charge cards, has been falling at an annual rate of more than 6% since the third quarter of 2008. Consumer spending as a percentage of gross domestic product (GDP) increased from 61% in the early 1950s to a peak of 72% just a little over a year ago. Economists predict that consumer spending in the future will be at two-thirds of GDP, where it was about 10 years ago. A recent survey of 5,000 U.S. consumers by Alix & Partners predicted post-recession spending will go back to just 86% of pre-recession levels, which is about a 10% drop in spending. Lee Scott, Walmart’s president and CEO, sees the consumer having new patterns of frugality that will live on long after the recovery. Paco Underhill, CEO of Envirosell, a retail consulting firm, says that conspicuous consumption has now become bad manners.

The rapid emergence of Grounded Consumers and their decreased spending is not the only challenge facing shopping centers needing to adjust to this new economy. The classic mall anchor, department stores, have been consolidating and closing. Consumers’ dissatisfaction with enclosed malls has likewise been growing. In their fifth annual survey of consumer dissatisfaction conducted last fall, the Baker Retailing Initiative at the Wharton School and the Verde Group found consumers are aggravated and uninspired by the sameness and predictability of shopping malls. The most common problems included an inadequate selection of restaurants, a lack of anything unique, too many stores carrying the same products, difficulty finding a parking space, too-limited selection of stores, too few restrooms, not enough signs and elevators, too many teenagers hanging around and no evidence of environmental consciousness.

Wharton marketing professor Stephen Hock, director of the retail initiative, puts it this way: “People go to the mall, and nothing stands out or makes the experience fun or exciting. There is no sense of discovery. Nothing catches the eye. It’s the same restaurants and the same stores in every mall. People are spending less time shopping aimlessly. I think this is a long-term trend. People are still shopping and spending but they do it less often and it has to be more purposeful.” This dissatisfaction was evident even before the full onset of the recession.

In a nutshell, most malls are boring. “Lifestyle centers,” which are new open-air centers, are trying to provide the ambience and flair most malls lack. However, in a recent white paper issued by The Center for Hospitality Research at Cornell University, commentator Karl Kalcher says most lifestyle centers “have begun to display the sameness similar to that of malls. These centers all seem to look like a set from the same mock Italian hill town, no matter whether the center is built in Maine or Mississippi” and contain the same national brand stores and restaurants as every other property in the same trade area.

And on top of all these issues, on-line shopping is slowly gaining market share, making a trip to the mall less necessary or relevant.

Many of all but the very best retail properties could soon become ghost towns, considering:

- Consumers making what appears to be permanent lifestyle and consuming changes,

- Store bankruptcies and closings, and

- Shoppers being dissatisfied with the sameness and unexciting experience of visiting most malls and even new lifestyle center

Green Street Advisors, Inc., a real estate research firm, predicts around 100 malls will join the dead-mall category by the end of 2010. Even the very best centers could have long-term vacancies. Between 1990 and 2005, consumer spending per capita rose 14%, adjusted for inflation, while retail space per capita in the U.S. doubled. The International Council of Shopping Centers reports there is currently 22.9 square feet of shopping center GLA for every man, woman and child in the country. That magnitude of retail space is not supportable by Grounded Consumers’ reduced expenditures on stuff. May 2009 non-anchor mall sales saw a 11.2% decline compared to May 2008, and May year-date sales were down 6.2% compared to the prior full year according to ICSC data. The basic model for shopping centers and malls built on a foundation of conspicuous consumption is fast becoming a dinosaur, and in order to prosper in the future, needs to be reinvented to attract Grounded Consumers’ time and money.

What is the answer? How can centers reinvent themselves to appeal to the post-recession consumer? A large part of the solution is to incorporate more experiences. We have moved into the “experience economy.” Experiences, both entertaining and enriching, are taking on even greater importance with consumers as the accumulation of stuff decreases in importance. The continued increase in the education level of Americans also is driving the desire for enriching experiences that increase their knowledge. Americans want to have fun and learn something at the same time. To generate traffic, shopping centers need to retain their destination status, but more for experiences, including dining, entertainment and knowledge -- and less as a destination primarily to buy stuff. According to Paco Underhill, U.S. developers are behind the times. “It can’t be a mall. It has to be ‘place making.’ Developers have to offer synergy, some other reason to be there. People want to be able to feel as if the act of going shopping isn’t about ratcheting up their credit card debt.” In other words, it needs to be a fun, leisure experience, not just a shopping experience.

Since the earliest days of the enclosed mall, entertainment in some form has been part of the mix, whether it was background music, a central mall court with periodic fashion shows or other shows, seasonal decorations or visits by Santa or the Easter Bunny. West Edmonton Mall in Alberta, Canada, ratcheted up the equation in 1981 when it opened Fantasyland (now renamed Galaxyland), a 400,000-square-foot indoor amusement park with 26 rides. The mall later added a waterpark, ice skating and bowling. Mall of America in Bloomington, Minnesota, followed in 1992 with the 6+-acre Knott’s Camp Snoopy, since rebranded as Nickelodeon Universe. Its other entertainment attractions include an aquarium, NASCAR Silicon Motor Speedway, miniature golf and a casino.

Several dozen North American malls have included amusement areas with rides or family entertainment centers (FECs) greater than 30,000 square feet as anchor attractions over the years. But those are the exceptions. Traditionally, amusement parks or family entertainment centers (FECs) aren’t an element in the North American mall mix. However, this is not true in other parts of the world. Particularly in Asia, no mall developer in his right mind considers developing a mall without a significant family entertainment center or other major entertainment destination (other than a cinema) as an anchor.

It appears other parts of the world are ahead of most North American mall developers in understanding the positive impact experiential and entertainment destinations can have on a mall’s success. Research has substantiated this. Visitor studies of malls with entertainment destinations and components have found:

- Between 7-25% of mall visitors came with the primary purpose of visiting family entertainment centers or cinemas

- Between 52-60% of entertainment visitors also shopped in stores

- Those shoppers spent between 35-75% as much in other stores as shopping-only mall visitors.

- Entertainment visitors are willing to travel farther than shopping-only visitors.

- There is a positive relationship between entertainment and mall profitability and value.

- Entertainment helps a mall establish its presence as the dominant regional mall and enhances its brand image.

- Consumers expect malls to provide not only merchandise, but also entertainment and fun.

As lifestyles change, department stores have been losing their appeal (especially with Generation Y) and their dominance as anchor tenants. At the same time, the American family entertainment center has been evolving from its early days of just rides and games in a large space to a variety of new hybrids. Other forms of entertainment venues are also appearing. Rather than the old formula of come for the entertainment, many are incorporating food and beverage as a major component, with the new formula of come for the food and drink and stay for the fun:

- Young adult upscale bowling lounges such as Lucky Strike and Splitzville Luxury Lanes & Dinner Lounge

- Adult dining and gameroom concepts such as Dave & Buster’s and GameWorks

- Cinema-dining-entertainment hybrids such as IPic Entertainment, E-Town, Cinnebar and Monaco Pictures

- Bowling-based family entertainment centers such as Brunswick Zone and Alley Cats Family Fun Center

- Family pizza buffet-entertainment centers such as John’s Incredible Pizza and StoneFire Pizza Co.

Other entertainment concepts announced or already appearing in shopping centers include Legoland Discovery Center, SeaLife Aquarium, live theater venues and children’s mega role-play edutainment centers such as Wannado City. We are also seeing interest in different forms of children’s play, edutainment and enrichment centers. Entertainment also is being incorporated into experiential retailers as retail-tainment, such as at Adrenlina, The Extreme Store, with its Flowrider surfing machine and at American Girl with its American Girl Bistro experiences for mother and child. Restaurants are also upping the ante with what we call experiential dining by introducing concepts such as T-Rex.

Entertainment-oriented shoppers spend less on average than shopping-oriented visitors, and entertainment venues typically cannot pay normal retail rents. For that reason, many shopping center developers in the past shied away from entertainment anchors. Today, along with restaurants, entertainment is becoming the new anchor and occupying an increasing percentage of a center’s GLA, as much as 30% or more in some instances. The rent and tenant improvement concessions once given to department stores are now being given to entertainment anchors that drive traffic and increase aggregate retail sales.

Most North American shopping center developers continue to treat entertainment as a tenant that belongs in a store space, with the exception of a few that have fully integrated entertainment into their common areas to enhance their sense of place, such as Nickelodean Universe at Mall of America, or partially with carousels or children’s soft play areas. North American mall and lifestyle developers are missing opportunities to truly make their centers experiential and have a unique sense of place. They now seem to understand the importance of ambiance and design with more landscaping, fountains and other common area amenities. Yet they still haven’t fully grasped the value of taking some of the entertainment “out of the box” so you don’t have to go through a store entrance to see or experience it and truly making it part of the shopping center experience for all visitors. This reluctance by developers probably is due to the paradigm that developers should be passive landlords that lease space rather than landlords that create experiential places. Yes, mall and lifestyle center landlords understand the importance of maintaining the common areas and marketing their centers, including staging periodic events, but they are still hesitant to take on the role of operating significant entertainment components as a business.

Entertainment districts, mixed-use and festival centers, such as Kemah Boardwalk, have learned how to intertwine entertainment into the common areas to create a much more unique, exciting and social experience for visitors and to differentiate their center from the blandness of other projects. Developers such as Cordish Companies and RED Development have taken a much more active role to ensure the destination status of their centers with their vertical integration ownership and management of some of the centers’ restaurant and entertainment venues.

In today’s challenging and competitive landscape, developers that break from the old landlord paradigm and learn how to make their shopping centers entertaining and enriching destination experiences with a true sense of place for the new Grounded Consumer will be the winners.

Randy White, CSM, is the CEO of the Kansas City, Missouri- and Doha, Qatar-based White Hutchinson Leisure & Learning Group. The company specializes in the feasibility, design and production of location-based entertainment and leisure venues and assists shopping center and hospitality owners and retailers with entertainment and edutainment strategies for their properties. Randy can be reached at +1.816.931-1040, ext 100 or via the company’s website www.whitehutchinson.com

References:

- Christiansen, Ph.D., Tim, Lucette Comer, Ph.D., Richard Feinberg, Ph.D. and Heikki Rinne, Ph.D., “The Effects of Mall Entertainment Value on Mall Profitability.” Journal of Shopping Center Research 3.2 (1996).

- Eppli, Marke and Charles Tu, “An Event Analysis of Mall Renovation and Expansion,” Journal of Shopping Center Research 12.2 (2005).

- Gregory, Sean, “How Consumers Shop Differently,” Time, (February 22, 2009).

- “Grounding the American Dream: A Cultural Study on the Future of Consumerism in a Changing Economy.” Context-Based Research Group (December 2008).

- Haynes, Joel and Salil Talpade, “Does Entertainment Draw Shoppers? The Effects of Entertainment Centers on Shopping Behavior in Malls.” Journal of Shopping Center Research 3.2 (1996).

- Haynes, Joel and Salil Talpade, “Consumer Shopping Behavior in Malls with Large Scale Entertainment Centers.” Mid-Atlantic Journal of Business (June 1, 1997).

- Hu, Ph.D., Haiyah and Cynthia R. Jasper, Ph.D., “Men and Women: A Comparison of Shopping Mall Behavior.” Journal of Shopping Center Research 11.1-2 (2004).

- Hudson, Kris and Vanessa O’Connell, “Recession Turns Malls Into Ghost Towns.” The Wall Street Journal (May 22, 2009).

- Irazabal, Clara and Surajit Chakravarty, “Entertainment-Retail Centres in Hong Kong and Los Angeles: Trends and Lessons.” International Planning Studies 12.3 (2007): 241-271.

- Kalcher, Karl, “North America’s New Town Centers: Time to Take Some Angst Out and Put More Soul In.” Cornell Industry Perspectives No. 3 (December 2008).

- Kang, Jikyeong and Youn-Kyung Kim, “Role of Entertainment in Cross-Shopping in

- Mui, Ylan Q, “Old Magnets Just Don't Attract: As the Big Stores Wilt, Malls Look to Food and Cinema.” Washington Post. (July 23, 2006): F01.

- Ooi, Joseph T.L. and Loo-Lee Sim, “The Magnetism of Suburban Shopping Centers:Do Size and Cineplex Matter?” Journal of Property Investing and Finance 25.2 (2007): 111-135.

- “Retail Real Estate Business Conditions,” ICSC Research, 6.9 (April 17, 2009).

- Rosenbloom, Stephanie, “Malls Test Experimental Waters to Fill Vacancies,” The New York Times, (April 5, 2009).

- Sit, Jason, “Understanding Satisfaction Formation of Shopping Mall Entertainment Seekers: A Conceptual Model.” ANZMAC Conference 2005: Broadening the Boundaries, Freemantle Western Australia. 05-07 Dec 2005.

- Sit, Jason, Bill Merrilees and Dawn Birch, “Entertainment-seeking Shopping Centre Patrons:The Missing Segments.” International Journal of Retail & Distribution Management 31.2 (2003): 80-94.

- “The Mall Pall: Have America’s Biggest Shopping Centers Lost Their Allure?” Knowledge@Wharton (December 10, 2008)

- “The Shopper of Tomorrow: Trading Down,” Knowledge@Wharton (February 18, 2009).

- “Theater Study Shows Impact on Shopping Malls: Study examines moviegoer cross-shopping in malls.” ICSC Research Quarterly (Spring 1997).

- “Theaters in the Mall.” ICSC Research Quarterly 6.3 (Fall 1999).

- Wang, Ph.D., Shuguang, Ricardo Gomez-Inausti, Ph.D., Marco Biasiotto, B.A., Pina Barbiero, B.A. and Bruce McNally, B.A., “A Comparative Analysis of Entertainment Cross-Shopping in a Power Node and a Regional Mall.” Journal of Shopping Center Research 7.1 (2000).