Vol. III, No. 6, June 2025

The growing influence of "been there, done that"

PGAV has released its 2025 Voice of the Visitor Report on the state of the attraction industry and its trends.

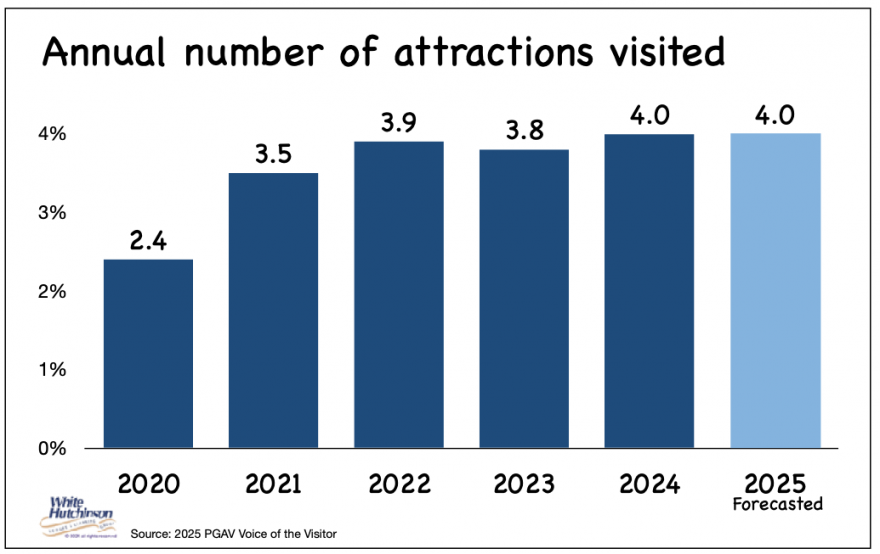

The good news is that PGAV has found that the average number of attractions visited annually has increased since the pandemic and is projected to hold steady in 2025.

One key finding was that "visitors are increasingly drawn to new experiences, prioritizing exploration and discovery over revisiting familiar destinations… Been there, done that shows a growing aversion to repetition." The report found that attraction visitors are less likely to return to the last attraction they visited than a decade ago, a four-point increase from 67% less likely to 72% currently. Non-returning visitors "are motivated by the excitement of trying something new and the value they place on unique and fresh experiences." PGAV found that younger generations (18-54) are more likely to build a diverse portfolio of unique and new experiences over visiting old ones.

Many factors contribute to the decline in the repeat appeal of many attractions.

Commoditization of experiences

One overall shortcoming of any attraction is that it quickly becomes commoditized. The 2nd time you have an experience, it is not as good as the first. The 3rd time you have an experience, it is not as good as the 2nd. The experience loses appeal after a few visits, and customers say, "Been there, done that." Instead of repeating it, they move on to something new.

Novelty seeking

It's human nature to seek new experiences rather than repeat ones. Our brains are hard-wired by evolution to crave novelty. The desire for novelty, to explore something new, is rooted in enabling us to learn something new about our environments and how to survive. Novelty triggers the production of dopamine, making us feel good, which, in turn, increases a person's motivation to seek more novelty.

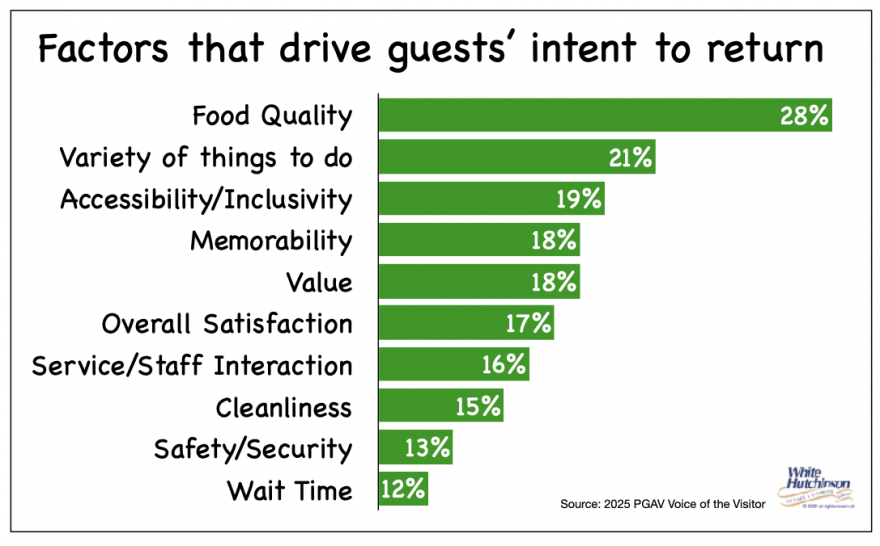

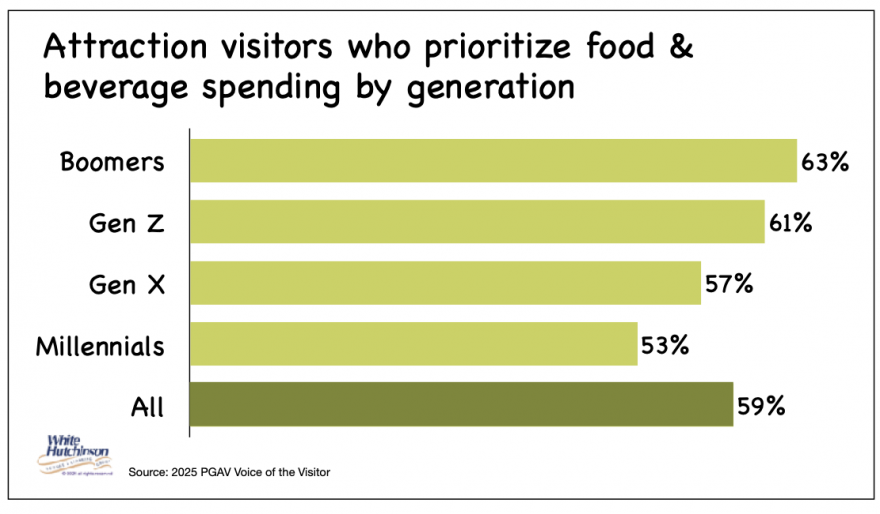

Change to what is OOH entertainment

There is a cultural shift in what is considered and valued as out-of-home (OOH) entertainment. More than half of Americans consider themselves foodies (53%). Foodies love food and are very interested in trying different types of food. They are searching for adventure and discovery with food and drink and the latest culinary trends. PGAV found that satisfaction with food quality at an attraction was the number one factor influencing guests' intent to return.

Almost two-thirds (62%) of millennials, the prime age group for many forms of OOH entertainment, now consider a good night out as more about the food, three times the percentage that rate live music as a good time out.

Along with restaurant dining, there has been a growth in the number of live and special events and festivals where the focus or a significant component is food, beer, and wine. 62% of Americans would attend an event just for the food. The craft brewery boom has resulted in many destination breweries. The number of destination cideries, wineries, and distilleries is also growing nationwide. These destinations are considered attractions, now competing with entertainment-type venues.

Conspicuous leisure and social media

Another influence is driving the desire to seek out new experiences rather than repeating them, especially for younger adults, including millennials. In the experience economy, priorities for participation in leisure and entertainment experiences have changed. The dimension of status and self-identity, the measure of social capital has shifted from owning envious material goods and stuff to participating in envious experiences. Today, what you do now matters way more than what you own. Nearly three-quarters of Americans (74%) prioritize experiences over products. Especially for younger adults, an impressive selfie capturing a memorable leisure experience is as enviable as a new car or fancy watch was to their parents. Social media has transformed conspicuous consumption. Conspicuous consumption of goods is out; conspicuous leisure consumption is in.

This experience economy means that the pursuit of experiences has taken on a more prominent role in people's lives than in the past. People use experiences as "social signaling" to express who they are or want to be and to build their identity and status, and social capital on social media. Two-thirds of Americans would rather be known for their experiences than their possessions. Experiences are the ultimate status symbol, especially for millennials. 48% of millennials and 61% of millennial parents say they attend live events to have something to share on social channels. Experiences, including out-of-home entertainment, are the new social currency.

Postings on social media can be viewed as important as the experiences themselves. For 20- and 30-somethings especially, if it isn't Instagrammable or sharable, it's probably not worth doing.

Influence of envy and FOMO

To get people to spend their leisure time and then their money at any OOH entertainment venue, including agritourism, requires getting their attention in an increasingly distractible world amidst an increasingly wide array of options available for spending that time. Seeing peoples' conspicuous leisure postings on social media generates that attention and motivates people to experience things they otherwise might never have known about.

Experience postings on social media result in FOMO (fear of missing out), creating the desire and motivation to participate in the same experiences people do to "keep up with the Joneses." This has increased conspicuous leisure, participation in, and posting as many unique, novel, and admirable experiences as possible to avoid missing out on anything. Conspicuous leisure consumption amplified by social media postings and resulting FOMO have become primary motivations for participating in as wide a variety of OOH experiences as possible rather than repeating a few.

A shift in the cultural meaning of entertainment

For many people, especially those in higher socioeconomic households (those with a member with a bachelor's or higher degree who account for 80% of all attendance spending at entertainment and cultural venues), entertainment is no longer just about fun and amusement. The bar has been raised. Along with the shift to the transformational economy, entertainment experiences now need to be meaningful, relevant, and engaging.

Almost limitless OOH leisure options

Amplifying the desire for new and unique attractions is the growing explosion of OOH options that are now almost limitless.

At the beginning of the 21st Century, OOH attractions were limited in number. In the last several decades, we have seen a massive expansion of new types of OOH experiences.

Now, there is little reason to repeat the visit to any one venue or event due to the growing expansion of the wide variety of OOH options, including the growth of the number of festivals, live events, foodie-worthy restaurants, breweries, distilleries, and wineries that satisfy conspicuous leisure consumption and for posting on social media.

There is a significant shift to variety-seeking rather than repeat visits to the same OOH experience. One- and limited-time events (O<Es) such as live events, festivals, and concerts - are now winning a more significant share of guests' time and wallets.

Heavily influenced by the values of the experience economy, conspicuous leisure, and social media, repeat appeal has lost out to "been there, done that" and the desire to move on to the greatly expanded landscape of all the new and sharable OOH leisure options that are now capturing consumers' attention, time and money.

Takeaway for agritourism

There has been a transformative and seismic change in out-of-home entertainment culture that is shifting market share to experiences that are more meaningful and relevant to the modern higher-socioeconomic consumer, including the expanding selection and variety of one- and limited-time, live, new, and unique OOH experiences including food and beverage options, and transformative/educational offerings.

Fortunately, many agritourism experiences are one- and limited-time events that only repeat annually. However, they can even lose their repeat appeal the following year if there aren't changes that make them unique from year to year. Each year featuring unique and different foods and drinks and different live entertainment, such as different music, can help with this. More extended duration agritourism events, even Fall festivals, will need different themed weekly or biweekly unique offerings to have repeat appeal and new and unique offerings each year. Adding educational opportunities to events, from classes to tastings, will enhance the appeal to higher socioeconomic consumers.

Subscribe to Agritourism Today