Vol. XIX, No. 6, July 2019

- Editor's corner

- Rising educational attainment

- Art-inspired mini-golf and eatertainment by Linda Beckring

- NAFDMA agritourism farm tour

- A different point of view. Can FECs be all things to all people? A response

- What are the implications of the low birth rate for entertainment centers?

- When more is not "More" by Frank Price

- Payment methods that consumers are using

- What's new with community leisure venues?

- Human contact Is becoming a luxury - The rise of participatory social eatertainment

- Suddenly the world (and out-of-home entertainment) is a different place

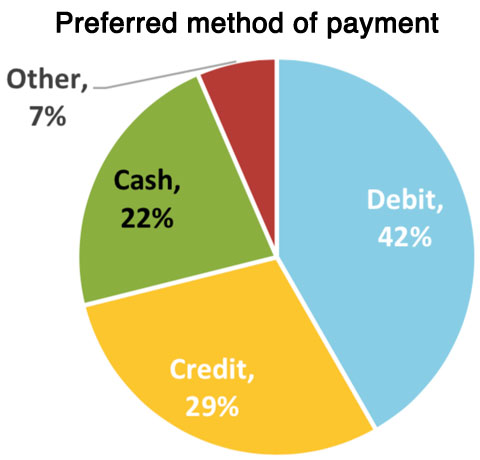

Payment methods that consumers are using

The Cash Product Office of the Federal Research System has released the findings from their 2019 Diary of Consumer Payment Choice (Diary). A demographically-representative sample of 2,873 individuals participated in the study and reported all of their payments and transactions over three consecutive days, staggered throughout October 2018.

Some highlights from the study are:

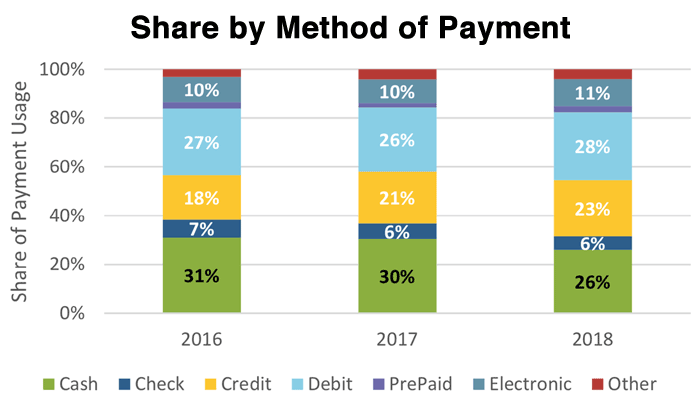

- Consumers used cash in 26% of transactions, down from 30% in 2017

- Debit cards were the most used instrument, accounting for 28% of payments

- Credit cards accounted for 23% of payments, a 2 percentage point increase from 2017

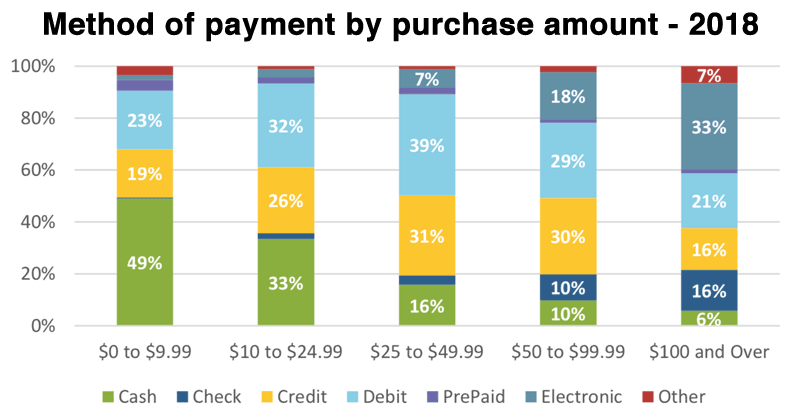

- Cash was used heavily for small-value payments, representing 49% of payments under

- $10

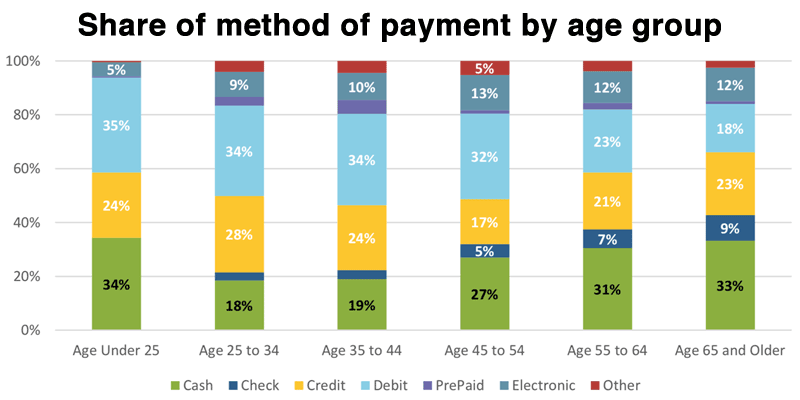

- The share of cash use among individuals under 25 years old is the highest of any age group

Cash is most popular by younger and older age groups.

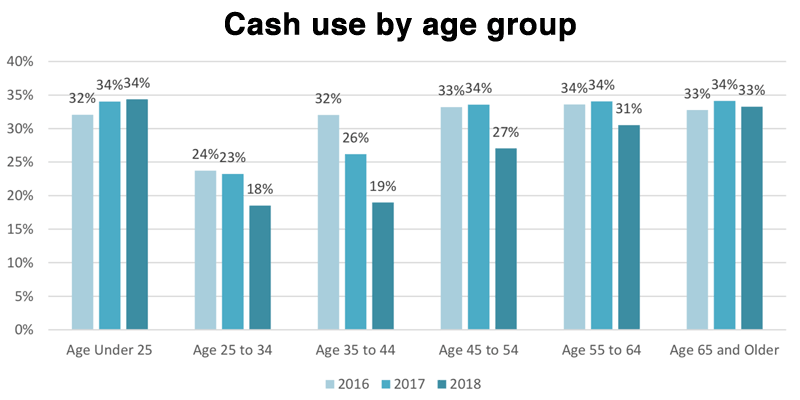

The use of cash has been declining in all age groups except under age 25

Cash is used most often from smaller purchases.

Participants' 2018 payment preferences remained similar to those stated in 2017. Most participants prefer to pay with debit cards (42%), while the next largest group prefer to pay with credit cards (29%); both shares remain unchanged from 2017. Cash is the third most preferred payment method, with 22% of participants reporting it as their primary way to pay for goods and services

* ”Electronic” payments include bank account number payments, online banking bill pay, and payment services like PayPal. “Other” payments include money orders, traveler's checks, transfers, and direct deposit.

Vol. XIX, No. 6, July 2019

- Editor's corner

- Rising educational attainment

- Art-inspired mini-golf and eatertainment by Linda Beckring

- NAFDMA agritourism farm tour

- A different point of view. Can FECs be all things to all people? A response

- What are the implications of the low birth rate for entertainment centers?

- When more is not "More" by Frank Price

- Payment methods that consumers are using

- What's new with community leisure venues?

- Human contact Is becoming a luxury - The rise of participatory social eatertainment

- Suddenly the world (and out-of-home entertainment) is a different place