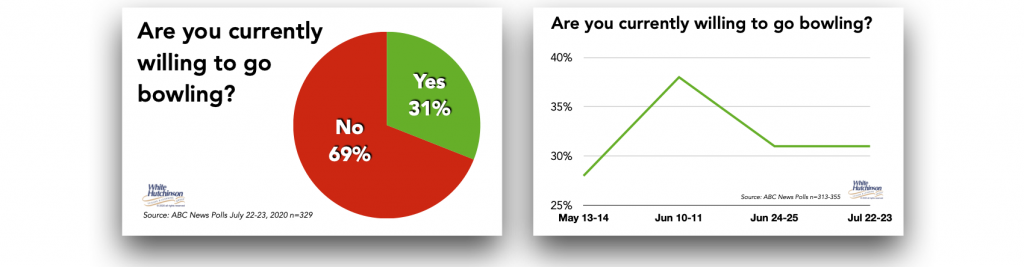

Of the many dozens of polls I’m following that are tracking peoples’ concerns, intentions, behaviors, and beliefs during the coronavirus pandemic, only one poll tracks peoples’ willingness to return to a location-based entertainment (LBE) venue in the family entertainment center (FEC) category. For the last four months, the ABC News/Ipsos poll has been tracking if people are ready to return to bowling. That poll is a good indicator, as unlike most polls that survey the entire population, the ABC News poll only calculates the readiness of adults who typically bowled pre-Covid. Bowling centers, which include multi-attraction bowling entertainment centers (BECs), are a good indicator for the public’s readiness to return to other types of indoor FECs as well.

The July 22-23 ABC News poll found that less than one-third of previous bowlers (31%) were currently ready to go bowling. That is a 7-percentage point drop from the 38% that were ready to return in the June 10-11 poll.

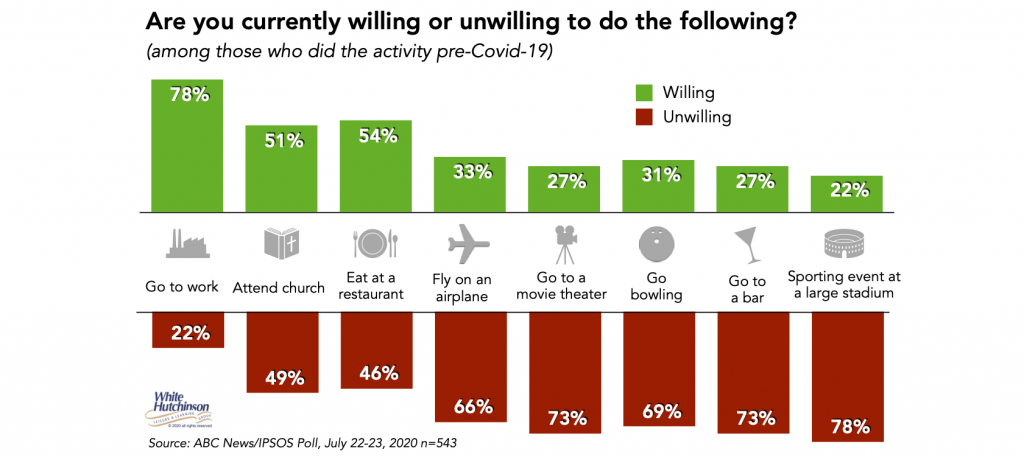

Here are some more of the findings from the ABC News poll.

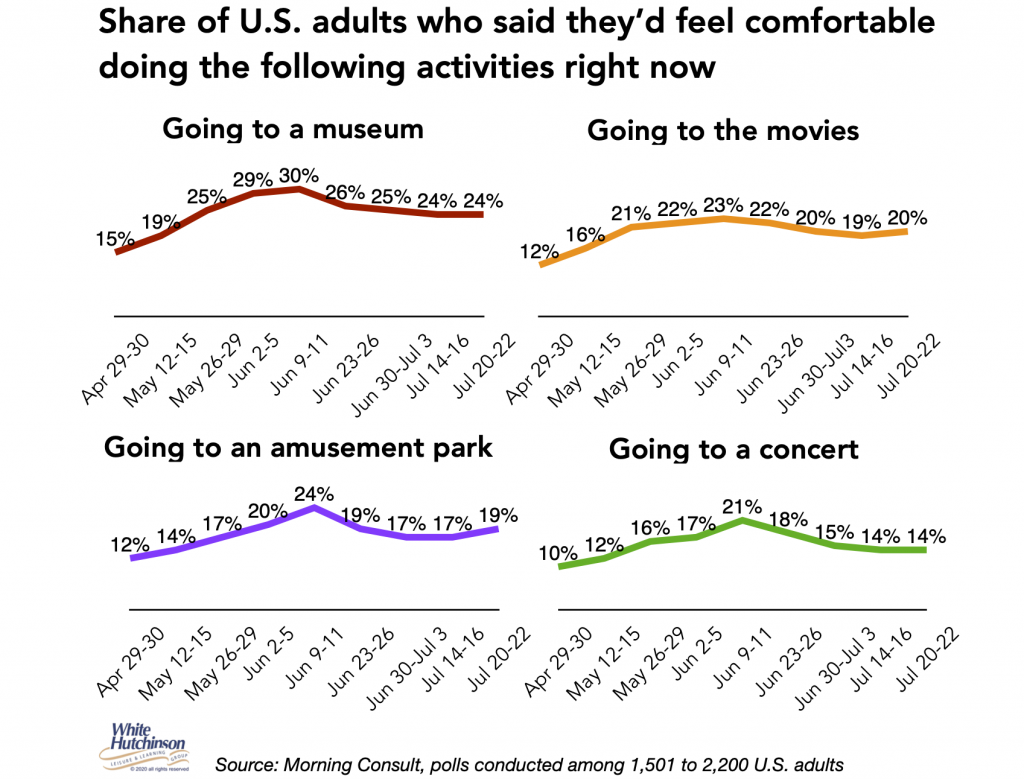

The decline since mid-June for bowling is the same decline I’ve seen in other polls for different out-of-home (OOH) public activities. Here’s the results from Morning Consult’s polls for some different OOH entertainment and cultural activities. All show a decline since their peaks in the early June poll.

The percentages of adults willing to do activities from the ABC News poll are a little higher than what other polls are finding for common activities they track. The ABC News poll is only examining people who typically did the activity, whereas the other polls include everyone. So, the other polls include people who won’t do the activities regardless of the Covid-19 risk. Those people are probably answering they wouldn’t, even if they felt it wasn’t too risky.

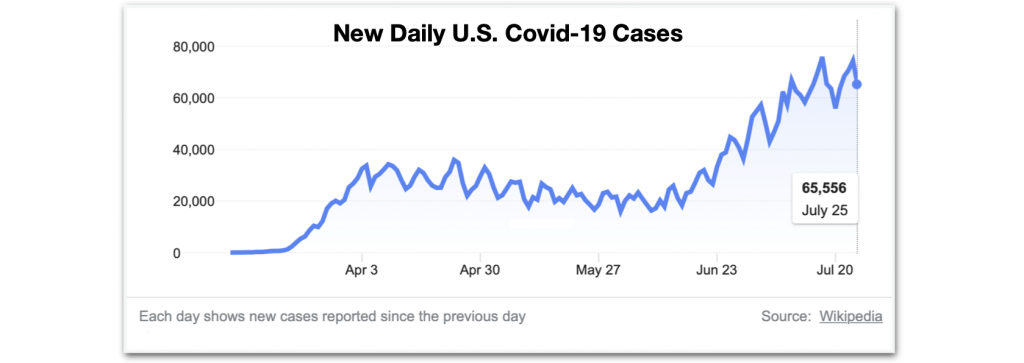

As you can see by comparing the ABC News and the Morning Consult graphs above with the one immediately below, the increases and decreases in willingness to go out to public activities inversely correlates with the decline and increase in U.S. coronavirus infections. As daily infections increase, comfort in going out declines. When infections are going down, comfort in going out increases.

Colleen Dilenschneider conducts weekly surveys of over 2,000 U.S. adults’ intentions to visit 84 unique cultural organizations within the United States – from art museums and aquariums to theaters and symphonies. Her most recent July 18-25 poll found that states with increasing coronavirus cases tend to have the lowest intentions to visit cultural institutions, confirming the inverse relationship the above graphs show between coronavirus infection rates and willingness to visit different public leisure venues.

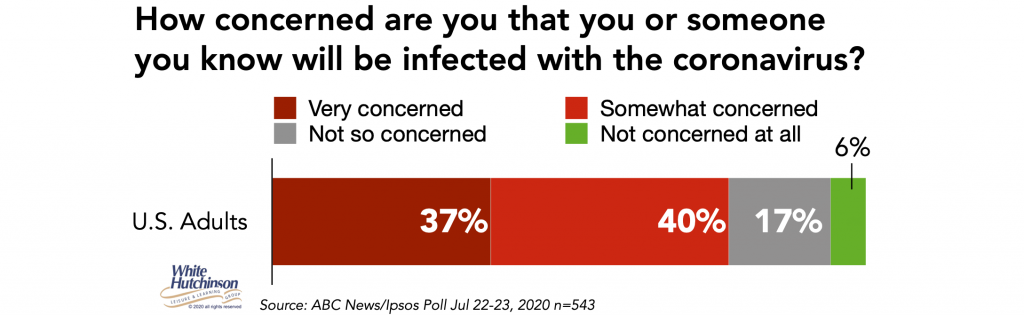

The ABC News poll found that more than three-quarters of people (77%) are currently very/somewhat concerned they or someone they know will be infected with the coronavirus.

A July 17-19 Harris poll found that more than half of adults (54%) fear they could die as a result of contracting the coronavirus. Nearly three-quarters (72%) are very/somewhat concerned that leaving their home to go to non-essential businesses (e.g. bars, hairdressers, cinemas, museums, etc.) would risk exposing them, their loved ones, or others to the coronavirus.

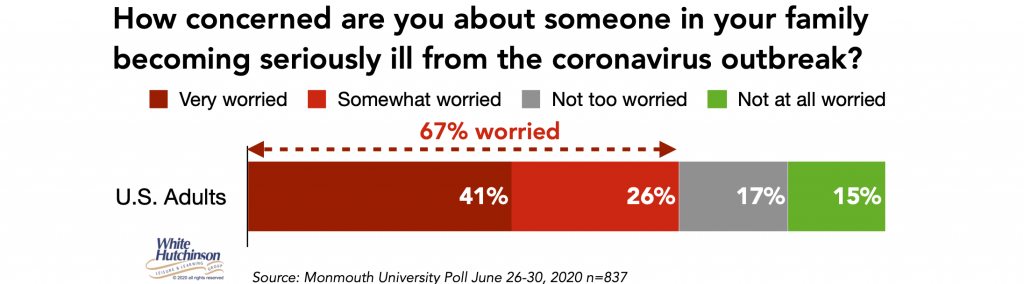

Those two polls and three others I track all found that less than one-sixth of adults currently report they are not at all worried about catching Covid-19 (it could be they are all the young adults who continue to party, not socially distance and not wear masks).

Another poll found that two-thirds of adults (67%) are worried about someone in their family becoming seriously ill from the virus.

There can be no doubt that the vast majority of people are fearful of a Covid-19 infection for themselves and for their family members. This is definitely restricting their participation in public leisure activities, including all dining, entertainment and cultural ones, and will continue to do so until they feel the benefits of visiting/attending outweigh the cost (time and money) and the risk of infection (and death) – the new added component of consumers’ cost-benefit analysis that Covid-19 has introduced to the going out decision equation.

Follow me on Twitter and Linkedin – I try to post news and information that is relevant to the location-based leisure, LBE and FEC industries a few times each weekday.