We’re living in truly tumultuous and historic times with both a pandemic and Black Lives Matter rapidly transforming the world and the lives we live. Fortunately, there are lots of ongoing polls documenting peoples’ opinions and behaviors as conditions unfold. I have been following 15 different national polls, some of which are updating with new surveys every few days. Sometimes for one poll, I have to sort through over 400 pages of data to find and then slice and dice the data that is relevant to location-based entertainment (LBE) and restaurants. Here’s some very recent data on when adults expect to return to restaurants and out-of-home (OOH) entertainment and cultural venues based on their incomes, education, generation and age.

I analyzed data from two very recent Morning Consult polls conducted May 21-25 and June 2-5 among a national sample of 2,200 adults. The data was weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. The sample was large enough so that granular analysis by income, education, generation and age would give meaningful results. Results from the full survey had a margin of error of plus or minus 2%.

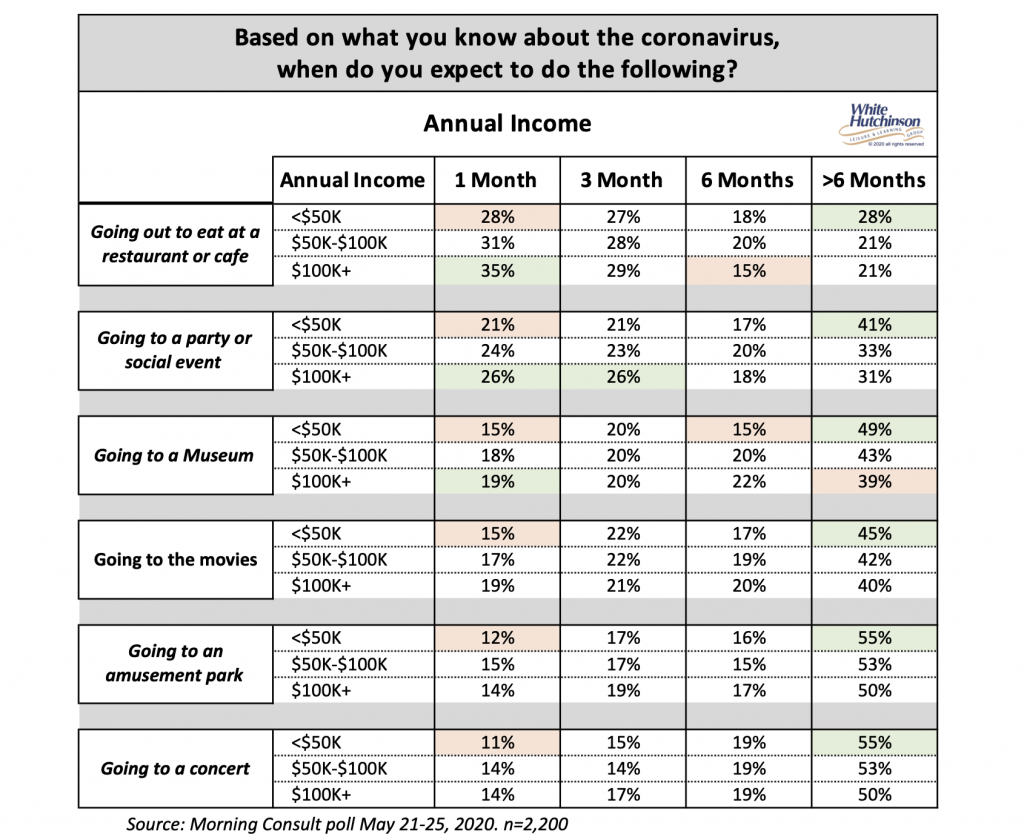

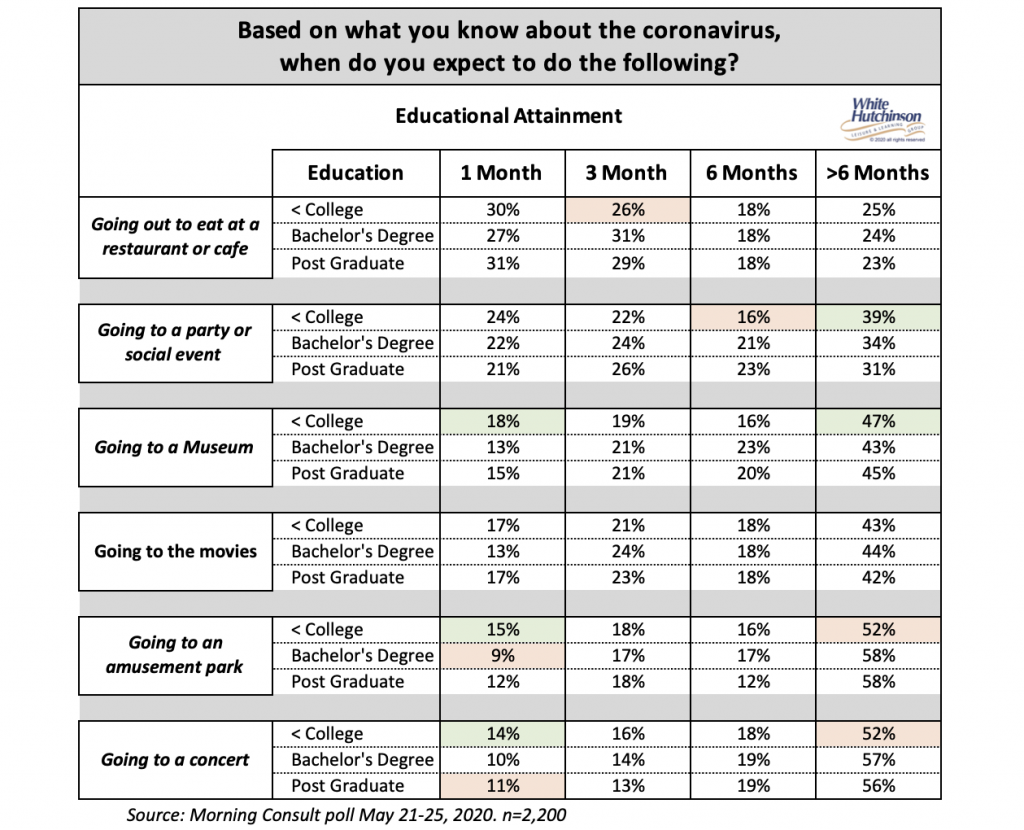

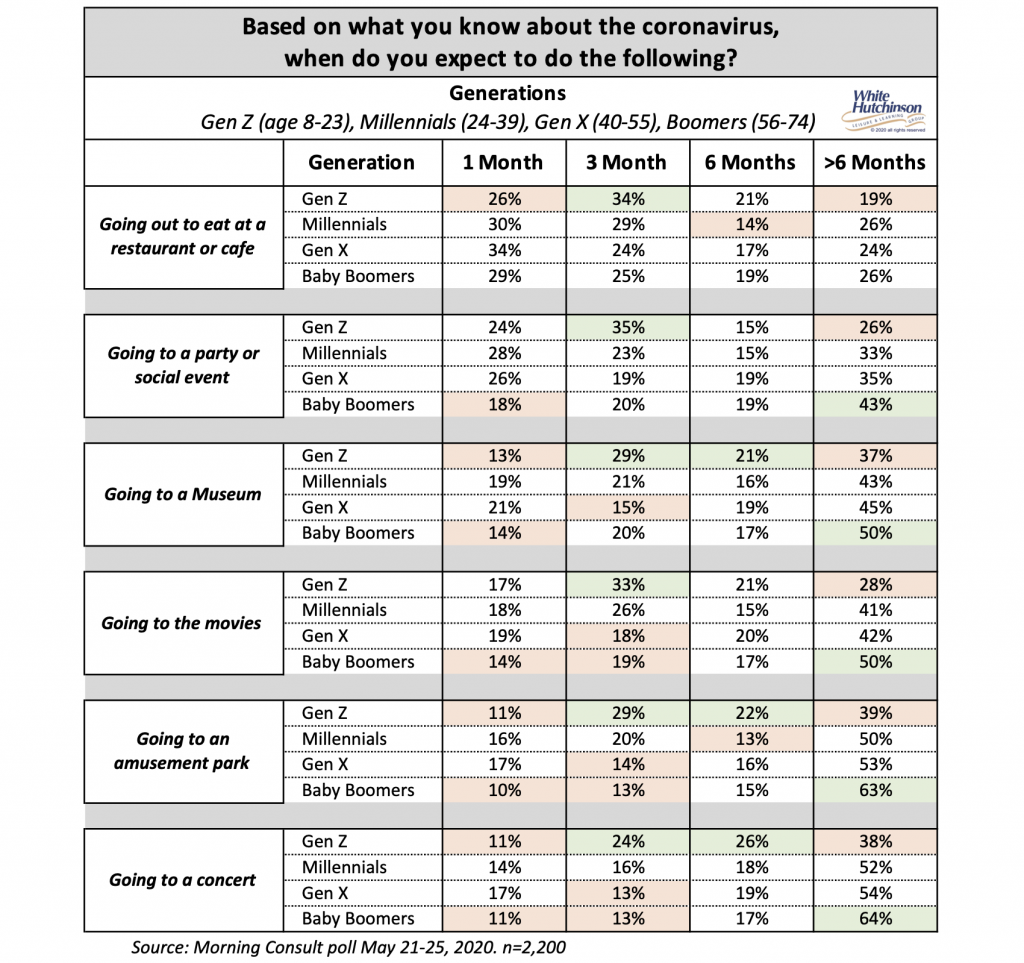

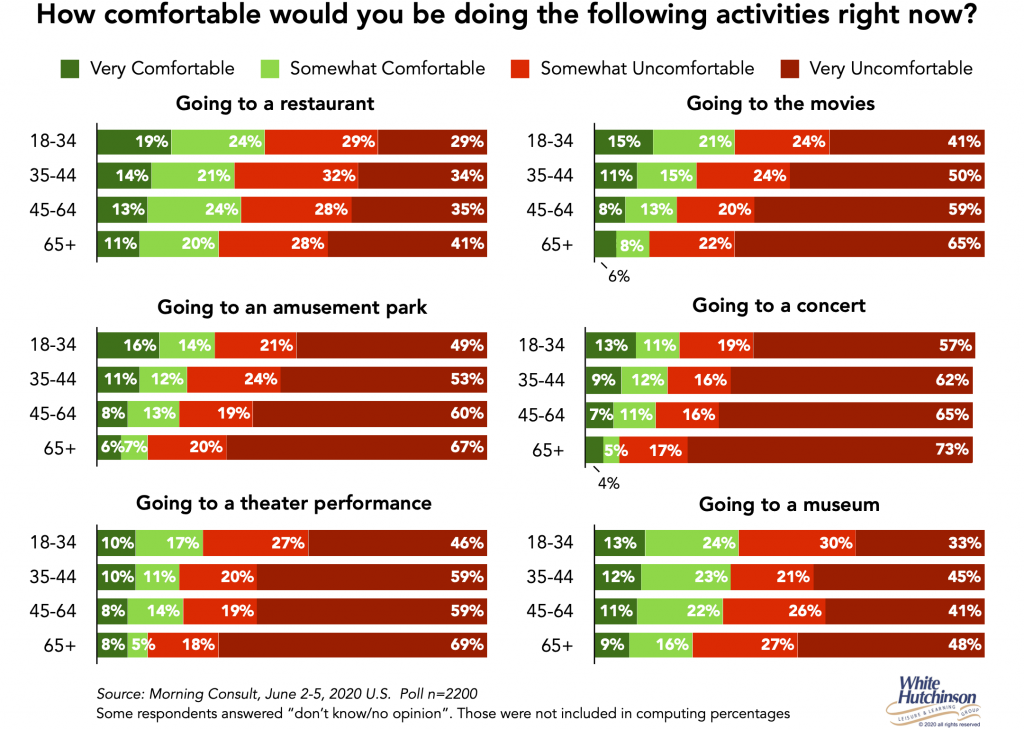

In all the charts, I’ve calculated the percentages by excluding the adults who answered, “don’t know/no opinion.” I’ve highlighted in light red where the percentages are noticeably lower and in light green where they are noticeably higher.

The most noticeable difference in the below chart for how soon people of different incomes plan to return to restaurants and OOH activities is that the lowest income group, those under $50,000 income, are saying they will not return immediately at as high a rate as the higher income groups, and more will wait for six or more months than the other income groups. This could be as attributable to limited or no discretionary income as much as to the coronavirus safety threat. Some of the one-month return expectations may be influenced not only by peoples’ concerns about catching Covid-19, but also by many venues still being locked down, so people know they can’t return immediately.

Across the three income levels, people say they expect to return to restaurants the fastest. Going to a party or social event has the next highest one-month return rate. LBEs show the slowest rate of return, with going to a concert the slowest.

Levels of educational attainment show a slight difference in what percent of people expect to return to activities in the next month. People without a college degree plan to return at the highest rate for many of the activities in the next month. Again, returning to a restaurant in one month has the highest return rate for all levels of education followed by a party or social event. Going to a concert has the lowest immediate return rate.

For all income and education groups, none of the OOH entertainment activities have a return rate higher than 40% within three months.

There are noticeable differences in when the different generations expect to visit different OOH activities. Gen Z skews more to returning to restaurants in three months than in one month. When it comes to activities that will have large groups of people, the parties or social events and the LBEs and cultural venues, Baby Boomers are generally the least likely to return in the next month as well as in three months.

The poll results by both income, education and generation consistently show that approximately one-quarter of people don’t plan to return to a restaurant for at least six months, rising to nearly or exceeding one-half for attending museums, amusement parks and concerts for the same greater than six-month time frame.

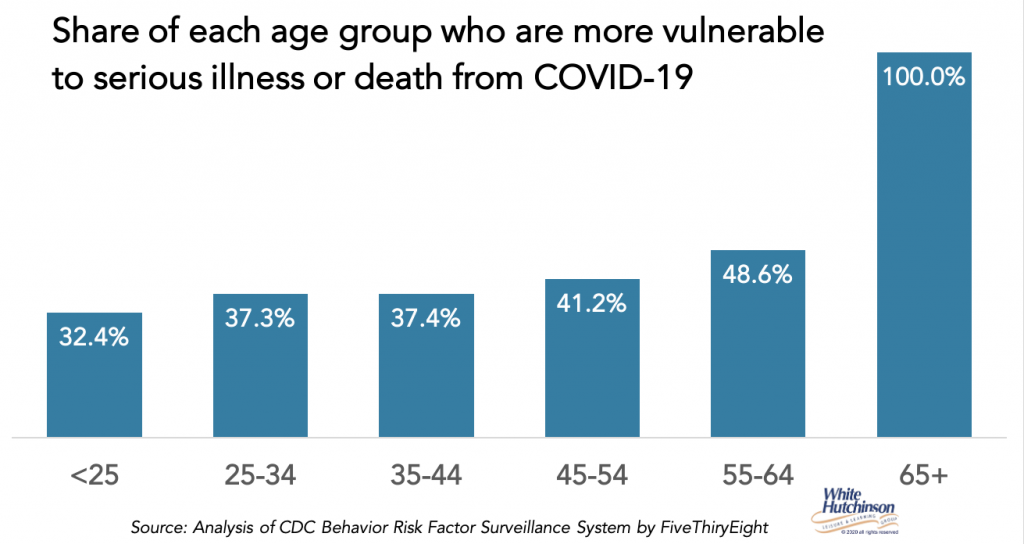

I was surprised that the percentages of Baby Boomers who expect to return to the different activities in the near future weren’t lower since the 65+ age group is at high risk of becoming seriously ill or dying from Covid-19. So, I dug into the data in the more recent Morning Consult poll that had results by age, with 65+ being one of the age cohorts. Here we see a more noticeable difference for the 65+ age group, being the most uncomfortable to return shown by the shorter length of their green graph bars for comfortable to return right now compared to the other age groups. The percent comfortable to return right now correlates with age, with the youngest showing the highest rate and the oldest the lowest.

The results from the above polls agree with the substantial portion of people who consider visiting a public place as a high risk to their own and/or their loved ones’ health. An Ipsos May 28-29 poll found that 3 in 10 adults age 18+ (30%) believe the coronavirus poses a high threat to them personally. A May 29-June 1 CBSNews/YouGov poll found that 30% of adults are very concerned and 39% are somewhat concerned (total 69% concerned) about themselves or a family member getting the coronavirus and over one-quarter (27%) say they will not be returning to any public places until the outbreak is over. An Ipsos June 5-8 poll found that 80% of adults were socially distancing, staying home and avoiding others as much as possible. Gallup’s May 25-31 poll asked adults if there were no government restrictions on what people were able to do, how soon would they return to their normal day-to-day activities. 40% answered not until there were no new cases in their state and 7% answered not until after a vaccine was developed. The Ipsos, CBSNews/YouGov and Gallup results are very consistent with all the data in the above charts on when people say they will start going to different OOH activities

As I reported in a previous blog, all adults age 65+ and 40% of adults under age 65 who have a medical condition are at high risk of serious illness or death if they catch Covid-19. The approximate one-half of people who say they won’t return to an LBE or cultural institution for at least six months probably not only includes most of them, but also non-high-risk people as well.

With the most optimistic hope for deployment of a vaccine more than a year away, we have no less than one-quarter, and possibly even more adults who plan to self-quarantine and not again visit restaurants and LBEs until the outbreak is over. What this means for restaurants and all types of LBEs, including family entertainment centers (FECs), bowling and bowling entertainment centers (BECs), escape rooms, axe throwing, laser tag, go-kart and social eatertainment centers, is they will need to develop their post-lockdown opening business models based on a slow return rate of customers, with some not returning for at least a year or more, the exact time dependent on development of a vaccine,

We need to remember in considering the results of these polls and many others, that they are only a snapshot of peoples’ safety comfort levels and expected behaviors based on conditions and information on the Covid-19 pandemic and its health risks, government restrictions and recommendations; peoples’ personal financial conditions and the practices of businesses and the public at one point in time, which is continually evolving, sometimes on a daily basis. Expectations, comfort and peoples’ actual behaviors could easily change one way or the other as the pandemic unfolds along with the economic downturn and unemployment. It is likely that peoples’ changing individual economic conditions, along with any changes in their perception of their safety risks, will have a major impact on changes of their future behaviors.