There’s been a lot of press coverage on consumers returning to reopened restaurants, location-based entertainment (LBE) and other businesses. Yes, the trend is up with increasing attendance. However, moving up from zero attendance doesn’t mean you will soon be at 100%. I wish I could tell you that in a few months things will be back to the old normal. The sooner it does, the sooner my business as a producer, designer and consultant for experience destinations will get back to normal along with all the location-based entertainment/leisure venues in our industry. However, all the data and research indicates we have a long road ahead until that happens. So rather than write some optimistic blog that could create false hopes, I’d prefer to prepare you for what is the likely reality.

A June 17, 2020 research paper by the Opportunity Insights Team at Harvard University found that reopening the economy by simply opening up consumer businesses won’t drive economic recovery. Rather, in the long-run, the only way to drive economic recovery is to invest in public health efforts that will restore consumer confidence and spending. In other words, fear of going out (FOGO) and catching the coronavirus in public places, including stores, restaurants and entertainment/leisure destinations, is what is stopping full economic recovery. Opening up alone doesn’t mean everyone will go back to their old normal behaviors. This is a very sobering conclusion.

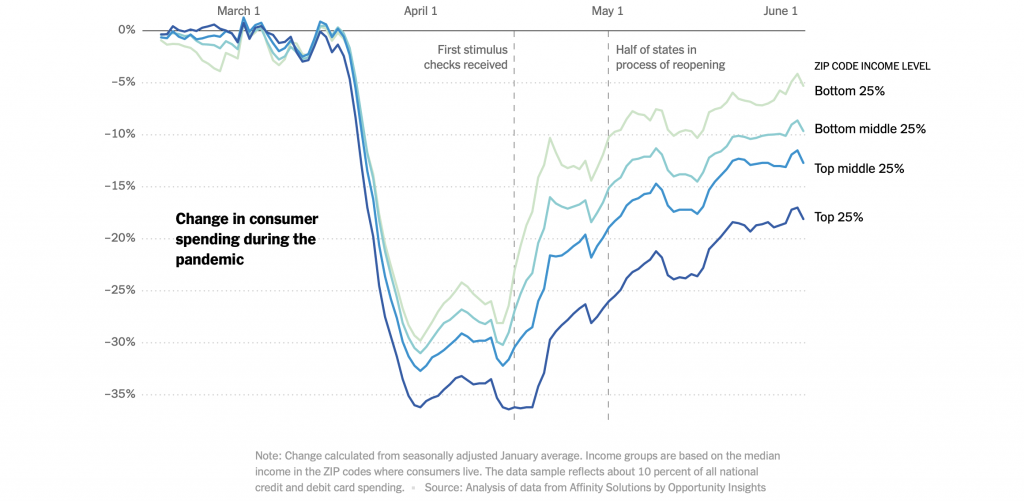

What the researchers found is that the economic crash has been driven disproportionately by high-income Americans who have reduced their spending more than poorer Americans, which in turn has devastated low-income workers and small businesses in affluent areas. They found that by the end of May, two-thirds of the fall in credit card expenditures since January (66%) was concentrated in the top 25% of households by income. The bottom income quartile, by contrast, was basically back to pre-pandemic spending patterns by the end of May, due in part to the stimulus checks.

High-income people spend more overall than low-income people, primarily for away-from-home services that require C2B in-person interactions. This higher percentage drop in overall spending by high-income households translates to an even more dramatic drop in total spending that is attributable to the highest-income segment of the population.

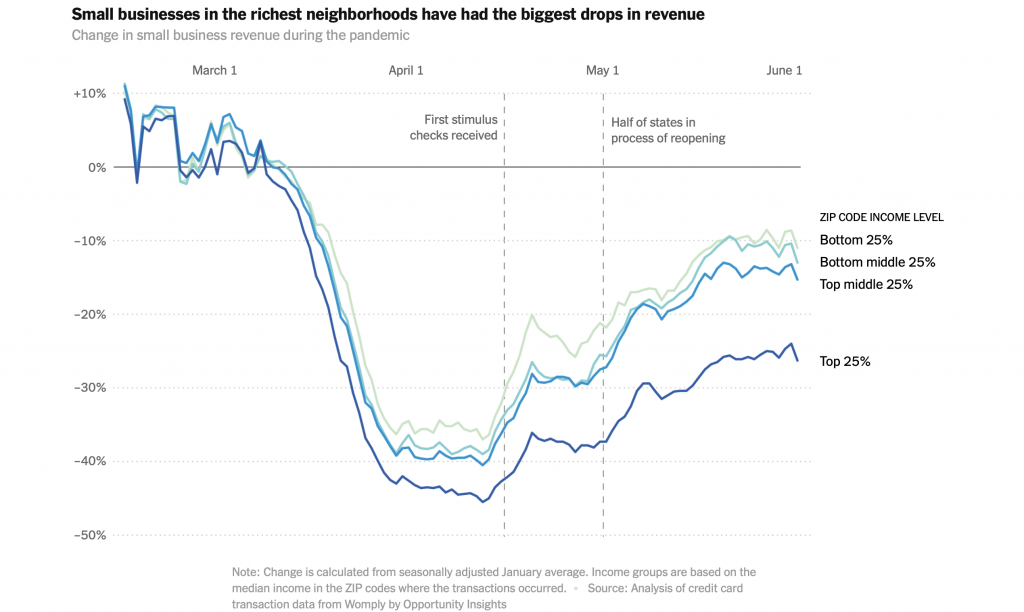

Because of the reduction in spending by high-income households, businesses in the most affluent neighborhoods lost more than 70% of their revenue, whereas those in the least affluent neighborhoods only lost 30%.

The research found that nearly three-fourths of the reduction in spending during the pandemic was for goods and services that require in-person physical interaction (and thereby carry a risk of Covid-19 infection), such as hotels, restaurants, transportation, recreation and LBEs.

As a result, 70% of low-wage workers in the high-income neighborhoods lost their jobs compared to 30% in the lowest income neighborhoods. So, the vast majority of the decline in spending, especially for in-person services, as well as the majority of low-wage job losses, is attributable to the reduced spending by high-income households.

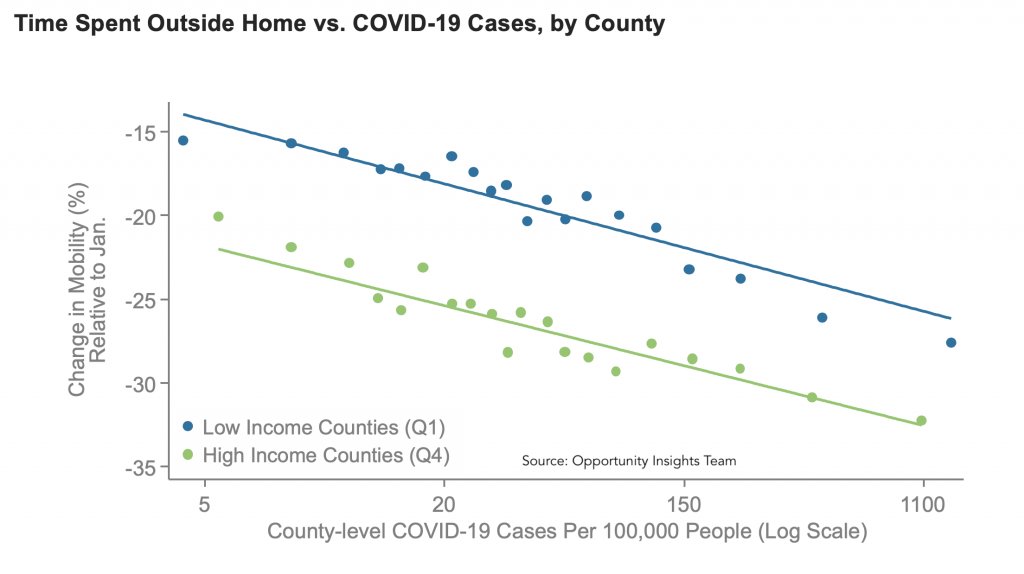

Spending fell the sharpest not just in high-income areas, but particularly in high-income areas with a high rate of Covid-19 infection. Regardless of the level of coronavirus infection, using anonymized cell phone data from Google, the research found that high-income people spent less time outside their homes than lower-income people.What we have is a high-income recession, primarily in the service sector, that is not due to a reduction in income or wealth, but rather to a sharp decline by high-income people visiting away-from-home businesses due to their Covid-19 infection concerns.

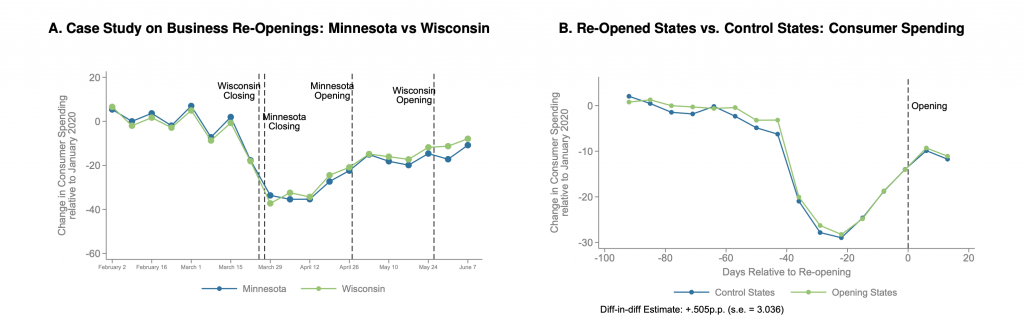

The researchers found that state-ordered reopenings of businesses only had a modest impact on economic activity. When they compared the spending in states that opened early with states that opened later, the trajectories of spending in the states were nearly identical during the same time periods, i.e. the spending in a state that was closed grew at the same rate as a state that was open during the same time.

The researchers found that reopening orders don’t actually reopen the economy; they didn’t seem to do anything to spur high-income people to spend more and didn’t increase economic activity. The researchers concluded, “The implications of this finding is that confidence in public health may be a prerequisite to a full recovery.” They also found the orders reopening states appear to endanger public health without any economic benefit.

The paper concluded, “In sum, our analysis suggests that the primary barrier to economic activity is depressed consumer spending due to the threat of Covid-19 itself as opposed to government restrictions on economic activity, inadequate income among consumers, or a lack of liquidity for firms.”

The research is telling us something very important: even when government restrictions are lifted, Americans, especially high-income ones, still won’t be spending at pre-pandemic levels due to fear for their health if they leave their homes. Until higher income households believe it’s safe to visit location-based businesses, especially service and entertainment ones, there won’t be a full recovery until there is a vaccine or some other measure that stops infections.

The research mirrors what Bill Gates told us in the early days of the pandemic. Until you get a treatment that is 95% effective against Covid-19, life and the economy will not return to normal. The government cannot restore confidence just by “reopening.”

It’s not surprising that history has also demonstrated this. Feeling safe enough to venture out into public places is what corresponded with the fastest economic recovery in parts of the country during the 1919 Spanish flu pandemic.

I dug into poll data to see if any of it confirms the research findings. Data from multiple polls confirms the relationship between the rate of infections and venturing out to make purchases. The ABC News/Washington Post May 25-28 poll found that the reluctance to resume normal activities is higher among people living in counties with more diagnosed cases. Sense360’s research as of June 14thfound that states with decreasing virus counts have improving foot traffic for all food purchases (retail+restaurants), while those with higher case counts are slowing down versus the national average. In the states with decreasing case counts, other than New York and New Jersey, the share of food foot traffic is shifting from retail to restaurants, which are perceived as higher risk than supermarkets and other food retail outlets.

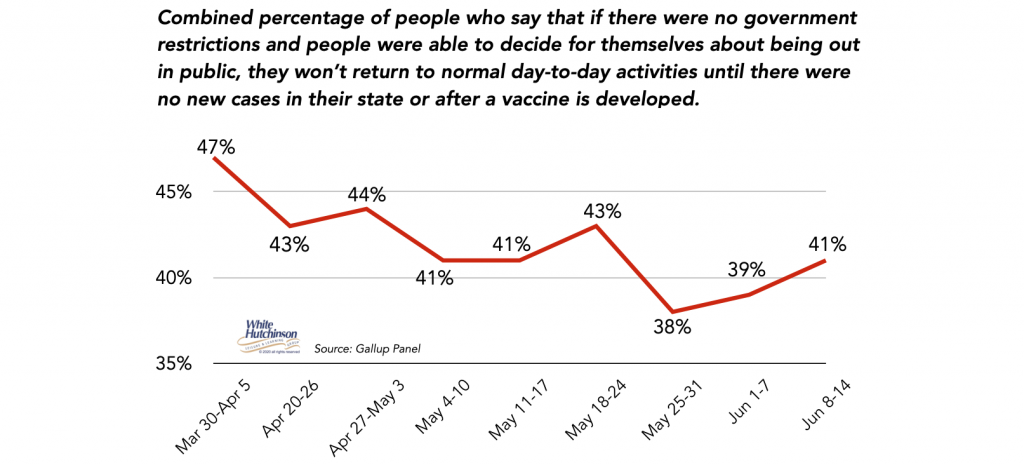

Gallup’s May 25-31 poll asked adults if there were no government restrictions on what people were able to do, how soon would they return to their normal day-to-day activities. 27% answered not until there were no new cases in their state and 14% answered not until after a vaccine was developed (41% total). The percent has shown a downward trend until the end of May when it started trending up, perhaps due to the increase in infections in parts of the country.

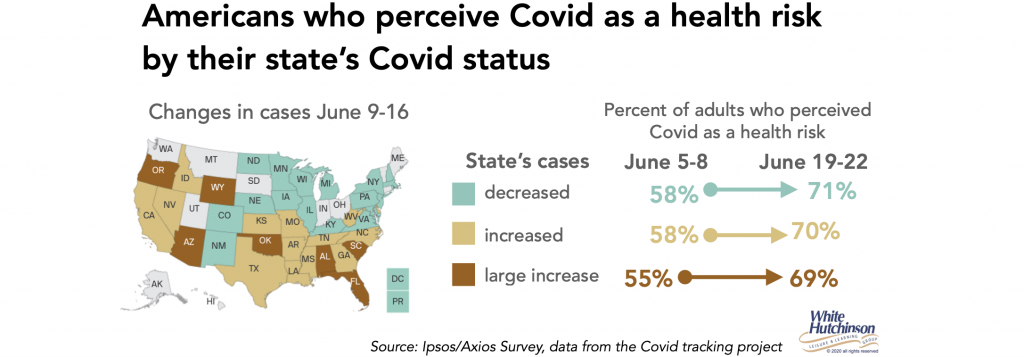

The just released June 19-22 Axios/Ipsos poll found an uptick in concern and fears about the coronavirus as infection rates are increasing in many states.

Currently, 56% of Americans are extremely or very concerned about the Covid-19 outbreak. This is up from 48% in early June. In states with the highest rates of increase, the share of people visiting with friends dropped 8% from 52% to 44%. Meanwhile in states with modest infection increases, those visiting friends increased by 6% to 46% and in states where infection rates are decreasing, it increased by 5% to 51%.

Americans are seeing normal out-of-home activities as increasingly risky. “In the places with the highest rates of increase, people are adjusting their behavior,” said Cliff Young, president of Ipsos U.S. Public Affairs. “The more proximate it is, the greater the likelihood they adjust their behavior [to visiting public places less].”

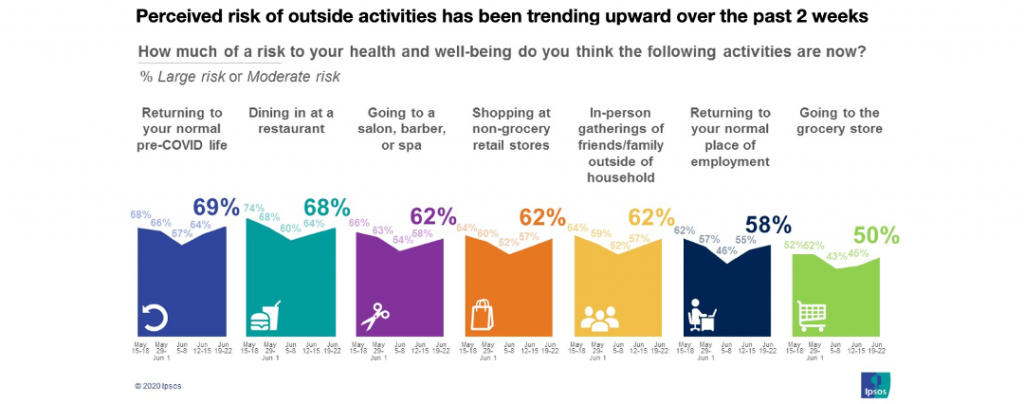

69% of people now say going back to their “normal” pre-Covid life would be a large or moderate risk, up from 64% a week earlier and 57% two weeks ago. Over the two weeks, those who consider it a large or moderate risk to dine in a restaurant has increased from 60% to 68%. Even going to a grocery store has increased from 43% to 50%, and shopping at non-grocery retail stores has increased from 52% to 62%

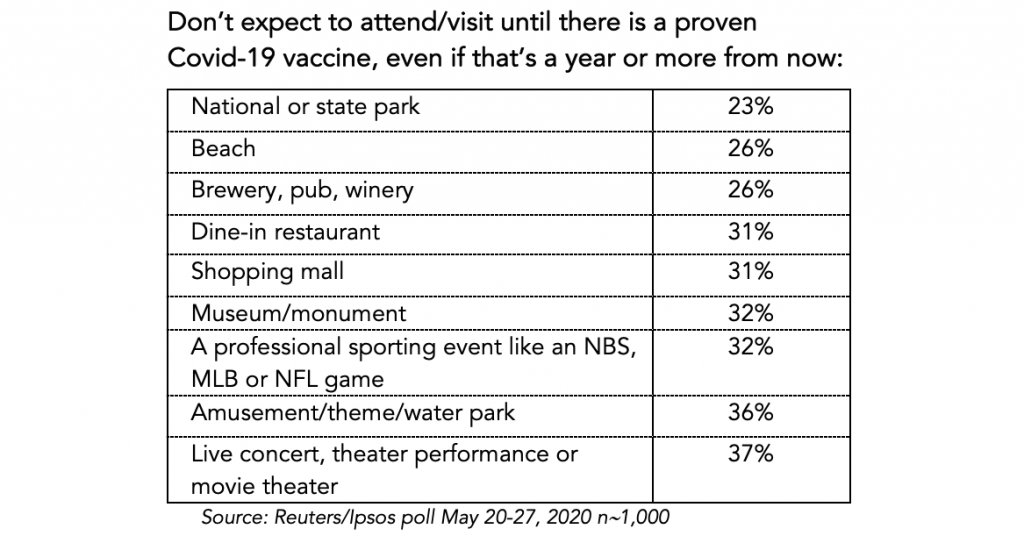

The Reuters/Ipsos May 20-27 poll found a third or more of adults said they won’t attend entertainment and cultural venues until there as a vaccine, even if that’s a year or more.

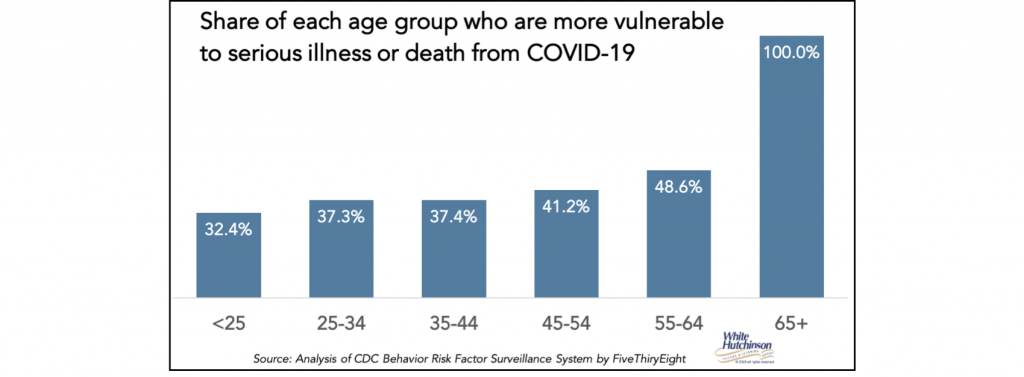

As I reported in a previous blog, people age 65+ and the 40% of adults under the age of 65 who have many health conditions are at high risk of a serious illness or death from Covid-19. They are probably a large share of people who will wait for a vaccine. This at-risk group includes over one-third (37%) of the prime target 25-44 age group for LBEs.

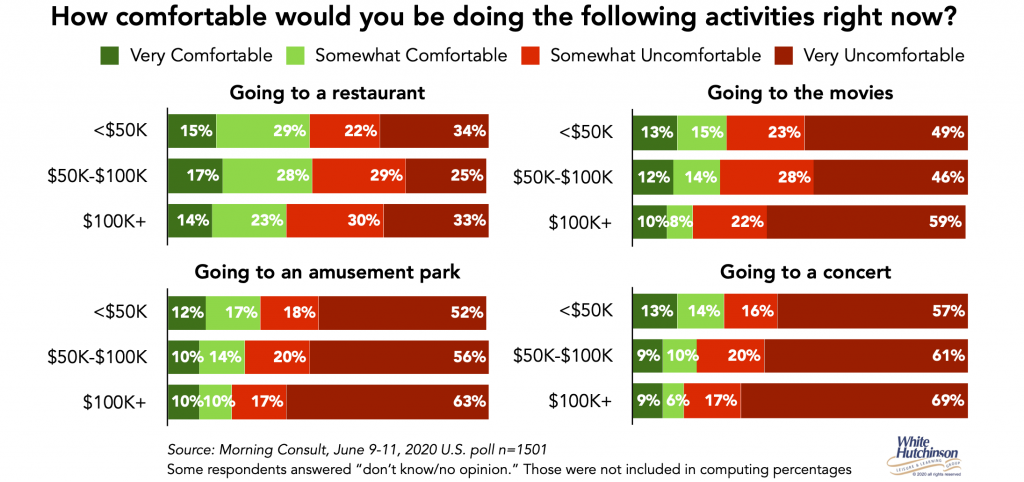

In regards to the high-income consumers waiting for the end of the Covid-19 health risks, the recent June 9-11 Morning Consult poll didn’t exactly ask that question. However, the large share of people who answered they are waiting 6 months or longer to return to different activities most likely indicates they are waiting for the health risk to significantly decrease or completely go away. These poll results definitely show that a higher percentage of people with $100,000+ incomes (basically equating to the top 25% of households by income) are waiting the longest to return to location-based entertainment activities.

Based on all the different polls, at least one-third or more of adults who will wait for a vaccine or something else that eliminates the health risk of the coronavirus before returning to LBEs. And the share for high-income adults is probably closer to 4 in 10.

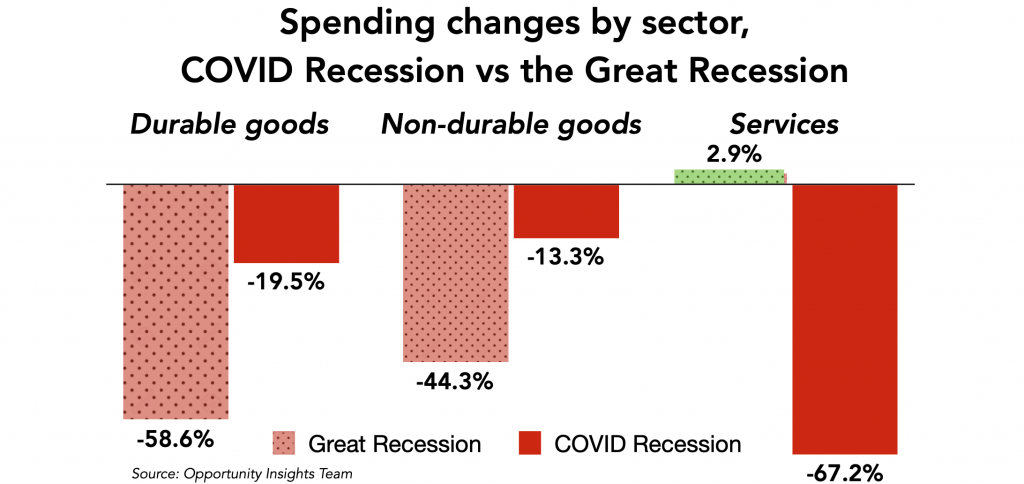

The Brookings research paper found that in the Great Recession, nearly all of the reduction in consumer spending came from a reduction in spending on goods; spending on services was almost unchanged. In the Covid-19 recession, 67% of the reduction in total spending came from a reduction in spending on services. Out-of-home entertainment falls within the services category the researchers examined.

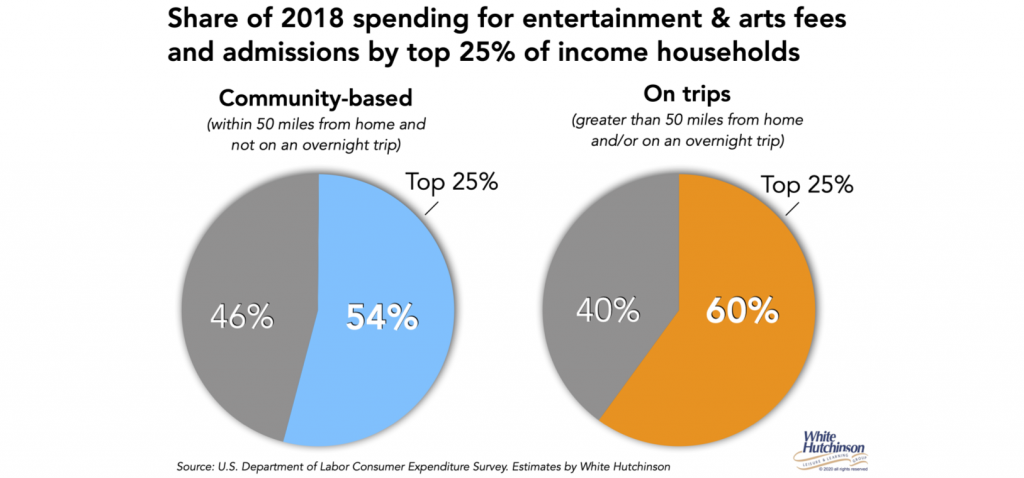

Since so much of the reduction of spending came from the top quartile of income consumers, I examined what that could mean in terms of the potential drop in spending on fees and admissions for out-of-home (OOH) entertainment and arts. It could be sizable, as the top 25% of households by income account for the majority of that spending.

If 4 in 10 high-income consumers stay away, that would result in at least a 20% reduction in attendance and revenues for community-based entertainment and arts (24% when on trips) until there is a vaccine, and that only accounts for a decrease by the high-income households. The decline for lower income households could be greater as they are being impacted to a greater degree by the recession.

As the research strongly indicates, if a significant share of high-income consumers stay away from OOH entertainment and arts activities until there is a vaccine or the risk of catching Covid-19 in public places is gone, OOH entertainment and arts businesses are going to struggle to survive as there won’t be the possibility of a full recovery until probably at least a year or more. LBEs and cultural institutions will need to modify their business models to be financially sustainable until the pandemic ends.

The polls and research make it clear that a critical factor in overcoming people’s FOGO and attracting them back to reopened LBEs and other leisure businesses is that they believe it is an activity safe from catching the coronavirus. Unfortunately, it appears the current trend for perceived safety may be going in the wrong direction due to the surge in infections.

Perceived safety not only includes uber sanitation and screening procedures, but also mandatory mask wearing by both workers and customers (see my previous blog about the importance of mandatory mask wearing). These practices are becoming increasing important to win back people on the road to recovery.

Access the original 85-page research paper here.

Access a VOX article that discusses the research findings here.