The coronavirus is likely to devastate large portions of the location-based entertainment industry. Businesses that survive should expect a less-saturated market with a changed consumer base and market size.

The impact that the COVID-19 virus is having on America’s location-based entertainment industry is devastating. If not already closed, soon every location-based entertainment center (LBE), which includes all the family entertainment centers (FECs) and theme parks, will be totally dark. Customers won’t be walking through the doors, staff will be unemployed, but rent, debt, utility and many other expenses won’t stop.

The unemployment rate in the country will be skyrocketing due not only to the closure of LBEs, but also due to closed retailers, restaurants and so many other business segments that depend on spending by consumers who are presently bunkered down in their homes, scared and conserving what money they have to try to survive. The country is going to be in a recession, not only until the pandemic subsides, but for much longer. Recovery won’t be overnight. Consumers are learning new and lasting habits of using ecommerce, restaurant carry-out or delivery and digital entertainment while being restricted in the homes.

How severe the recession will be, how long it will last and how permanently consumer behavior will be changed will depend on how long the shut down and social distancing needs to be maintained. The longer it does, the greater the long-term impact will be.

“It’s amazing how slowly habits change, where people get stuck in the ruts of doing things, and then you have a shock like this that can change everything,” said Erik Brynjolfsson, director of the MIT Initiative on the Digital Economy. “It forces people to overcome the switching costs, figure out something new and say, ‘Hey, this is way better.’”

Prior to the pandemic, LBEs were already facing headwinds in many markets due not only to industry overexpansion, but also to the growth of one-time events such as festivals and the increased perception of dining out in restaurants as a form of entertainment. These shifts in entertainment preferences are especially true for younger adults, the prime target market for most LBEs. LBEs, especially attraction-based ones, were losing their repeat appeal (an essential element of their business model) to “Been there, done that, so many other (Instagrammable) experiences to do.”

With the exception of about a dozen national FEC chains and the major theme park operators, most LBEs are individually owned. They don’t have the financial survival wherewithal to weather the storm that large chains and companies have. Many are over leveraged and capital poor. We are sure to see a high failure rate during the pandemic and shortly thereafter.

Even when we move into the post-virus era (and here’s hoping it happens much sooner than later), there’s no question stir crazy consumers will want to go out again for face-to-face social and entertainment experiences. Joe Pine, co-author of The Experience Economy, believes that the experiences now being shut down will draw people again in future. Joe says, “We are social beings and we crave social environments. While the experience economy might be a new thing, the desire for experiences is from time immemorial.”

However, it will be a slow ramp-up of demand for LBE experiences for a number of reasons. Many consumers will be financially strapped and lack any discretionary spending. This will be especially true for low-wage and middle-class consumers who are most likely to lose their jobs during the pandemic. Nearly 40% of Americans already were living paycheck to paycheck before the coronavirus hit.

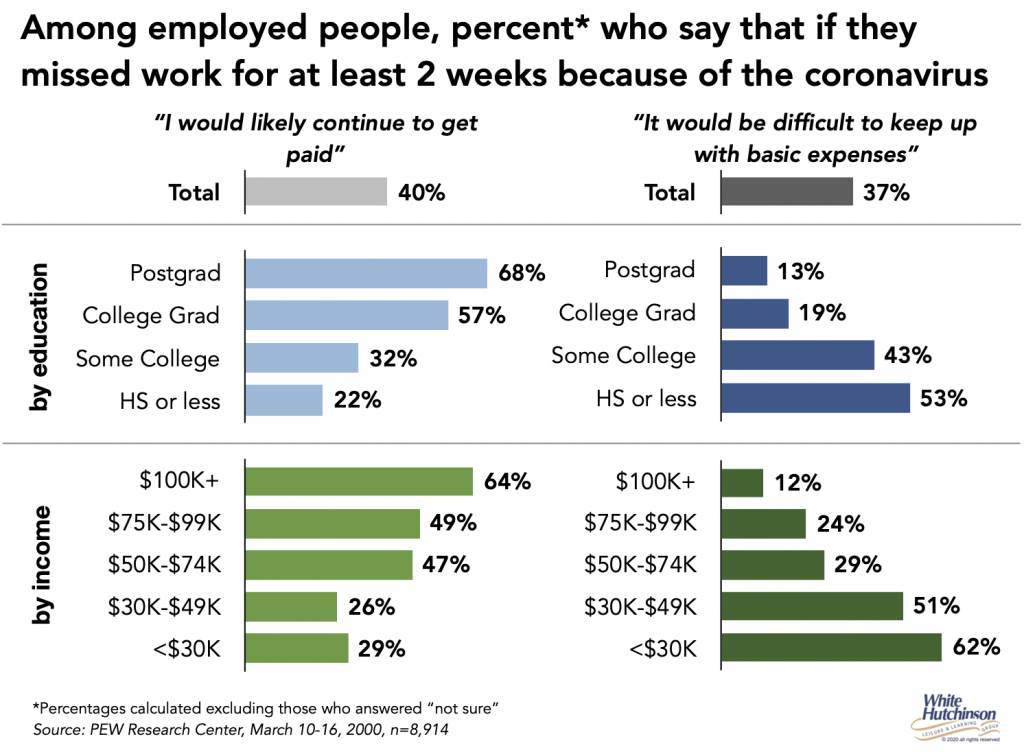

Based on a March 10-16 survey by the Pew Research Center, only 40% of employed adults said they would likely continue to get paid during a coronavirus shutdown. 37% said if they had to miss work and not get paid for at least two weeks due to the coronavirus, it would be difficult for them to keep up with basic expenses. The percentage who said they would likely continue to get paid increased with incomes and education and the percentage who said it would be difficult after two weeks declined with incomes and education.

Many consumers are reshaping their attitudes towards out-of-home entertainment and other leisure experiences as more threatening to their health than before. Many will have learned to substitute at-home digital entertainment and restaurant meal delivery for some of their previous out-of-home leisure. Discretionary spending will take a long time to recover to pre-pandemic levels if it ever does. The pandemic will have a disproportional impact on low-wage workers and much of the middle class who lack the savings and resources to financially survive the pandemic, with many continuing to remain unemployed after its end. Additionally, post-virus, the vast majority of consumers are likely to become ultra-cautious with all their spending and devote more of their incomes to building a rainy-day, or future pandemic fund and less to discretionary entertainment and leisure.

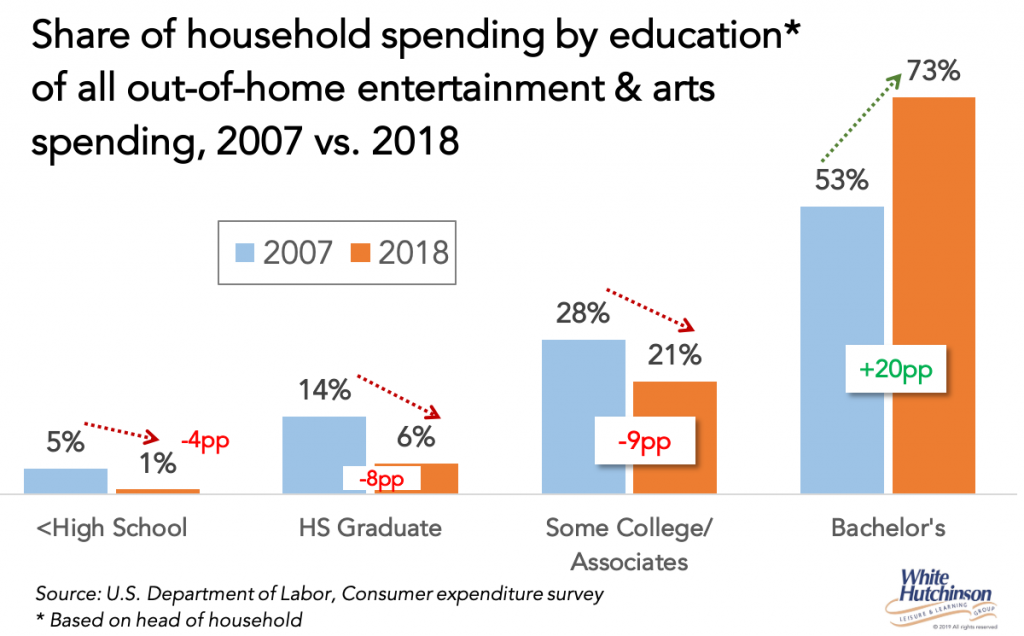

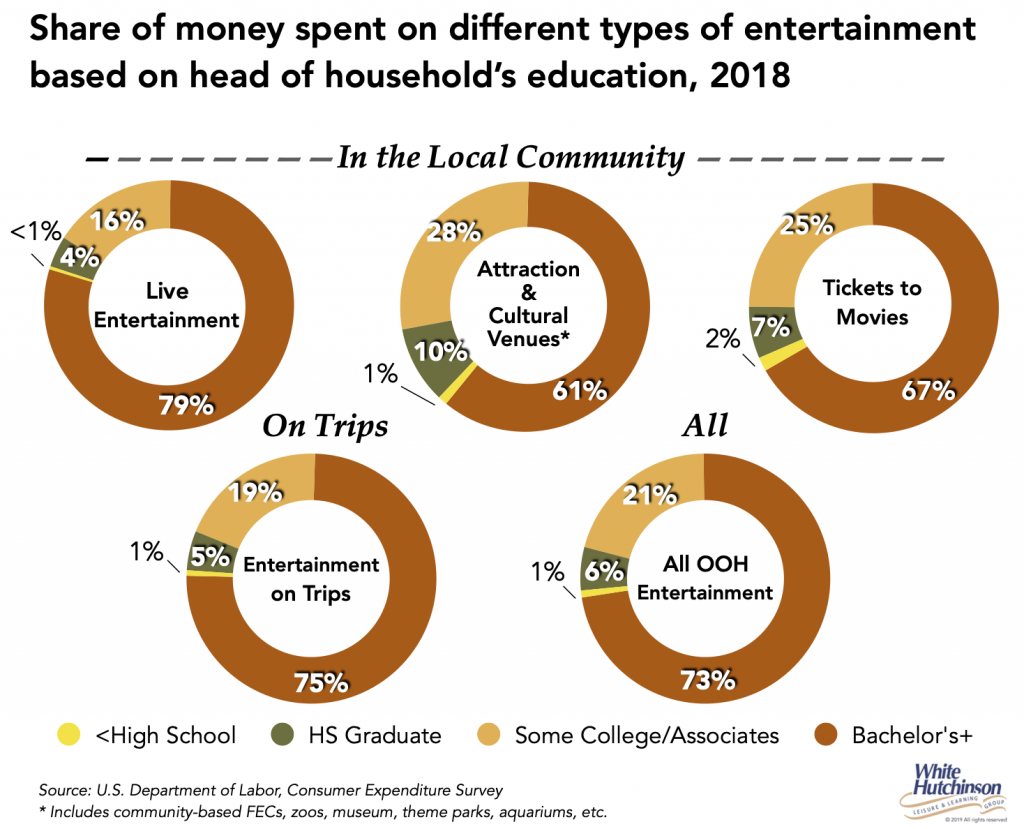

The future is sure to see an acceleration of the LBE gentrification trend that has been underway since the Great Recession and that has shifted a greater share of out-of-home entertainment, arts and restaurant spending to households with a bachelor’s or higher degreed heads of household. Pre-pandemic, those households grew to account for nearly 3/4s of all spending on out-of-home entertainment and arts (73%).

Even for what is probably the most affordable form of out-of-home entertainment, movie going, bachelor’s+ households accounted for two-thirds of all ticket sales.

As the PEW survey shows, college educated households are less likely to be negatively financially impacted by the pandemic than low-wage and middle-class households who have a higher likelihood to lack the savings and resources to financially survive the pandemic if they become unemployed, with many continuing to remain unemployed after its end.

The post-pandemic out-of-home entertainment landscape is sure to be completely different. There will be less competition, but at the same time the demand will be less and slow to grow. With some permanent reset to consumers’ entertainment habits of relying more on at-home entertainment options and the loss of large segments of low-wage and middle class consumers, demand for out-of-home entertainment may never return to pre-pandemic levels. Whether supply and demand will be in balance will depend a lot on how many LBEs survive to operate on the other side of the pandemic and how fast and to what degree consumer demand returns.

It is possible that outdoor venues may recover faster than indoor ones, as with continuing health concerns, consumers may consider outdoor environments safer health-wise than the confined and more tightly crowded indoor ones. Those venues could include agritainment/agritourism, theme parks, adventure parks and outdoor attractions such as miniature golf.

There will be a new normal for LBEs on the other side of the pandemic, and it will be very different than the normal we had just a month ago.