Vol. XVII, No. 1, January 2017

- Editor's Corner

- Are you ready for hygge?

- 2017 Foundations Entertainment University dates

- Top 2016 articles

- The untold truth about feasibility studies

- The growing inequality of entertainment & the growth of eleisure

- What's happening to sports participation?

- Becoming the industry contrarian

- Is a new virtual reality disruption coming to out-of-home leisure?

- Predictions for 2017

- The curse of customer fatigue; the downfall of many CLVs & FECs

The curse of customer fatigue; the downfall of many CLVs & FECs

A new attraction opened on the 4th floor of Mall of America, a 12 million dollar, 40,000-square-foot entertainment venue called Smaaash, billed as an arcade on steroids. The mall's owner hopes it will lead to a revival of the fourth floor that was originally planned to be a hub for adult nightlife. While still the home of the mall's movie theater, since the mall opened 25 years ago, the fourth floor has seen the comings and goings of Planet Hollywood, Players Bar & Grill, Jillian's, America's Original Sports Bar, Fat Tuesday's, Knuckleheads Comedy Club and the 400 Bar.

Smaaash (“The triple ‘A' in Smaaash stands for ‘America's Adrenaline Arena,') will feature a multi-level go-kart track, virtual reality games featuring sports and other physical challenges and a bar and restaurant.

Paco Underhill, author of “The Call of the Mall” and “Why We Shop: The Science of Shopping” and founder of Envirosell, a behavioral research and consulting firm that specializes in retail and commercial environments, said he thinks Smaaash has an excellent chance of being successful in the short-term. But he asks, “Will the third, fourth and fifth times be as fun as the first and second?” Customer fatigue is definitely one of the biggest challenges for all types of community leisure venues (CLVs).

Yes, CLVs all work the first time when everyone shows up to check it out. The second visit depends on a good impression made the first time. Typically, after that, the repeat appeal slowly fades, as it becomes the same old, same old and customer fatigue sets in.

Today, CLVs, and especially the traditional FECs, face a constantly increasing challenge of not becoming the same old, same old, what is known in psychology as hedonic adaptation – been there, done that. The appeal to visit fades over repeat visits, as nothing is really that different on each visit. What was perhaps amazing on the first visit just becomes humdrum after a few visits so there is no longer any excitement to drive them to come back again. There is no long-term repeat appeal.

In today's highly competitive entertainment environment, CLV's face accelerated obsolescence compared to just a few years ago. Today there are many more out-of-home leisure options. Even retailers are now turning shopping into ‘experiences.' Additionally, there is disruption from all the new forms of digital at-home and mobile entertainment. And within a few years, at-home virtual and augmented reality entertainment, gaming, cultural and sports experiences will be mainstream. With so many other options for our leisure time and discretionary spending, hedonic adaption occurs even faster then back in FECs' early years – been there, done that, moving on to something new as there are so many other options to experience. Another issue is that in the experience economy, experiences are shared and become a part of people's identity and social capital. So people are in constant search of new experiences worth sharing. So today FECs can't maintain their repeat business as long as in the past. Today, it's an entirely new competitive ballgame.

Offering live and limited time events is becoming increasingly important to overcoming customer fatigue to generate continuing attendance. It harnesses the power of FOMO, fear of missing out. Customers share their limited time experiences by posting their attendance at the events on social medial, mostly in photos, to gain social capital and that in turn becomes powerful marketing for the event. Over half of all Millennials and Gen-Xers considering unique and limited experiences better if they can share them on social media.

Eventbrite has found that 8 in 10 Millennials (82%) and 70% of older generations attend or participate in a variety of live experiences each year, ranging from parties, concerts, festivals, performing arts and races and themed sports. They found that over three-quarters of Millennials (77%) say some of the best memories of their life have been made at live events. And 79% feel that going to live events with family and friends helps deepen their relationship.

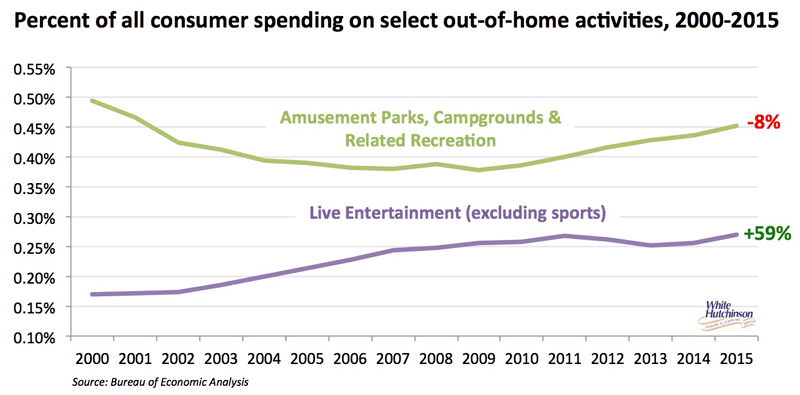

Live entertainment is gaining a growing share of consumers' spending. Since the beginning of the 21st Century, the share of all spending devoted to live entertainment has increased by 59%, whereas the share of all spending for amusement parks, FECs, and related types of entertainment and recreation has declined by 8%.

Almost half (45%) of all community-based entertainment spending by the households in the top 40% of incomes is now spent on live entertainment, not passive or attraction spending that is typical at most FECs and CLVs. Those 40% of higher income households (basically the upper middle class+) account for 71% of all community-based entertainment spending. They are the market to target and attract.

In addition to live and limited time events, the one thing that has long-term repeat appeal is food and drink. Eating and drinking is an experience we cannot live without. On average we now do it five times a day when snacking occasions are included. With food and drink, each experience can be unique as we discover new flavors and choices. People eat out 50 times more often than they go to the movies, the most popular and frequented form of entertainment. The top 40% of income households who account for the vast majority of all entertainment spending in their local community also account for 63% of all spending at local restaurants and bars.

So the challenge today for CLVs to stay competitive is to offer leisure experiences that don't become the same old, same old, what you did last weekend, and to target the higher socioeconomic consumers. CLVs need to offer more than fixed entertainment equipment and games. They need to also offer changing live and limited time events and contemporary food and drink that keep the joy of coming back again alive.

Vol. XVII, No. 1, January 2017

- Editor's Corner

- Are you ready for hygge?

- 2017 Foundations Entertainment University dates

- Top 2016 articles

- The untold truth about feasibility studies

- The growing inequality of entertainment & the growth of eleisure

- What's happening to sports participation?

- Becoming the industry contrarian

- Is a new virtual reality disruption coming to out-of-home leisure?

- Predictions for 2017

- The curse of customer fatigue; the downfall of many CLVs & FECs